Robust Market Enabled by Biophotonics

Biophotonics is the interdisciplinary science of applying light to biological life sciences – such as genomics, molecular and cell biology, neuroscience, pharmacology, and biomechanics. It is a core technology enabling Medical Diagnostics, Medical Devices, Therapeutics, Life & Environmental Sciences and Medical Imaging markets. From early diagnosis of disease to minimally invasive surgery to detection of environmental contamination, Biophotonics is addressing and solving today’s environmental and healthcare challenges. It enhances our quality of life and safeguards our health and environment.

The market for private placements in development stage and high growth life science and healthcare businesses is robust. In 2013, a reported $3.6billion of private placements went to work commercializing technology and scaling businesses with core enabling technology in biophotonics. In 2014, 594 private placements topped $5.1billion.

Private Placements

Private placement transactions for target companies including equity and debt are researched with closing, effective, or announce dates from January 1 to December 31, 2014. Transactions volumes, values, geographies and market segments are analyzed. Values are in $US at historical rates of exchange. Follow this link to transaction detail. <2014 Jan to Dec Biophotonics Private Placements>

Activity

Transaction Volume

In line with last year, the Diagnostics sector saw the most activity in 2014 – 40% of private placements. It predominantly included investments in companies employing fluorescence, optical label-free, and molecular imaging methods to gene, protein, and cell based diagnostic assays and point-of-care devices. There was a relatively higher volume of investments promising to make cost effective genetic testing and personalized medicine a reality in the not so distance future. Also, in 2014, there were a significant number of investments in companies offering wearable sensor devices tracking everything from general fitness to environmental toxins.

Compared to 2013, there was 3x the volume of investments in the Medical Imaging sector – companies developing and supplying medical imaging instruments and consumable dyes – Computed Tomography (CT, OCT, SPECT, PET), Magnetic Resonance Imaging (MRI), Multispectral Imaging, X-ray Imaging, and Nuclear Imaging. There were more than 25 investments in Endoscopy – companies bundling therapeutic and diagnostic functionalities with non-invasive endoscopic imaging and offering 3-D and heads-up visualization.

Life Sciences sector followed with 15% of private placements. Investments in Life Sciences fueled companies developing research tools, drug discovery platforms, and equipment used for environmental analysis.

Private Placement Transaction Volume

Biophotonics

January – December 2014

The Medical Devices sector includes investments in image-guided surgery, dental imaging, and surgical laser ablation, cutting and surfacing. The Therapeutics sector includes investments in photodynamic therapy, drug delivery, orthopedics, and light based minimally invasive therapies. New areas of investment in the Ophthalmics sector included implantable therapeutic devices for treatment of glaucoma and macular degeneration and diagnostic and drug delivery devices employing the human eye, instead of blood, to detect disease and deliver therapies.

Transaction Value

Removing 4 large private placements in publicly traded entities, totaling $650million, the Life Sciences sector accounts for $475million – less than 10% of the total transaction value. Investments in early stage ventures promise to commercialize 3-D printing technologies for wound healing, drug delivery, and drug testing. Unlike in the Diagnostics segment that employs identical optical methods competing with fluorescence based ELISA tests, investors in the Life Sciences sector are investing in platforms with first products targeting Research Use Only (RUO) clinical tests or environmental detection applications. In general, these platform companies rely on their end-users to create content and application specific assays – arguably enabling their customers to capture more of the value created. For this reason, the 23 platform target companies in the Life Sciences segment realize lower valuation and are less in number than their closely related peer companies in the Diagnostics segment.

Private Placement Transaction Value

Biophotonics

January – December 2014

In line with last year, the Diagnostics segment accounted for $1.5billion. There were more than 50 investments in point-of-care diagnostics. These companies are developing disease-specific tests that are administered and evaluated in minutes at the patient’s point-of-care instead of in hours or days at a remote centralized laboratory. Recent advances in LEDs, lasers, detectors and micro-optics are enabling portable, low cost, and high performance devices. Companies realizing the highest valuations are those offering a consumable assay or pharmaceutical in combination with a low cost of ownership device.

Historically, a mature market for photonics technology, the Ophthalmics segment saw $550million investment in early stage companies developing new therapies for macular degeneration, glaucoma, and cataracts – as well as companies employing the eye to deliver pharmaceuticals and to diagnose diseases like Alzheimer’s and diabetes.

Overview

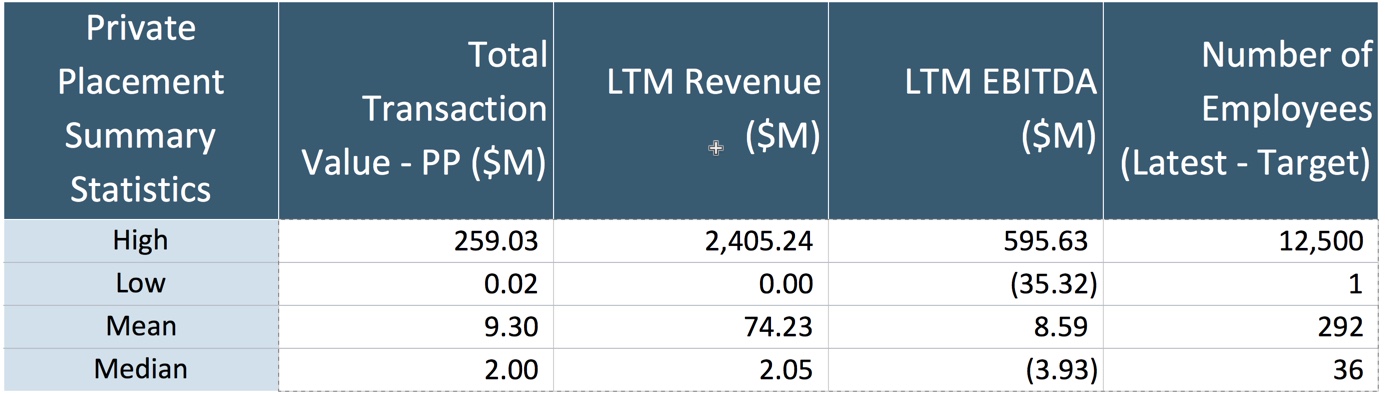

Transaction values for two-thirds of private placements were less that $5million. The number of deals less than $5million doubled in 2013. 20% of the $5.1billion was invested in deals greater than $10million.

Trend Toward Later Stage Investments

In 2013, the lion’s share of private placements, more than 90%, were made by development or product launch stage companies realizing less than $10million revenue and no earnings. In 2014, it dropped to 15% with a significantly higher concentration of investments in companies with >$10million revenue. This may imply that more investors are investing at a much later stage.

Geography

The concentration of private placements for targets in the Unites States and Canada is growing. In the same analysis in 2012, targets in the United States and Canada saw 2x the volume of Asia and Europe. In 2013 and 2014, they saw 4x to 5x the volume in Asia and Europe and realize almost 70% of the value.

Private Placement Transactions

Follow this link to transaction detail. <2014 Jan to Dec Biophotonics Private Placements>