Mergers & Acquisitions in Photonics | Jan thru Sept 2024

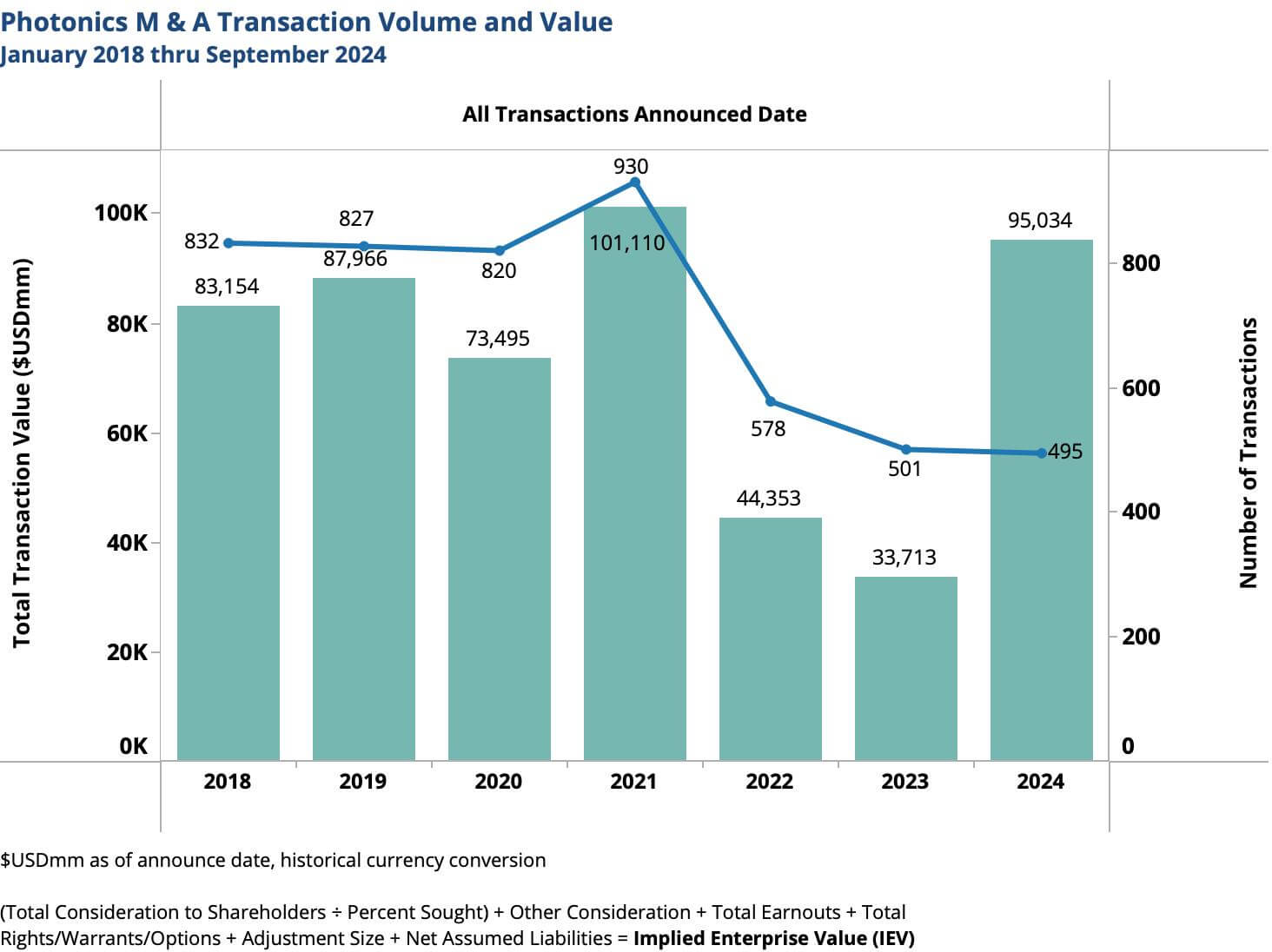

There remains uncertainty in the global M&A market as deal volume and total deal value recover from the record lows of 2023. M&A activity for targets employing photonics technology, however, appears to be on a steep upward trajectory in 2024.

High interest rates, lower valuations and geopolitical instability are show-stoppers for many buyers and sellers, while fueling the strategic need for M&A to grow stronger, creating pent-up demand. Today, global macroeconomic trends reflect cautious optimism. Inflation is declining more rapidly than expected, driven by unwinding supply-chain issues and restrictive monetary policies. The likelihood of a severe economic downturn is reduced with U.S. and large economies showing resilience. The U.S. Federal Reserve initiates interest rate cuts, signaling an easing cycle that could stimulate growth. As a result, it appears the gates are opening to release latent demand for M&A.

Organic revenue growth remains difficult to achieve in today’s relatively lower growth economies. Further, faced with technological disruptions and labor shortages, corporations can not only survive, but succeed by acquiring key competitive capabilities, talent and technology or by divesting non-core assets today. Also, after a long dry period, private equity funds need to divest portfolio companies to generate investor distributions and attract new investment capital.

Why be bullish on targets with core photonics technology? The explosion of Artificial Intelligence applications and cybersecurity threats create an insatiable demand for computing that only optical communications and in the future, quantum computing can fill. Geopolitical instability is fueling game-changing, photonics enabled solutions in drones and counter-drone technology; Laser Directed Energy Weapons (LDEW); military robots; 3D printing of munitions; and Counter Communications Systems (CCS) for electronic warfare. In manufacturing and service industries alike, photonics enabled automation and robotics solutions are alleviating labor shortages and reducing costs. In-line and satellite-based environmental monitoring made possible with optical methods plays a critical role in alleviating global warming by tracking greenhouse gas emissions, providing early warning systems and improving regulatory compliance.

The Transactions

M&A transactions are researched with announce dates from January 1 to September 30, 2024. Activity and valuations are analyzed by market segments. Values are in $US at historical rates of exchange. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

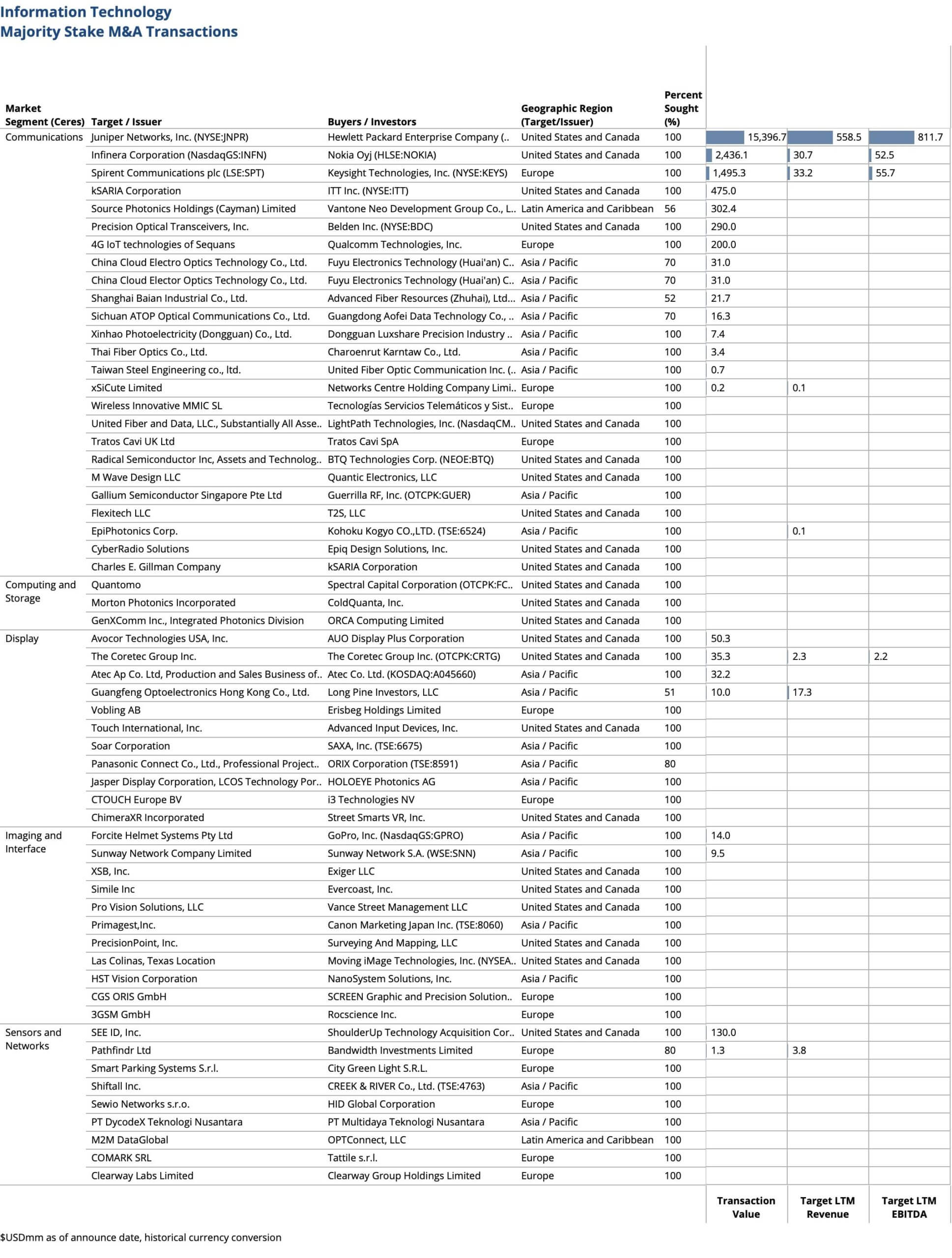

After a very slow start in the first quarter of 2024, the volume of transactions for photonics targets is now tracking 30% higher than 2023. Total deal value of $95billion is tracking 25% higher than 2021 peak with the announcement of some of the largest deals in the M&A market as a whole. Synopsys, Inc. $33B acquisition of ANSYS, Inc., a supplier of engineering simulation software and services. Shenzhen Newway Photomask Making Co., Ltd $18B acquisition of 29% stake in Chengdu Newway Optoelectronics Co., Ltd., producer of photomasks, essential components in semiconductor manufacturing. Hewlett Packard $15B acquisition of Juniper Networks, Inc., a supplier of optical data communications networking equipment.

Total value tops $1B for additional eight transactions, including Nokia Oyj $2.4B acquisition of Infinera Corporation, supplier of optical access to long haul networking gear and CoStar Group $2.0B acquisition of Matterport, Inc., pioneer of LiDAR and AI based digital twin technology.

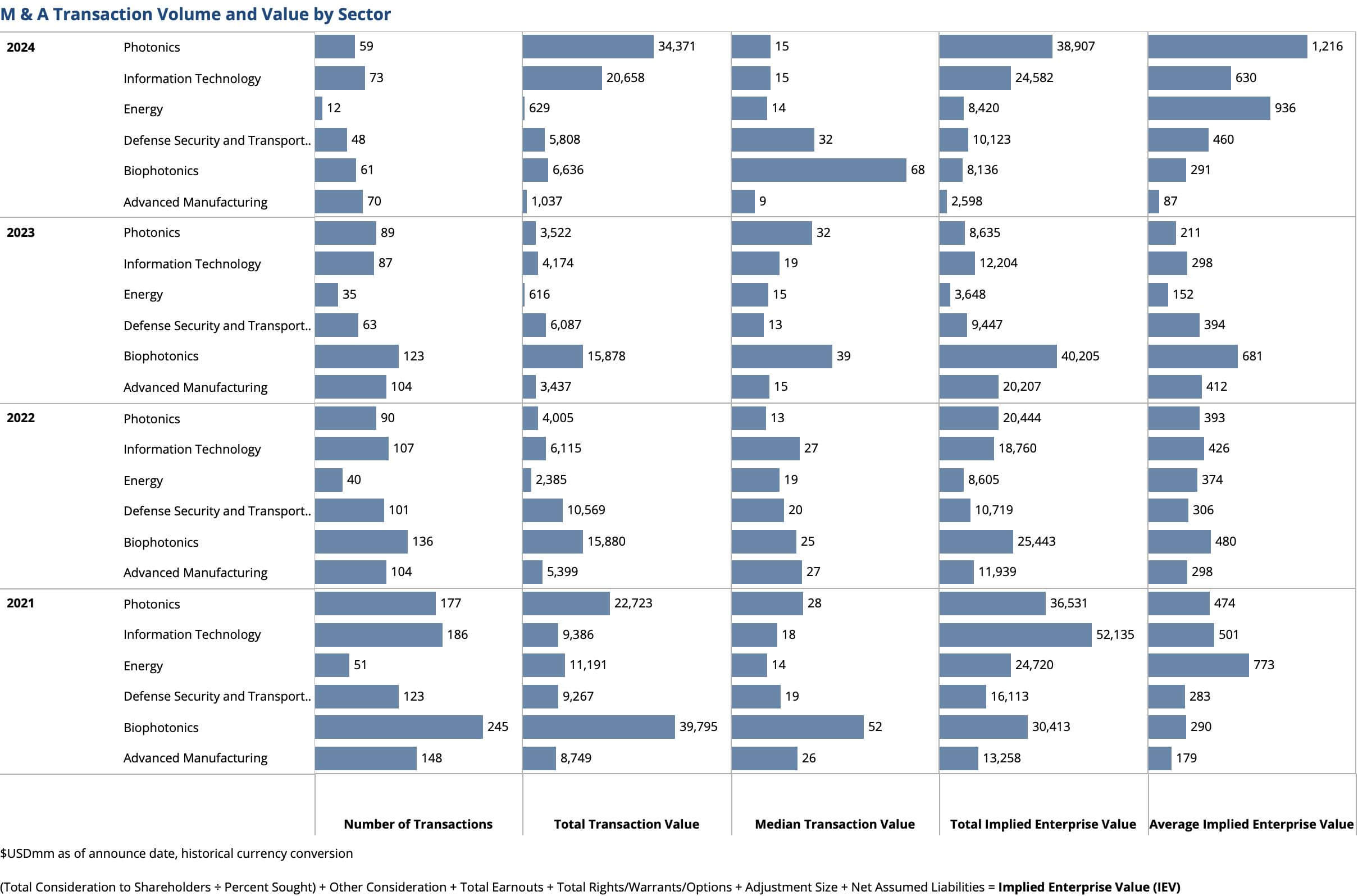

Inconsistent with previous years, Robotics and Automation (Advanced Manufacturing) and the Surveillance and Navigation (Defense Security and Transportation) see the most activity in first three quarters 2024. The high level of activity and relatively low total value in these market segments is evidence of a very high concentration of capabilities deals.

Inconsistent with previous years, Biophotonics does not see the most activity and highest total value of all photonics enabled sectors this quarter. This is inherent to today’s market conditions in medical devices and diagnostics.

Geographically, in line with 2023, the first three quarters 2024 see target M&A activity in Asia and Pacific region modestly out pacing both United States/Canada and Europe.

The Valuations

In the M&A market as a whole, strategic deals trade at the highest multiples in history across the board in 2021 with the decreasing valuations in 2023 continuing into the first half 2024. Many generalist analysts predict valuations to stabilize here with a new normal of higher interest rates and geopolitical instability. Based on researched transactions for targets with photonics technology, 2021 was also a banner year, but in contrast with the M&A market as a whole, strategic deals continue to trade relatively high for photonics targets.

Very few transactions report target financials. Of the researched transactions for majority stake, 46 buyers report Implied Enterprise Value (IEV) multiples for majority stake.

The Pure-Play Photonics Targets

In 2024, most pure-play photonics market leaders are not acquisitive. Many divested businesses. Han’s Laser Technology Industry Group Co., Ltd. sells 65% stake in its optical scanning system solutions business to investors for $145M. Gooch & Housego sells its optoelectronic components and laser modules business to Luminar Technologies, Inc. and divests EM4, Inc., supplier of optoelectronics modules. The British government acquires struggling factory from Coherent Inc. to secure domestic manufacture of gallium arsenide semiconductors for military technology. Synopsys, Inc. sells its Optical Solutions Group to Keysight Technologies, Inc. to obtain regulatory approval for its proposed $35B acquisition of ANSYS, Inc. IPG Photonics Corporation sells its Russian subsidiary in a management buyout for $51M, finalizing its exit from Russia after imposed trade sanctions with Ukraine war. Emcore Corporation continues to restructure with divesture of its discontinued chips business line to HieFo Corporation for $2.9M. ams OSRAM AG sells its Passive Optical Components to Focuslight Technologies Inc. for $49M.

In addition to several lower middle market strategic acquisitions of capabilities, product lines and technical talent, there is increase in pure-play photonic targets acquired for vertical integration. Launching strategy to secure its supply chain, Theon International Plc acquires 60% controlling stake in Harder Digital Ingenieur- Und Industrieges. Mbh, its supplier of Image Intensifier Tubes for $37.5M.

The Targets with Core Photonics Technology

Advanced Manufacturing

The Advanced Manufacturing sector sees the most activity in 2024. Transactions are lower middle market or smaller with high concentrations of capabilities deals and vertical integration plays.

Machine vision, 3D printing, optical metrology and 3D sensing have been advancing manufacturing for decades. Factory automation is evolving rapidly, driven by advancements in technologies such as AI, robotics and data analytics. Combined with advances in photonics technologies, the products and services of targets being acquired today offer game changing improvements in process optimization, quality control, energy efficiency, inventory management and supply chain, skilled labor demand and security.

Biophotonics

Defense, Security and Transportation

Information Technology

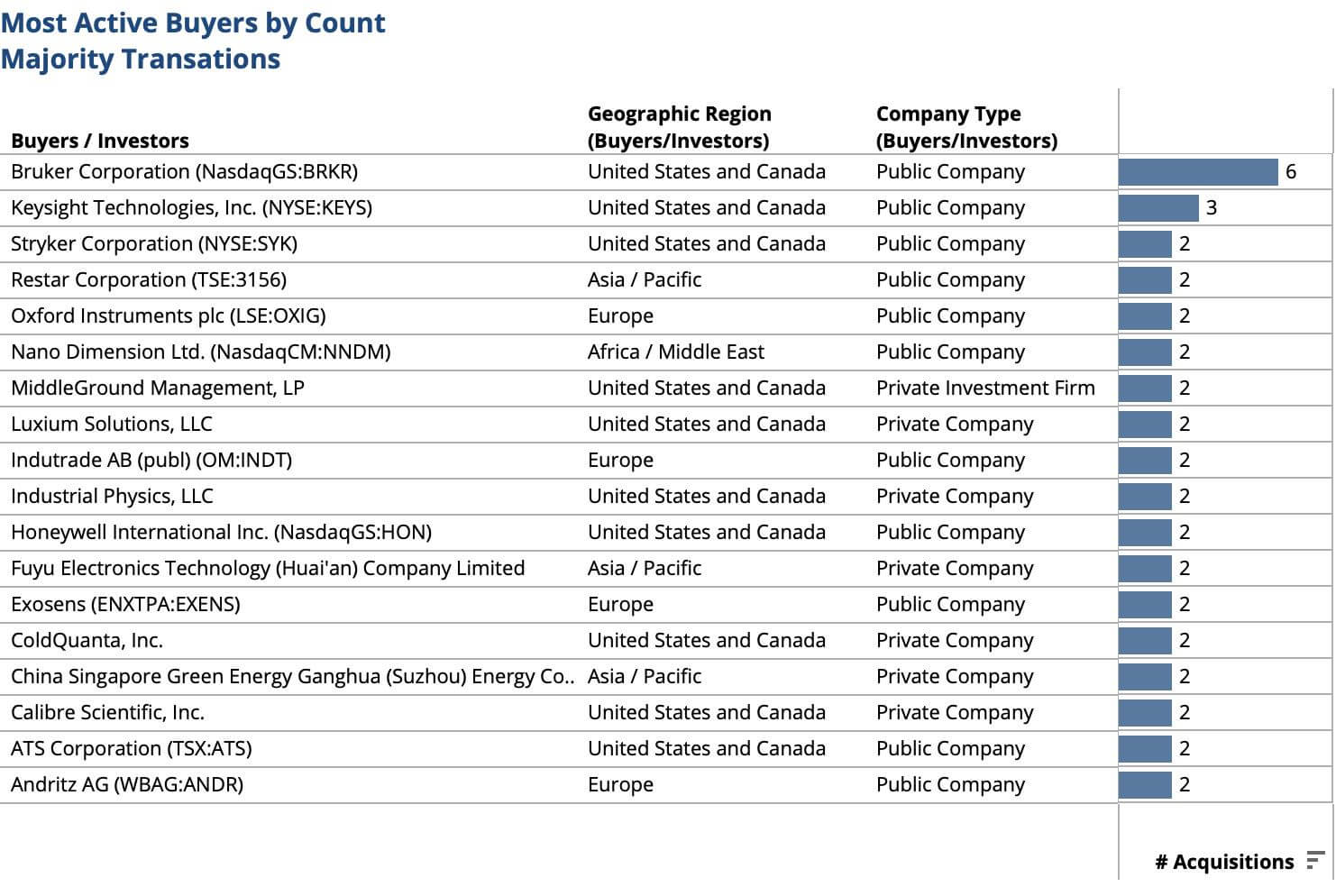

The Most Active Buyers

In line with history, the most active buyer is Bruker Corporation who acquires five Biophotonics companies – Nanophoton Corporation, provider of laser microscopes (3.50x $5M revenue); Spectral Instruments Imaging, LLC, provider of preclinical optical systems for bioluminescent, fluorescent and x-ray imaging (3.75x $10M revenue); Tornado Medical Systems, Inc., provider of optical spectrometers for raman spectroscopy and spectral-domain optical coherence tomography; NanoString Technologies, Inc., provider of life science tools for translational research and molecular diagnostics for $393M (2.3x $168M revenue); and ELITech Group SAS, manufacturer of in vitro diagnostic equipment and reagents for $943M. Bruker also acquires Nion Company, manufacturer of scanning transmission electron microscopes (7.25x $8M revenue).

Following is Keysight Technologies, Inc. who makes three acquisitions – Spirent Communications plc, provider automated test and assurance solutions for $1.5B; Synopsys, Inc. Optical Solutions Group, provider of optical design tools; and AUTO Mobility Solutions Co. Ltd., developer of AI self-driving technologies for indoor use for $943M.

In line with history, there continues to be much higher concentration of strategic buyers than financial buyers.

2024 Photonics M & A

Despite economic and geopolitical uncertainty, M&A activity for targets employing photonics technology appears to be on a steep upward trajectory – outpacing the global M&A market as a whole.

High interest rates, lower valuations and geopolitical instability are show-stoppers for many buyers and sellers, while fueling the strategic need for M&A to grow stronger, creating pent-up demand. The flood gates seem cracked open for M&A given a recent strong quarter of activity and the essential roles of photonics technology enabled targets in transforming and disrupting markets.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.