Mergers & Acquisitions in Photonics | January thru December 2024

The photonics M&A market, like the broader global M&A landscape, endures a tumultuous three years, with activity and deal values well below the peak levels of 2020 and 2021. Macroeconomic headwinds, including surging inflation, aggressive interest rate hikes, and geopolitical instability across key regions such as the Middle East, Europe, and China, dampen deal-making momentum. Compounding these challenges are persistent supply chain disruptions and labor shortages, which have added layers of complexity for buyers and sellers alike. High interest rates, lower valuations, and geopolitical instability deter many buyers and sellers while simultaneously creating pent-up demand for strategic M&A in recent years.

Following record lows of 2023, M&A activity for photonics-related targets is now on the rise, driven by strategic buyers seeking to navigate evolving markets, technological advancements, and the realities of government intervention. Over recent years, the focus of M&A in photonics shifts —from scaling core businesses to securing niche capabilities through smaller transactions and vertical integrations. As strategic players aim to secure competitive advantages, photonics technologies are key enablers across sectors, offering innovative solutions to address global challenges ranging from digital transformation to national security and environmental sustainability.

The opportunities are particularly compelling for photonics-enabled targets. The insatiable demand for computing power, fueled by AI and cybersecurity needs, underscores the critical role of optical communications and, eventually, quantum technologies. Meanwhile, geopolitical dynamics are driving innovation in defense, automation, and environmental monitoring, further solidifying photonics’ position as a transformative force. Game-changing applications like Laser Directed Energy Weapons (LDEW), Counter Communications Systems (CCS) for electronic warfare, military robotics, and 3D printing of munitions highlight photonics’ critical role in addressing national security threats. In manufacturing and service industries, photonics-enabled automation and robotics are alleviating labor shortages and driving cost efficiencies. Additionally, in-line and satellite-based environmental monitoring using optical methods is playing a critical role in mitigating climate change by tracking greenhouse gas emissions, providing early warning systems, and enhancing regulatory compliance.

The Transactions

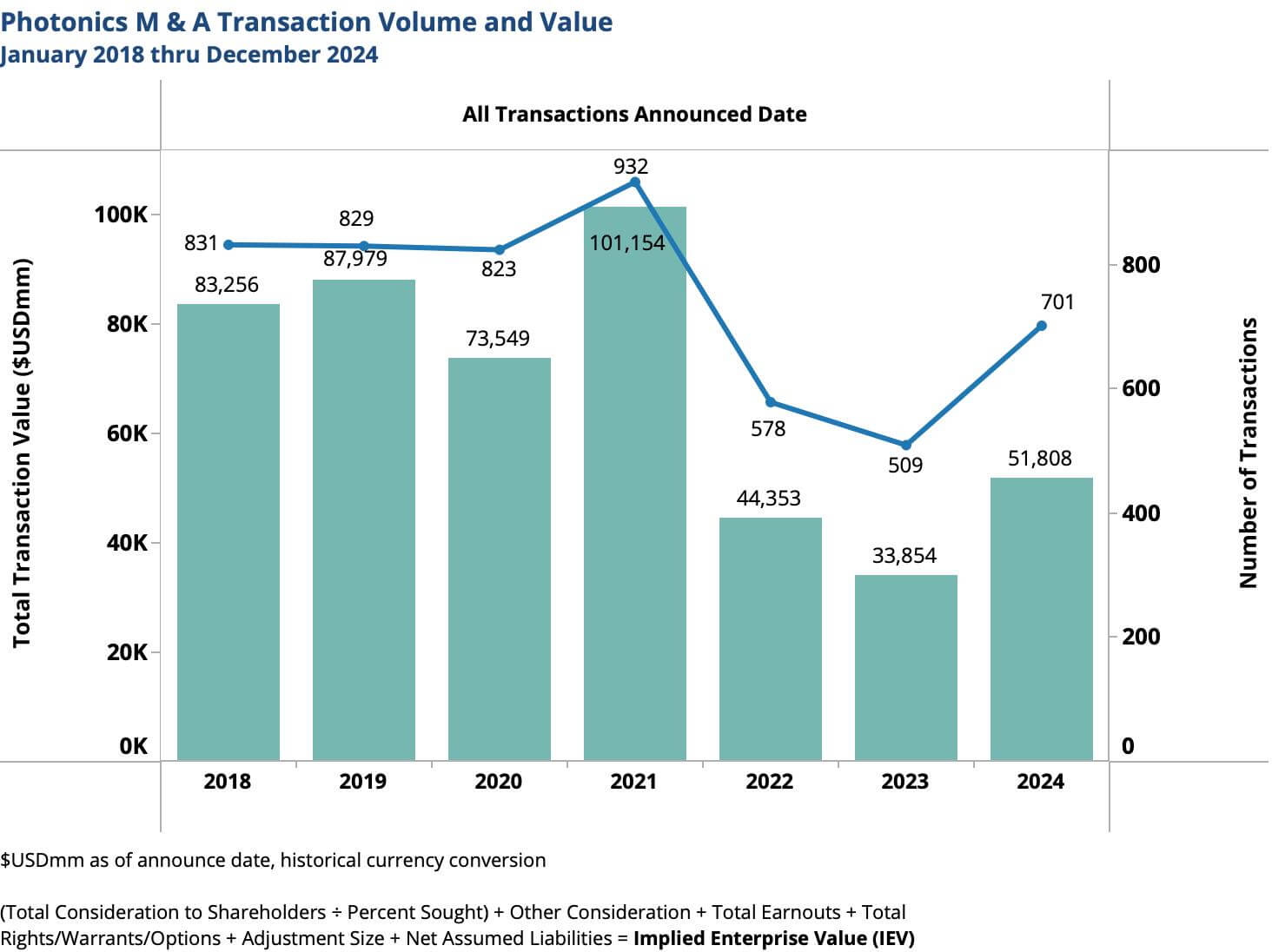

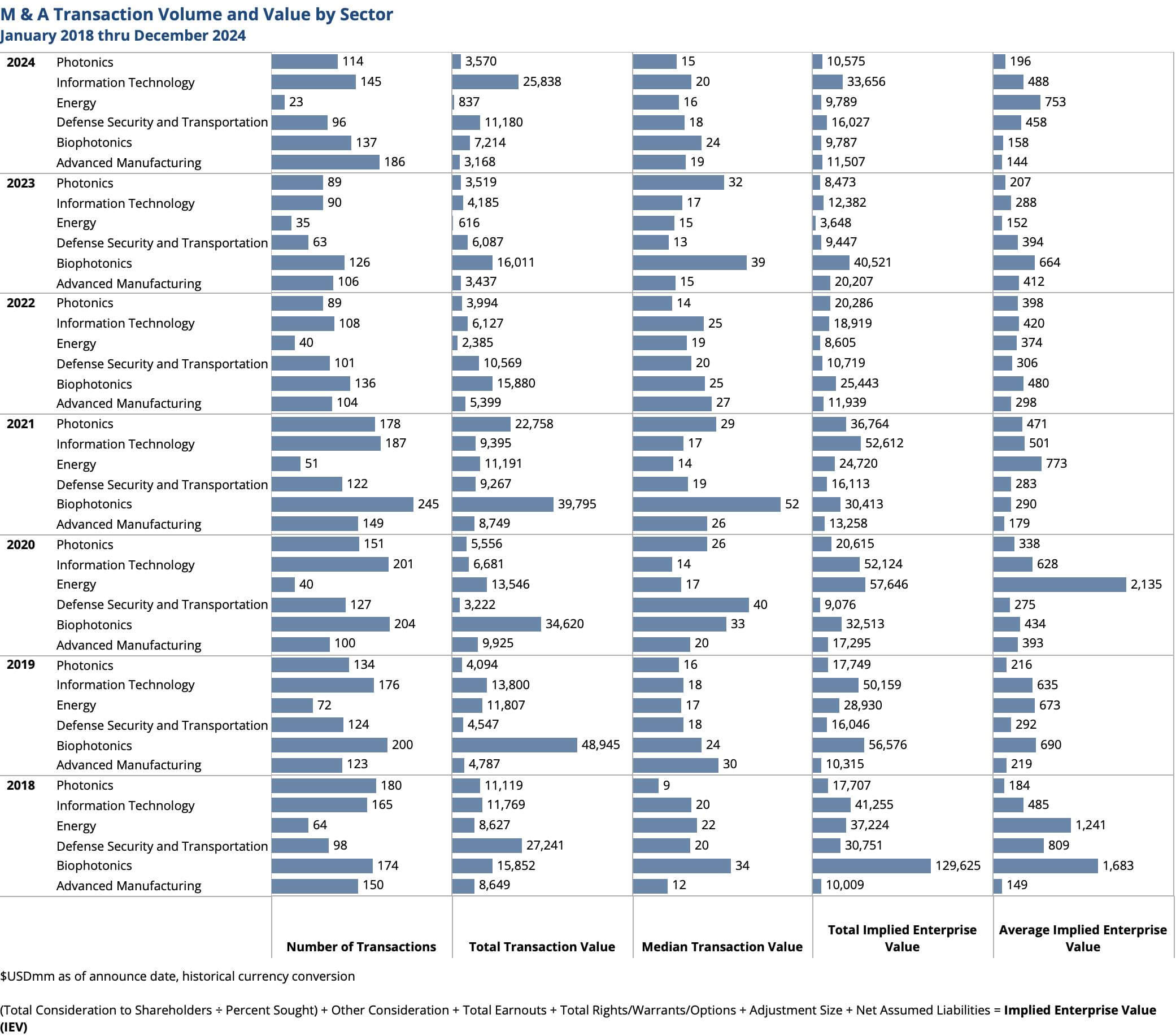

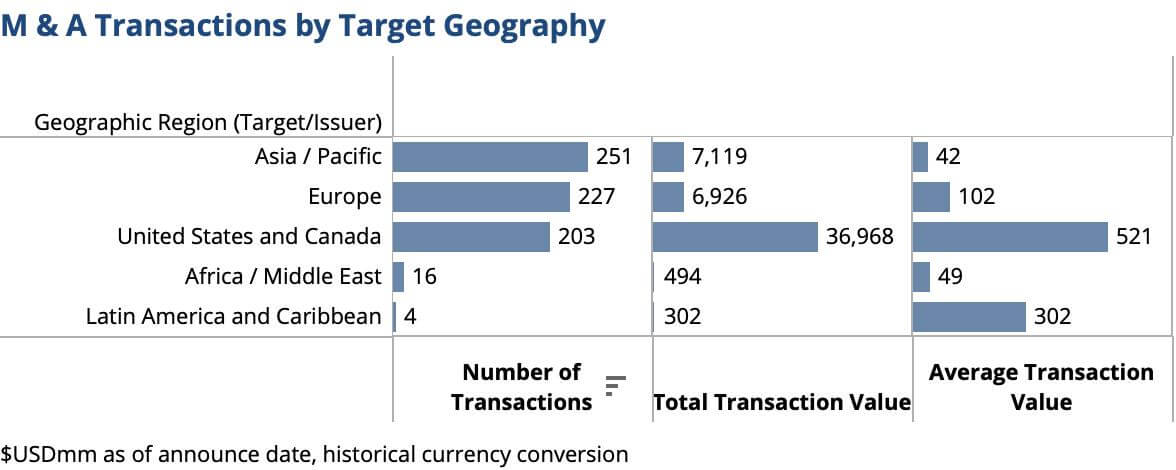

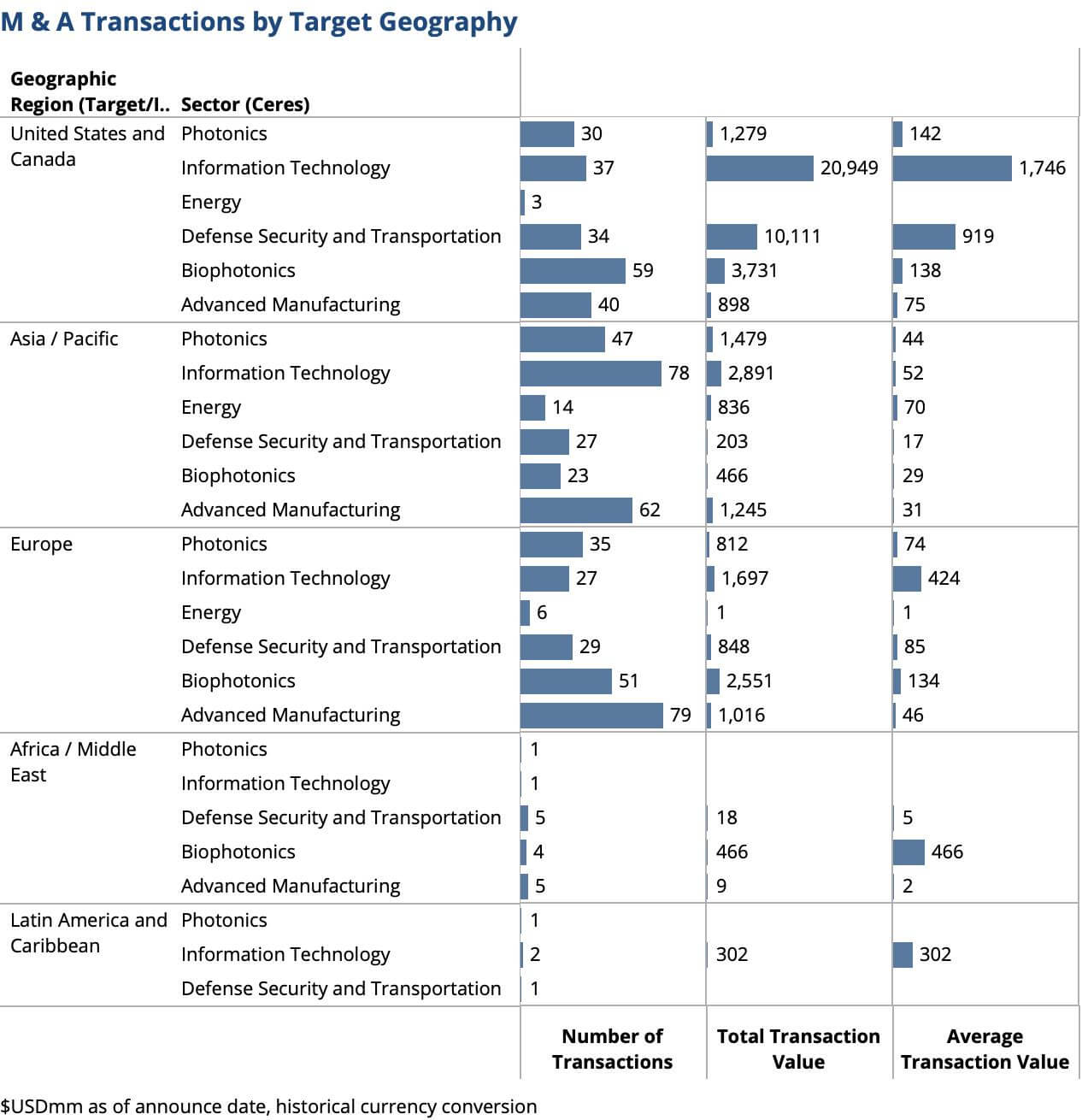

In 2024, 42,798 M&A transactions valued at $2.5 trillion are announced globally. CERES identifies and analyzes 701 transactions valued at $51.8 billion specifically in the photonics industry and vertical markets where photonics technologies serve as core differentiators.

M&A activity and volume appear to be on a steep upward trajectory in 2024. However, although higher than 2022 and 2023 levels, the overall M&A market in 2024 remains far below its 2021 peak, with total transaction value and count declining by 45% and 26%, respectively. The photonics M&A market faces similar challenges, with transaction value dropping 48% and deal volume falling 24% since its 2021 peak.

After a very slow start in the first quarter of 2024, the volume of transactions for photonics targets is 40% higher than 2023. Total deal value of $52billion is more than 50% higher than last year.

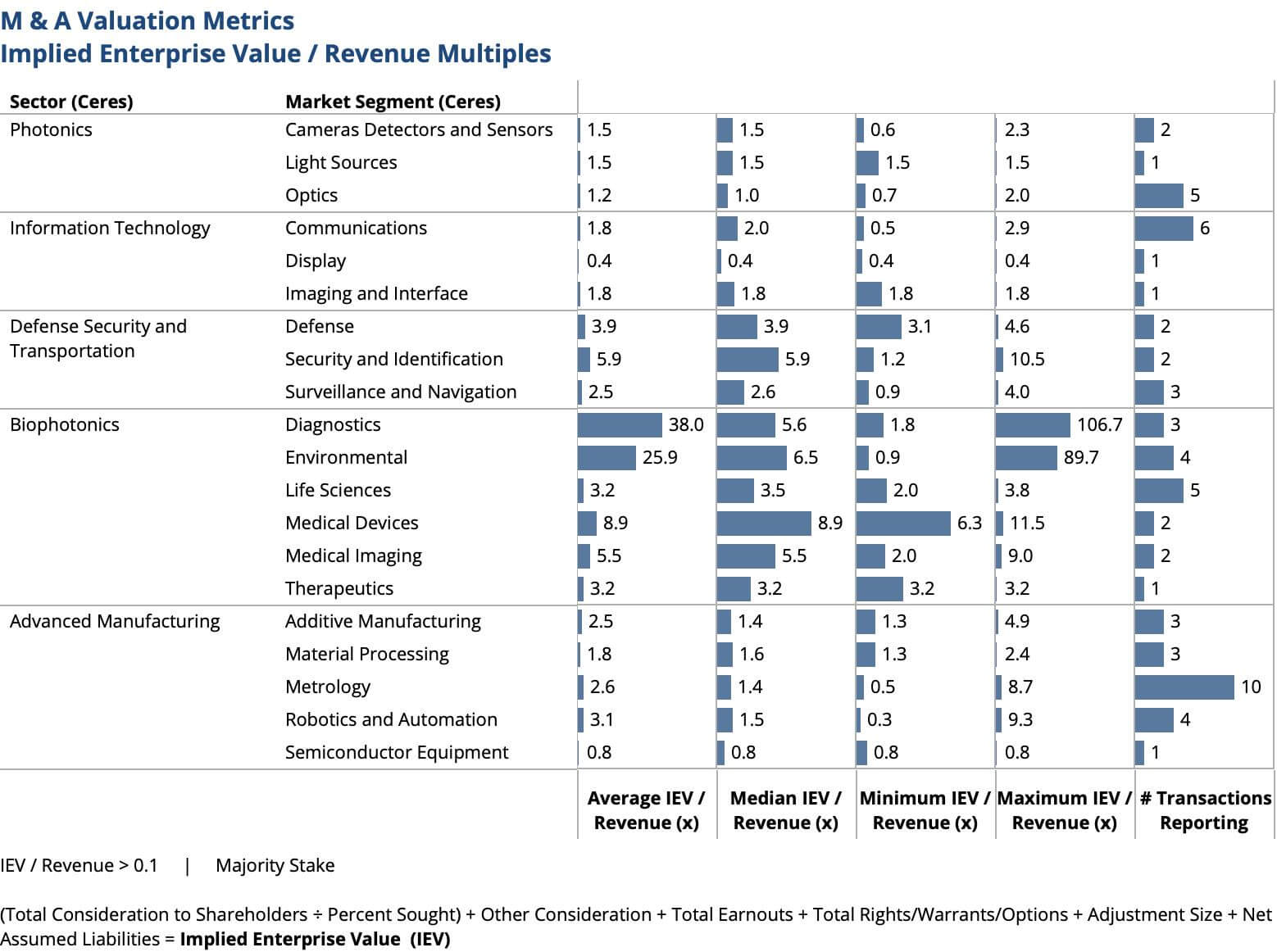

CERES research includes M&A transactions announced between January 1 and December 31, 2024 for targets employing photonics technologies. Activity and valuations are analyzed by market segments. Values are in $US at historical exchange rates. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

The Valuations

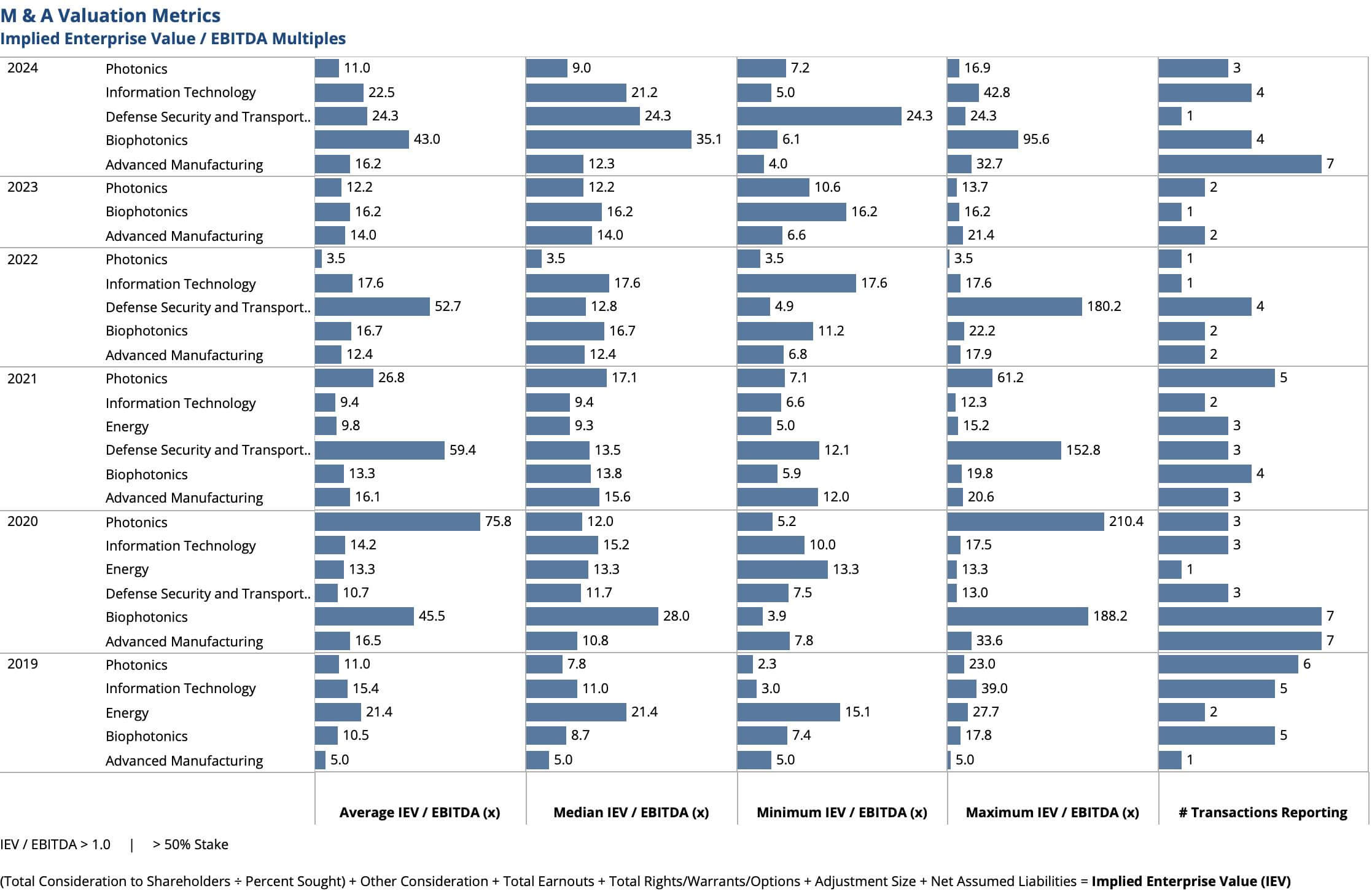

Valuations in photonics M&A remain robust in 2024, with transaction multiples reflecting the sector’s strategic importance. IEV/EBITDA multiples for photonics deals consistently outpace broader market benchmarks, driven by the high demand for specialized capabilities and the scarcity of high-performing assets.

According to Bain & Co., valuation multiples for strategic M&A market as a whole remain relatively stable in 2024, with enterprise value to EBITDA (IEV/EBITDA) ratios around 10.4x. This steadiness indicates cautious optimism among corporate buyers, balancing growth ambitions with prudent valuation assessments. In contrast, public market valuations, exemplified by the S&P 500, maintain higher multiples, averaging 16.6x IEV/EBITDA. This disparity contributes to a valuation expectations gap. Elevated borrowing costs with higher interest rates influence deal structures and valuations, with a rise in all-cash deals and increased use of earnouts to bridge valuation gaps between buyers and sellers, influencing deal negotiations.

Few transactions researched disclose financial details, as regulations often exempt those without a material near-term impact on financial statements. Nevertheless, M&A transaction data remains critical for understanding market dynamics and buyer behavior. Among the identified and researched deals, 136 report valuation metrics, and 62 involve majority share acquisitions.

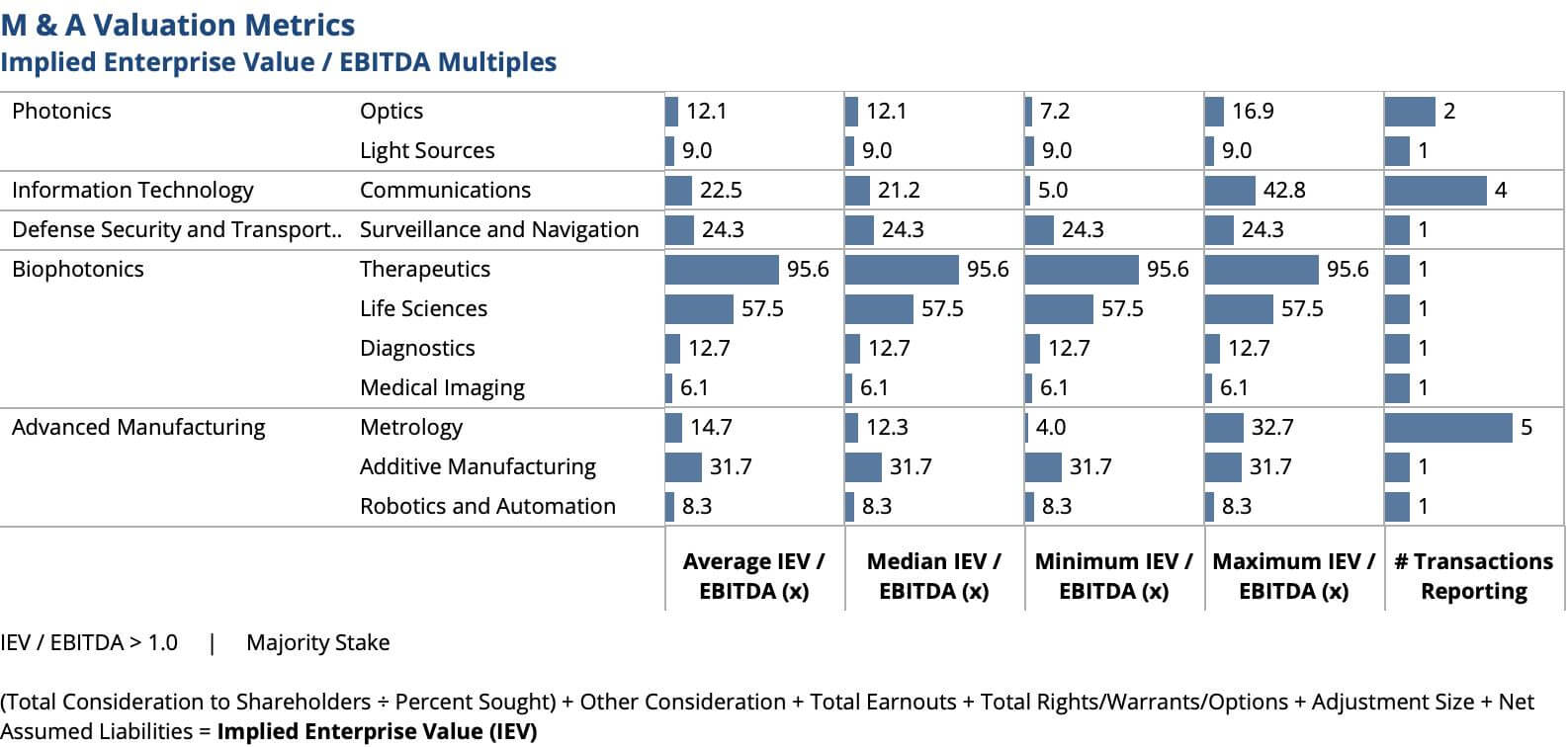

Leading the pack on IEV/EBITDA multiples for acquisitions of 100% share are: Hamilton Thorne Ltd. (57.5x), an established player in the niche, high-value Assisted Reproductive Technology market employing IR lasers fitted to standard microscopes for precision embryo treatment (US); Infinera Corporation (42.8x), provider of optical semiconductors and networking equipment (US); Air Control Entech Ltd (32.7x), provider of robotic inspection services for oil and gas industry (UK); and Desktop Metal, Inc. (32.7x), manufacturer of additive manufacturing technologies (US).

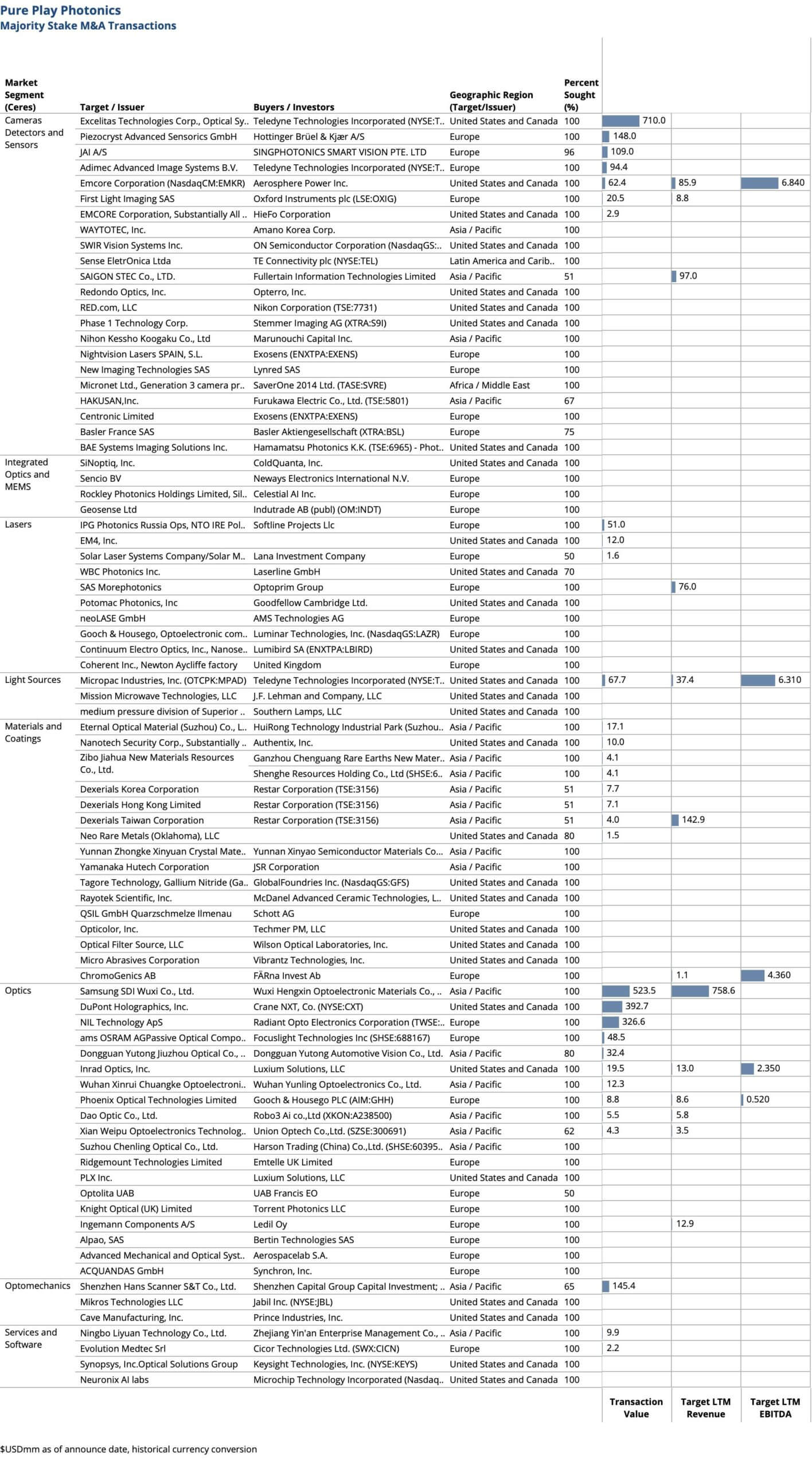

Pure-Play Photonics

Photonics, defined as the core components market in SPIE Optics & Photonics Global Industry Report 2024, outpaces global GDP growth for a decade, with total market size approaching $370 billion.

Pure-play Photonics market leaders remain largely not acquisitive in 2024. The total number of transactions is on an upward trajectory due to a high concentration of small and middle-market strategic acquisitions of capabilities, product lines and technical talent by the smaller market participants. The total transaction volume, however, is flat and far below 2021 in the absence of any mega mergers. The absence of mega mergers is attributed to several factors – high interest rates and increased cost of capital, regulatory scrutiny due to geopolitical tensions and a shift to focus on core assets.

Divestitures

In 2024, many pure-play Photonics market leaders strategically divest businesses to realign with long-term growth objectives. Proceeds from these divestitures are often reinvested into core growth initiatives or used to reduce debt burdens. Additional motivations to divest include heightened regulatory scrutiny, driven by geopolitical and antitrust concerns, as well as challenges related to technology obsolescence and management bandwidth constraints.

Han’s Laser Technology Industry Group Co., Ltd. sells 65% stake in its optical scanning system solutions business to investors for $145M. Gooch & Housego sells its optoelectronic components and laser modules business to Luminar Technologies, Inc. and divests EM4, Inc., supplier of optoelectronics modules for $12M. The British government acquires struggling Newton Aycliffe factory from Coherent Inc. to secure domestic manufacture of gallium arsenide semiconductors for military technology. Synopsys, Inc. sells its Optical Solutions Group to Keysight Technologies, Inc. to obtain regulatory approval for its proposed $35B acquisition of ANSYS, Inc. IPG Photonics Corporation sells its Russian subsidiary in a management buyout for $51M, finalizing its exit from Russia after imposed Ukraine war trade sanctions. Emcore Corporation continues to restructure with divesture of its discontinued chips business line to HieFo Corporation for $2.9M. ams OSRAM AG sells its Passive Optical Components to Focuslight Technologies Inc. for $49M. Excelitas Technologies Corp. sells select aerospace and defense electronics businesses, including Qioptiq® Optical Systems and Advanced Electronic Systems to Teledyne Technologies Incorporated. Samsung SDI Co., Ltd. divests Samsung SDI Wuxi Co., Ltd., supplier of polarizing display films, for $524M, to focus on high growth markets for next-generation semiconductor materials and OLED technology. Amplitude Technologies SA divests its Continuum nanosecond laser product line to Lumibird SA. Hoya Corporation divests its 46.57% stake in AvanStrate Inc., manufacturer of glass substrates for LCD’s.

The Targets with Core Photonics Technology

Advanced Manufacturing

The Advanced Manufacturing sector sees the most activity in 2024. Transactions are lower middle market or smaller with high concentrations of capabilities deals and vertical integration plays. Within the Advanced Manufacturing sector, the Robotics and Automation market segment sees the most activity with a high concentration of smaller strategic capabilities deals.

Machine vision, 3D printing, optical metrology and 3D sensing have been advancing manufacturing for decades. Factory automation is evolving rapidly, driven by advancements in technologies such as AI, robotics and data analytics. Combined with advances in photonics technologies, the products and services of targets being acquired today offer game changing improvements in process optimization, quality control, energy efficiency, inventory management and supply chain, skilled labor demand and security.

In manufacturing and service industries alike, photonics enabled automation and robotics solutions are alleviating labor shortages and reducing costs. Wall Street Journal reports a focus on Artificial Intelligence (AI) and Robotics and cites investments in AI and robotics are significant, with venture capitalists predicting increased M&A activity in these areas. The integration of AI into manufacturing, business processes and advancements in robotics are expected to drive deal-making in the future.

The largest transactions in the sector are: 56% of Mimasu Semiconductor Industry Co., Ltd., supplier of semiconductor materials and metrology equipment, acquired by Shin Etsu Chemical Co., Ltd. for $379M; Desktop Metal, Inc., provider of additive manufacturing technologies, acquired by Nano Dimension Ltd. (31.7x $7.6M EBITDA); 96% of Stemmer Imaging AG, provider of machine vision subsystems, acquired by MiddleGround Management, LP in three separate transactions for a total of $330M (12x to 17x EBITDA).

Information Technology

The Information Technology sector accounts for the largest total value in 2024, due to the acquisition of Juniper Networks, Inc., supplier of optical data communications networking equipment, by Hewlett Packard Enterprise Company for $15.4B (17.5x EBITDA). Following are three very large transactions also in the Communications market segment – Nokia Oyj acquisition of Infinera Corporation, provider of optical semiconductors and networking equipment, for $2.4B (42.8x EBITDA); Amphenol Corporation acquisition of Carlisle Interconnect Technologies Inc., provider of optical interconnects, for $2.0B; and Keysight Technologies, Inc. acquisition of Spirent Communications plc, provider of automated test equipment for optical networks, for $1.5B (24.9x EBITDA).

The high value and number of transactions in the Communications market segment among companies supplying components, equipment, and testing for optical networks strongly signals a tremendous future demand for optical data communications, closely tied to several transformative trends. First, there is an explosion of AI and data traffic driving a surge in data generation, requiring high-speed, low-latency optical networks. Data center expansion, critical for AI, is at a hyper-scale, relies heavily on optical networking solutions to manage the immense volumes of data being processed and transferred. Second, growth in edge computing to support AI-driven applications demands robust optical interconnects to bridge data centers and distributed network nodes. Second, there is huge demand for higher bandwidth and scalability. Next-generation networks’ shift to 5G, and eventually 6G, requires significant investments in optical backhaul and fronthaul infrastructure to handle the increased bandwidth demand. Companies are consolidating capabilities to deliver scalable solutions, as customers require end-to-end optical solutions that integrate hardware, software, and testing.

The elevated EBITDA multiples in Communications transactions indicate strong confidence in future growth prospects for optical networking technologies. Companies with specialized technologies, like automated testing or advanced optical interconnects, command very high valuations as they address critical bottlenecks in the ecosystem.

Unlike 2021 peak, augmented reality and virtual imaging drive very little M&A activity in 2024. The majority of the value in the Display market segments is consolidation of LCD and OLED component and display manufacturers.

In 2022, the quantum computing market (Computing and Storage) sees strategic acquisitions by market leaders placing bets on emerging companies and VC funded start-ups merging. In 2023, there are no acquisitions. In 2024, there are handful of acquisitions, predominantly vertical integration plays by quantum computer developers – ColdQuanta, Inc., ORCA Computing Limited, IonQ, Inc. and Spectral Capital Corporation.

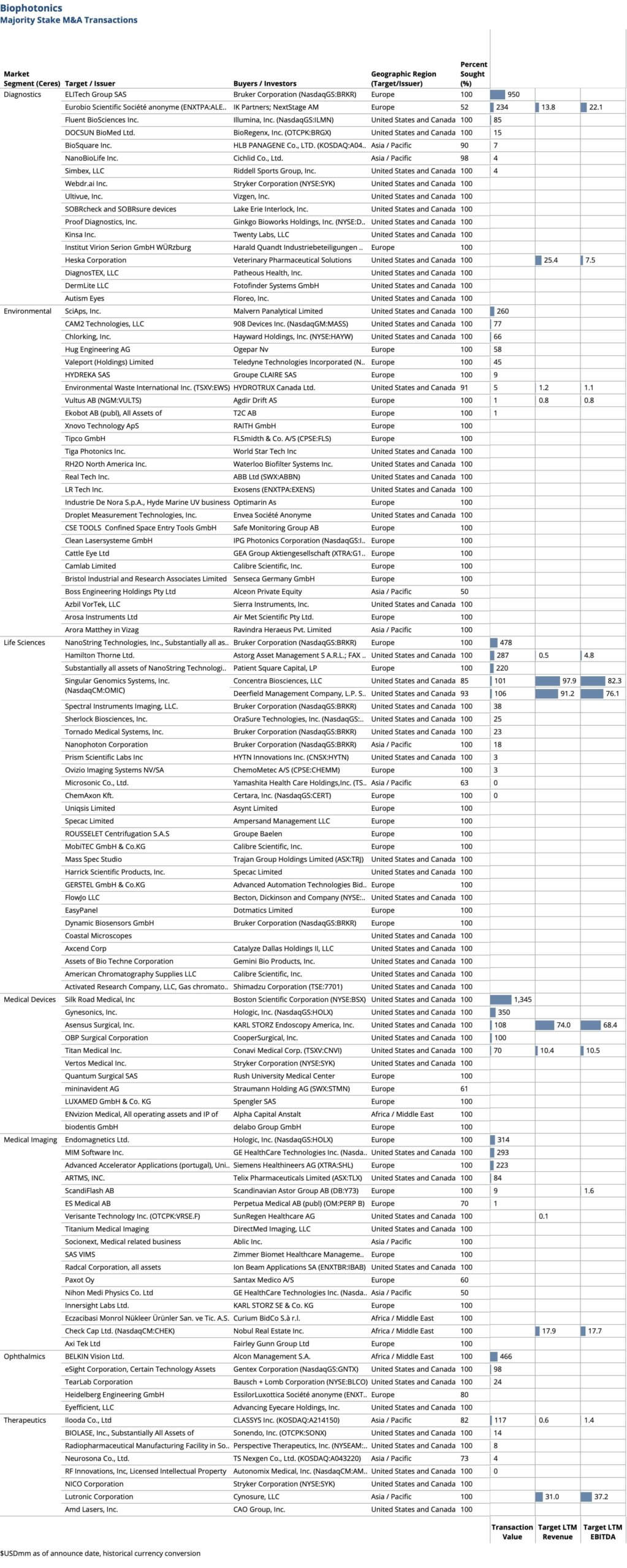

Biophotonics

Typically resilient to economic downturns, the Biophotonics sector faces a prolonged slump since 2022, with the number and volume of M&A transactions remaining subdued in 2024. There is evidence, however, in the market as a whole and with targets relying on photonics technology of an upward trajectory into the future.

The M&A market for Medical Devices as a whole is characterized by notable activity in the latter half of 2024. Many targets employ minimally invasive optical surgical guidance methods. They include: Silk Road Medical, Inc, developer of solutions to prevent stroke and treat carotid artery disease employing x-ray imaging fluoroscopy for real-time guidance and placement of its devices within the carotid artery, acquired by Boston Scientific Corporation for $1.3B; Gynesonics, Inc., developer of solutions for symptomatic uterine fibroids in women employing sonography guidance and radiofrequency (RF) ablation, acquired by Hologic, Inc. for $350M; and Vertos Medical Inc., developer of outpatient treatments for lumbar spinal stenosis employing fluoroscopically guidance, acquired by Stryker Corporation.

The M&A market for Medical Diagnostics as a whole also experiences a dynamic M&A landscape late 2024 with technological advancements driving M&A. Market leaders are seeking to enhance their technological capabilities through strategic acquisitions to stay competitive. A focus on innovation includes advancements in diagnostic technologies, such as next-generation sequencing and point-of-care diagnostics dominates the landscape of Diagnostics targets acquired in 2024. ELITech Group SAS, acquired by Bruker Corporation for $950M, enhances the specificity and sensitivity of molecular assays, utilizing melting curve analysis alongside multiple optical channels, enabling precise differentiation of genetic variants, such as distinguishing SARS-CoV-2 Omicron variant from other variants. Integrating downstream with its fluorescence-based sequencers, Illumina, Inc. acquires Fluent BioSciences Inc., developer of novel single cell analysis products that offer scalable molecular analysis without complex instrumentation and microfluidic consumables, for $85M.

In 2024, unlike other photonics enabled sectors, Biophotonics sees significant activity, more than half of the transactions, for private equity sponsors on the buy side.

Announced January 2025 and not included in analysis presented, but evidence of a return of the robust Biophotonics market segment, Boston Scientific Corporation acquires Bolt Medical, Inc., supplier of laser-based intravascular lithotripsy devices with Implied Enterprise Value of $820M.

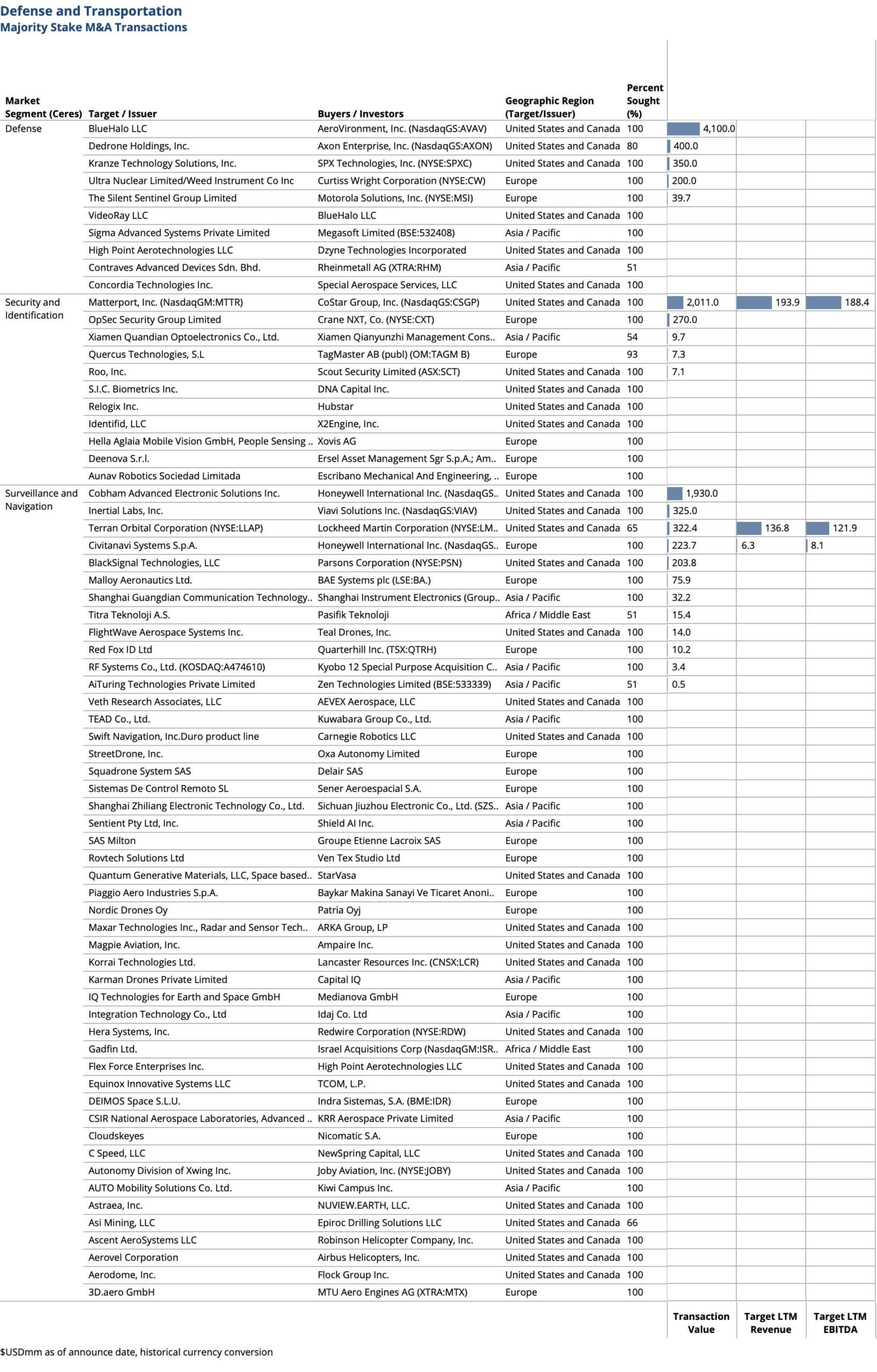

Defense, Security and Transportation

The overall global Defense M&A market in 2024 is characterized by increased deal activity, a focus on emerging technologies, significant private equity involvement, supply chain consolidation efforts, and the influence of geopolitical factors. These trends reflect the industry’s response to modern warfare demands and the strategic importance of technological advancement in defense.

The largest transactions in the Defense, Security and Transportation sector are: BlueHalo LLC, provider of solutions for space superiority, laser directed energy weapons, missile defense, and cyber and intelligence, acquired by AeroVironment, Inc. for $4.1B (4.6x Revenue); Matterport, Inc. , provider of LiDAR sensors, infrared depth sensors and high-resolution photographic imaging, acquired by CoStar Group, Inc. for $2B (10.5x Revenue); and Cobham Advanced Electronic Solutions Inc., supplier of advanced antenna and laser based systems for electronic warfare, radar systems, satellite communications and targeting, acquired by Honeywell International Inc. for $1.9B.

The volume of M&A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for autonomous ground and aerial vehicles and smart robots. The volume of M&A activity in the Security and Identification segment is largely attributed to targets supplying facial recognition and other optical biometrics security solutions.

While the largest transactions are with US targets, only one-third of all targets are US. Market leaders and financial sponsors in China, Europe and India are also very acquisitive.

The Geographies

M&A activity in photonics exhibited significant regional variation in 2024, shaped by macroeconomic factors and geopolitical trends.

The U.S. is experiencing a rebound in mergers and acquisitions, particularly in the technology sectors. This resurgence is driven by anticipated interest rate cuts and a pro-business regulatory environment under the Trump administration.

In Europe, M&A activity is more subdued, with lingering inflationary pressures and regulatory scrutiny impacting deal flow. Targeted acquisitions, however, in telecommunications and environmental monitoring highlight the region’s commitment to technological advancement and sustainability goals. Germany and the UK are most active, driven by their robust industrial bases.

The Asia-Pacific region show mixed results. India experiences an 18% increase in deal values, reflecting growing demand for photonics solutions in infrastructure and manufacturing. Meanwhile, China faces continued headwinds from geopolitical tensions and economic challenges, which constrained cross-border deal-making.

These geographical trends underscore the diverse opportunities and challenges shaping the photonics M&A landscape, with regional dynamics playing a pivotal role in driving activity.

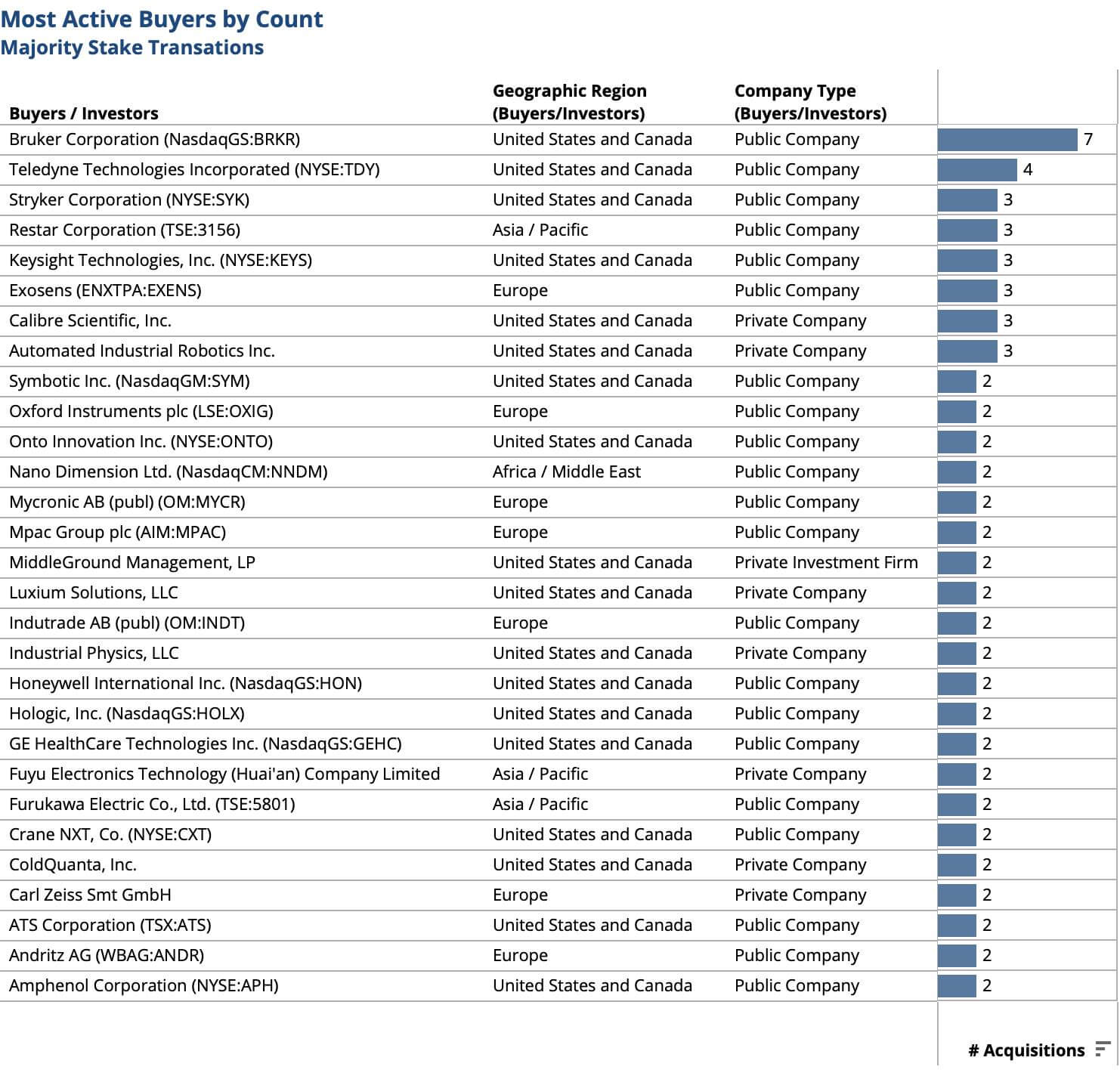

The Most Active Buyers

In line with history, the most active buyer is Bruker Corporation who acquires six Biophotonics companies – Nanophoton Corporation, provider of laser microscopes (3.50x $5M revenue); Spectral Instruments Imaging, LLC, provider of preclinical optical systems for bioluminescent, fluorescent and x-ray imaging (3.75x $10M revenue); Tornado Medical Systems, Inc., provider of optical spectrometers for raman spectroscopy and spectral-domain optical coherence tomography; NanoString Technologies, Inc., provider of life science tools for translational research and molecular diagnostics for $478M (2.84x $168M revenue); ELITech Group SAS, manufacturer of in vitro diagnostic equipment and reagents for $950M (5.58x $162.5M revenue); and Dynamic Biosensors GmbH, developer of label-free biomolecular interaction analysis solutions. Bruker also acquires Nion Company, manufacturer of scanning transmission electron microscopes (7.25x $8M revenue).

Teledyne Technologies Incorporated makes four acquisitions – Adimec Advanced Image Systems B.V., manufacturer of industrial cameras and lens assemblies for machine vision, medical imaging, and military applications, for $94M; Optical Systems Business and Advanced Electronic Systems Business of Excelitas Technologies Corp., for $710M; and Micropac Industries, Inc., provider of optocouplers and fiber optic transceivers for military, space and satellites, for $56.5M (9.0x $6.3M EBITDA); Valeport (Holdings) Limited, manufacturer of turbidity sensors, fluorometers, multi-parameter probes and optical backscatter sensors for environmental monitoring, for $41M.

Keysight Technologies, Inc. makes three acquisitions – Spirent Communications plc, provider of automated test and assurance solutions, for $1.5B; Synopsys, Inc. Optical Solutions Group, provider of optical design tools; and AUTO Mobility Solutions Co. Ltd., developer of indoor use AI self-driving technologies, for $943M.

Exosens makes three acquisitions – Nightvision Lasers SPAIN, S.L., manufacturer of man portable night vision and thermal devices; Centronic Limited, provider of detectors, including silicon photodiodes; and LR Tech Inc., provider of spectroradiometers and infrared imaging solutions for atmospheric sounding and remote sensing in Defense.

In line with history, the photonics M&A market is dominated by strategic buyers who are willing to pay premiums for strategic fit, operational synergies and long term value. Further, compared to private equity buyers, a strategic buyer’s intimate industry knowledge and technology depth allow for speed and certainty of closing with reduced financing contingencies. Strategic buyers have the benefit to focus on core competencies to expand their market position, as opposed to extracting short-term financial returns.

Photonics M & A Future

As we step into 2025, the global M&A market is characterized by cautious optimism. Declining inflation, easing monetary policies, and resilient economic performance in key economies are creating a more favorable environment for deal-making, even as uncertainty lingers.

Strategic buyers are expected to maintain their focus on portfolio realignment. This includes divesting non-core businesses to concentrate resources on long-term growth priorities and pursuing acquisitions to expand capabilities, penetrate new markets, and enhance supply chain resilience. Vertical integration and access to niche technologies will remain critical objectives as companies strive to navigate global challenges and maintain competitive advantages.

The composition of M&A activity is also evolving. There appears to be a continued trend toward fewer mega-mergers and deals aimed at scaling large core businesses, alongside a higher concentration of lower middle market transactions. This highlights the growing focus on smaller, lower middle market transactions, where buyers are prioritizing strategic acquisitions to enhance specific capabilities or address targeted needs. These transactions reflect the cautious approach many buyers are taking, opting for manageable deals that minimize risk while still offering opportunities for growth and competitive positioning.

For well-capitalized strategic buyers and growth-oriented financial buyers, the current market conditions present an opportune time to act. Financial buyers, however, who often rely on capital markets for funding through Limited Partners and debt financing, may face greater challenges in an environment of high interest rates and valuation uncertainties caused by market volatility. Private equity-driven leveraged buyouts largely take a back seat in recent M&A activity, given the dual pressures of rising borrowing costs and fluctuating valuations. Nonetheless, financial buyers targeting companies with core photonics technologies are likely to apply proven strategies from other sectors.

Photonics technologies are poised to play a transformative role in 2025 and beyond, driving innovation across a broad landscape of industries. With pent-up demand and a supportive macroeconomic backdrop, the photonics M&A market holds immense potential, making it an exciting space for both strategic and financial buyers. The photonics M&A market is not just rebounding—it is poised to lead a new wave of growth and technological progress, setting the stage for a transformative era.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.