Medical Devices, Diagnostics, Environmental Monitoring, and Therapeutics

Biophotonics is the interdisciplinary science of applying light to biological life sciences – such as genomics, molecular and cell biology, neuroscience, biomechanics, and environmental science.

While not an industry in and of itself, Biophotonics is at the core of world-changing medical and life science products and businesses. From early diagnosis of disease to minimally invasive surgery to detection of environmental contamination, biophotonics is addressing and solving today’s environmental and healthcare challenges. It enhances our quality of life and safeguards our health and environment.

Life Sciences and Healthcare markets are highly regulated, have high customer acquisition costs, and are characterized by strategic cooperation among competitors. Intellectual property landscapes are typically complex. Whether a business is a start-up or an established player, a successfully executed exit strategy or inorganic growth strategy relies on a sound understanding of current market dynamics and valuation.

2014 M&A Activity

The M&A market for development stage and high growth life science and healthcare businesses enabled by Biophotonics is robust. So far in 2014, there are more than 100 transactions. Transactions are researched with closing, effective, or announce dates from January 1 to September 2, 2014. Transactions volumes, values, geographies, and market segments are analyzed. Values are in $US at historical rates of exchange. Follow this link to transaction detail. <2014 Jan to Aug Biophotonics M&A Transactions>

The Diagnostics segment sees the most activity in volume of transactions, while the Life Sciences segment realizes the highest total transaction value. Diagnostics includes target companies employing fluorescence, optical label-free, and imaging methods to protein and cell based diagnostic assays, drug development, and point-of-care devices. Life Sciences includes target companies supplying and developing research tools and equipment used for environmental analysis.

Imaging follows closely in both transaction total volume and value. Imaging includes target companies developing and supplying medical imaging instruments and consumable dyes – Computed Tomography (CT, OCT, SPECT, PET), Magnetic Resonance Imaging (MRI), Multispectral Imaging, X-ray Imaging, and Nuclear Imaging.

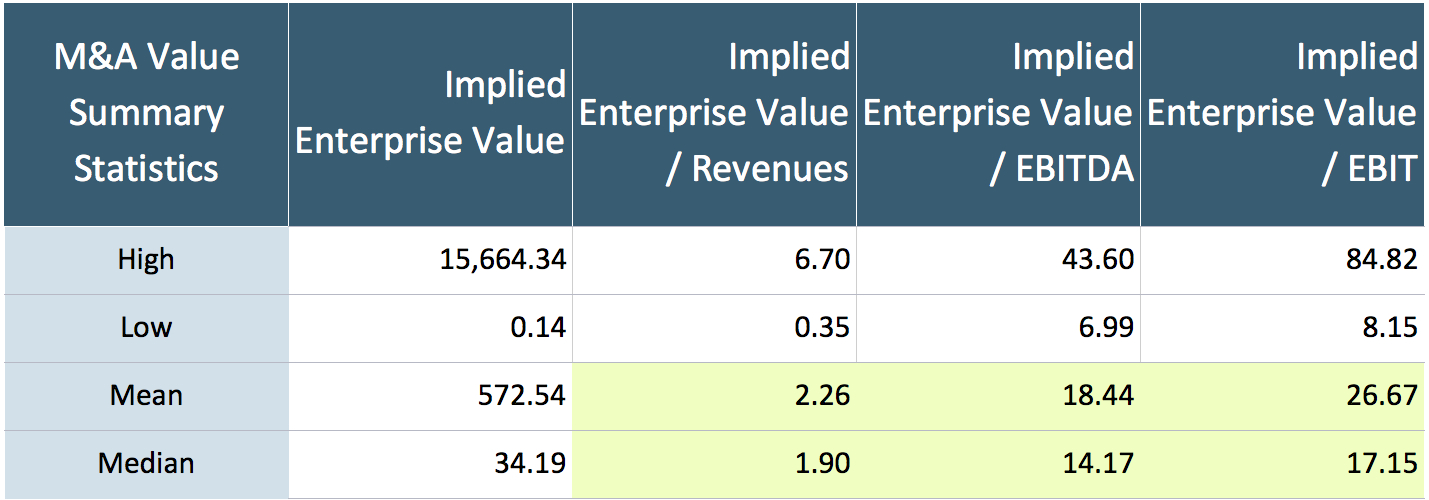

In 2014, the total and average Enterprise Value of the 55 transactions reporting financial data are $30 billion and $573 million respectively. Multibillion-dollar deals are inked by Thermo Fisher Scientific, The Carlyle Group, Covidien, Grifols, and Panasonic – strategic buyers acquiring Biophotonics enabled Medical Devices and Diagnostics businesses.

Premium Priced Strategic Acquisitions

Middle market companies employing Biophotonics to address markets, such as gastrointestinal health, point-of-care anemia in-vitro diagnostics (IVD), proteomics research, diagnosis of blot clotting disorders, and IVD instrumentation and consumable assays for colon, lung and prostrate cancer, are realizing high valuations. So far this year, a handful of lower middle market companies with strong photonics IP portfolios and product roadmaps are driving-up average Enterprise Value/EBITDA multiples.

Leading the pack in valuation with Enterprise Value/EBITDA multiples of 30-40x are: ProteinSimple, a developer of instrumentation and consumables for protein analysis; Given Imaging, a provider of gastrointestinal diagnostic products based on a wireless pill camera; and DiaSpect Medical, a developer of hemoglobin measurement systems.

Small and Middle Market

50% of researched transactions disclose the transaction value. Of those disclosed, 19% and 20% are small market (<$5M) and lower to middle market ($5 to $100M) transactions. Like other vertical market enabled by photonics, strategic buyers are acquiring orders of magnitude smaller businesses providing products that are highly differentiated with strong product development roadmaps and intellectual property positions.

Strategic vs. Financial on Buy and Sell Side

Approximately 10% and 30% of transactions represent acquisitions and divestitures respectively by financial buyers, such as private equity firms. Characteristic of Medical and Life Science markets, product development and early stage growth is financed by private equity firms that exit to large strategic buyers, who in turn, scale the business after most of the technology and market risk have been mitigated.

Geography

The United States and Canada, as a geographical region, experiences most of the sell-side and buy-side activity – 41% and 37% respectively. Europe follows closely with Asia/Pacific accounting for just under 20% of activity. Approximately 25% of transactions represent buyers acquiring targets outside their geographical region.

The Transactions

Follow this link to transaction detail. <2014 Jan to Aug Biophotonics M&A Transactions>