Mergers & Acquisitions in Photonics – March 31 2022

The value and volume of global merger and acquisition (M&A) activity is down in the first quarter 2022 from the blockbuster years of 2020 and 2021. Market volatility fueled by Russia’s invasion of Ukraine makes deal execution especially challenging for strategic buyers looking to use their public market capitalizations to scale core businesses.

Further, first quarter 2022 may suffer from sellers’ high expectations set by 2021 record-breaking volumes and valuations. The rising cost of energy, higher inflation and the disruption of supply chains are also impacting both strategic and private equity buyers. With the cost of debt, however, still relatively low, private equity buyouts remain healthy.

The global M&A market for pure-play photonics companies and companies employing photonics technologies as core differentiators is also down. Volume is down 23% comparing average 2021 quarterly volume with that of the first quarter 2022. Value is down 39% comparing average 2021 quarterly value with that of the first quarter 2022. A decrease in value greater that the M&A market as a whole is largely due to strategic public buyers executing scale deals dominating 2021 deal volume and these types of deals being most effected by today’s market volatility.

M&A Transaction Volume and Value by Quarter

Targets with Photonics Technology

Strategic buyers of companies with core photonics technology continue to address the challenges of growth, an abundance of investment capital, advances in digital and mobile technologies and government intervention with M&A. They acquire companies to open new markets, enhance capabilities and implement new business models. In 2021, M&A appears to shift back from the high concentration of capability deals of 2017 to 2019 to scale deals as market leaders seek to strengthen their core business. Historically and in 2021, the vast majority of buyers of companies with core photonics technology are strategic. There is evidence from the first quarter 2022 that there may be return to a higher concentration of small capabilities deals executed by strategic buyers and a higher concentration of deals involving private equity buyers.

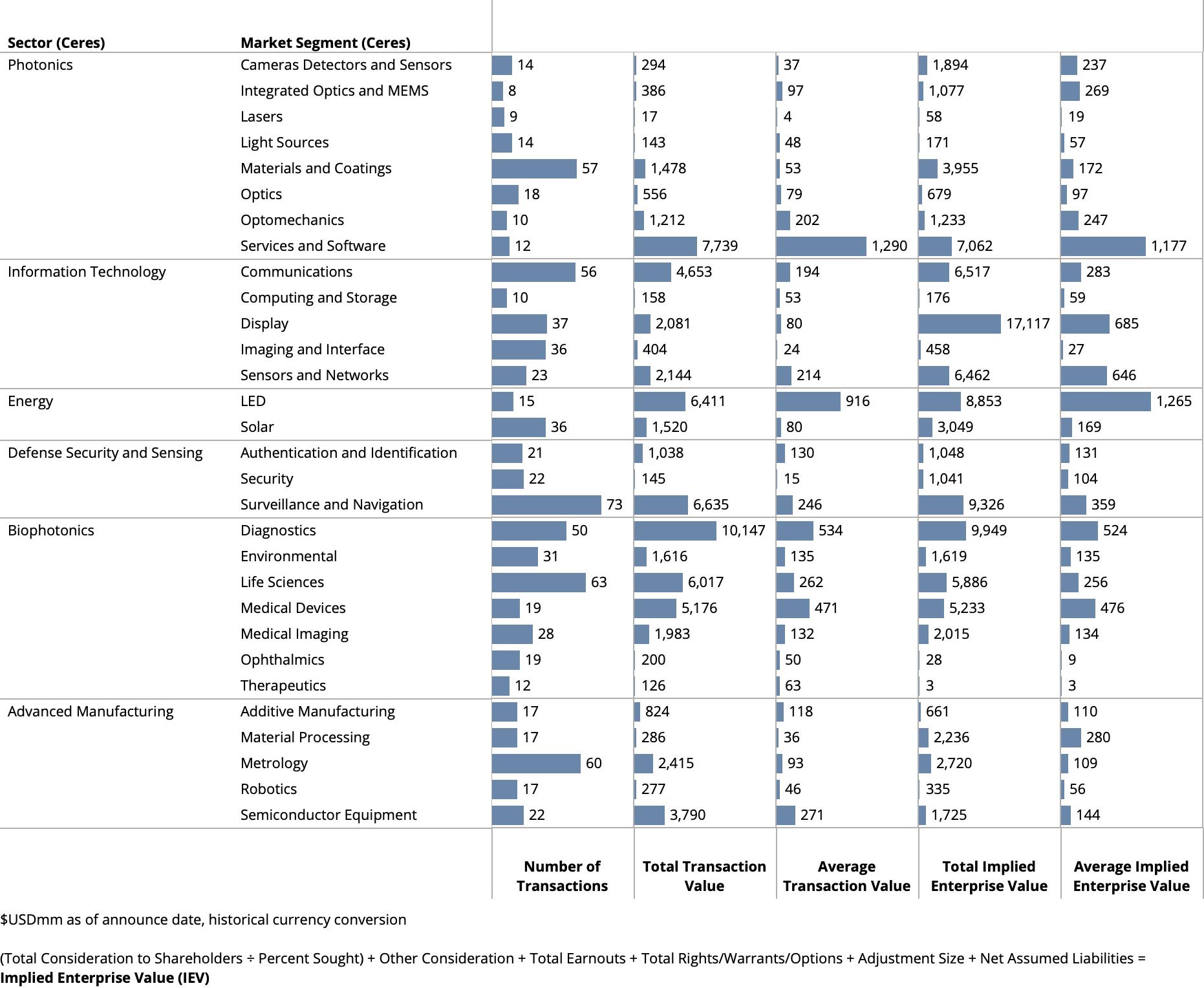

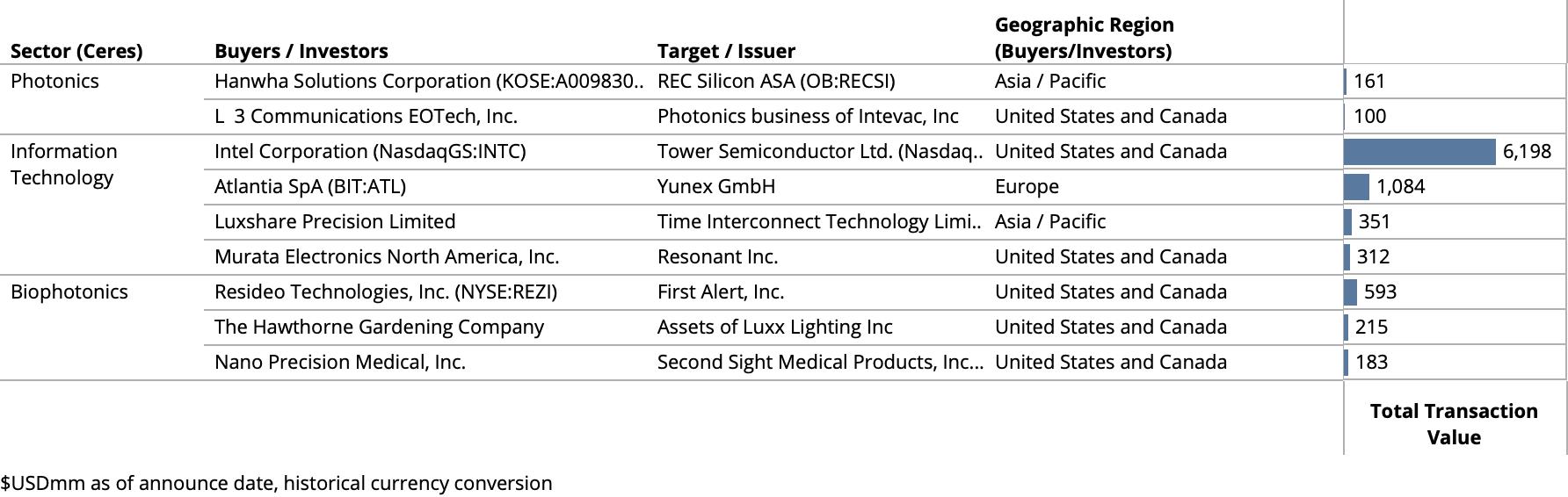

The Transactions

M&A transactions are researched with announce dates from October 1, 2021 to March 31, 2022. Activity and valuations are analyzed by market segments. Values are in $US at historical rates of exchange. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

56,306 transactions worth $43trillion are announced globally in the Last Twelve Month (LTM) period ending March 31, 2022. Of that, CERES identifies and researches 824 transactions with reported value of $70billion in the photonics industry and vertical markets employing photonics technologies as core differentiators. The total and average Enterprise Value of targets reporting financial data are $103billion and $296million respectively.

For analysis of previous year periods, 2019 to 2021, follow this link.

M&A Transaction Volume and Value by Sector

LTM March 31, 2022

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value of all photonics enabled sectors. Due to the relatively high research and development costs and risks, companies serving these markets are highly dependent on inorganic growth and competencies in M&A.

M&A Transaction Volume and Value by Market

LTM March 31, 2022

Consistent with 2021, the Surveillance and Navigation (Defense Security and Sensing), Materials and Coatings (Photonics), Life Sciences (Biophotonics), Metrology (Advanced Manufacturing) and Communications (Information Technology) markets see the most activity. With the exception of Life Sciences, the high level of activity and relatively low total value are evidence of a continued high concentration of capabilities deals – as well as vertical integration plays to secure supply chains.

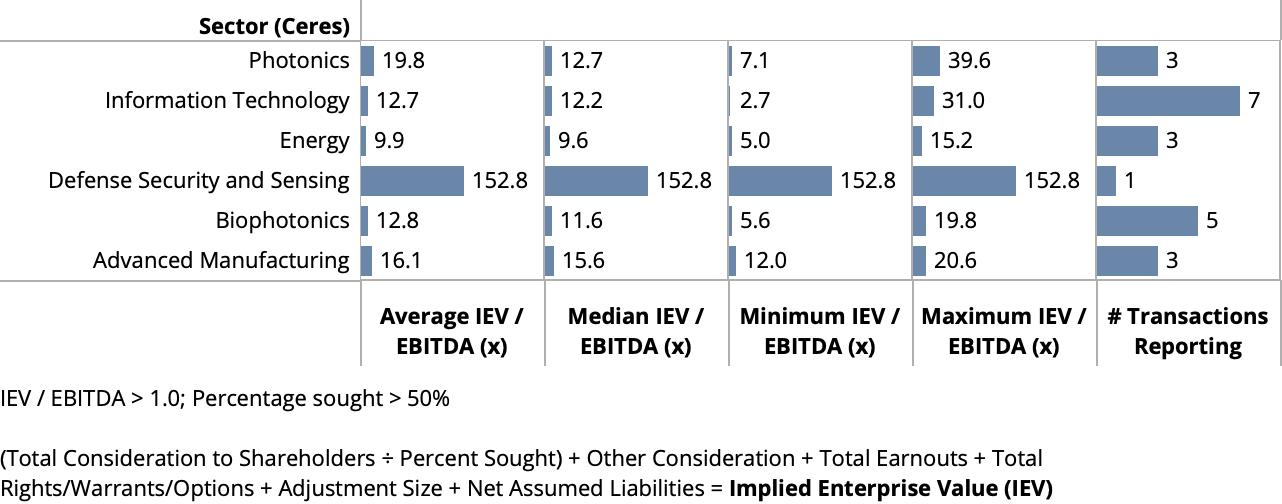

Valuations

Few transactions report financials, because regulations do not require if a transaction does not have material near term impact on financial statements. Regardless, M&A transaction data is highly relevant to understand market dynamics and buyer behavior. Of the identified and researched transactions, 126 report valuation metrics. Of the 126 transactions, 69 represent majority share.

Companies employing core photonics technology and innovative business models across a wide breadth of vertical markets realize relatively high valuations from seed to growth stage investors. Reference “Photonics in Today’s Transformative Age Amidst a Global Pandemic” article.

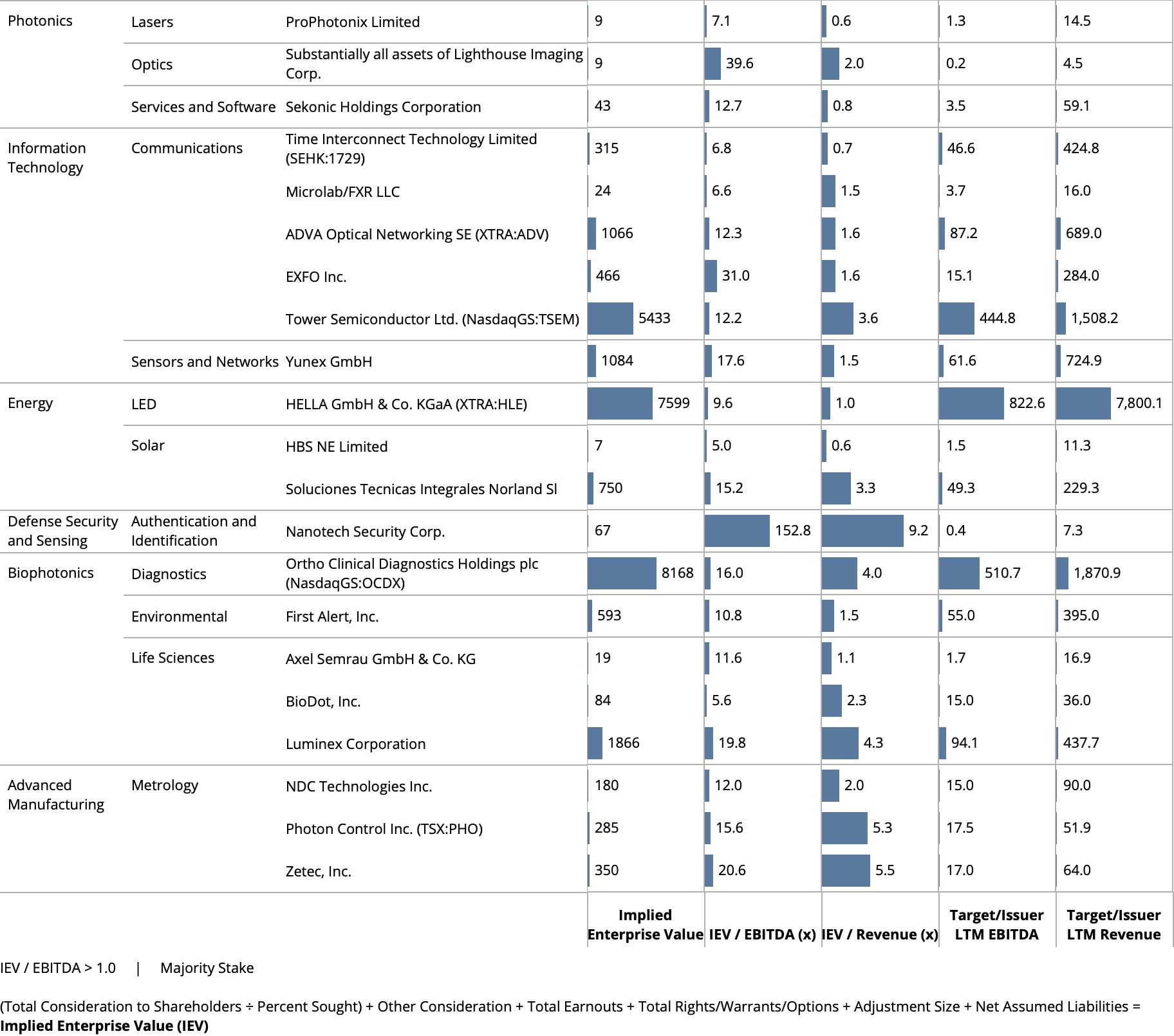

Leading the pack on IEV / EBITDA for acquisitions of majority share are: Nanotech Security Corp. (152.8x), high-volume, roll-to-roll lithography producer of nano-optic structures for authentication applications (Canada); Lighthouse Imaging Corp. (39.6x), provider of optical design and manufacturing solutions for medical device OEM’s; Zetec, Inc. (20.6x), manufacturer of nondestructive NDE inspection solutions (US); Luminex Corporation (19.8x); Yunex GmbH (17.6x), provider of hardware, software, IoT devices and advanced modular traffic management solutions; Ortho Clinical Diagnostics Holdings plc (NasdaqGS:OCDX) (16.0x), provider of in vitro diagnostics instruments and assays (US); and Photon Control Inc. (TSX:PHO) (15.6x), supplier of optical position and temperature sensors (Canada).

Leading the pack on Implied Enterprise Value / Revenue for acquisitions of majority share are: TASCOM CO.,LTD (153.8x), provider of in vitro diagnostic portable point-of-care analyzers and consumables (S. Korea); Resonant Inc. (139.8x), a late stage development company who designs and develops filters for radio frequency (RF)(US); Fetch Robotics, Inc. (30.5x), provider of autonomous mobile robot solutions for warehousing and intralogistics (US); and Mobidiag Oy (18.9 x), provider of molecular diagnostics for infectious diseases and antibiotic resistances (Finland).

M&A Valuation Metrics

Implied Enterprise Value / EBITDA Multiples

LTM March 31, 2022

M&A Valuation Metrics

Implied Enterprise Value / Revenue Multiples

LTM March 31, 2022

M&A Valuation Metrics

Implied Enterprise Value Multiples

LTM March 31, 2022

Pure-Play Photonics

The majority of pure-play photonics market leaders execute only a single transaction in the year period ending March 31, 2022 with the deals scaling existing core businesses. Viavi Solutions Inc. (NasdaqGS:VIAV), provider of optical networking test equipment, did not close its announced transaction with EXFO Inc., provider of optical networking test equipment, for $478M on $284M revenue. Lumentum Holdings Inc. (NasdaqGS:LITE), provider of photonics communications products, acquires NeoPhotonics Corporation (NYSE:NPTN), provider of optical transceivers/receivers for hyperscale data centers, for $979M on $278M revenue. Jenoptik AG (XTRA:JEN) acquires BG Medical Applications GmbH/SwissOptic AG/SwissOptic (Wuhan) Co., Ltd., OEM supplier of medical device optics for $412M. ANSYS, Inc. (NasdaqGS:ANSS) acquires Zemax, LLC, supplier of optical design software and services for $349M.

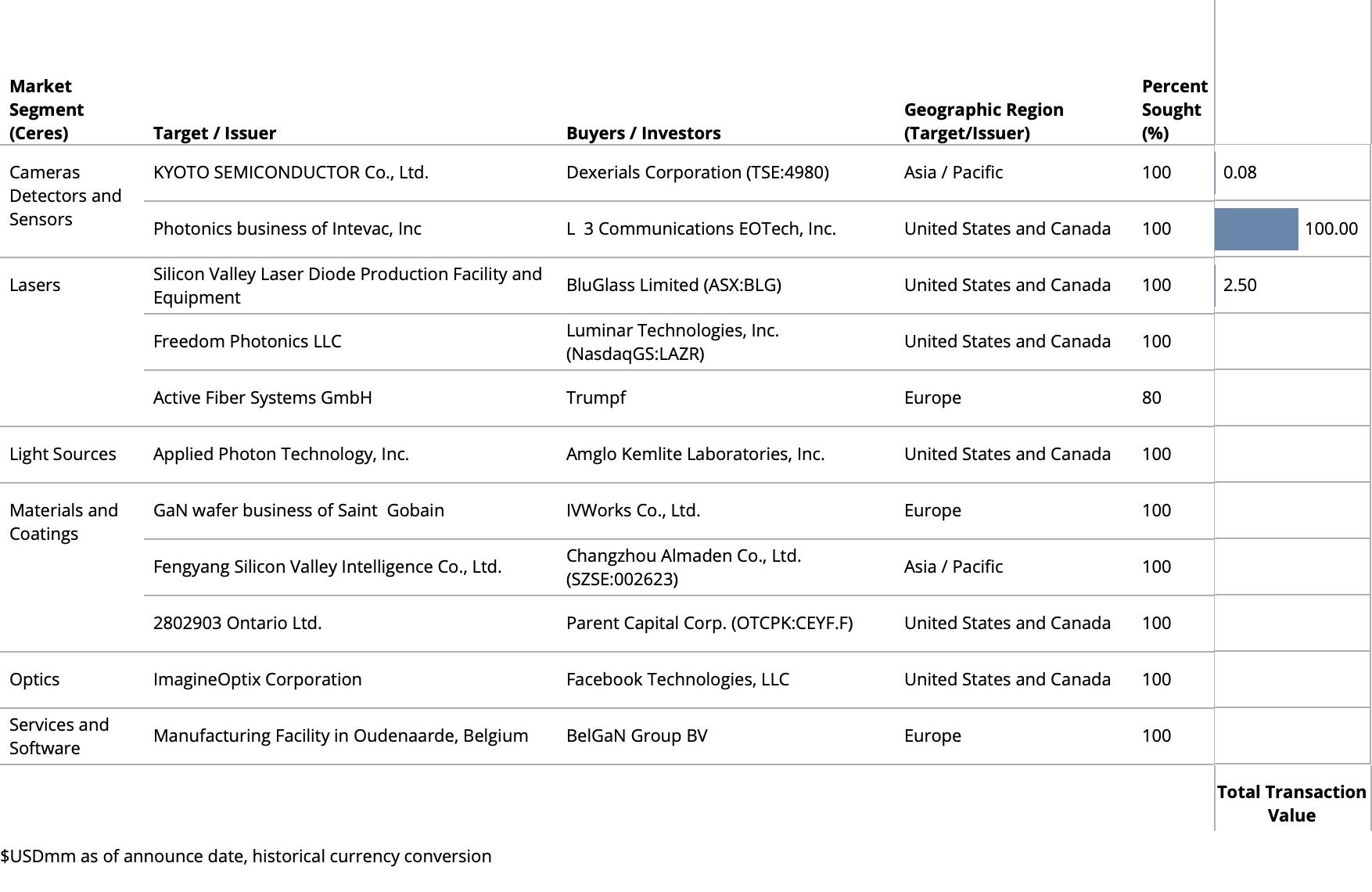

M&A – Photonics

Majority Stake Transactions

First Quarter 2022

Markets with Core Photonics Technology

Advanced Manufacturing

Within the Advanced Manufacturing sector, the Metrology market segment continues to see lots of activity with a high concentration of smaller strategic capabilities deals. Activity within other photonics technology enabled markets in the sector, such as Material Processing and Additive Manufacturing pick-up Q1 2022 likely due to previously paused capital equipment installations caused by the Covid crisis.

Information Technology

Addressing the Communications market, the largest acquisitions are Intel Corporation (NasdaqGS:INTC) $6.2billion acquisition of Tower Semiconductor Ltd. (NasdaqGS:TSEM), an independent semiconductor foundry who manufactures CMOS imagers at 12.2x IEV/EBTIDA.; ADTRAN, Inc (NasdaqGS:ADTN) $1.2billion acquisition of ADVA Optical Networking SE, provider of optical and Ethernet based networking solutions, at 12.3x IEV/EBTIDA. With eight transactions valued over $475M, the dominant strategic buyers are executing scale deals in LTM March 31, 2022.

While the activity and volume of transactions are consistent with previous years in the Display market, there are marked additions in LTM March 31, 2022 to the strategic consolidation of LED and OLED flat panel manufacturers. We see strategic acquisitions of 3D Augmented and Virtuality Reality display technologies, including Snap Inc. (NYSE:SNAP)‘s acquisition of WaveOptics, Ltd.‘s lightweight, binocular and large field of view augmented reality display technology for $520M and Facebook Technologies, LLC‘s acquisition of ImagineOptix Corporation liquid crystal polymers (LCP) based optic technology.

Biophotonics

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value.

The largest transactions are Quidel Corporation (NasdaqGS:QDEL) acquisition of Ortho Clinical Diagnostics Holdings plc (NasdaqGS:OCDX), in vitro diagnostics market leader ($8.4B); ICU Medical, Inc. (NasdaqGS:ICUI) acquisition of Smiths Medical, Inc., provider of interventional medical imaging products ($2.6B); DiaSorin S.p.A. (BIT:DIA) acquisition of Luminex Corporation, supplier of biological testing technologies that integrate microfluidics, optics, and digital signal processing ($2.1B); GE Healthcare Inc. acquisition of BK Medical Holding Company, Inc., intraoperative ultrasound imaging equipment provider ($1.5B); and Boston Scientific Corporation (NYSE:BSX) acquisition of Baylis Medical Company Inc., medical products for cardiology, pain management, and radiology applications employing radio frequency (RF) technology ($1.8B).

Rockley Photonics Holdings Limited (NYSE:RKLY), provider of a mobile health monitoring platform based on silicon photonics; and Quantum-Si Incorporated (NasdaqGM:QSI), developer of next generation protein and genomics sequencing platform, ride the wave of Special Acquisition Companies (SPAC’s). SPAC’s are companies that are formed strictly to raise capital through an IPO for the purpose of acquiring an existing company. It is an attractive go-to-market strategy given the ability to quickly go to market at high valuations with lower levels of scrutiny relative to traditional IPOs.

Rockley and Quantum-Si start publicly trading following the completion of business combinations with SC Health Corporation and HighCape Capital Acquisition Corp. As of April 18 2022, their market capitalizations of $0.57B and $0.59B are far below their summer peaks of $2.0B and $1.9B respectively. Quantum-Si puts its publicly raised capital to work to secure its supply chain and support scaling commercialization efforts by acquiring Majelac Technologies Inc., a supplier of semiconductor and optoelectronic assembly services.

Defense, Security and Sensing

The high volume of M&A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for unmanned ground and aerial vehicles and smart robots. The high value of M&A activity in the Surveillance and Navigation segment is attributed to SSW Partners’ acquisition of Veoneer, Inc. (NYSE:VNE) (Sweden), provider of automotive radar and camera systems for highly automated/autonomous driving and driver monitoring LiDAR sensor systems ($4.5B).

Geographies

Wall Street Journal article, “Some Companies Put M&A on Hold Amid Russian War on Ukraine” of April 4, 2022, reported “a handful of European companies, including U.K.-based Spectris PLC, a measurement-device company …. called off prospective deals following the Russian invasion in late February, citing market uncertainty.” Spectris ends $2.4 billion pursuit of Oxford Instruments amid Ukraine crisis. Both companies employ photonics across business units spanning Life Sciences and Advanced Manufacturing. The conflict in Ukraine does not appear to substantially affect global or photonics relevant M&A on a large scale. However, some acquisitions of European companies are reportedly taking longer to close due to rising commodity prices and stock market valuation volatility.

Geographically, the most significant trend prior to 2018 is an acceleration of cross-regional acquisitions. That trend loses its momentum and falls off a cliff in 2019 with increased government intervention on cross-border deals and trade tensions between US and China. In 2021, this trend is accelerated by supply chain concerns exposed by the Covid crisis and government scrutiny expanding beyond sensitive defense and technology industries.

North American M & A activity involving Chinese buyers falls by more than 90% from its 2016 peak. Referencing article, “Foreign Investment in US Photonics Technologies“, US-based companies and Chinese acquirers cease doing business due somewhat to the trade war, but most likely due to The Committee on Foreign Investment in the US. CFIUS has effectively blocked transactions, mostly on national security grounds. Photonics, as well as Information Technology and Defense, Security and Sensing sectors, are affected.

Regarding Coherent, Inc. (NasdaqGS:COHR), laser supplier (US), receives proposal from II-VI Incorporated (NasdaqGS:IIVI), supplier of engineered materials and optoelectronic components, for total consideration of $7.0B. The pending acquisition receives the approval, or indication of imminent approval, of three out of four global antitrust regulatory authorities. Approval of the antitrust authorities are a condition of the transaction’s closing. The companies anticipate closing the acquisition by the middle of the second calendar quarter of 2022, upon receiving approval in China, the remaining jurisdiction.

M&A Transactions by Target Geography

First Quarter 2022

Most Active Buyers

Across all markets, no single buyer is very acquisitive in first quarter 2022, but the following are off to fastest start each making two acquisitions. The most active buyers are: 3D Systems Corporation (NYSE:DDD), who acquires a provider of large industrial 3D printers and a supplier of 3D printers for medical devices; Bruker Corporation (NasdaqGS:BRKR), who acquires a provider of nanoflow liquid chromatography (nanoLC) columns for mass spectrometry proteomics applications and a supplier of high pressure liquid chromatography (HPLC) automation devices for pharmaceutical manufacturing ; RadNet, Inc. (NasdaqGM:RDNT), who acquires machine learning artificial intelligence (AI) medical imaging software providers for analyzing brain and lung scans; and Sorrento Therapeutics, Inc. (NasdaqCM:SRNE), who doubles down on two alternatives to high cost lab-based PCR testing, rapid point-of-care diagnostics test products employing electrochemical and gold colloidal labelling.

Most Active Buyers by Count

First Quarter 2022

Most Active Buyers by Volume

First Quarter 2022

Summary

In conclusion, the global M&A market for pure-play photonics companies and companies employing photonics technologies as core differentiators is down, but is keeping pace with M&A market activity as a whole. Strategic buyers still have an appetite for deals that enhance capabilities and facilitate new business models and they still have the advantage over financial sponsors in private equity, in that they can create proprietary deal flow. More activity, however, is expected from financial buyers. Most M&A deals today are auction processes with stiff competition from financial sponsors, who have more deal making capability and capacity and much less exposure to public market volatility than strategic buyers.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.