2018 Private Placements – Photonics

In 2018, $29billion of $822billion announced private placements worldwide goes to work commercializing photonics technology and growing businesses with core photonics technology.

Communications, LEDs, and Solar attract the most investment. Autonomous vehicles, 3D sensing, point-of-care medical diagnostics, AI powered imaging and display see the most activity. With the exception of materials for smart architectural glass, investment in pure-play photonics companies continues to lag.

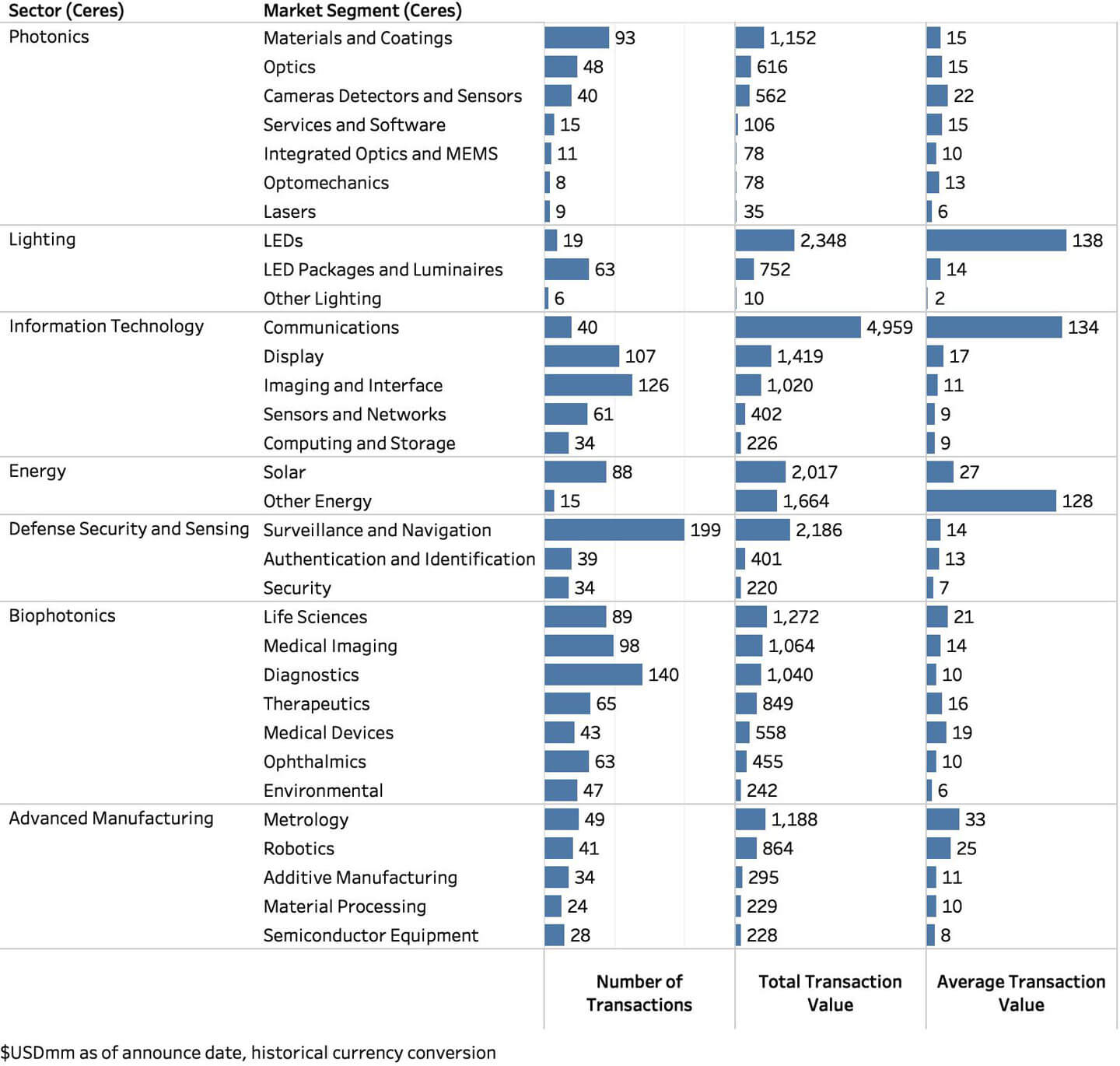

Private Placement Count and Value by Sector

The Transactions

Private placement transactions for target companies are researched with announce dates from January 1 to December 31, 2018. Private placements include private equity or growth capital, venture capital and private investments in public entities. Transactions volumes, values, geographies and market segments are analyzed. Values are in $US at historical rates of exchange.

Follow this link to access detail for transactions analyzed in this article

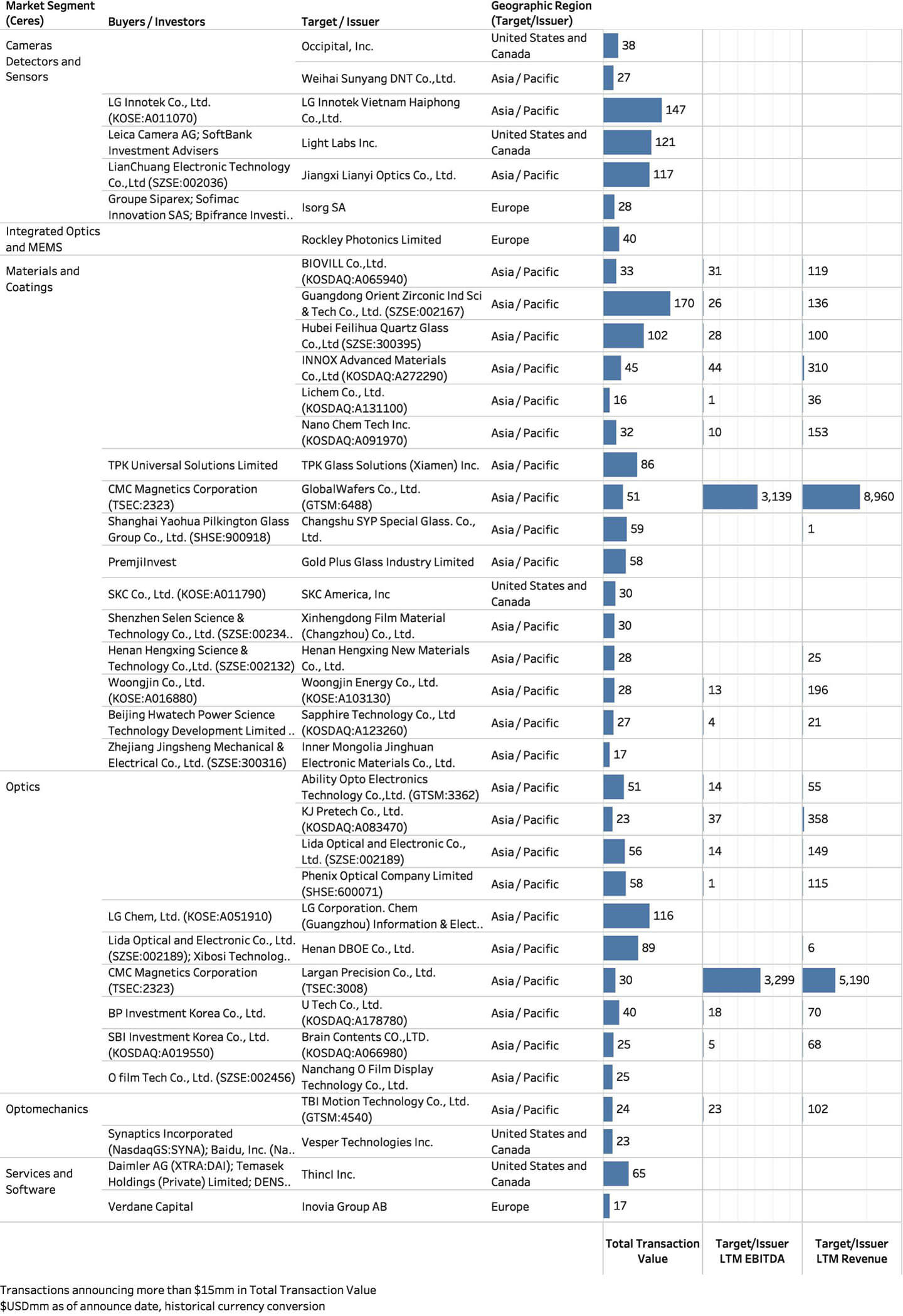

Photonics Private Placement Transaction Detail

Private Placement Count and Value by Sector and Market

Photonics

Since 2015, private placement investment in pure-play Photonics increases. With the exception of materials for smart architectural glass, investment in pure-play photonics companies still lags companies employing photonics technologies further up the value chain. In 2018, $2.6billion was invested globally in Photonics – predominantly in Materials and Coatings; Cameras, Detectors and Sensors; and Optics. There continues to be very little investment in Lasers.

2018 Private Placements – Photonics

Photonics Converging with Healthcare

The Biophotonics and Information Technology sectors see the most activity by number of transactions and total transaction value. Demonstrating today’s radical convergence of industries, within Biophotonics markets, most investments are in business models based on capturing, sharing and analyzing individual’s health data.

Point-of-Care and Wearable Diagnostics

Today’s $40billion point-of-care diagnostics (POC) and $25billion wearables markets are reshaping as they collide with the consumer goods and information technology services sectors. With data and analytics everywhere, every healthcare company is a technology company.

Photonics technologies fuse the biological, digital and physical worlds. Established fluorescence, optical label-free, spectroscopic and molecular diagnostics methods are moving to the point-of-care and to wearable as cameras, lasers/LEDs and wafer-scale optic technologies mature and miniaturize. New entrants and established players earn healthy profits from plethora of opportunities that cross hardware, software, data, consumables and services.

2018 Investment Highlights

- WaveGuide Corporation (US), developer of point-of-testing handheld nuclear magnetic resonance spectrometer for early diagnosis of cancer and tuberculosis, receives $3.4mm

- Tasly Pharmaceutical and 3E Bioventures Capital participate in $45mm financing for Profusa, Inc. (US), developer of tissue-integrated biosensors for diabetes management

- Sugentech Incorporate (S. Korea), provider of POC optical analysis testing products, issues private placement valued at $2.7mm

- Hamamatsu Photonics and Shizuoka Capital invest $0.4mm in Nanotis Corporation (Japan), developer of smart chip devices that work with smart phones to instantly diagnose infectious disease

- Bio invests $0.3mm in CLINICAI Inc. (US), developer of a smart toilet for wellness and early detection of gastrointestinal diseases

- MagIA Diagnostics SAS (France), developer of chip to detect presence of virus or bacteria, receives $1.1mm

Photonics Converging with Information Technology

The Gartner Hype Cycles provide a snapshot of emerging technologies along a predictable pattern of enthusiasm, disillusionment and eventual realism. It distills insights from more than 2,000 technologies into a succinct set of must-know emerging technologies that will have the greatest impact in delivering a high degree of competitive advantage over the next five to 10 years. Photonics is core to most of these emerging technologies.

Gartner’s 2018 Hype Cycle for Emerging Technologies

Trends that Organizations Must Track to Gain Competitive Advantage

Quantum Computing

The ability to coherently control quantum systems at the level of single quanta (atoms, ions, electron spins, photons) is heralding a new technological revolution. Quantum Cryptography is the enabling technology for Quantum Key Distribution that provides an information theoretically secure solution. The Quantum Encryption market driven by growing incidents of cyber-attacks and increasing data security and privacy concerns is projected to surpass $1.2billion by 2023 (CAGR 27%).

Quantum computing and simulation solve computational tasks impossible to solve with today’s computers. Quantum computing technologies have the potential to change long-held dynamics in commerce, intelligence, military affairs and strategic balance of power. The market is projected to grow at CAGR of 24.6% to $8.5billion from 2018 to 2024.

2018 Investment Highlights

- ID Quantique (Switzerland), who is commercializing quantum-safe network encryption solutions for the protection of data in transit receives $65mm from SK Telecom (S. Korea)

- D-Wave Systems (Canada), developer of commercial superconducting quantum computers raises $50mm from Public Sector Pension Investment Board

- Real Ventures leads $7mm investment in Xanadu Quantum Technologies (Canada), developer of photonics quantum computers

- Zapata Computing (US), developed of quantum software algorithms raises $5mm

- Lightspeed Venture invests $4mm in Strangeworks (US), quantum computing software developer

- TrueNorth CX (Canada), cryptocurrency exchange provider employing auto-scale architecture with quantum cryptography raises $2mm

- Pentech Ventures leads $3mm round in GTN (UK), who engages in drug discovery through quantum machine learning technology

Augmented and Virtual Reality

Today’s $120billion augmented reality and $30billion virtual reality (VR) markets are providing new canvases for consumer marketing, entertainment, connected and mobile content sharing, product design, scientific modeling, education and tele-present medicine.

This new canvas makes possible innovate business models for the dominant consumer facing companies, such as Alibaba and Amazon – as well as level the playing field for new entrants and more focused competitors.

2018 Investment Highlights

- WayRay (Switzerland), developer of holographic navigation systems to advance connected cars using AR, raises $125mm from strategic venture arms of Comcast, du Pont, Intel, Verizon and Yamaha Motors

- Red Star Macalline Group invests $47mm in Guangzhou Sanweijia IT Co. (China), provider of 3D home design and furnishing through its VR portal

- Accel Partners and Google Ventures lead $15mm investment in Blue Vision Labs (US), developer of city-scale AR and robotics technology for UGV’s

- Norwest Venture leads $8mm investment in 8th Wall (US), developer of mobile AR platform to build machine learning apps

- Khosla Ventures leads $7mm round for Light Field Lab (US) who develops holographic capture display technology systems

- Motorola & Verizon Ventures invest $6mm in Edgybees (US), who delivers highest speed AR experiences for first responders and city planning

Unmanned Aerial / Ground Vehicles and Smart Robots

Light Imaging, Detection and Ranging (LIDAR) and 3D sensing technologies are connecting the physical and digital worlds. They are sensing technologies which use lasers, optics and detectors to collect measurements that can be combined with information technologies, such as artificial intelligence and machine learning, to create 3D models and maps of objects and environments.

LIDAR is a metrology method that measures the distance to a target by illuminating it with laser. It is a key enabling technology for and drones, self-driving cars and smart robots.

Unmanned Aerial Vehicles (UAV) are used to make high-resolution maps, with applications in geography, geology, geomorphology, forestry, laser guidance and altimetry. This market is projected to reach $28.3billion by 2022 (CAGR 13.5%). The market for Unmanned Ground Vehicles (UGV) employing LIDAR with laser 3D scanners used for obstacle detection and collision avoidance is projected to reach $18.7billion by 2020 (CAGR 23.7%). In 2018, the Smart Robots market is $4.9billion and projected to reach $14.3billion by 2020 (CAGR 23.7%).

2018 Investment Highlights

- CRV leads $43mm investment in Airobotics (US), manufacturer of automated industrial drones for inspection, surveying and emergency response

- Blackmore Sensors and Analytics (US), developer of LIDAR for Defense, raises $18mm from Millennium Technology Value Partners; BMW i and Toyota AI

- Fortune Venture Capital invests $16mm in Shenzhen LeiShen Intelligent System (China), supplier of LIDAR for smart robots

- Beijing Surestar Technology (China), developer of imaging LIDAR, raises $15mm from StarVC and China V Fund

- Verity Studios (Switzerland), supplier of indoor drone systems, raises $18mm from Fontinalis, Airbus Venture and SONY Innovation

- Y Combinator leads $12mm round in May Mobility (US), manufacturer of autonomous vehicles

Geographies

Historically, United States and Canada, as a geographical region, receive the most investment. However, in 2018, Asia / Pacific target companies receive 40% more investment than target companies in United States and Canada. Average transaction sizes are larger in Asia / Pacific with use of funds being growth and scaling of established businesses. Whereas United States and Canada still lead in count and total transaction value to finance pre-earnings, early-stage and lower middle market companies with new technologies and innovative business models.

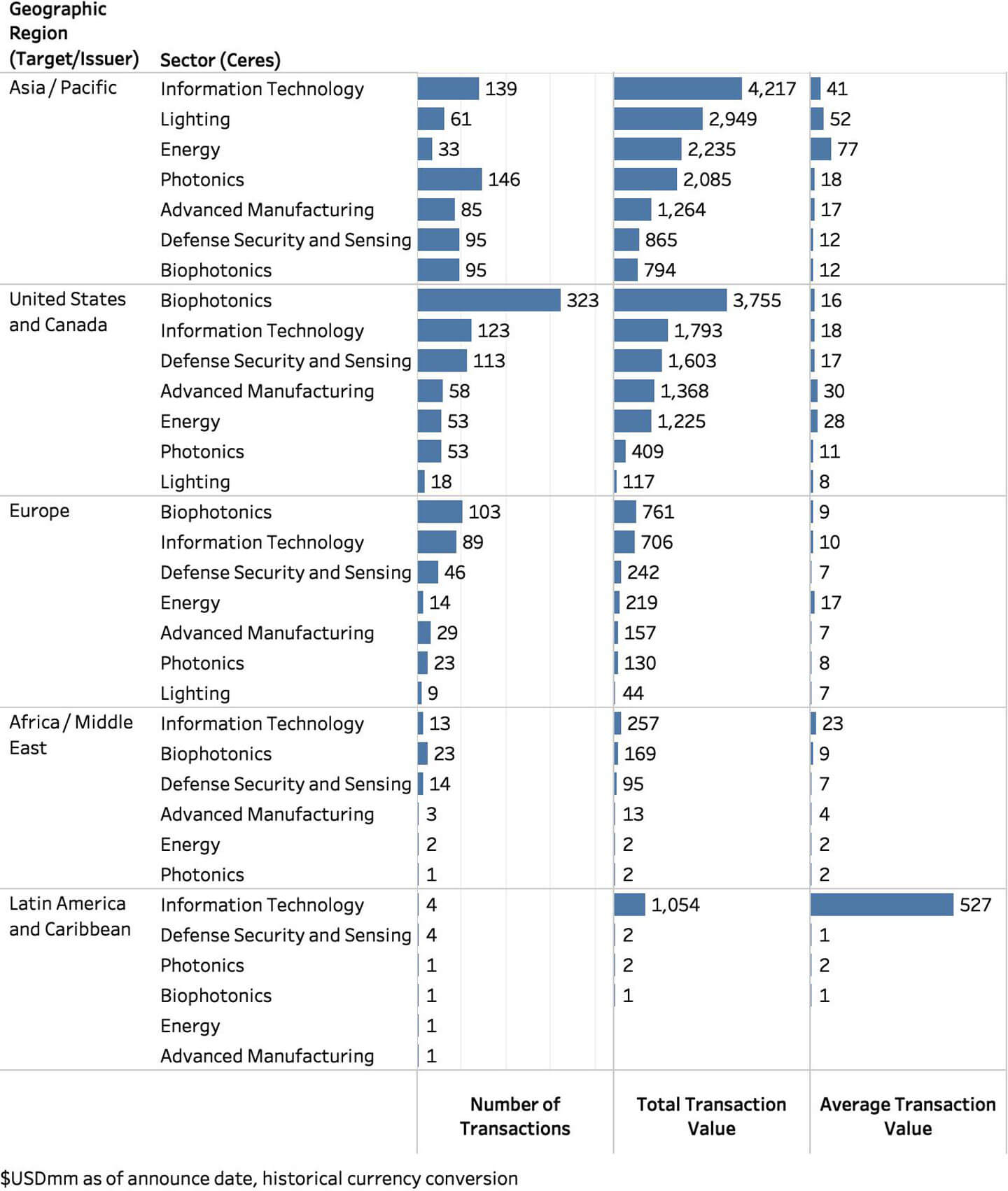

Private Placements by Target Geography

In Asia / Pacific, the highest concentrations of investment value are in Communications; LEDs; Solar; Display; and Materials and Coatings markets.

In United States and Canada, the highest concentrations of investment value are in Surveillance and Navigation, namely 3D sensing and autonomous vehicles; Energy, namely smart architectural glass; and Communications.

In Europe, the highest concentrations of investment value are in Surveillance and Navigation, namely 3D sensing and autonomous vehicles; Medical Diagnostics; and Solar.

On a country basis, United States still has, by far the most buy and sell side activity in photonics. However, activity in China and South Korea is increasing year over year.

Trending down from 25% in 2014 and 18% in 2015, more transactions represent buyers acquiring targets inside their geographical region. Reference article, “Foreign Investment in US Photonics Technologies”. {Link to Newsletter article}

Outlook for 2019

Emerging Technologies – Autonomous Vehicles

In 2019, it is anticipated that autonomous vehicle partnerships and M & A activity will remain elevated while automakers, suppliers and technology players continue vertical integration and consolidation. Strategic partnerships and M & A will be key for Waymo competitors to catch-up.

Venture Capital

New participants in venture capital will continue to propagate – large pensions, endowments and foundations, sovereign wealth funds and family offices. As a result of more competition for deal flow, valuations in early stage businesses are forecast to step-up with a continued trend toward larger venture capital funds and larger financing rounds.

Non-Traditional Investors Increase Participation in Outsized Deals

US VC Deal Activity with Tourist Investor Participation

Private Equity

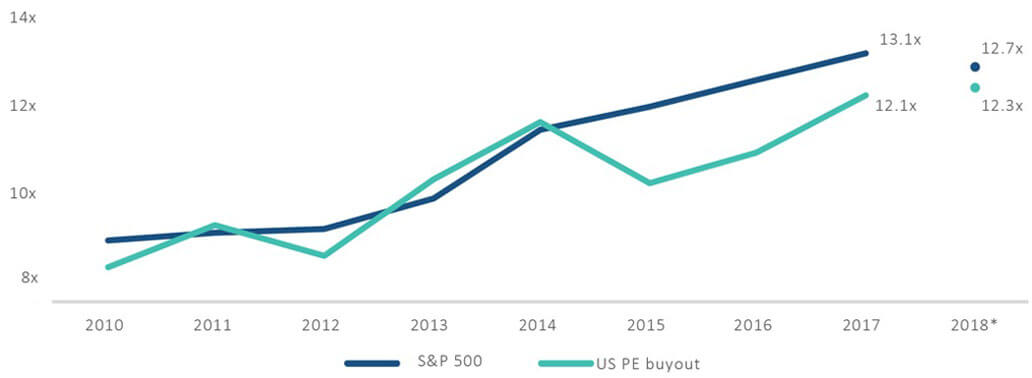

In 2018 and expected through 2019, valuation multiples for public and private middle market companies converge further as private equity performance improves relative to public markets. For companies financing with private equity, this maps to higher valuations and more available capital. For public companies, take-private is a viable alternative.

Median EV / EBITDA multiples for US PE buyouts and S&P 500

CERES sources transaction data from publicly available information. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.