Mergers & Acquisitions in Photonics | 2025 Three Quarters

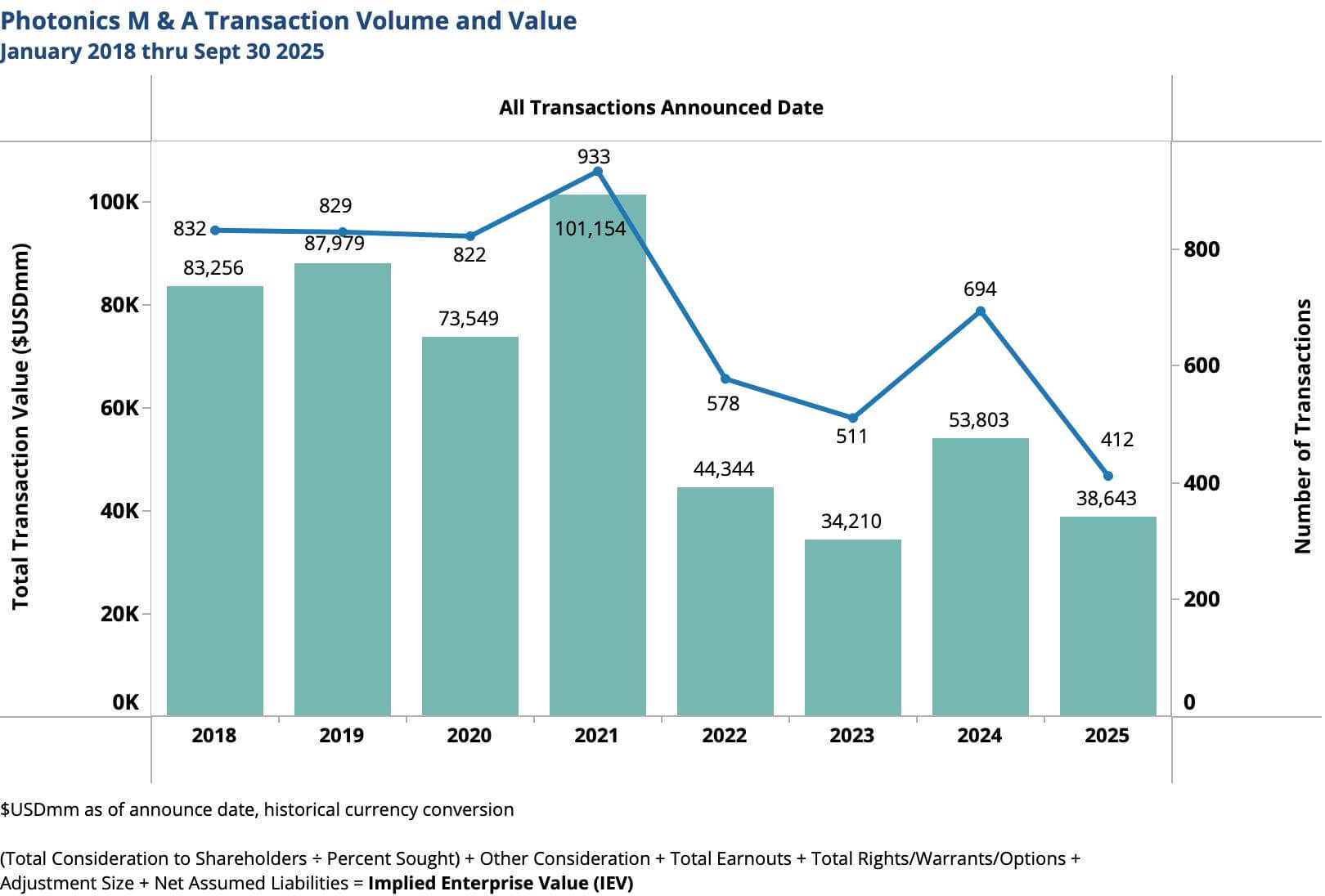

The global M&A market in 2025 is defined by divergence: deal values continue to climb while overall volumes remain flat. For the twelve months ending September 30, 2025, announced deal values rose 24% year-over-year, even as the number of transactions held steady. The result is a market characterized less by breadth and more by scale and selectivity, with higher-than-average deal sizes underscoring focus on fewer, larger and more strategic moves.

Photonics-related M&A, by contrast, does not mirror these broader patterns. While deal flow is dominated by mega-acquisitions in AI software and utility consolidation—areas only tangentially connected to photonics – Photonics M&A sees a decline in both volume and value.

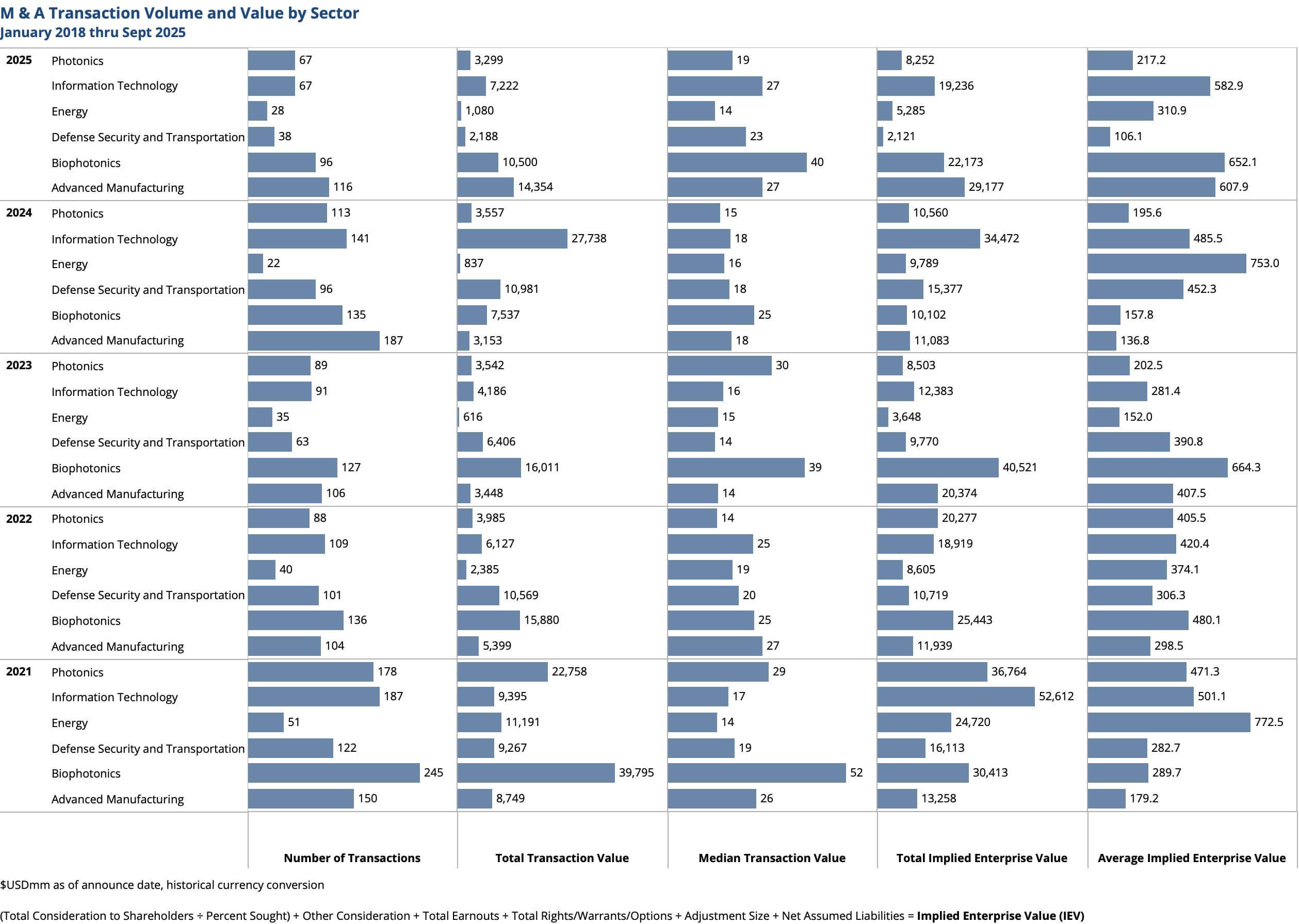

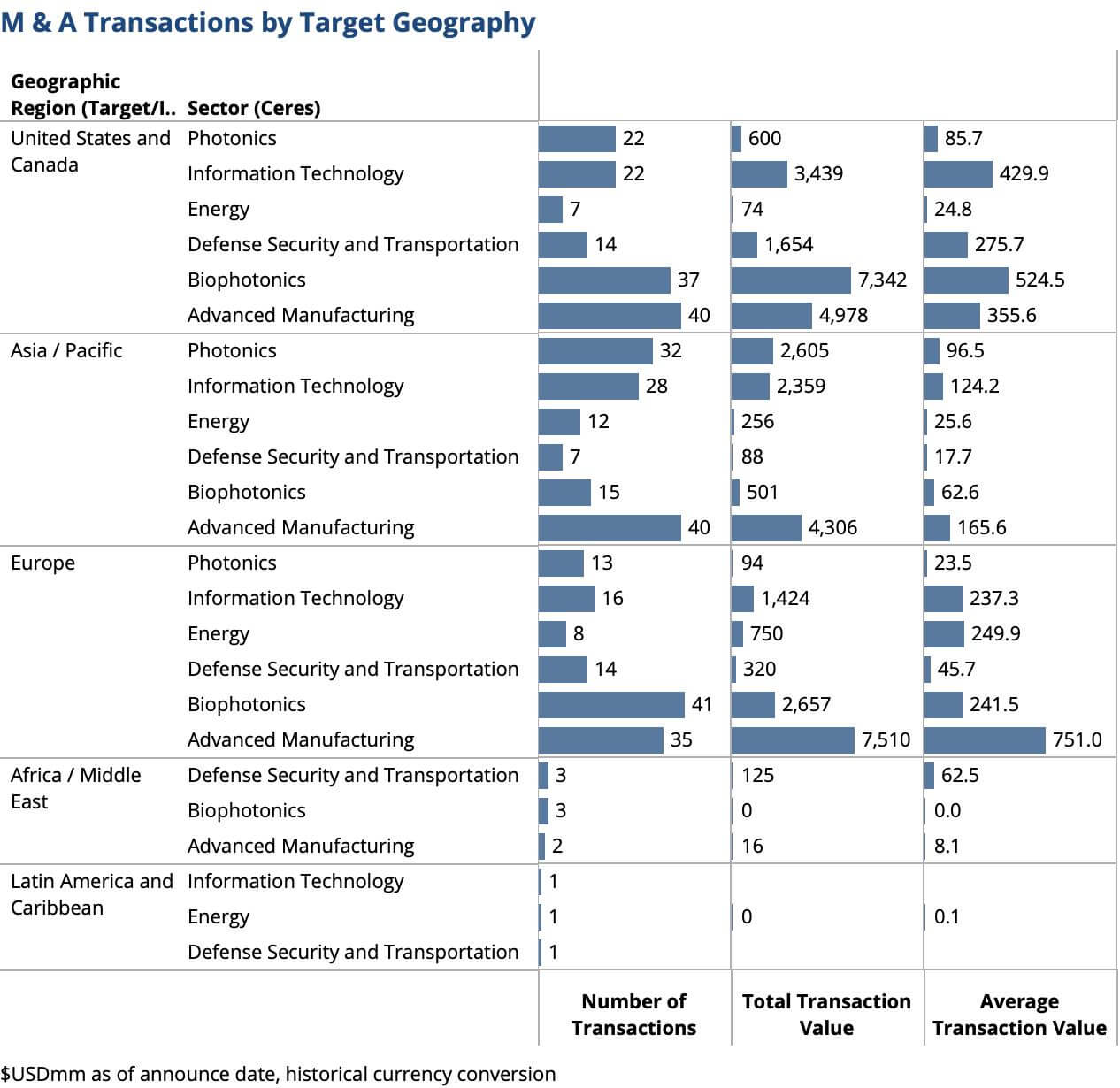

The picture, however, is not one of contraction alone. In Photonics-related M&A, deal value shows an upturn in both Advanced Manufacturing and Biophotonics, even as Information Technology activity declined in the absence of mega-deals in 2025. As in prior years, it often moves on a different axis than the broader market. This reflects the distinct profile of photonics-enabled targets: smaller, highly differentiated businesses that can attract buyers and thrive even in periods of macroeconomic uncertainty.

While headline metrics diverged, the drivers shaping the broader M&A market remain highly relevant to photonics.

Strategic buyers are concentrating on capability-driven acquisitions. This year, M&A is less about expanding geographic reach or simply adding revenue, and more about acquiring enabling technologies, including photonics technologies. These themes reflect a broader industry imperative: access to new capabilities is now a critical driver of competitive positioning.

At the same time, private equity reasserts itself as a major force. With dry powder at record levels and exit windows reopening through secondaries and IPOs, sponsors are increasingly stepping back into large-ticket transactions.

Another notable trend is the shift in geographic focus. Many acquirers prefer domestic or intra-regional deals, which carry lower regulatory and geopolitical risk. Yet cross-border activity remains significant in select markets. Japan, for example, set a record in the first half of 2025 with $232 billion in M&A volume, driven largely by take-private transactions and outbound investment.

On the financing side, acquirers are leaning more on all-cash deals where possible, which generate stronger reception from investors and owners. Larger transactions still require complex funding mixes of debt, equity, and private capital. With interest rates stabilizing but capital still costly, creative structuring remains a hallmark of 2025 deals.

At the same time, deal structures are becoming more risk-sensitive. Buyers are inserting stringent conditions, earnouts, and breakup clauses, while valuation gaps frequently stall negotiations. Regulatory scrutiny is intense, and governments are playing an increasingly active role through antitrust reviews, foreign investment screening, or ESG mandates.

Corporates are also pursuing portfolio realignment. Divestitures and carve-outs are gaining momentum, not just as exits but as tactical moves to unlock capital and sharpen focus on core growth areas. This activity adds a layer of complexity to the market, as assets circulate between strategics and sponsors in rapid succession.

Finally, the market takes on a distinctly “lopsided” structure. While not as extreme as the M&A market as a whole, a handful of large transactions are driving aggregate value, while the mid-market remains subdued. At the other end of the spectrum, smaller bolt-on acquisitions are attractive for their precision and relatively lower risk. The result is a barbell-shaped market where megadeals and niche acquisitions thrive, while mid-sized deals struggle to gain momentum.

For photonics, the opportunity set remains particularly compelling. Relentless demand for computing power — fueled by AI, edge computing, and cybersecurity — underscores the essential role of optical communications and, increasingly, quantum technologies. Geopolitical dynamics are accelerating investment in defense, automation, and environmental monitoring, entrenching photonics as a transformative force. Emerging applications such as Laser Directed Energy Weapons (LDEW), Counter Communications Systems (CCS), military robotics, and 3D-printed munitions reflect photonics’ expanding role in national security. In manufacturing, photonics-enabled automation and robotics are mitigating labor constraints and improving cost structures. In climate and environmental markets, optical technologies for in-line and satellite monitoring are essential in tracking emissions, enabling early warning systems, and supporting regulatory compliance.

Taken together, these dynamics show a market that is cautious yet ambitious, with buyers prepared to pay premiums for capabilities and control points, but unwilling to take unnecessary risks. For sellers, the lesson is clear: positioning around strategic fit, regulatory readiness, and deal certainty has never been more important.

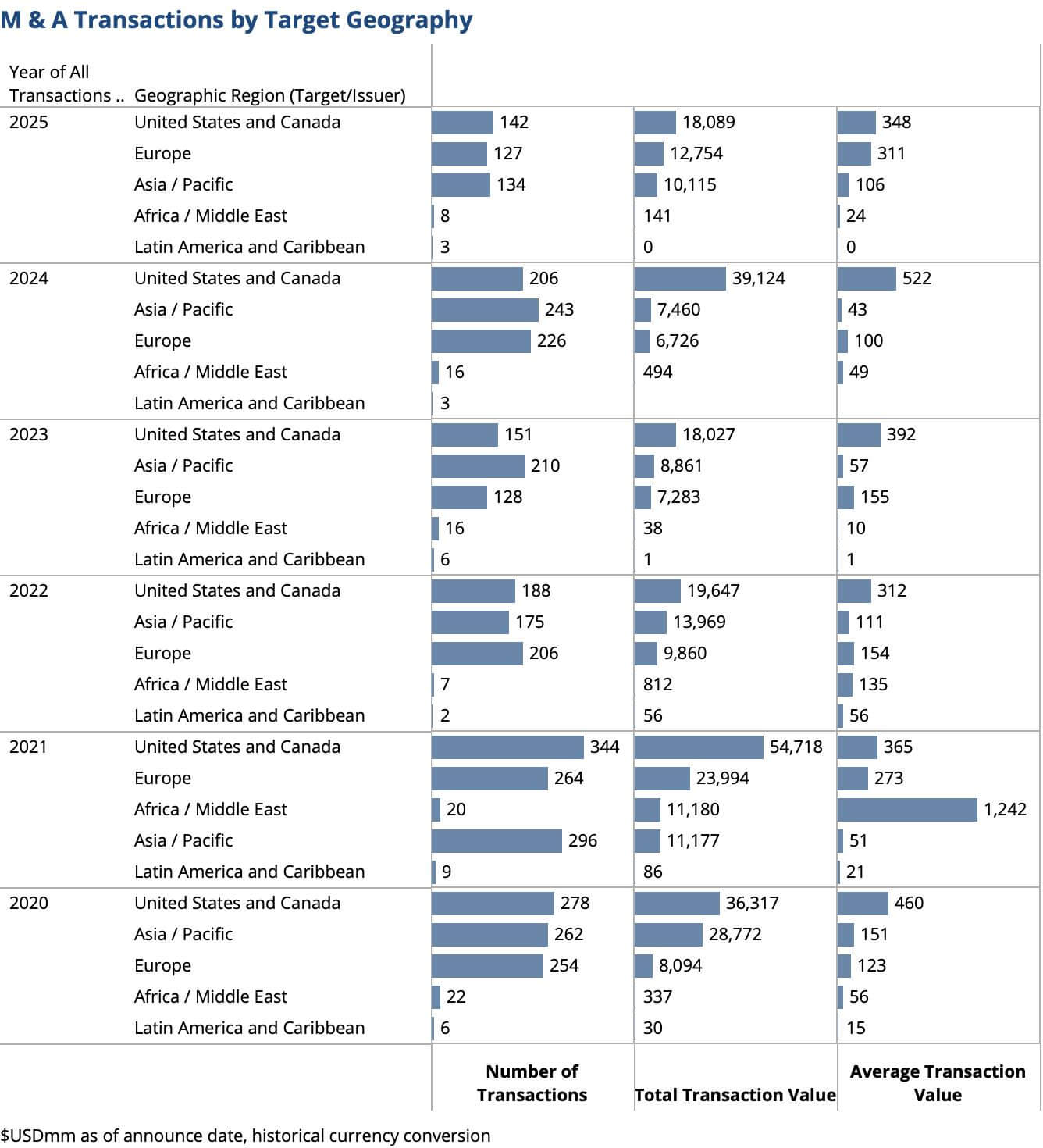

The Transactions

In the first three quarters of 2025, CERES identifies and analyzes 412 transactions involving targets in the photonics industry or in vertical markets where photonics technologies are core differentiators. These transactions represent an aggregate $38.6 billion in Total Transaction Value. For comparison, across the M&A market as a whole during the same period, 33,407 transactions are announced with a combined value of $2.7 trillion.

While total deal volume in the M&A market as a whole has very modest increase compared to the prior year, aggregate deal value is up 24%, driven by a resurgence of mega-deals. This divergence between volume and value is far more muted in photonics M&A. Deal counts in photonics are 8% below the prior year, and total deal value is down 18%, reflecting a concentration of smaller, strategically targeted transactions despite reduced activity overall.

Notably, sector trends diverge. In the M&A market as a whole, strength in technology, financial services, and media offset ongoing weakness in industrial and healthcare sectors. By contrast, in photonics, deal value showed an upturn in industrial (Advanced Manufacturing) and healthcare (Biophotonics) verticals, alongside a decline in technology (Information Technology) due to the absence of mega-deals.

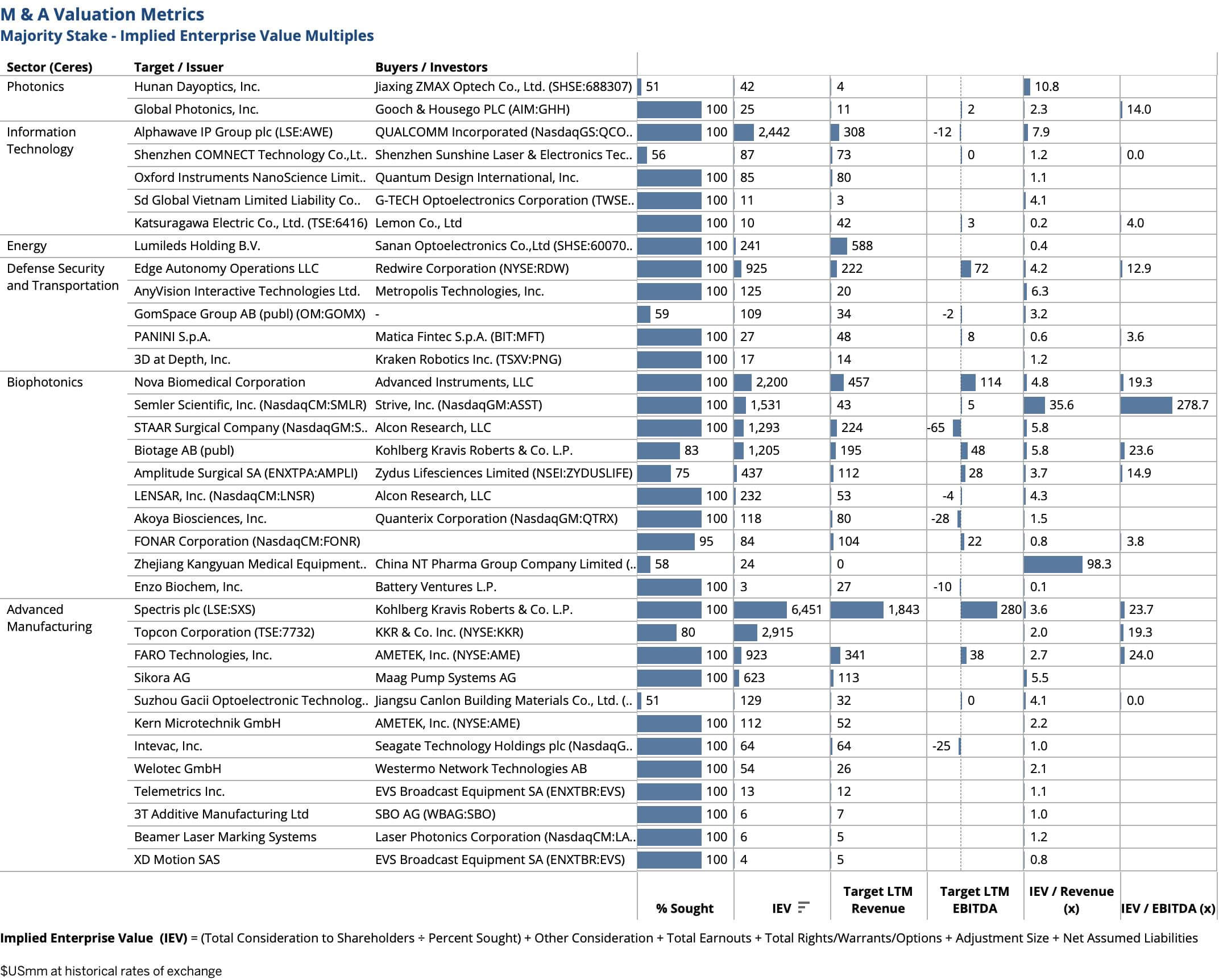

CERES research includes M&A transactions announced between January 1 and September 30, 2025 for targets employing photonics technologies. Activity and valuations are analyzed by market segments. Values are in $US at historical exchange rates. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

The Valuations

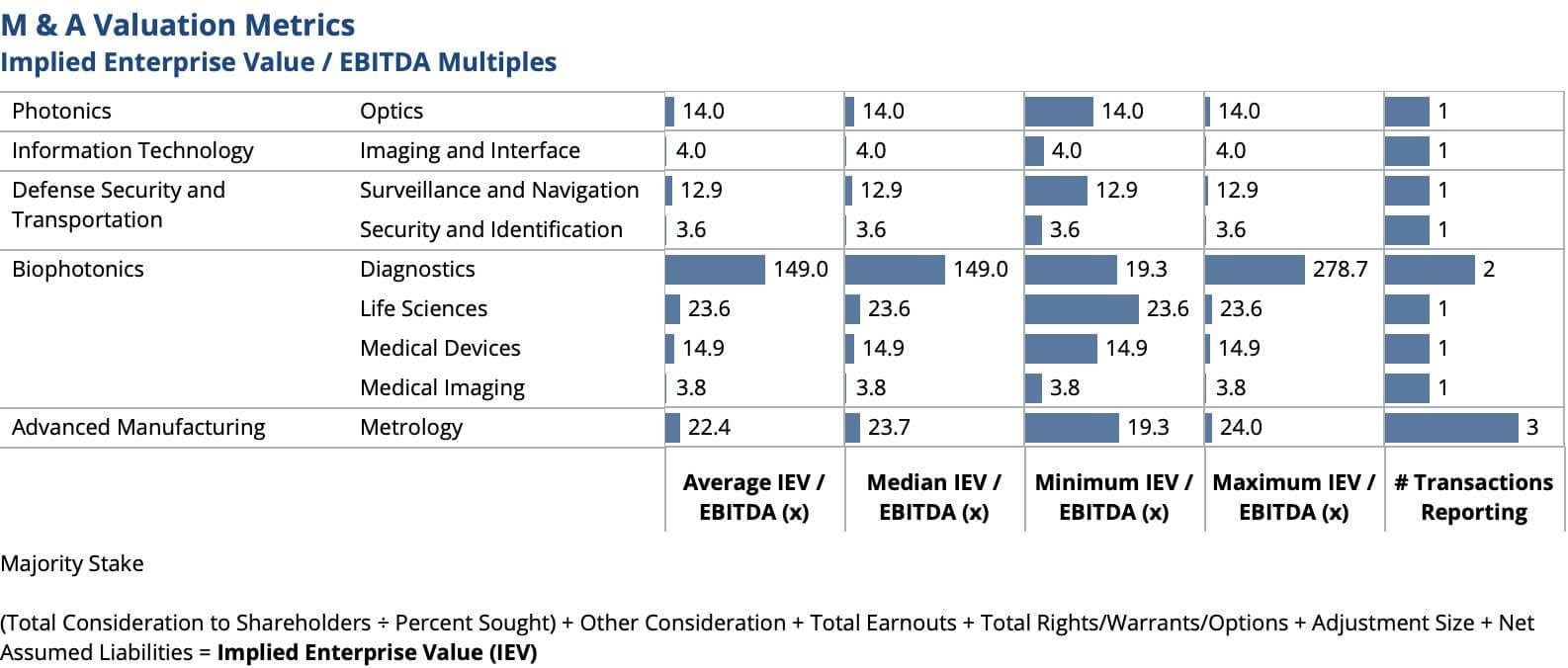

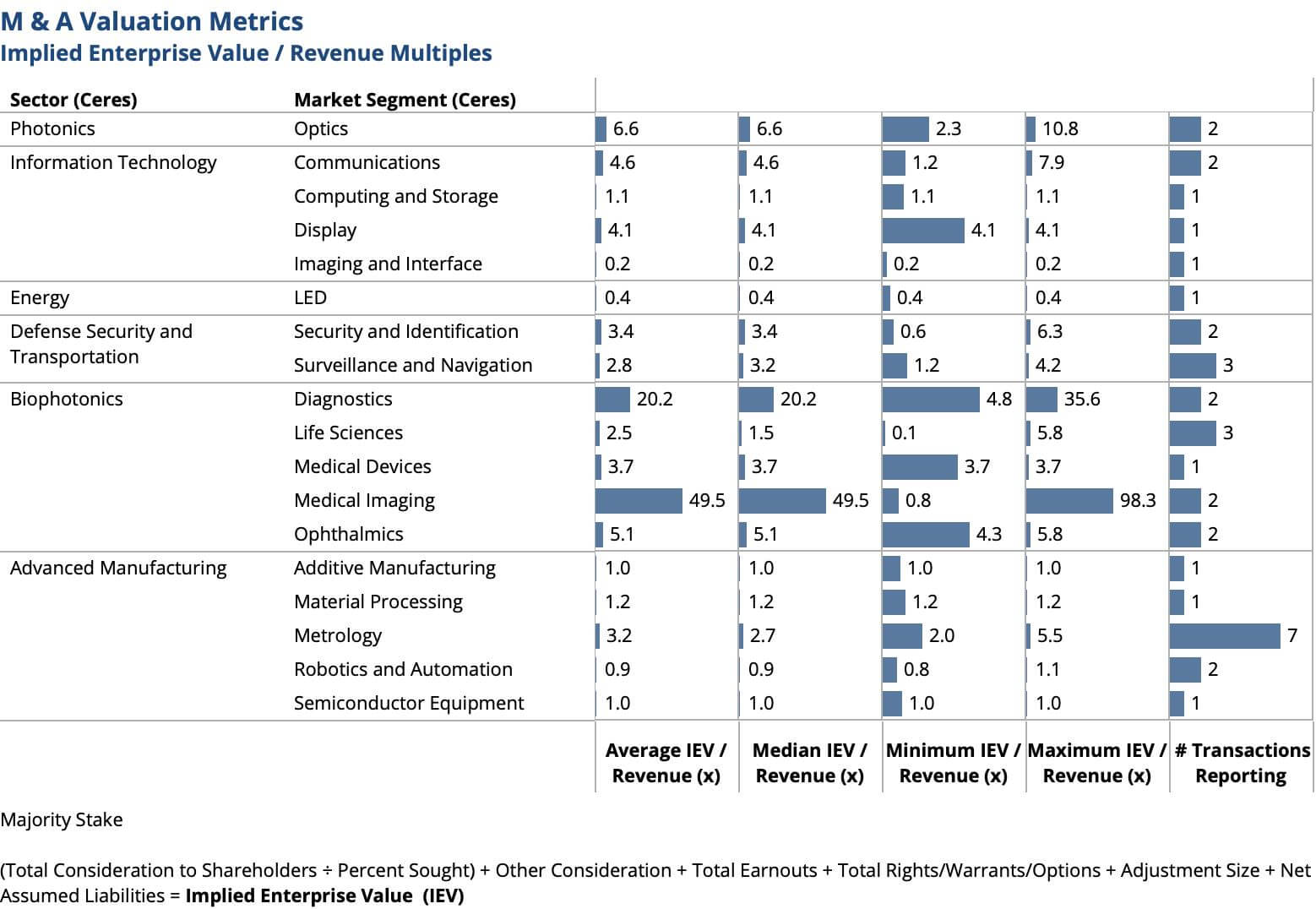

Valuations in photonics M&A remain robust in 2025, with transaction multiples reflecting the sector’s strategic importance. IEV/EBITDA multiples for photonics deals consistently outpace broader market benchmarks, driven by the high demand for specialized capabilities and the scarcity of high-performing assets.

According to Bain & Co., valuation multiples for strategic M&A market as a whole remain relatively stable in 2025, with enterprise value to EBITDA (IEV/EBITDA) ratios flat around 10.4x. This steadiness indicates cautious optimism among corporate buyers, balancing growth ambitions with prudent valuation assessments. In practice, Q1 2025 Argos Index data shows strategic multiples slipping to ~ 9.2×, hinting at some downward pressure in the near term.

In contrast, according to Capital IQ, public market valuations in 2025, exemplified by the S&P 500, averaged 18.5x TEV/EBITDA as of Sept 30 2025, still well above the ~10.4× strategic M&A benchmark, underscoring a persistent valuation gap between corporate buyers and public equities. Elevated borrowing costs continue to shape deal structures, with a rise in all-cash transactions and increased reliance on earnouts to bridge buyer-seller expectations.

Few transactions researched disclose financial details, as regulations often exempt those without a material near-term impact on financial statements. Nevertheless, M&A transaction data remains critical for understanding market dynamics and buyer behavior. Among the identified and researched deals, 80 report valuation metrics, and 33 involve majority share acquisitions.

Putting the Semler Scientific and Strive deal aside that is bitcoin driven, leading the pack on IEV/EBITDA multiples for acquisitions of 100% share are: FARO Technologies, Inc., manufacturer of 3D measurement, imaging, and realization, at 24.0x (Advanced Manufacturing, US); Spectris plc, provider of precision measurement solutions, at 23.7x (Advanced Manufacturing, US); and Biotage Ab, provider drug discovery, analytical testing, and water and environmental testing products, at 23.6x (Biophotonics,US).

Pure-Play Photonics

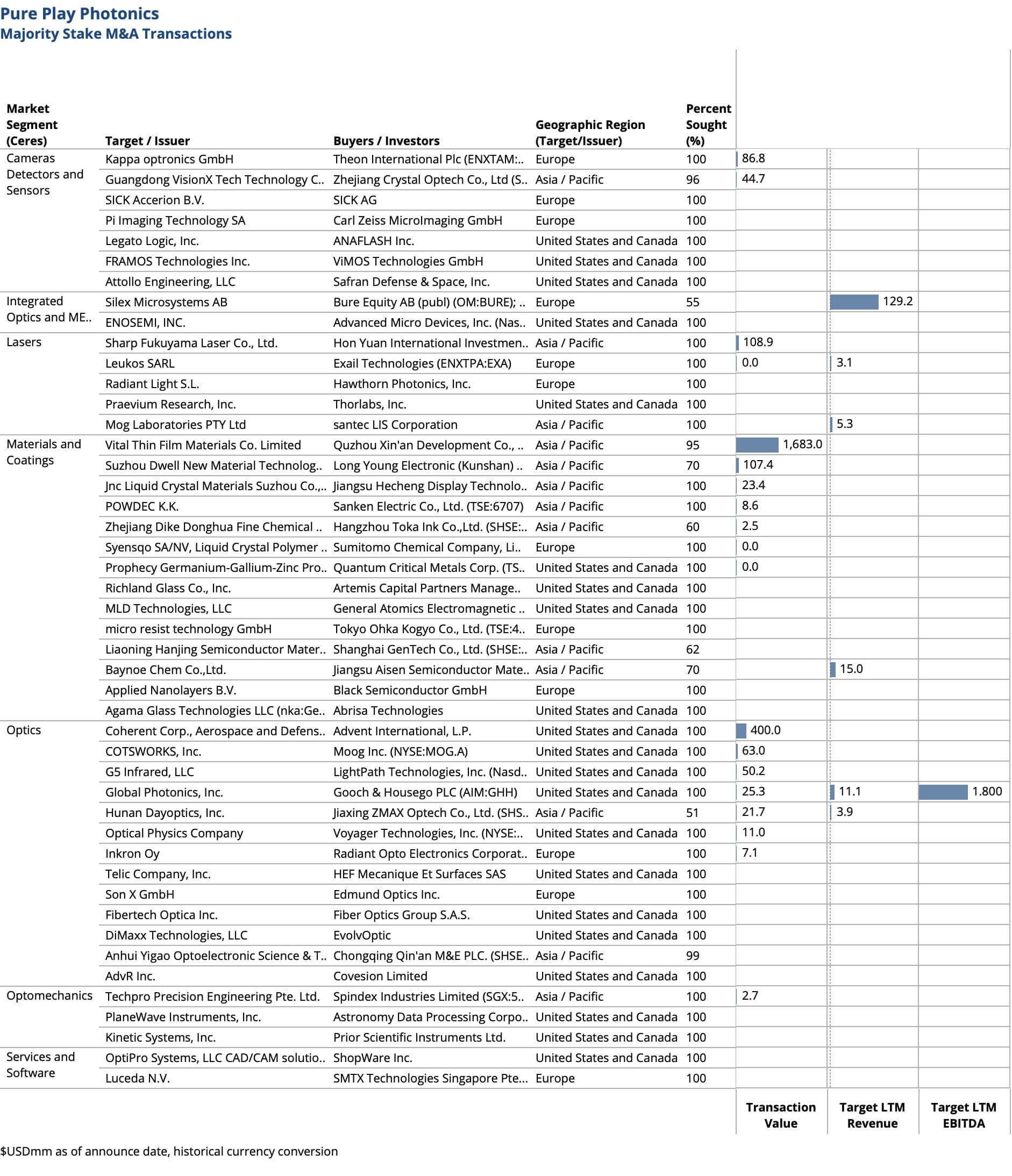

Photonics, defined as the core components market in SPIE Optics & Photonics Global Industry Report 2025, outpaces global GDP growth, with a total market size in the mid $300billions and a 2025 step-up expected as demand tied to AI, quantum, renewable energy, displays, and healthcare continues to diffuse across end markets. Enabled markets collectively exceed the multi-trillion-dollar mark, underscoring the breadth of photonics’ pull across the economy.

The sector includes thousands of smaller, specialized companies. A small handful of large multinationals capture the majority of the revenue and remain largely not acquisitive since 2021. Today, there are a plethora of lower middle market private equity firms swarming to put their leveraged buyout playbooks to task on acquiring a middle market platform company with the potential of thousands of subsequent bolt-ons. With so few companies meeting textbook LBO or strategic corporate development financial criteria, valuations of the few available targets with scale are very high and deals are infrequent.

Manufacturing capacity in photonics steadily migrated toward Asia, yet global revenue leadership remains concentrated in U.S.-headquartered companies, whose brands, IP, and distribution networks give them an outsized share of industry value.

Deal Activity

Like 2024, M&A activity in 2025 is selective and strategically motivated, with fewer transactions than the 2019–2021 surge years but several emblematic moves that set the tone for the year.

Capability Acquisitions

In 2025, pure-play photonics M&A is fundamentally about small and middle market buyers acquiring capabilities—proven product lines, manufacturable processes, IP, and technical teams that buyers can push through existing global channels. Strategic buyers prioritize assets with immediate commercial fit where go-to-market leverage is clearest and pass on targets with R&D risk until adoption is visible.

Divestitures

Divestitures continue to shape the pure-play photonics landscape in 2025, following a dozen large-scale moves in 2024, including Excelitas Technologies Corp. (AEA Investors) sale of its Aerospace and Defense electronics businesses Systems to Teledyne Technologies Incorporated for $710M. In 2025, Coherent Corp. (Bain Capital) sells its Aerospace and Defense business to Advent International, LP for $400M citing the use of proceeds to reduce debt, accrete Earnings Per Share, and concentrate on core growth areas. Also in 2025, aligning with a sharper focus on semiconductor and medical optics, Meopta optika, s.r.o. (Carlysle Group) divests Global Photonics, Inc., provider of high-precision optical systems and thin-film coatings for the Aerospace and Defense sectors, divests to Gooch & Housego PLC.

Together, these transactions show that the largest diversified players are not acquiring, but actively reshaping portfolios, pruning certain defense-linked operations and concentrating capital and management attention on core commercial markets.

Vertical Integration

Vertical integration, both forward and backward, across commercial and defense-oriented offerings is a recurring theme over the previous four years.

Optical component providers are using M&A to move up the value chain into subsystems, where margins and differentiation are higher. This is a challenging capability to build organically and a more straightforward, lower-risk path through acquisition. Similarly, material suppliers are accelerating their move up the chain by acquiring niche optical component businesses, enabling them to capture more value quickly and profitably while reducing execution risk. [Press Release – Ceres Advises DiMaxx on Sale to EvolvOptic]

While diversified incumbents moved away from Defense linked assets, Defense and Aerospace focused acquirers move in the opposite direction — using M&A to integrate photonics capabilities directly into their system portfolios.

Notable 2025 examples include:

- General Atomics Electromagnetic Systems Inc. acquisition of MLD Technologies, LLC, U.S. manufacturer of extreme performance optical coatings capable of ultra-high laser power handling [Press Release – Ceres Advises MLD Technologies on Sale to General Atomics]

- Voyager Technologies, Inc. acquisition of Optical Physics Company, advanced optical systems for aerospace and defense

- Theon International Plc acquisition of Kappa optronics GmbH, manufacturer of application specific cameras for aerospace

- Safran Defense & Space, Inc. acquisition of Attollo Engineering, manufacturer of infrared systems for imaging and laser detection

Each transaction reflects a strategy to secure precision optics, coatings, imaging, and sensor expertise, reducing dependence on external suppliers and ensuring tighter control over IP, performance, and supply continuity. This defense-driven vertical integration stands in contrast to the divestitures by larger diversified players, highlighting how ownership of critical photonics capabilities is being rebalanced across the industry.

Geography Matters

Production of core photonics components progressively migrates toward Asia, particularly China, Taiwan, and Korea. Yet U.S.-headquartered companies continue to capture a disproportionate share of global revenue, anchored by intellectual property, brand strength, and global distribution networks (SPIE Global Industry Report 2025).

The year’s transactions reflect this imbalance. The largest transaction is Quzhou Xin’an Development Co. agreement to acquire a controlling stake for $1.8B in Vital Thin Film Materials Co. Limited., a leading supplier of sputtering targets and thin-film materials used across semiconductors, displays, and optics. The deal positions Vital as a high-growth platform play, reflecting Chinese financial sponsors’ appetite for foundational photonics manufacturers and underscores Asia’s rising production weight. In contrast the most prominent divestitures and portfolio reshaping moves — Coherent’s sale of its Aerospace & Defense business and Meopta’s sale to G&H — were led by Western players, highlighting where revenue leadership and corporate control remain concentrated.

The Targets with Core Photonics Technology

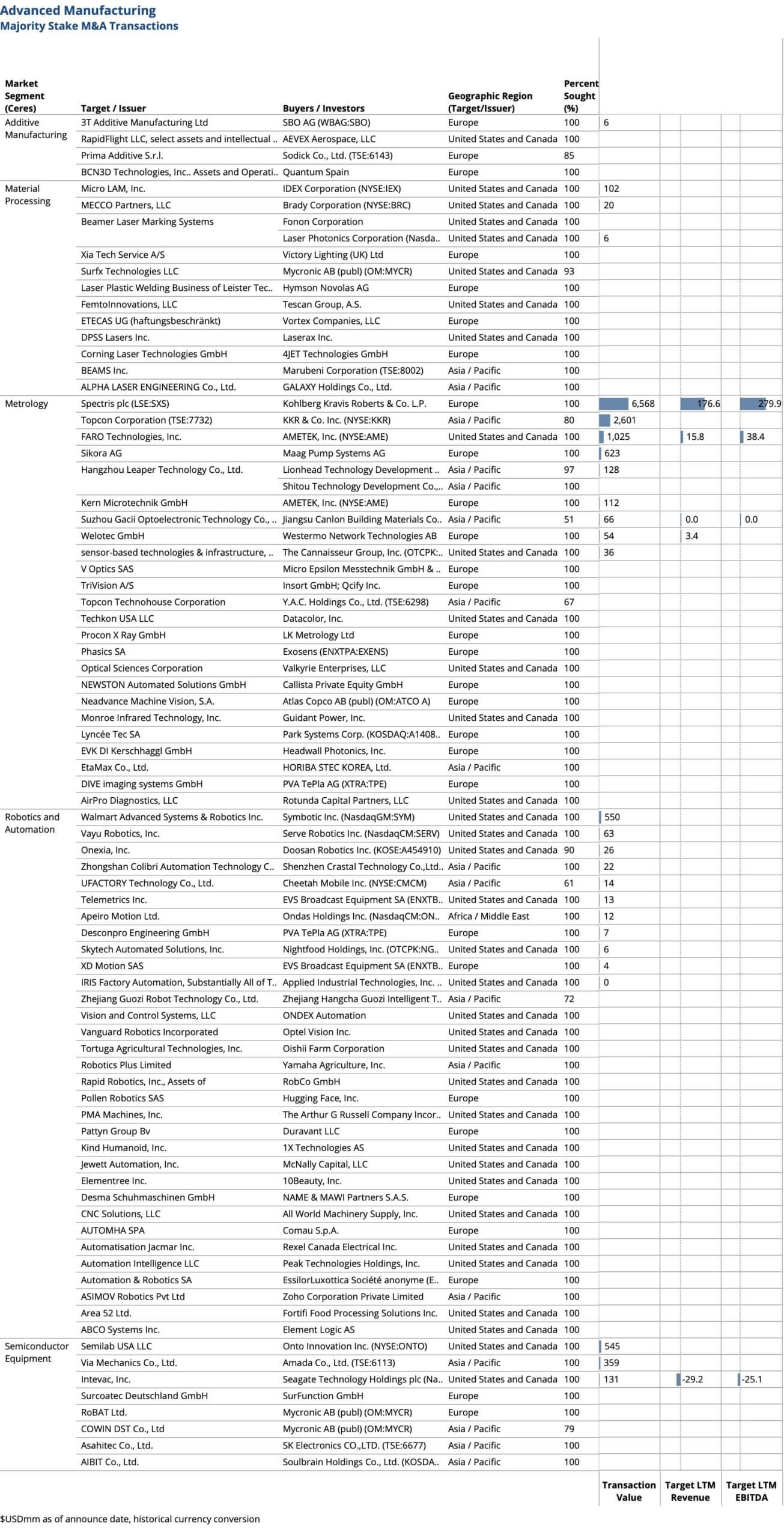

Advanced Manufacturing

Machine vision, 3D printing, optical metrology, and 3D sensing have been transforming manufacturing for decades, steadily raising precision, throughput, and efficiency. Today, factory automation is evolving even more rapidly, powered by advances in AI, robotics, and data analytics. Combined with innovations in photonics, the companies being acquired in 2025 are delivering step-change improvements in process optimization, quality control, energy efficiency, inventory management, supply chain resilience, labor productivity, and security.

Across both manufacturing and service industries, photonics-enabled solutions are alleviating labor shortages and reducing costs. The integration of AI into manufacturing processes, paired with photonics-driven automation and sensing, is expected to be a key driver of future deal-making.

Advanced Manufacturing M&A in 2025 shows a market that is smaller in deal count than the surge years of 2019–2021, yet exceptional in aggregate value. The year’s record total was driven not by broad activity across all segments, but by a handful of outsized Metrology transactions layered on top of steady middle-market deal flow in Robotics/Automation and Semiconductor Equipment. Additive Manufacturing and Material Processing contributed a thinner stream of selective, lower-value deals, but included emblematic transactions that illustrate how photonics-enabled disruption continues to create new acquisition opportunities.

Metrology

Metrology was the primary driver of 2025’s record transaction value. The largest checks of the year concentrated here, focused on precision measurement and in-line inspection platforms indispensable for process control and compliance. Sponsor appetite was evident in the competing bids for Spectris plc (Advent withdrawn; KKR announced), showing that metrology assets with deep customer embed and strong service mix remain highly prized. Strategics were equally active: AMETEK, Inc. makes two acquisitions – FARO Technologies, Inc., supplier of software driven 3D measurement, imaging, and realization solutions, for $1.05B (24.0x $38.4M EBITDA); and Kern Microtechnik GmbH, provider of CNC precision machining centers with embed machine vision and optical metrology, for $112M (2.2x $51.8M Revenue).

Robotics / Automation

Robotics and Automation produced the highest deal activity at the lower- to middle-market levels, with acquirers targeting machine vision, sensing, and control technologies that integrate directly into automation stacks. What stands out in 2025 is the unusual density of non-majority acquisitions within this segment, almost entirely involving Chinese buyers and sellers. This appears to be a regional feature of the Chinese market, shaped by local ownership structures and capital dynamics that favor partial stakes and joint structures over outright control. Outside China, most robotics and automation transactions followed the more typical pattern of full tuck-ins or platform exits.

Semiconductor Equipment

Semiconductor Equipment deals clustered in the mid- to upper-middle market, anchored around tool components, inspection modules, and specialty subsystems. Buyers focused on supply chain resilience and recurring service models, seeking tighter control of bottleneck technologies. Mycronic AB exemplified the strategy with three acquisitions in 2025: Surfx Technologies LLC, provider of atmospheric plasma systems for treating microelectromechanical systems (MEMS), microfluidics, semiconductors, solar cells, medical devices, sensors, plastics, and composites; Cowin Dst Co., Ltd., provider of back-end semiconductor equipment; and RoBAT Ltd., manufacturer of backplane test systems based on in-line automated optical inspection. Together, these moves expand Mycronic’s footprint in high-demand precision markets, positioning it for long-term growth in next-generation electronics.

Additive Manufacturing & Material Processing

Additive Manufacturing and Material Processing together formed a smaller, selective slice of activity. Transactions largely fell below $100M, with acquirers emphasizing bolt-ons and asset purchases tied to established customer use cases. The strategy was not scale-seeking, but incremental: expand into adjacent materials, throughput ranges, or applications where customers were already active. One exception underscored the segment’s disruptive potential: AEVEX acquired RapidFlight, whose “drone factory of the future” applies additive manufacturing for mobile, tactical-edge production of modular drone airframes. By enabling production in the field rather than centralized facilities, the deal shows how earlier-stage companies with photonics at their core are creating new business models that appeal to buyers.

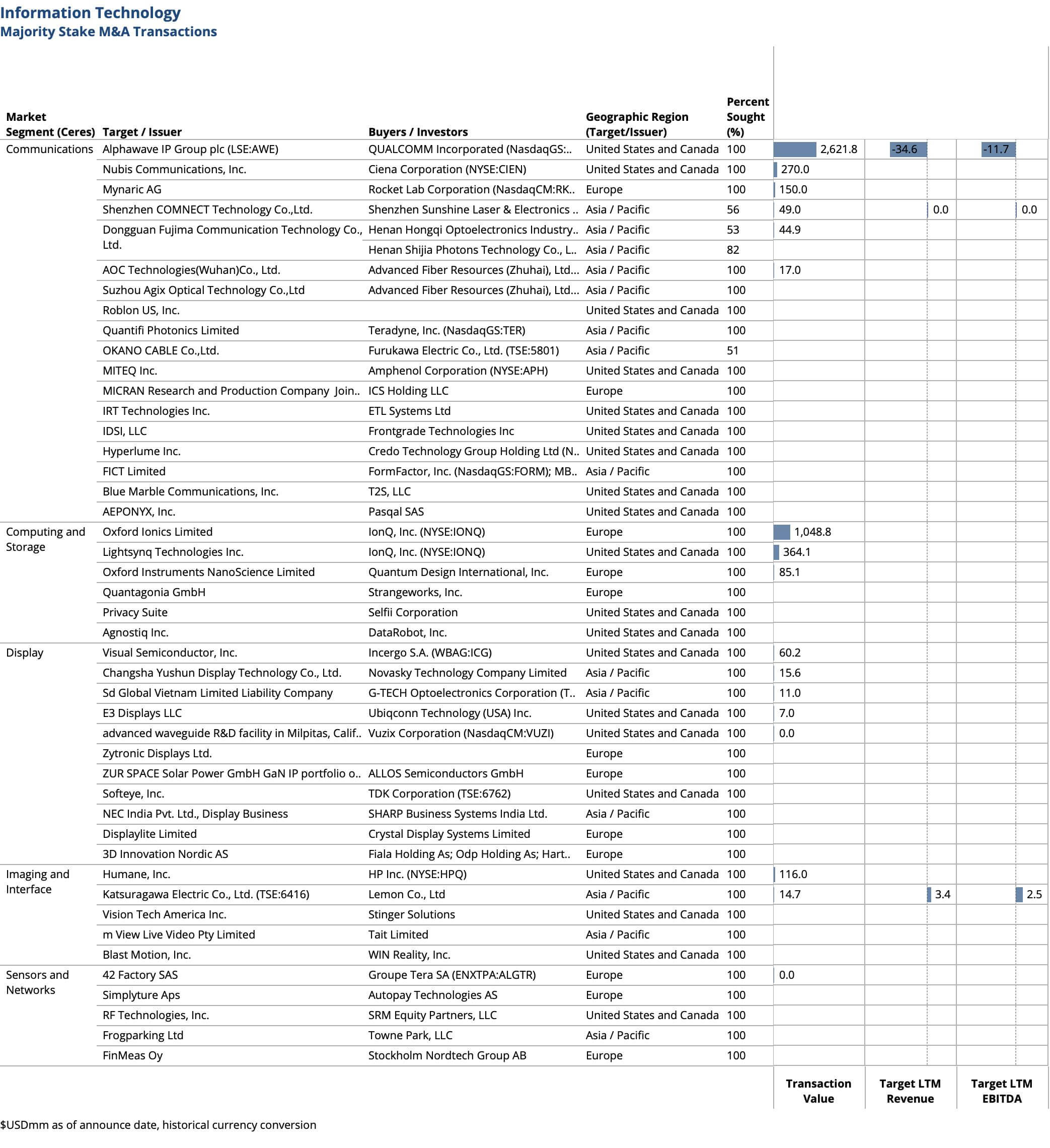

Information Technology

The consistent healthy volume of activity over the previous five years in the Communications market segment among companies supplying components, equipment, and testing for optical networks strongly signals a tremendous future demand for optical data communications, closely tied to several transformative trends. First, there is an explosion of AI and data traffic driving a surge in data generation, requiring high-speed, low-latency optical networks. Data center expansion, critical for AI, is at a hyper-scale, relies heavily on optical networking solutions to manage the immense volumes of data being processed and transferred. Second, growth in edge computing to support AI-driven applications demands robust optical interconnects to bridge data centers and distributed network nodes. Finally, the next-generation networks’ shift to 5G, and eventually 6G, requires significant investments in optical backhaul and fronthaul infrastructure to handle the escalating bandwidth demand. Companies are consolidating capabilities to deliver scalable solutions, as customers require end-to-end optical solutions that integrate hardware, software, and testing.

The Information Technology sector’s total deal value is skewed high in 2025, driven by the year’s largest transaction: QUALCOMM Incorporated acquisition of Alphawave IP Group plc ($2.6B, 208x EBITDA). While Alphawave works with silicon photonics, Qualcomm acquired it primarily for its market-leading high-speed wired connectivity IP, chiplets, and custom silicon designs to expand into the data center and AI markets.

Following are two large transactions– TCL Technology Group Corporation acquisition of Shenzhen China Star Optoelectronics Semiconductor Display Technology Co., Ltd., provider of thin film transistor liquid crystal display devices and organic Light Emitting Diode (OLED) products for $1.6B; IonQ, Inc. acquisition of Oxford Ionics Limited, developer of an advanced quantum computing systems features trapped ion technology, for $1.0B.

Unlike the 2021 peak, augmented reality and virtual imaging drives very little M&A activity in 2025. The majority of value in the Display segment reflects consolidation of LCD and OLED component and display manufacturers.

Quantum Computing (Computing & Storage) saw a clear uptick in 2025 after muted years, with activity largely comprising vertical integration plays by quantum computer developers — including Agnostiq Inc., Lightsynq Technologies Inc., Privacy Suite, Quantagonia GmbH, Oxford Ionics Limited, ID Quantique SA, and Oxford Instruments NanoScience Limited.

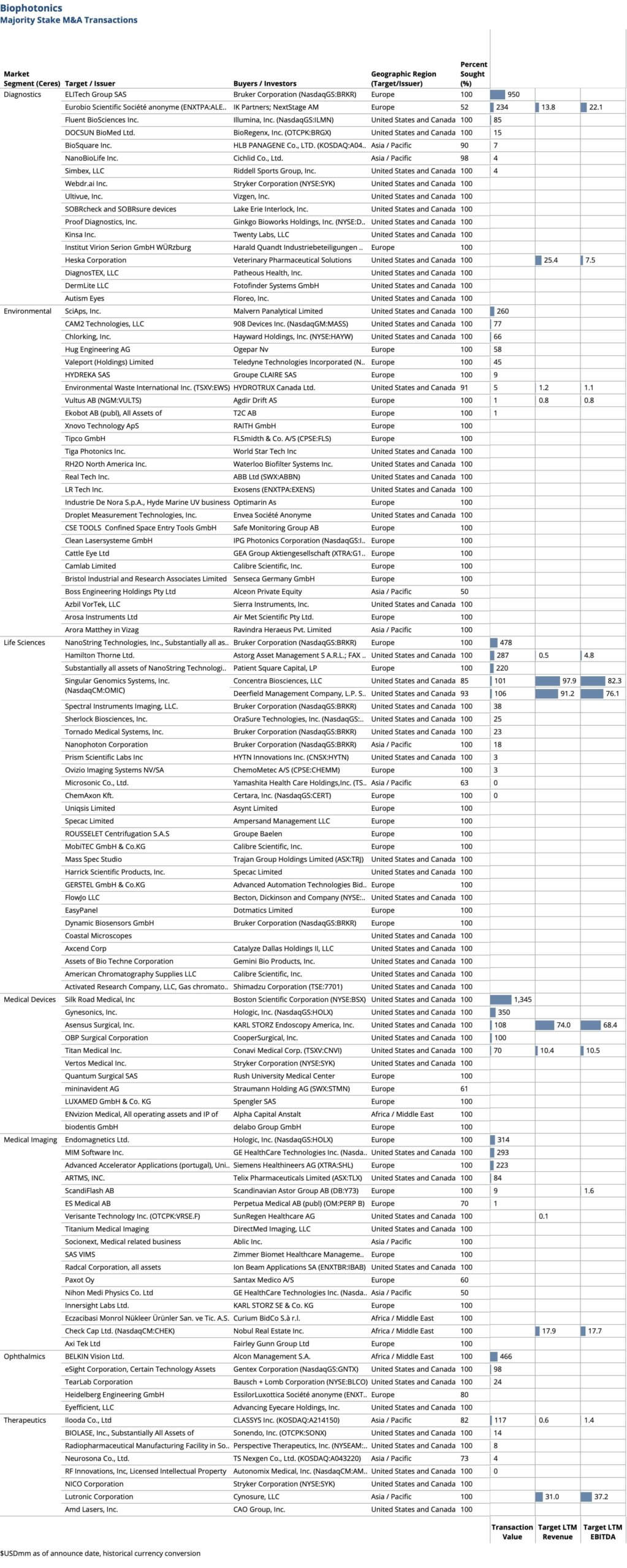

Biophotonics

Biophotonics M&A has stabilized at a lower baseline following the three-year surge from 2019 through 2021. Prior to that surge, activity was more moderate, and 2025 looks closer to those earlier levels than to the peak years. The market today is smaller in scale but steady and strategically targeted. Buyers are active across all major segments, with a strong presence in the middle market. Strategics continue to prioritize proven product lines that can be scaled through their global sales channels, while financial sponsors primarily engage in secondary transactions to manage portfolios.

Diagnostics

Diagnostics accounts for the largest share of transaction value in 2025. Buyers are targeting established product lines with adoption and recurring revenue rather than early-stage technologies. A standout example is Advanced Instruments’ acquisition of Nova Biomedical for $2.2B (19.3x $114M EBITDA), illustrating how strategics are willing to commit significant capital for platforms with proven clinical traction. The mix of large headline deals and mid-market acquisitions reflects confidence in scaling validated solutions. One clear outlier is Strive, Inc. all stock acquisition of Semler Scientific at 279x EBITDA, driven as much by Bitcoin treasury strategy as by healthcare diagnostics, underscoring how unique strategic motives can distort valuation multiples.

Environmental

Environmental matches Diagnostics in deal count but is characterized by numerous small tuck-ins, consolidating fragmented providers in water, air, and food safety monitoring. Deere & Company is the exception, pursuing a vertical integration strategy — embedding photonics-based sensing directly into its precision agriculture platform. This stands apart from the consolidation-driven approach of most other Environmental buyers.

Life Sciences

Life Sciences activity in 2025 was limited and concentrated in the lower middle market. Buyers focused on smaller, established platforms in genomics, cell analysis, and laboratory workflows that could be scaled through distribution, but the segment lacked true large-scale strategic acquisitions. The only transaction of scale was investor-driven; Kohlberg Kravis Roberts & Co. L.P. bought out investors in Biotage AB, underscoring that institutional reshuffling, rather than strategic expansion, accounted for the segment’s single larger deal.

Medical Devices

Medical Devices contributes only a handful of deals in 2025, but the capital committed per deal is significant from market leaders, Boston Scientific Corporation and Zimmer Biomet Holdings, Inc. Buyers are focusing on photonics-enabled devices with defensible IP and integration into regulated clinical workflows. Strategics dominate this segment, leveraging their global distribution to capture value.

Ophthalmics

Ophthalmics stood out in 2025 due to Alcon’s unusually acquisitive posture, with four significant transactions: STAAR Surgical Company, LENSAR, Cylite Pty Ltd, and LumiThera. These deals span refractive surgery, diagnostic imaging, and therapeutic devices, reflecting a broad push to expand Alcon’s product portfolio. The pace and breadth of these acquisitions distinguish Alcon from other buyers, underscoring the company’s strategy of reinforcing leadership in ophthalmic technologies through targeted, product-line additions.

In the same segment, Regeneron Pharmaceuticals, Inc.’s acquisition of Oxular Limited followed a different strategy: it was a technology-driven deal centered on proprietary Optical Coherence Tomography (OCT)–enabled delivery technology for noninvasive, real-time monitoring of drug delivery, rather than the acquisition of a ready-to-sell product line for distribution.

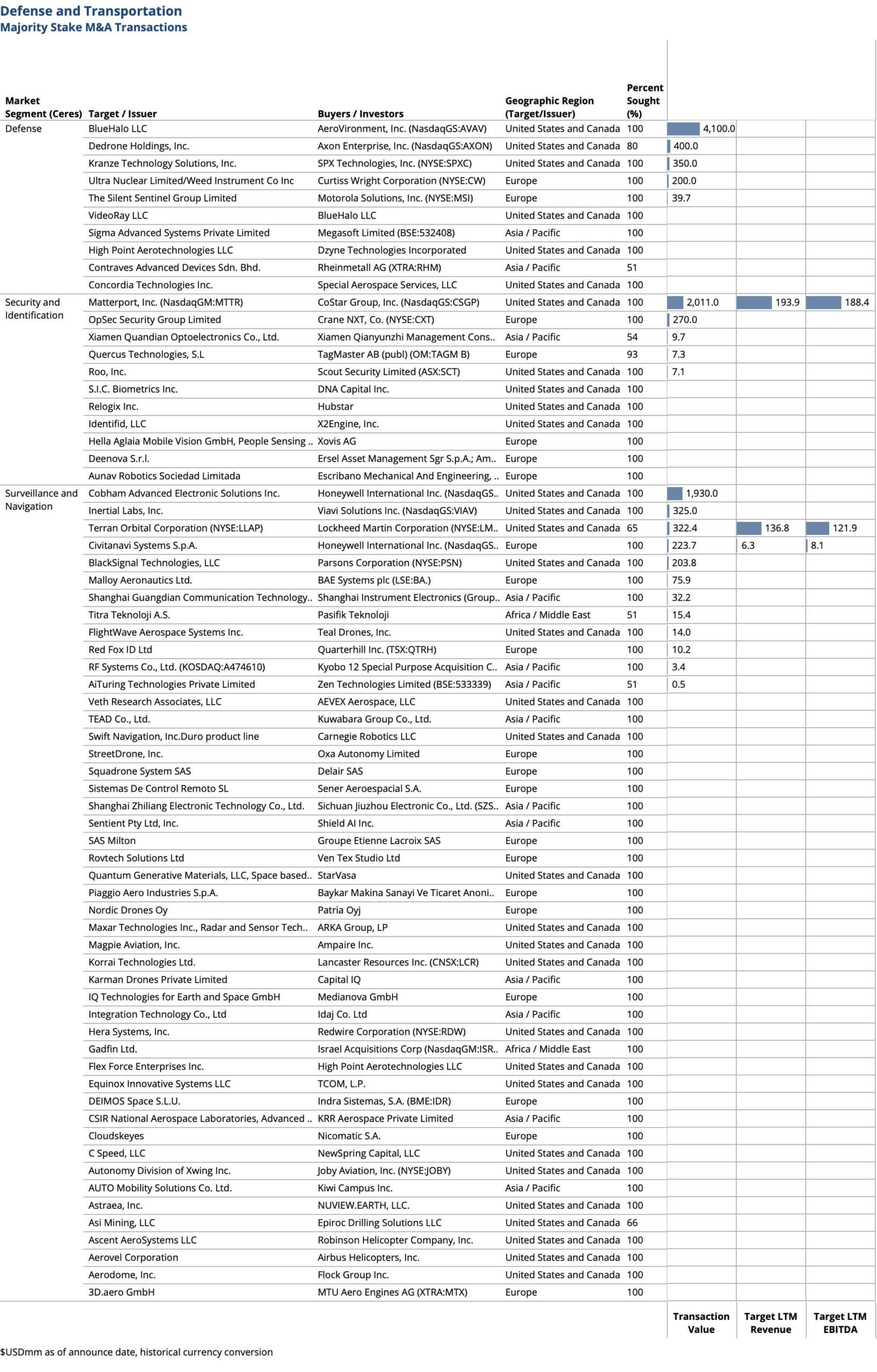

Defense, Security and Transportation

The overall global Defense Security and Transportation M&A market in 2025 is characterized by decreased deal activity, a focus on emerging technologies, sparse private equity involvement, supply chain consolidation efforts, and the influence of geopolitical factors.

The volume of M&A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for autonomous ground and aerial vehicles and smart robots. The volume of M&A activity in the Security and Identification segment is largely attributed to targets supplying facial recognition and other optical biometrics security solutions. These trend with the very few deals in Defense segment reflect the US response to modern warfare demands and the strategic importance of technological advancement in defense.

The largest transactions in the Defense, Security and Transportation sector are: Edge Autonomy Operations LLC, manufacturer of fixed wing unmanned aerial vehicles (UAVs) and stabilized EO/IR camera payloads, acquired by Redwire Corporation for $925M (12.9x EBITDA); Vector Atomic, Inc., provider of quantum sensors for positioning and GPS free navigation, acquired by IonQ, Inc. for $392M; and GEOST, LLC, designer-integrator of electro optical infrared sensors for national security space missions, acquired by Rocket Lab Corporation for $253M.

Photonics M&A in a Global Context

M&A activity in photonics has broadly mirrored the global market in 2025. Deal values are rising even as overall volumes decline, with companies and sponsors pursuing fewer but more strategic transactions. Yet, much of the headline value this year has been driven by mega AI acquisitions and large-scale utility consolidation — sectors that lie outside the photonics-enabled landscape. The more relevant picture is found in the steady mid-market transactions, bolt-ons, carve-outs, and portfolio reshaping that align directly with photonics technologies and their enabled markets.

Across geographies, a common thread runs through 2025: the most strategically attractive photonics-enabled opportunities often coincide with the highest regulatory scrutiny. Success now depends less on chasing headline megadeals and more on navigating regional policy shifts, integrating tariff strategies, and structuring transactions with regulatory foresight.

Americas

Underlying momentum in the Americas comes from mid-market transactions, bolt-ons, and carve-outs, particularly in industrial technology, healthcare, photonics, and specialty manufacturing. Private equity continues to recycle capital, while corporates are divesting noncore assets to realign portfolios. A key driver is tariff uncertainty, which is forcing companies to reshape supply chains and reposition portfolios around end markets — often using M&A as the lever.

Foreign buyers are showing renewed interest in U.S. assets but face tighter CFIUS scrutiny, frequently opting for minority stakes or joint ventures to gain access. Overall, the region’s story is less about blockbuster headlines and more about the bread-and-butter deals that quietly keep capital in motion.

Europe & Israel

Europe’s activity is mixed. Deal volumes are down, but private equity exits and reinvestments remain strong, with sponsors driving much of the momentum. At mid-year, Europe briefly overtakes North America in PE exit counts, underscoring its role as a recycling ground for sponsor capital. Fiscal stimulus — notably Germany’s €500 billion defense program — is supporting demand, but execution risk is elevated by national FDI regimes, the U.K.’s National Security and Investment Act, and EU dual-use controls, making execution risk higher than in the U.S.

In Israel, deal flow remains active in defense and advanced technology, where photonics-enabled systems continue to attract both strategic and financial buyers despite regional security concerns.

Asia-Pacific

Asia-Pacific is a story of divergence. Japan is having a record year, with deal values surging on landmark megadeals and outbound acquisitions, even as overall transaction counts fall. India continues to be a growth engine, with double-digit increases in deal volumes driven by infrastructure, imaging, and fiber investments.

China remains constrained by geopolitical tensions and capital controls, limiting cross-border M&A. Still, outbound capital from the region into the Americas is more than doubled year-to-date, underscoring sustained appetite for U.S. assets despite policy uncertainty.

Australia

Australia emerges as a cautionary tale. Regulatory and tax uncertainty already derails more than $40 billion in announced deals this year, underscoring how quickly policy can undermine deal certainty. For strategic technologies, foreign buyers are now building extended timelines, breakup fees, and more conservative structuring into bids.

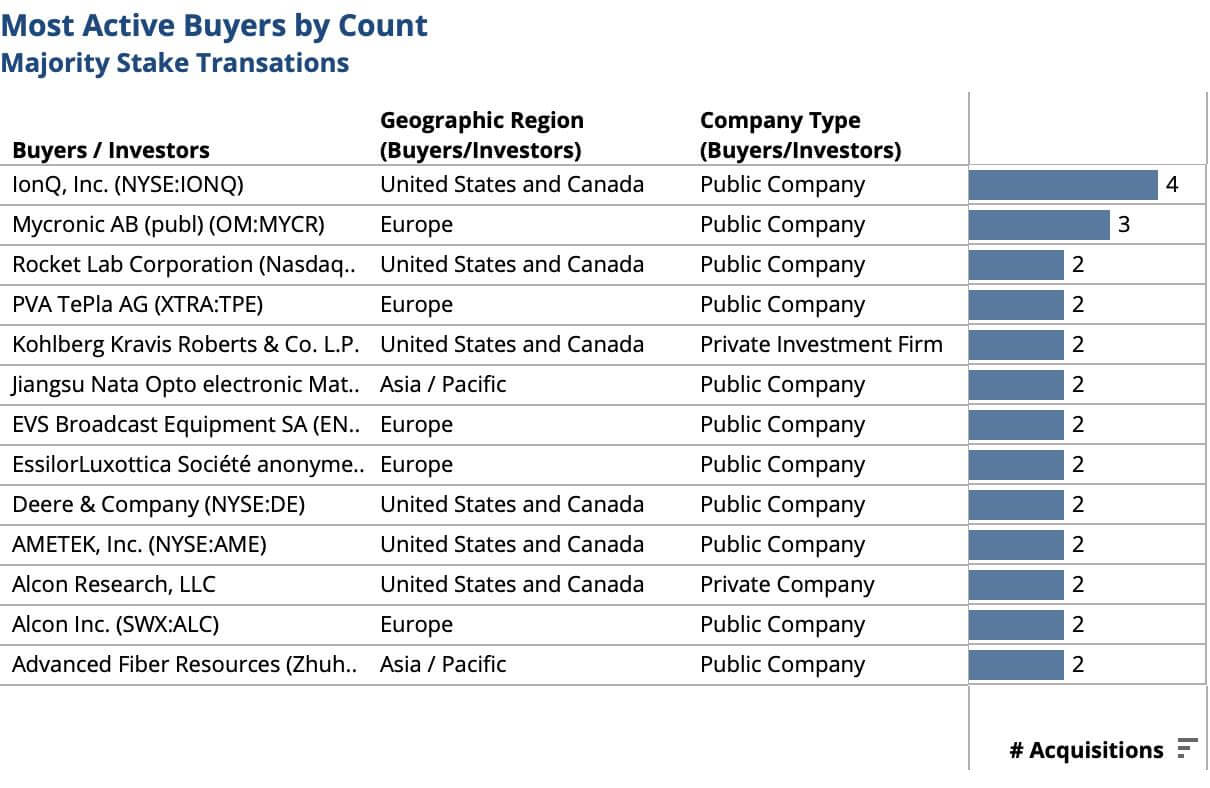

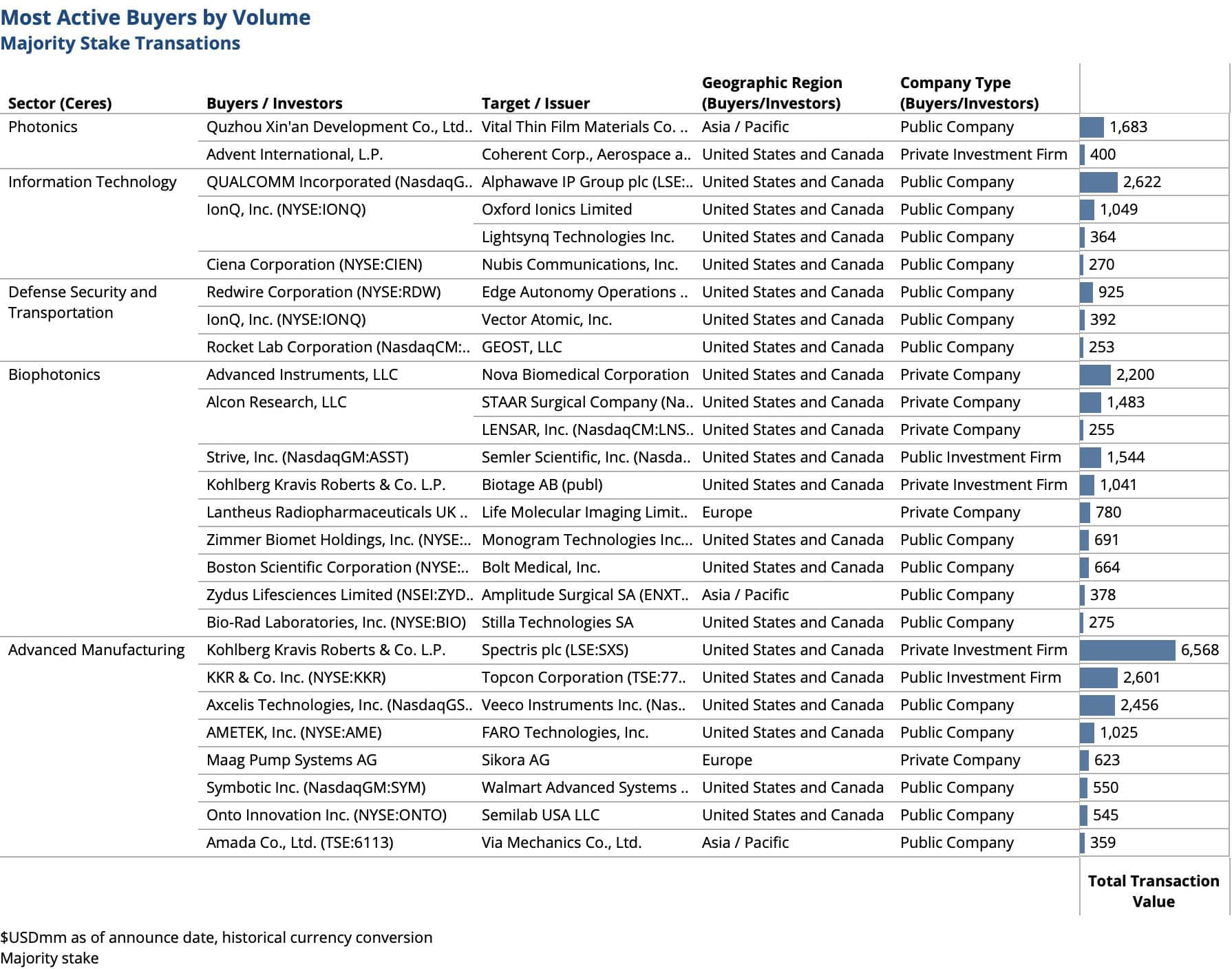

The Most Active Buyers

In line with history, the photonics M&A market is dominated by strategic buyers willing to pay premiums for strategic fit, operational synergies and long term value. Compared to private equity buyers, a strategic buyer’s intimate industry knowledge and technology depth allow for speed and certainty of closing with reduced financing contingencies. Strategic buyers have the benefit to focus on core competencies to expand their market position, as opposed to extracting short-term financial returns.

IonQ, Inc., market leading developer of quantum computers and networks, puts its $21B market cap on $52M revenue to work. It acquires: Lightsynq Technologies Inc., developer of optical interconnect technology for modular quantum computing; Oxford Ionics Ltd., developer of advanced quantum computing trapped ion technology that enables scalable and efficient chip fabrication, utilizing standard semiconductor fabrication methods ($1.4B common stock); Vector Atomic, Inc., manufacturer of quantum sensors for positioning, GPS-free navigation, telecommunications, computing, and timing applications ($392M common stock); and ID Quantique SA, developer of quantum safe network encryption solutions (majority stake, $125M common stock).

Alcon also makes four acquisitions – STAAR Surgical Company, provider of implantable lenses and laser-based ophthalmic procedures for $1.5B (5.8x $224.5M Revenue); LENSAR, Inc., provider of laser system for the treatment of cataracts for $255M (4.3x $53.5M Revenue); Cylite Pty Ltd, developer of 3D imaging and measurement systems employing hyper-parallel optical coherence tomography for ophthalmology for $132M; and LumiThera, Inc., provider of proprietary light delivery system for the treatment of dry age-related Macular Degeneration.

The most active buyer by deal value is middle market U.S. private equity sponsor, Kohlberg Kravis Roberts & Co. L.P. and its Japan affiliate of KKR & Co. Inc. (NYSE:KKR). In the Advanced Manufacturing segment, KKR acquires both Spectris plc, provider of precision measurement solutions, including laser-based particle measuring systems, NIR and Raman spectrometers and X-ray diffraction tools for $6.6B (23.7x $280M EBITDA) and Topcon Corporation, provider of precision ophthalmic instruments like fundus cameras, slit lamps, optical coherence tomography (OCT) systems, autorefractors, tonometers, and ophthalmic lasers; surveying instruments such as 3D laser scanners and rotating and pipe lasers; and precision optical components, for $2.6B (19.6x EBITDA). In the Biophotonics segment, KKR acquires Biotage AB, provider of instruments incorporating UV/Visible absorbance detectors, fiber‑optic UV monitors, spectral detection and spectral analysis software.

Photonics M & A Future

Macroenvironment

Looking ahead into 2026 and 2027, the M&A landscape is expected to build on the dynamics that shaped 2025. Interest rates are projected to drift lower as central banks ease policy, which should gradually support risk appetite even if global growth slows. This creates a favorable environment for dealmaking, though volatility will remain an undercurrent. As a result, deal values are likely to stay elevated while overall volumes remain selective. Companies will continue to pursue fewer but larger and more strategic transactions rather than broad-based acquisition sprees.

Financing & Liquidity

Financing conditions should improve as credit markets loosen and refinancing walls are pushed further out. High-yield and leveraged loan markets are already showing more stability compared to the challenging windows of 2023–24, although access can still close quickly. At the same time, secondary transactions and a reopening IPO market are providing sponsors with more reliable exit paths, recycling capital back into new acquisitions.

Buyer Behavior

On the corporate side, strategics are expected to remain focused on capability-driven acquisitions. Especially relevant to a high density of photonics technology enabled targets, supply-chain “control point” assets will continue to attract premiums, as will technologies with defense dual-use relevance serving both commercial markets and military or national security applications.

A supply chain control point asset is a company, technology, or infrastructure element that sits at a critical chokepoint in a value chain. Ownership or influence over that point gives the acquirer disproportionate leverage because other players depend on it to move downstream or upstream. It’s not necessarily the largest or most profitable business in the chain — it’s the one that others cannot easily bypass or replicate.

Technologies with defense or dual-use relevance serve both commercial markets and military or national security applications. These technologies are especially attractive in M&A because they command premium valuations, draw strong government funding, and often face high barriers to entry.

Private equity is set to return to the offensive, but in a selective and disciplined way. With record levels of dry powder and healthier exit channels, sponsors will increase their bids, often using creative structures such as earnouts, seller notes, and continuation funds to bridge valuation gaps.

Regulatory Landscape

Regulation will remain a major factor shaping the market. Foreign investment screening is broadening. This means buyers will need to build longer timelines, prepare remedy options in advance, and factor in higher deal execution risk. Breakup fees and material adverse change clauses are becoming more decisive in competitive processes.

Although new US tariffs were announced in 2025, it is too early to see a direct effect on photonics M&A. Most transactions closing this year are already in motion. Still, early signals are emerging: Reuters reported that tariff turmoil already led to some global deals being withdrawn or delayed while BDO notes that buyers are scrutinizing targets’ import exposure more heavily and factoring tariff risk into valuations. For photonics, the immediate impact is muted, but tariffs are likely to shape 2026 deal activity more visibly — favoring regional acquisitions, selective vertical integrations, and caution around import-dependent targets.

Photonics and Deep-Tech

For photonics and other deep-tech niches, the story is even more focused. Attractive lanes include advanced manufacturing and metrology; ruggedized imaging and edge-AI vision systems; high-power laser subsystems; and precision optics, coatings and integrated subassemblies. Re-shoring trends in the U.S. and Europe, combined with defense demand and stricter reliability standards, make these technologies appealing. When positioning such businesses for sale, the strongest levers will be defensible IP, customer qualifications, proven unit economics at scale, and visibility through funded backlog.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.