Photonics in Today’s Transformative Age

Radical Convergence of Industries

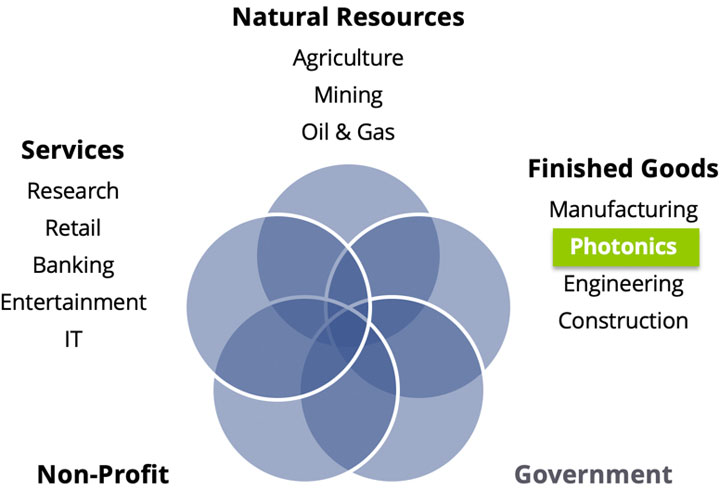

Today’s transformative age is blurring the lines between sectors, while creating new and unique opportunities to step beyond traditional boundaries. With this collision of industries, leaders in traditionally defined sectors are seizing opportunities to create new value for their customers and reshape their businesses.

To understand how traditionally pure-play photonics companies may reshape, we put aside the view that photonics is merely enabling technology with photonics companies at the bottom of a value chain. Instead, we look to learn from market leaders around the world who are innovating with new business models, new collaborations and partnerships, and new ways to deliver value to their customers.

In 2018, evidence of this collision with the photonics lies in the more than $30billion investment and $90billion in strategic acquisitions of companies employing photonics technologies. The majority of these companies and certainly those realizing the highest valuations are serving customers with more innovate business models than the traditional hardware-centric, cost-plus business models that have dominated the photonics industry for decades.

Companies built on photonics technologies, especially those enjoying very healthy valuations, are stretching their business models even further in very creative ways. For examples, in 2018, many traditionally pure-play laser companies are aggressively pursuing vertical forward and backward integration strategies with acquisitions to create new value for their customers and futureproof their critical resources. Learn more

Like never before, amidst colliding industries, there are new entrants and established players reshaping their businesses who are threatening the status quo and incumbent leaders.

The Future

Cities

As cities get bigger, can we make them better?

- Rapid urbanization is creating opportunities to re-think urban planning and smart infrastructure

- Opportunity for government and private sector to work together to build cities that meet citizens’ ever-changing needs

- Data driven technology will be integrated into buildings, streets, utilities

- Autonomous, connected and shared electric vehicles will move people and goods more efficiently

- Governments cannot solve modern problems with traditional methods, collaboration with industry is vital

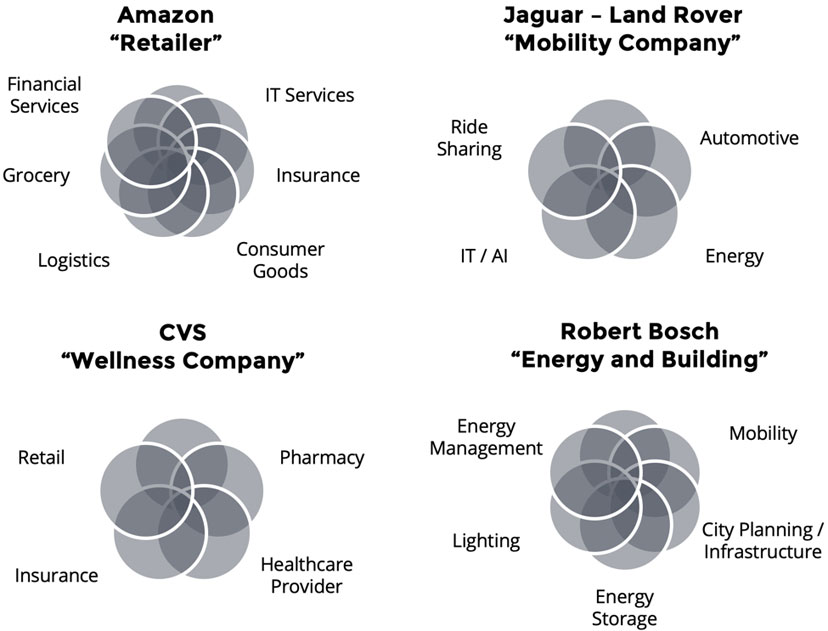

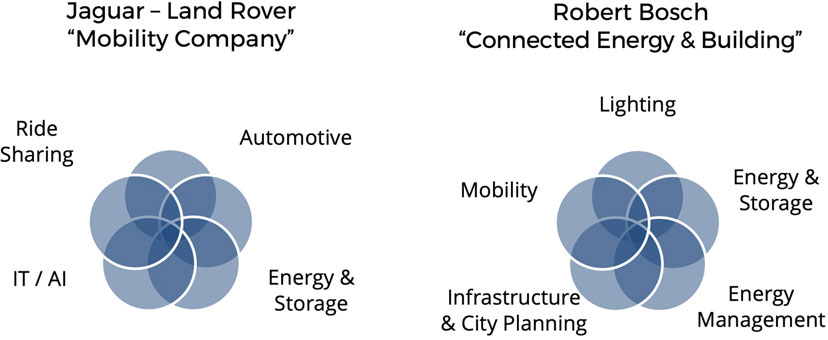

Companies are shifting to seize these unique opportunities to step beyond traditional boundaries. Automotive companies are transforming into “Mobility” companies. Engineered products companies are transforming into “Connected Energy and Building” companies.

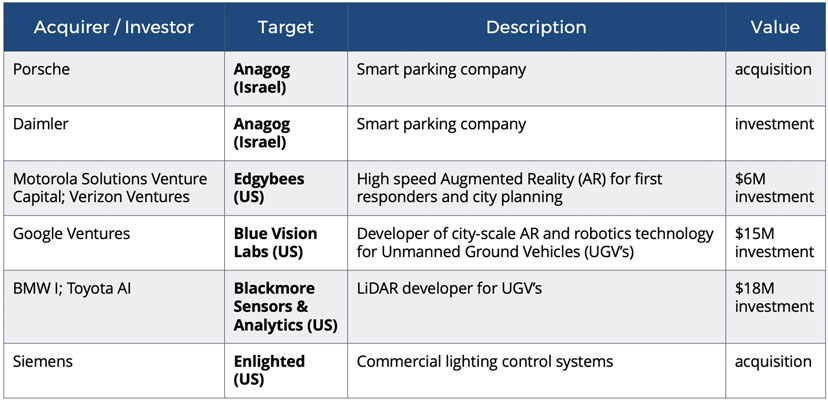

To remain competitive, these companies are looking externally for innovation and partnerships. In 2018, many of their collaborations were with emerging companies outside their traditional sector employing innovative business models and photonics core technology.

Unmanned Aerial/Ground Vehicles and Smart Robots

Light Imaging, Detection and Ranging (LIDAR) and 3D sensing technologies are connecting the physical and digital worlds. They are sensing technologies which use lasers, optics and detectors to collect measurements that can then be used to create 3D models and maps of objects and environments. When combined with information technologies, such as artificial intelligence and machine learning, cities will be better with people and goods moving more efficiently and more safely. Learn more

Health

When human body is biggest data platform, who will capture value?

- Insurance, retail, consumer and technology companies will develop new products to improve health

- Redefining how value is captured, shifting power from the traditional healthcare incumbents to consumers, payers and new entrants

- Technology and increased customer expectation are disrupting the healthcare industry

- Availability of data and algorithms are empowering consumers to make more informed health choices and demands for more personalized health products and services

Companies are seizing these unique opportunities to capture value. CVS, traditionally a pharmacy, is transforming into “Wellness” company. Technology conglomerates, like Google and Baidu, are leveraging their technologies and critical resources to shake-up healthcare incumbents to better serve consumers and payers.

Point-of-Care and Wearable Diagnostics

Today’s $40billion point-of-care diagnostics (POC) and $25billion wearables markets are reshaping as they collide with the consumer goods and information technology services sectors. With data and analytics everywhere, every healthcare company is a technology company.

Photonics technologies fuse the biological, digital and physical worlds. Established fluorescence, optical label-free, spectroscopic and molecular diagnostics methods are moving to the point-of-care and to wearable as cameras, lasers/LEDs and wafer-scale optic technologies mature and miniaturize. New entrants and established players earn healthy profits from plethora of opportunities that cross hardware, software, data, consumables and services.

2018 Private Placement Highlights

WaveGuide Corporation (USA), developer of POC handheld nuclear magnetic resonance spectrometer for early diagnosis of cancer and tuberculosis, receives $3.4M.

Tasly Pharmaceutical and 3E Bioventures Capital participate in $54M financing for Profusa, Inc. (USA), developer of tissue-integrated biosensors for diabetes management.

Sugentech Incorporate (S. Korea), provide of POC optical analysis testing products, issues private placement valued at $2.67M.

Hamamatsu Photonics and Shizuoka Capital invest $0.4M in Nanotis Corporation(Japan), developer of smart chip devices that work with smart phones to instantly diagnose infectious disease.

Indie.Bio invests $0.25M in CLINICAI, Inc. (USA), developer of a smart toilet for wellness and early detection of gastrointestinal disease.

MagIA Diagnostics SAS (France), developer of a chip to detect presence of virus or bacteria, receives $1.1M.

Consumer

When bots do the buying, where is value in shopping?

- Consumers use data to optimize their lives and AI curate smarter choices

- Opportunities for leaders who anticipate how future consumers will be different than today as consumer facing companies must change fundamentally

- Retailers work with media companies as shopping becomes entertainment

- Consumer goods manufacturers will join healthcare, pharmaceutical and technology players to provide life styles on subscription

Amazon, originally a marketplace for consumer goods, is a now the largest B2B and B2C retailer of goods and services in the world. Today, Amazon practices business models that range from its traditional marketplace to its flat-free Amazon Prime subscription to its Amazon Web Services’ fractional ownership offering of computer power and storage.

To create new profit systems, these companies employ unique business models for each of their massive offerings of goods and service. In 2018, many of these new business models are built on investments in emerging companies with core photonics technology in 3D sensing and augmented reality.

Augmented and Virtual Reality

Today’s $120billion augmented reality and $30billion virtual reality (VR) markets are providing new canvases for consumer marketing, entertainment, connected and mobile content sharing, product design, scientific modeling, education and tele-present medicine.

This new canvas makes possible innovate business models for the dominant consumer facing companies, such as Alibaba and Amazon – as well as level the playing field for new entrants and more focused competitors.

2018 Investment Highlights

WayRay (Switzerland), developer of holographic navigation systems to advance connected cars using AR, raises $125mm from strategic venture arms of Comcast, du Pont, Intel, Verizon, and Yamaha Motors.

Red Star Macalline Group invests $47mm in Guangzhou Sanweijia IT Co., (China), provider of 3D home design and furnishings through its VR portal.

Accel Partners and Google Ventures lead $15mm investment in Blue Vision Labs(US), developer of city-scale AR and robotics technology for UGV’s.

Norwest Venture leads $8mm investment in 8th Wall (US), developer of mobile AR platform to build machine learning apps.

Khosla Ventures leads $7mm round for Light Field Lab (US), developer of holographic capture display technology solutions.

Motorola and Verizon Ventures invest $6mm in Edgybees (US), who delivers highest speed AR experiences for first responders and city planning.

Photonics Colliding Across Sectors

Corporate Venture Investing in Photonics for the Future

Market leaders are investing in photonics for future cities, health and consumers directly and via their corporate venture capital arms. Corporate venture investment hit a record $67billion in 2018. Corporate venture capital accounted for more than 50% of all 2018 venture deals.

Market leaders find strategic value in the venture market, because these smaller technology developers innovate, create and shift much faster than can a larger corporation. These investments can lead to acquisitions while mitigating the risks and minimizing the costs of relatively capital-intensive research and development required for innovation.

Top 15 Most Active Corporate Venture Investors in Photonics

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.