Highlights from 2015

Photonics is the science and technology of generating, controlling, and detecting photons, which are particles of light. The 21st century will depend as much on photonics as the 20th century depended on electronics. A core enabling technology, photonics applications include: drug discovery and early diagnosis of disease, cell phone displays, energy-saving LED lighting, solar energy, 3D printing, fiber optic communications networks, and more.

In 2015, $50billion of the $1trillion in private placements worldwide goes to work commercializing technology and scaling photonics businesses or businesses with core enabling technology in photonics.

Private Placements

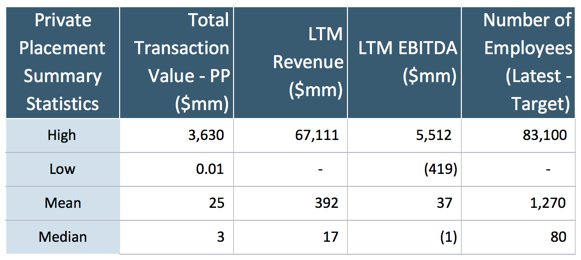

Private placement transactions for target companies are researched with closing, effective, or announce dates from January 1 to December 31, 2015. Private placements include private equity or growth capital, venture capital and private investments in public entities. Transactions volumes, values, geographies and market segments are analyzed. Values are in $US at historical rates of exchange. Follow links at the end of this article for transaction detail.

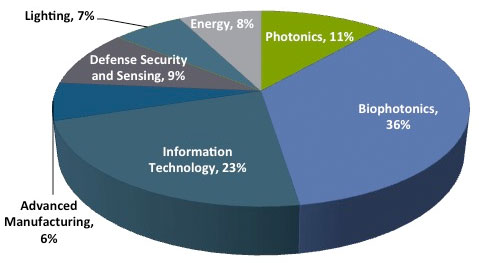

Markets Enabled by Photonics

Biophotonics – Diagnostics

2015 Private Placement Highlights

Da An Gene Co., supplier of molecular diagnostic and analytical instruments, devices, and consumables announces $237mm private placement.

Qjagen leads $45mm investment in Exosome Diagnostics to commercialize personalized diagnostics based on RNA/DNA/protein analysis.

JNJ Innovation & Novartis Venture Funds participate in $20mm round for Atlas Genetics, to develop point-of-care DNA analysis platform fir diagnosing chlamydia, MRSA, streptococcus, and meningitis.

Allied Minds participates in $34mm round for Precision Biopsy to commercialize optical biopsy technology to improve diagnosis of prostate cancer.

Thermo Fisher Scientific invests $8mm in Premaitha Health, company employing DNA analysis technology to develop tests for prenatal screening.

Arch invests $5mm in Ultivue, supplier of reagents to obtain microscopic images at an unprecedented resolution.

In the $55billion In Vitro Diagnostics market, there is a concentrated base of instrument manufacturers employing fluorescence, optical label-free and molecular imaging methods to gene, protein and cell based diagnostics. Thousands of companies worldwide are developing assays and pharmaceuticals with those instruments.

In 2015, Biophotonics is fueling economic growth and investment in improved platform technology, point-of-care devices, bioinformatics, reagents, sample collection and clinical laboratory services – as well as prolific commercialization of disease-specific and personalized assays and pharmaceuticals.

Additive Manufacturing

2015 Private Placement Highlights

Sequoia Capital & Google Ventures invest $90mm in Carbon 3D’s high speed UV processing amenable to the whole family of polymer materials.

Index Ventures & Hewlett Packard Ventures invest $35mm in Shapeway’s 3D printing marketplace.

Kleiner Perkins Caufield & Byers & Stratasys invest $14mm in Desktop Metal’s aluminum and titanium 3D printer.

Arch Venture Partners & In-Q-Tel invest in Voxel8’s desktop printer and design software for printable electronic devices.

GE Ventures & Autodesk invest $6mm in Optomec’s production grade systems for 3D printing micron-scale electronics.

Khosla Ventures invests $1mm in Feetz, supplier of custom 3D printed shoes.

The $4billion Additive Manufacturing market is dominated by a handful of players supplying 3D printers. Hundreds of companies worldwide are providing scanners, materials, software, integrated systems, contract manufacturing services and content. Additive manufacturing allows goods to be infinitely more customized and manufactured closer to point of consumption – causing a switch from centralized factories to local production with higher unit costs but no shipping and inventory costs.

In 2015, Photonics is fueling economic growth and investment in improved printing technology, 3D scanners, materials, software, rapid prototyping and contact manufacturing services.

Photonics

Materials and Coatings

In the Photonics segment, Materials and Coatings sees the most investment. China based Dongxu Optoelectronic Technology and Lens Technology closed and announced private placements of $1.2 and 1.0billion respectively. The companies supply display glass and touch-panel sensor glass. $100million and larger private placements were announced or closed by suppliers of synthetic diamond, rare earths, sapphire for LED’s and silicon for photovoltaics.

Optics, Lasers and Detectors

For a comprehensive list of private equity and venture capital investments in Photonics, join us at Lasers & Photonics Marketplace Seminar on February 15 at Photonics West or visit this page after the seminar.

Private Placement Activity

Transaction Volume

In line with previous years, the Biophotonics sector sees the most activity in 2015 – almost 40% of private placements. The Diagnostics predominantly includes investments in companies employing fluorescence, optical label-free, and molecular imaging methods to gene, protein, and cell based diagnostic assays and point-of-care devices. There is a relatively higher volume of investments promising to make cost effective genetic testing and personalized medicine a reality in the not so distance future. Also, in 2015, there are a significant number of investments in companies offering wearable sensor devices tracking everything from general fitness to environmental toxins.

Private Placement Volume

Photonics & Vertical Markets Served

2015

Information Technology follows in volume of investment activity. In addition to the large Display transactions cited above, there are a large number of investments in augmented and virtual reality hardware and content. In the Imaging and Interface segment, we see investments across a wide range of consumer electronics applications including low-cost application specific cameras and 3D scanners, 3D image processing technology and gesture control interfaces.

Transaction Value

By far, in 2015, the most investment is directed toward the Materials and Coatings, Solar, Display, and LED Packages & Luminaires. In the Materials & Coatings segment, the majority of investments are in support of the Solar, Display and LED markets.

Private Placement Value

Photonics & Vertical Markets Served

2015

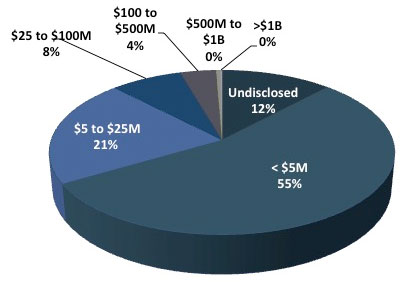

Size of Transaction

Up 53% of total in 2012, transaction values for two-thirds of private placements are less that $5million. 12% of the $48billion is invested in deals greater than $25million.

Trend Toward Higher Concentration of Later Growth Stage Investments

In 2012, the majority of private placements, more than 90%, are made by development or product launch stage companies realizing less than $10million revenue and no earnings. In 2015, that dops to 43% of investments reporting transaction value in companies with >$10million revenue. This may imply that more investors are investing at a much later stage.

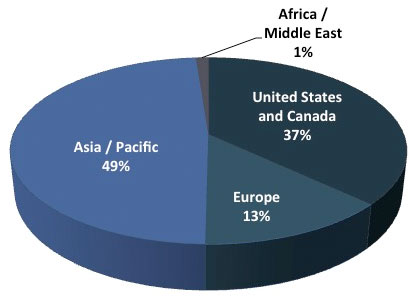

Geography – High Concentration in Asia for Photonics

In 2015, there are 34,306 private placement transactions across all sectors. There is a substantially higher concentration of investments in Asian targets in the Photonics industry than in the all sectors combined.

Private Placement Count by Geography – Target

Photonics

2015

Private Placement Count by Geography – Target

All Sectors

2015

In 2015, there is $989billion of private placement value across all sectors – compared to $612billion in 2012. There is a substantially higher concentration of investment value in Asian targets in the Photonics industry than in the all sectors combined.

Private Placement Values by Geography – Target

Photonics

2015

Private Placement Values by Geography – Target

All Sectors

2015

Given the relatively smaller transaction values, the relatively larger # of transactions and the negative EBITDA’s for target companies in Europe and North America, it appears that investment in European and North American Photonics companies is focused on technology commercialization whereas investment in Asian Photonics companies is focused on growth.

Follow this link to transaction detail for Photonics and Markets Served. <Download 2015 Photonics Private Placement Transaction Detail>