Radical Convergence of Industries

Today’s transformative age is blurring the lines between sectors, while creating new and unique opportunities to step beyond traditional boundaries. With this collision of industries, leaders in traditionally defined sectors are seizing opportunities to create new value for their customers and reshape their businesses.

To understand how traditionally pure-play photonics companies may reshape, we put aside the view that photonics is merely enabling technology with photonics companies at the bottom of a value chain with players further up the value chain capturing most of the value.

Instead, we look to learn from market leaders around the world who are innovating with new business models, new collaborations and partnerships, and new ways to deliver value to their customers.

This is not a new trend, but a continuum. What is new in 2020? The global pandemic. It is accelerating this transformation. Concurrently, the adoption of photonics technologies and the growth of established companies employing photonics technologies are also accelerating.

In 2020, evidence of these sector collisions with photonics and accelerated adoption lies in the more than $63billion of private placements and $94billion of acquisitions of companies employing photonics technologies.

Private placements in pure-play photonics companies tripled since 2018. Private placements in companies employing photonics more than doubled since 2018.

There are $94billion M&A transactions announced worldwide for companies with core photonics technology – down from $191billion in 2019. The M&A market as of Photonics West 2020 is hot. Not unsurprisingly, the market stalls in Q2, because of pandemic uncertainty.

The frothy public markets, access to low interest debt and fears of increasing US capital gains tax with a new administration, however, appear to be refueling a quick recovery.

In line with history, the majority of acquired companies and certainly those realizing the highest valuations are serving customers with more innovate business models than the traditional hardware-centric, cost-plus business models that have dominated the photonics industry for decades.

Technology companies who address the new normals and synergistically converge with other industries not only survive, but grow at an expected faster pace. Further, private equity leveraged buy-outs and venture capital backed emerging technology IPO’s (Initial Public Offerings) surge in 2020. Reference “Despite the Pandemic, Frothy Public Markets and New Normals Refuel Photonics M&A and IPO Markets in 2020.”

The Future of Supply Chain, Health and Food

Like never before, there are unique opportunities to step beyond traditional boundaries as lines between sectors blur and the pandemic accelerates photonics technology adoption. New entrants and established players are reshaping their businesses and threatening the status quo and incumbent leaders.

Explore the future of three industries that are transforming very rapidly – supply chain, food and health.

Supply Chain

How can we build a better supply chain?

- “If it ain’t broke, don’t fix it” inert supply chain industry will be forced to adopt modern technologies

- Data driven technology will be integrated throughout the supply chain

- Autonomous, connected and shared vehicles and robots move people and goods more efficiently

- Industrial automation will drive efficiency and safety in the workplace

- Augmented and virtual reality will foster safe and sanitary environments

The supply chain industry historically is inert and slow to adopt. Like or not, ready or not, the industry is transforming. So, what does the future look like?

We can look and learn from Amazon who leads across all sectors with its highly scalable logistics platform. Originally a marketplace for consumer goods, Amazon is a now the largest B2B and B2C retailer of goods and services in the world. Today, Amazon practices business models that range from its traditional marketplace to its flat-free Amazon Prime subscription to its Amazon Web Services’ fractional ownership offering of computer power and storage.

Unlike its competition who is asset driven and tremendously unprepared for the pandemic, Amazon, leads across all sectors in which competes as a “Logistics and Technology Company”.

There are some problems that logistics and information technology alone cannot solve. For examples, a shortage of glass and air transport driven by surge demand of glass vial vaccine packaging and vaccine shipments. Capital intensive production and transportation cannot scale quickly. Enter, photonics, to save the day.

The disruption from COVID-19 provides an unprecedented opportunity for businesses to redesign their supply chains, fueling faster adoption of photonics technologies core to the transformation.

Technologies solving problems at hand and securing substantial investment for businesses to take advantage of this un-precedented opportunity include:

- Mobility Tech

- Industrial Automation

- Augmented and Virtual Reality

- Communications and Computing

Mobility Tech

Even for “Logistics and Technology Company”, Amazon, supply chain is a transportation asset heavy business – fork lifts, trucks, planes, trains, ships. Autonomous, connected and shared vehicles will move people and goods more efficiently. At the core of these vehicles is photonics technology – light-based surveillance and navigation and optical communications.

Drones, Self-Driving Vehicles and Smart Robots

Key mobility technologies for navigation and surveillance are Light Imaging, Detection and Ranging (LIDAR) and 3D sensing technologies, such as Time of Flight (ToF). They are sensing technologies which use lasers, optics and detectors.

Unmanned Aerial Vehicles (UAV), a $25billion market, are used to make high-resolution maps, with applications in geography, geology, geomorphology, forestry, laser guidance and altimetry.

Unmanned Ground Vehicles (UGV), a $20billion market, employ LIDAR with laser 3D scanners for obstacle detection and collision avoidance.

Autonomous Mobile Robots, am $8billion market, employ 3D sensing for autonomous navigation.

2020 IPO Highlights

Despite the pandemic, 2020 marks boom across IPO market fueled by frothy public markets, a wave of Special Acquisition Companies (SPAC’s) and individual shareholders wanting to lock in lower capital gains rates. A SPAC is a company formed strictly to raise capital through IPO for purpose of acquiring an existing company. SPAC’s are attractive go-to-market strategy given ability to quickly go to market at high valuations with lower levels of scrutiny relative to traditional IPO’s. SPAC’s are not new, LIDAR companies OmniVision and Terra Imaging used the financial vehicle in 2016 and 2014.

Velodyne Lidar, Inc. (NasdaqGS:VLDR) started publicly trading following the completion of its business combination with SPAC Graf Industrial Corp. At year-end 2020, its market capitalization is $3.9B. Luminar Technologies, Inc. (NasdaqGS:LAZR), with strategic investments from Volvo, Daimler, and MobileEye, entered the public markets via a combination with SPAC Gores Metropoulos, Inc. As of year-end 2020, its market capitalization is $11.0B. In November 2020, Porsche-backed lidar startup AEVA, INC. announced it would merge with SPAC InterPrivate Acquisition Corp. (NYSE:IPV) at a $2.1 billion post-deal market valuation. Ouster, Inc. announces intent to go public with Colonnade Acquisition Corp. (NYSE:CLA) at $300M.

These are spectacular valuation given LIDAR companies face a legacy auto industry that is historically slow to innovate and robust levels of competition. Start-ups compete with Alphabet Inc. (NasdaqGS:GOOG.L), Apple (NASDAQ: AAPL), Amazon.com, Inc. (NasdaqGS:AMZN), and Intel Corporation (NASDAQ: INTC) that have substantial strategic interests in the future of transportation.

2020 Investment Highlights

Locus Robotics (US), provider AMR’s for fulfillment warehouses, raises $41mm

Yunjing (Narwal) Intelligence Technology (China), producer of intelligent cleaning robots, raises $141mm

Cepton Technologies (Germany), developer of LIDAR products for multiple markets including industrial robotics and security, raises $50mm from Koito Manufacturing

Robotik Innovations (US), supplier of warehouse intelligent robot and sensor systems, raises $5mm

VisionNav Robotics, (China) provider of unmanned forklifts, tractors, and industrial vehicles, raises $14mm

Third Wave Automation (US), developer of autonomous forklifts using machine learning, computer vision and robotics, raises $15mm

Vecna Robotics (US), provider of robotic autonomous vehicles to optimize logistics and material handling operations, raises $53mm of $64mm total

Industrial Automation

Prior to pandemic, automation is considered as a means to reduce labor costs. Amidst a pandemic, robotics and autonomous technology augment the workforce when staff is unavailable or conditions are unsafe.

Addressing disruptions in supply chains are Machine Vision, Industrial Robotics and Process Analytical Instrumentation. Machine Vision, a $20billion market by 2027, includes cameras, sensors, imaging and illumination optics, lighting, image processing hardware, frame grabbers and software. Industrial Robotics

is a $24billion market today forecast to grow to $53billion market by 2026. Process Analytical Instrumentation, a $3billion market, includes spectrometers, chromatographs and gas/liquid analyzers.

Historically, these were large markets – and based on the private placements in photonics last year, they are poised to grow at a more rapid pace. Common to companies attracting investment is the collision of machine vision and optical metrology with Artificial Intelligence (AI) and machine learning.

2020 Investment Highlights

Matrixtime Robotics (China), developer of deep learning and robot vision technology for manufacturing, raises $16mm

Berkshire Grey (US), developer of AI robotic and automated material handling systems, raises $263m

Beijing Aqrose Technology (China), developer of computer vision and core robotic technology for industrial automation, raises $20mm of $28mm total

AMP Robotics (US), manufacturer of robotic systems for material recovery and recycling, raises $55mm of $78mm

Drishti Technologies (India), developer of AI based in-line computer vision solutions for process control raises $25mm of $35mm total

Borges3D (Netherlands), provider of end to end digital manufacturing solutions for 3D printed parts, raises $4mm

Augmented and Virtual Reality

Augmented Reality (AR) and virtual reality (VR) markets are providing new canvases for consumer marketing, entertainment, connected and mobile content sharing, product design, scientific modeling and education and tele-present medicine.

The global AR/VR market is projected at $1.3trillion in 2030, (CAGR of 43% since 2019). While a small subset of the wide range of applications, the pandemic brings front and center how this technology can improve supply chains by making the workplace safer and more productive.

It closes the gap between the physical and digital worlds hands-free. SLAM (Simultaneous Localization and Mapping) AR assists workers on a factory floor with 3D object recognition. It makes possible tele-present field service and maintenance – as well as education and simulation to improve workplace safety.

2020 Investment Highlights

Innovega (US), developer of wearable displays, glasses and contact lenses for medical, consumer, and industrial applications, raises total of $6mm

RE’FLEKT (Germany), provider of AR applications for automotive, industrial, distribution, and real estate raises total of $6mm

Apprentice FS (US), provider of an industrial AR platform for R&D and manufacturing operators, scientists, and engineers to control work environments, raises 24mm of $42mm

AIIT ONE (S. Korea), provider of VR/AR/MR smart learning systems to prevent industrial accidents and for industrial operations and maintenance training, raises $5mm of $37mm total

Shanghai Quanshi Sensing Technology (China), developer of AR/VR robotic SLAM solution, raises $3mm

VRMedia (Italy) raises $3mm to develop AR hands-free solution to increase productivity in field maintenance and manufacturing allowing remote users to live the situation on site and on site workers to receive support

Health

When human body is biggest data platform, who will capture value?

- Insurance, retail, consumer and technology companies will develop new products to improve health

- Redefining how value is captured, shifting power from the traditional healthcare incumbents to consumers, payers and new entrants

- Technology and increased customer expectation, intensified by the pandemic, are disrupting the healthcare industry

- Availability of data and algorithms are empowering consumers to make more informed health choices and demands for more personalized health products and services

Companies are seizing these unique opportunities to capture value. CVS, traditionally a pharmacy, is transforming into a “Wellness” company. In store and on site at long term care facilities, CVS offers no cost COVID-19 testing and vaccines.

Technology conglomerates, like Apple, Google and Baidu, are leveraging their technologies and critical resources to shake-up healthcare incumbents to better serve consumers and payers. With high resolution displays and cameras, 4000 apps and capabilities such as heart rate monitoring, Apple devices are helping medical professionals deliver personalized care.

The disruption from COVID-19 is accelerating the growth of the point-of-care diagnostics and environmental monitoring markets. There are investments across all stages in 2020 in these markets – from Angels to late stage Private Equity. There are plethora of opportunities for healthy profits when merging hardware, software, data, consumables and services.

Point-of-Care Diagnostics

Today’s $30billion point-of-care diagnostics (POC) market is reshaping as it collides with the consumer goods and information technology services sectors. With data and analytics everywhere, every healthcare company is a technology company.

Photonics technologies fuse the biological, digital and physical worlds. Established fluorescence, optical label-free, spectroscopic and molecular diagnostics methods are moving to the point-of-care and to wearable as cameras, lasers/LEDs and wafer-scale optic technologies mature and miniaturize. New entrants and established players earn healthy profits from plethora of opportunities that cross hardware, software, data, consumables and services.

2020 Investment Highlights

LumiraDx Ltd (UK), supplier of microfluidic immunofluorescence assay and POC diagnostic platform for detection of COVID-19, receives $164mm for total of $704mm raised.

NanoDiagnostics (US) raises $18mm with $30mm raised in aggregate to develop its POC IVD products addressing traumatic brain injury – as well as nanosensor platform to detect COVID-19.

Y Combinator makes early stage investments in COVID-19 detection with LSK Technologies (Canada), developer of machine vision based analyzers and SiPhox (US), provider of home-use photonic chip biosensors.

Environmental

The market for environmental monitoring is expected to exceed more than US$ 23.0 Billion by 2024 at a 5-year CAGR of 7.5%. Chemical, biological and particulate detection often employ photonics.

Like the market for elective surgical medical devices, Internet of Things (IoT), an emerging market targeting environmental monitoring, is negatively impacted by the pandemic due to safety challenges around physically installing sensors and networks. Venture Capital tends to be insulated from economic disruption looking 5 to 10 years ahead. Recovery of IoT and acceleration of photonics environmental monitoring technologies are evident in the many early stage investments in 2020.

Like the market for medical diagnostics, we see investments across all stages in 2020 – from Angels to late stage Private Equity. Lots of opportunities for healthy profits when merging hardware, software, data, consumables and services.

2020 Investment Highlights

Enviral Tech (US) raises $2.5mm to develop kits for COVID 19 surveillance and early warning detection for long term care communities

Precision Biomonitoring (Canada) raises $5mm to develops eDNA surveillance platform for earlier detection of organisms such as COVID-19

R Zero Systems (US), provider of hospital grade UV C surface and air disinfection solution that destroys pathogens, raises $18mm

Hesai Photonics (China), provider of laser sensors for remote sensing of gas leaks raises $173mm of $228mm raised to date

Mergers & Acquisitions – Biophotonics

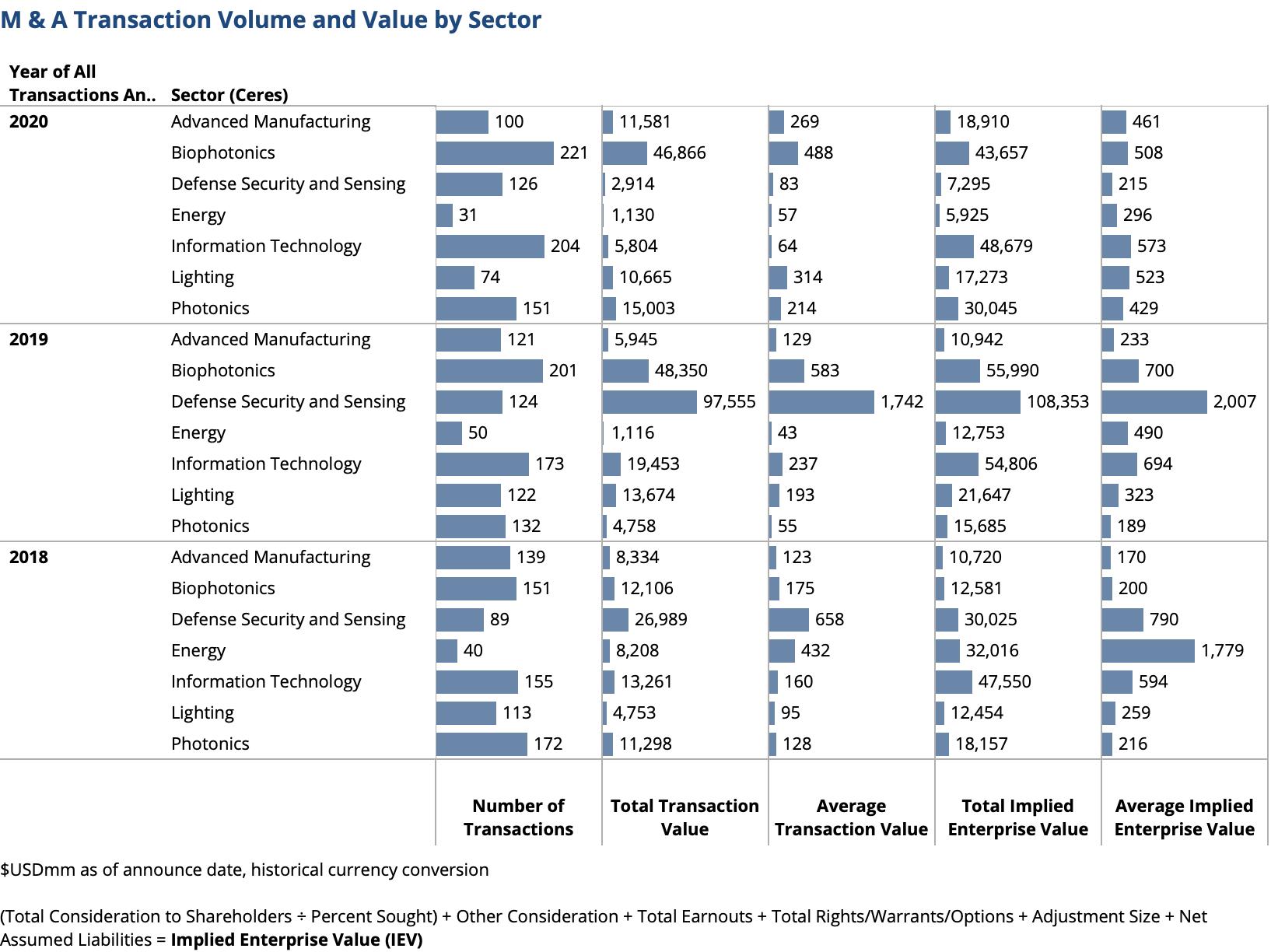

2020 M&A valuations in Biophotonics are evidence of growth being accelerated for gold-standard established photonics technologies – such as PCR, electrochemiluminescence and other fluorescence labeled modalities. In 2020, Biophotonics, the Diagnostics segment in particular, sees the most activity and highest total value.

Within Diagnostics, the largest transactions are Quebec B.V.’s acquisition of QIAGEN N.V. (NYSE:QGEN) for $13B; Illumina Inc.‘s (NasdaqGS:ILMN) acquisition of GRAIL, Inc. for $8B and Invitae Corporation’s (NISE:NVTA) acquisition of ArcherDx, Inc. for $1.4B. Acquired companies develop polymerase chain reaction (PCR) products that are detected and analyzed with fluorescence-based DNA sequencing, electrochemiluminescence or other fluorescence labeled methods. All are addressing cancer with personalized medicine while QIAGEN’s COVID-19 diagnostic and research portfolio makes headlines this year.

Food

How will we eat?

- Extreme weather patterns raise risk of harvest failures worldwide

- Consumers demand transparency, safety and sustainability

- Impoverished areas globally seeing large booms in population

- Agriculture and food waste produce potent greenhouse gases contributing to climate change

- Pandemic exposes significant waste and vulnerabilities in supply

The food supply chain is fundamentally changing from a commodity-oriented, built-for-scale industry. The consumer and global dynamics, especially amidst a pandemic, present challenges, but also present opportunities.

AgTech

The pandemic exposes significant waste and vulnerabilities in the food supply chain, attracting more Venture Capital to AgTech.

Advanced farm equipment, including drones and robotic smart field equipment is dependent on photonics. Investing in solutions addressing climate change and population growth, VC funding grew to $4.1B in 2019, a 32.7% 10-year CAGR.

Enabling photonics technologies include 3D sensing and LiDAR for autonomous navigation; spectroscopy and hyper-spectral imaging for analysis; solar energy and ultraviolet processing. Combining with AI, machine learning and innovative digital strategies, entrepreneurs in traditionally defined sectors are seizing opportunities to create new value for their customers.

2020 Investment Highlights

Aquabyte, developer of smart camera system for fish farming based on computer vision and machine learning, raises $10mm of $25mm total raised

Chemometric Brain (Spain), software developer for near infrared spectroscopic quality control of food, raises $34mm

RootWave, provides solutions for automated weeding in agriculture using visual recognition raises $7mm of $8mm total raised

SemiosBio Technologies (Canada), provider of pest management solutions to growers of tree fruits, nuts, and grapes worldwide, raises $75mm of $86mm total raised

Zero Mass Water (US), developer of solar energy fueled equipment to produce potable water, raises $50mm of $114mm raised in aggregate

Iron Ox, developer of autonomous robots for crop harvesting, raises $20mm of $47mm total raised

2021 Financial Outlook – Photonics Colliding Across Sectors

Corporate Venture Investing in Photonics for the Future

Market leaders are investing in photonics for the future directly and via their corporate venture capital arms. Market leaders find strategic value in the venture market. Some establish corporate venture capital (CVC) arms to gain insight to key strategic areas, while getting access to new technologies and capabilities or expanding their ecosystems. These investments can lead to acquisitions or new customers while mitigating the risks and minimizing the costs of relatively capital-intensive research and development.

Corporate venture investment hit a record $67billion in 2018. Corporate venture capital accounted for more than 50% of all 2018 venture deals.

Corporate venturing in photonics was active, but at half the volume of 2018 for the Top 15 most active players in 2020. The pandemic causes many large corporations and CVC’s to focus internally in 2020. Despite CVC activity being down across the board in 2020, new CVC investors emerged. Motivated by mass disruption to industries worldwide, strategic corporations are likely to continue their charge into VC, in order to succeed in a post-pandemic world.

Top 15 Most Active Corporate Venture Investors in Photonics

2021 Global Private Placements

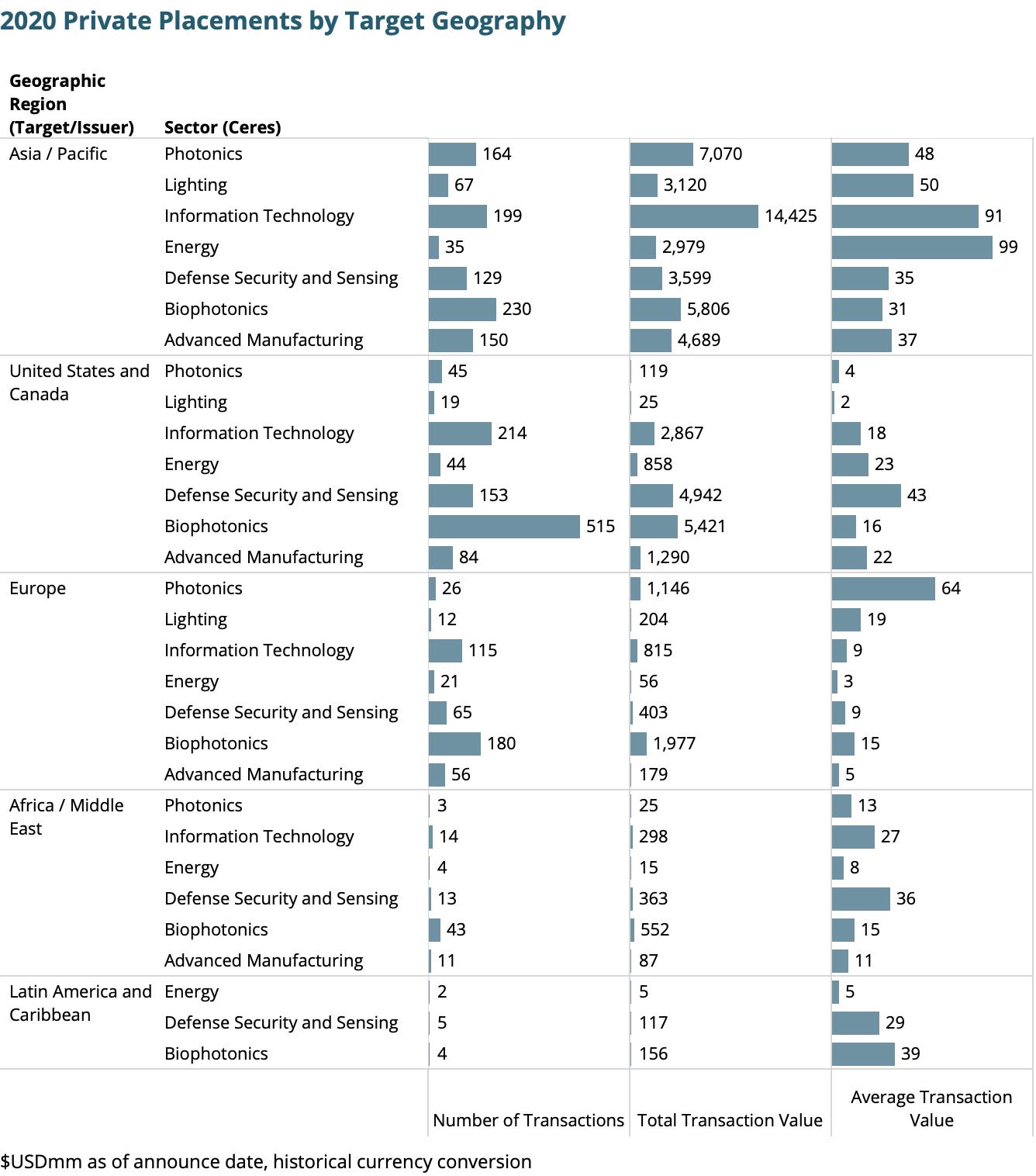

In 2020, Asia, namely China, trounces US and Europe in total volume and value of investments in companies with core photonics technology.

Without the access to US technology like in previous years, China is investing in China. This is expected to continue as the Biden administration is reportedly beefing up CFIUS to scrutinize Chinese investment in US tech startups. A more assertive CFIUS is going to exist for a long time.

Chinese buyer valuations of US tech companies were great – but now US buyer valuations of US tech companies are great. So, for another reason, the trend is expected to continue.

It is across all sectors with the exceptions of Biophotonics and Defense, Security and Sensing where it did not trounce, but just exceeded. In pure-play photonics, Asia, namely China, invested far more in emerging and growth companies in Cameras, Detectors and Sensors; Materials and Coatings; and Optics. Like in previous years, but by a larger margin, Asian (predominantly Chinese) optical communications and display (including AR/VR) companies raised 10 – 20x the amount raised by US companies.

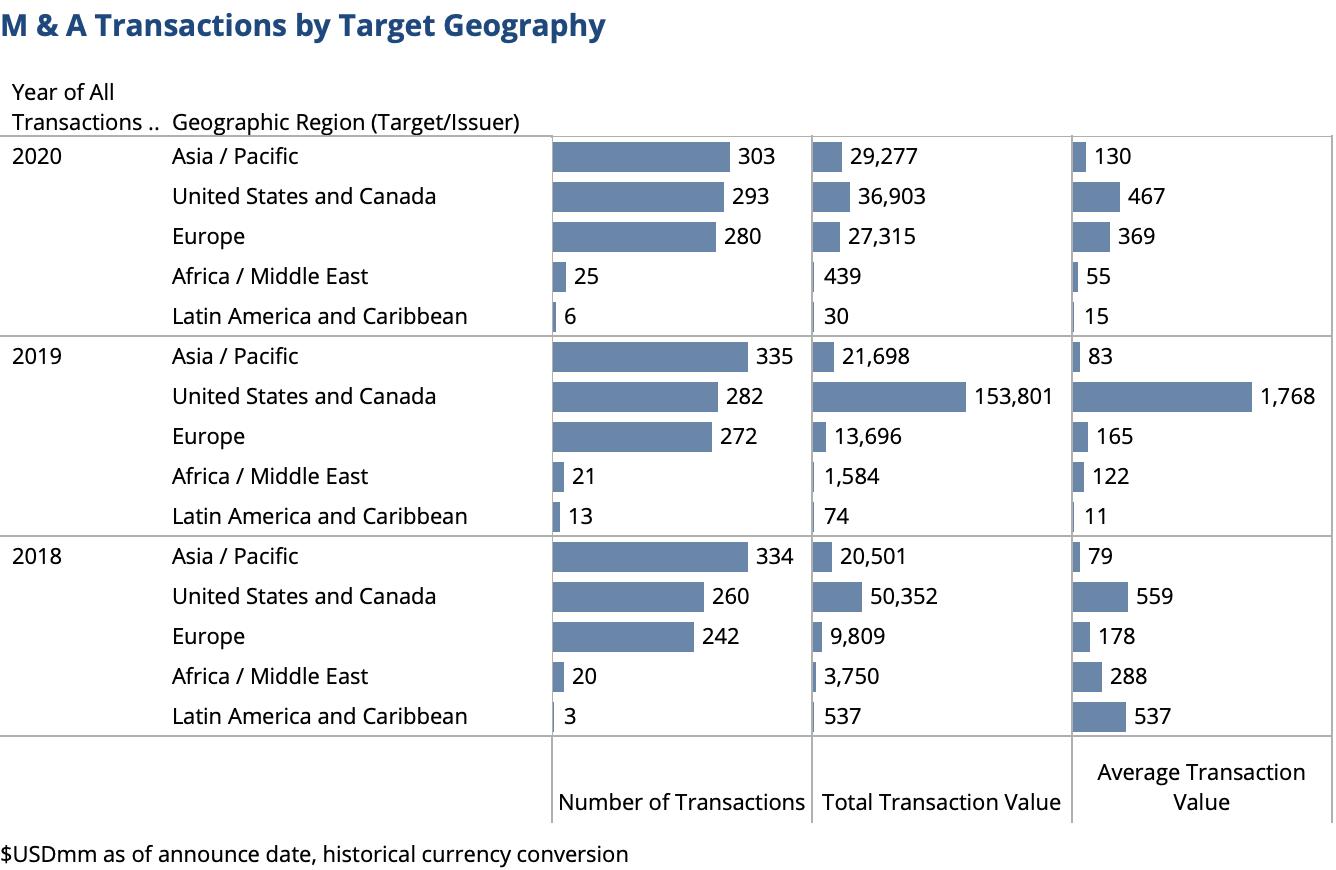

2021 Global Mergers and Acquisitions

Advances in digital and mobile technologies continue. Advances in photonics technologies commercialized over last decades adoption are accelerated further.

Financial and strategic buyers with core competencies in M&A are able to act quickly. Great companies are scarce. Sales processes are competitive. There is an abundance of investment capital and prices are high.

There is higher concentration of strategic vs financial buyers.

Buyers are acquiring companies to open new markets, enhance capabilities and implement new business models. Pure-play photonics companies consolidate.

Government intervention continues. Most significant geographical 5-year trend of acceleration of cross-regional acquisitions lost its momentum in 2018.

New US administration expects to maintain CFIUS regulations on investing in “critical technologies”.

- Optical Instrument and Lens Manufacturing NAICS: 333314

- Other Guided Missile and Space Vehicle Parts and Auxiliary Equipment Manufacturing NAICS: 336419

- Research and Development in Nanotechnology NAICS: 541713

- Search, Detection, Navigation, Guidance, Aeronautical, and Nautical System and Instrument Manufacturing NAICS: 334511

- Semiconductor and Related Device Manufacturing NAICS: 334413

2020 Investments and M&A

Private Placements

In 2020, $63billion of the $740billion announced private placements worldwide goes to work commercializing photonics technology and growing businesses with core photonics technology. Total investment in pure-play photonics companies tripled from 2018. Total investment in companies employing photonics more than doubled from 2018.

Since 2015, private placement investment in pure-play photonics increases year over year. In 2020, $8billion is invested globally (3x 2018). Greater than 95% is invested in Asian companies. There continues to be very little investment in Lasers.

Mergers and Acquisitions

There are $94billion M&A transactions announced worldwide – down from $191billion in 2019.

The market was hot as of last year at Photonics West. Not unsurprisingly, the market stalled in Q2, because of pandemic uncertainty. However, the frothy public markets, access to low interest debt and fears of increasing US capital gains tax with a new administration appear to be refueling a quick recovery in our M&A market.

Medical Diagnostics and Therapeutics markets see highest total transaction value. Advanced Manufacturing and Biophotonics sectors see high concentrations of Lower Middle Market ($25mm to $100mm) transactions.

In line with history, the majority of acquired companies and certainly those realizing the highest valuations are serving customers with more innovate business models than the traditional hardware-centric, cost-plus business models that have dominated the photonics industry for decades.

In 2020, almost 95% of acquisitions of photonics enabled targets involve strategic buyers, compared to 80% in 2019. I t may be strategic buyers are more capable in getting deals done remotely with more intimate knowledge of the sellers and their markets. Similar to previous years, most private equity buy-outs are smaller add-ons to larger platform companies.

There are 151 acquisitions of pure-play photonics companies announced in 2020 with total value of $15billion. The highest IEV/EBITDA multiples for majority stakes are Materion‘s acquisition of Optics Balzers AG (12x) and Xinyi‘s acquisition of China Glass Holdings Limited (16x). IEV/EBITDA multiples for pure-play photonics companies ranged from 5x to 16x.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.