2021 Mergers & Acquisitions in Photonics

2021 marks the highest total transaction value in history for Mergers and Acquisitions. Global aggregate M&A transaction value is up more than 40% over 2019. The M&A market for photonics technology enables companies also has a banner year.

This may be due to an inherently high concentration of strategic deals. According to Bain & Company, “while strategic M&A is on track to reach its highest value in six years, it also accounted for the lowest portion of deal value yet; sponsor, SPAC, and VC deals grew two to five times faster.” In 2021 and in line with history, only 10% of acquisitions of photonics enabled targets involve financial buyers.

Strategic buyers of companies with core photonics technology continue to address the challenges of growth, an abundance of investment capital, advances in digital and mobile technologies and government intervention with M&A. They acquire companies to open new markets, enhance capabilities and implement new business models. In 2021, however, M&A appears to shift back from the high concentration of capability deals of 2018 and 2019 to scale deals as companies seek to strengthen their core business. Strategic buyers are also executing more vertical integration plays, bringing critical capabilities in-house to address supply chain disruptions.

The Transactions

M&A transactions are researched with announce dates from January 1 to December 31, 2021. Activity and valuations are analyzed by market segments. Values are in $US at historical rates of exchange. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

55,793 transactions worth $4.6trillion are announced globally in 2021. Of that, CERES identifies and researches 862 transactions with reported value of $85billion in the photonics industry and vertical markets employing photonics technologies as core differentiators. The total and average Enterprise Value of targets reporting financial data are $132billion and $338million respectively.

M&A Transaction Volume and Value by Sector

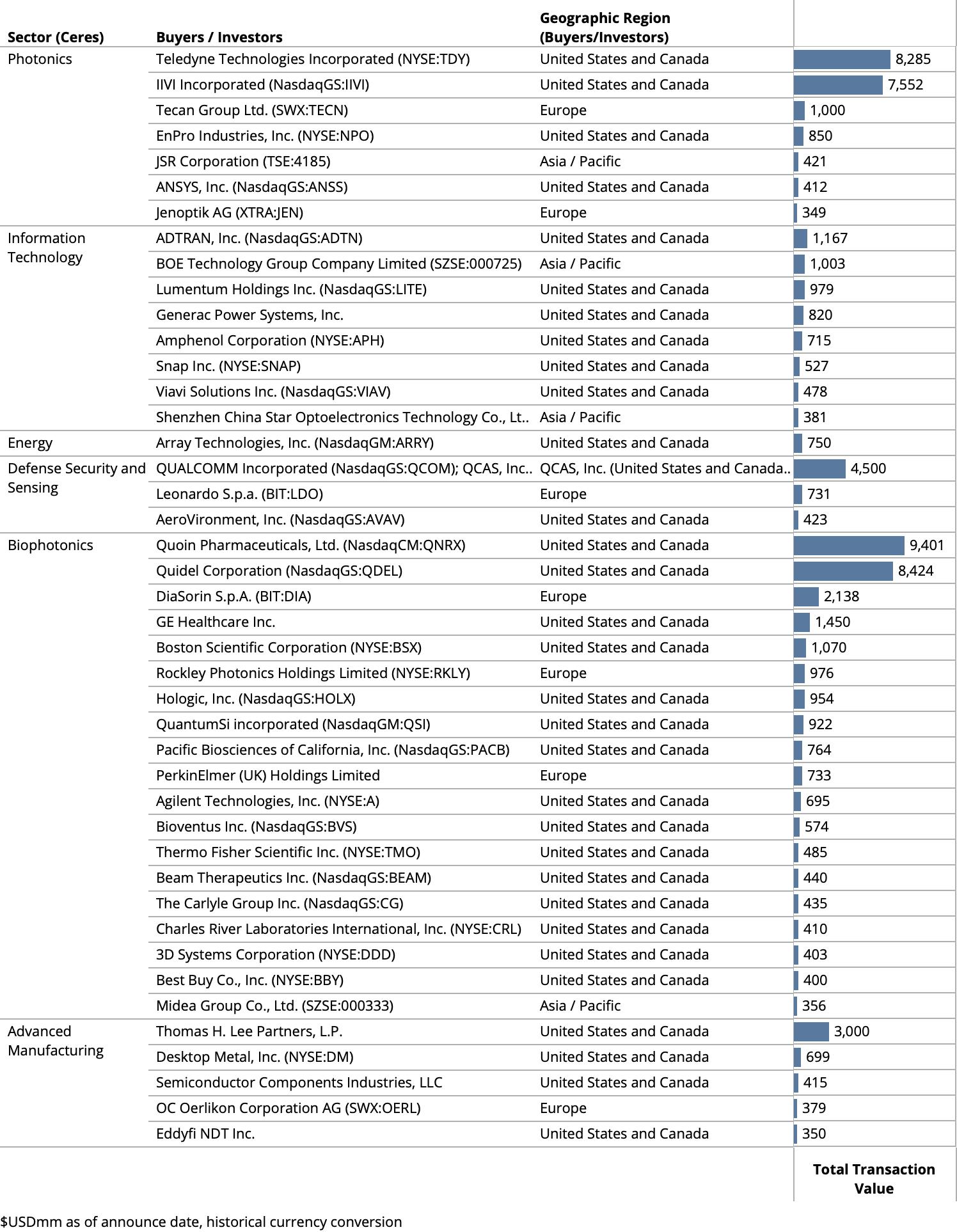

Due to two industry consolidating transactions, 2021 marks the highest total transaction value in history of M&A for the pure-play Photonics sector. Teledyne Technologies Incorporated (NYSE:TDY) closes on acquisition of FLIR Systems, Inc. (NasdaqGS:FLIR), provider of thermal and visible light imaging systems (US) for $7.5B. Coherent, Inc. (NasdaqGS:COHR), laser supplier (US), receives proposal from II-VI Incorporated (NasdaqGS:IIVI), supplier of engineered materials and optoelectronic components, for total consideration of $7.0B.

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value of all photonics enabled sectors. Due to the relatively high research and development costs and risks, companies serving these markets are highly dependent on inorganic growth and competencies in M&A.

2021 M&A Transaction Volume and Value by Market

The Surveillance and Navigation (Defense Security and Sensing), Materials and Coatings (Photonics), Life Sciences (Biophotonics), Metrology (Advanced Manufacturing) and Communications (Information Technology) markets see the most activity. With the exception of Life Sciences, the high level of activity and relatively low total value are evidence of a continued high concentration of capabilities deals – as well as vertical integration plays to secure supply chains.

Valuations

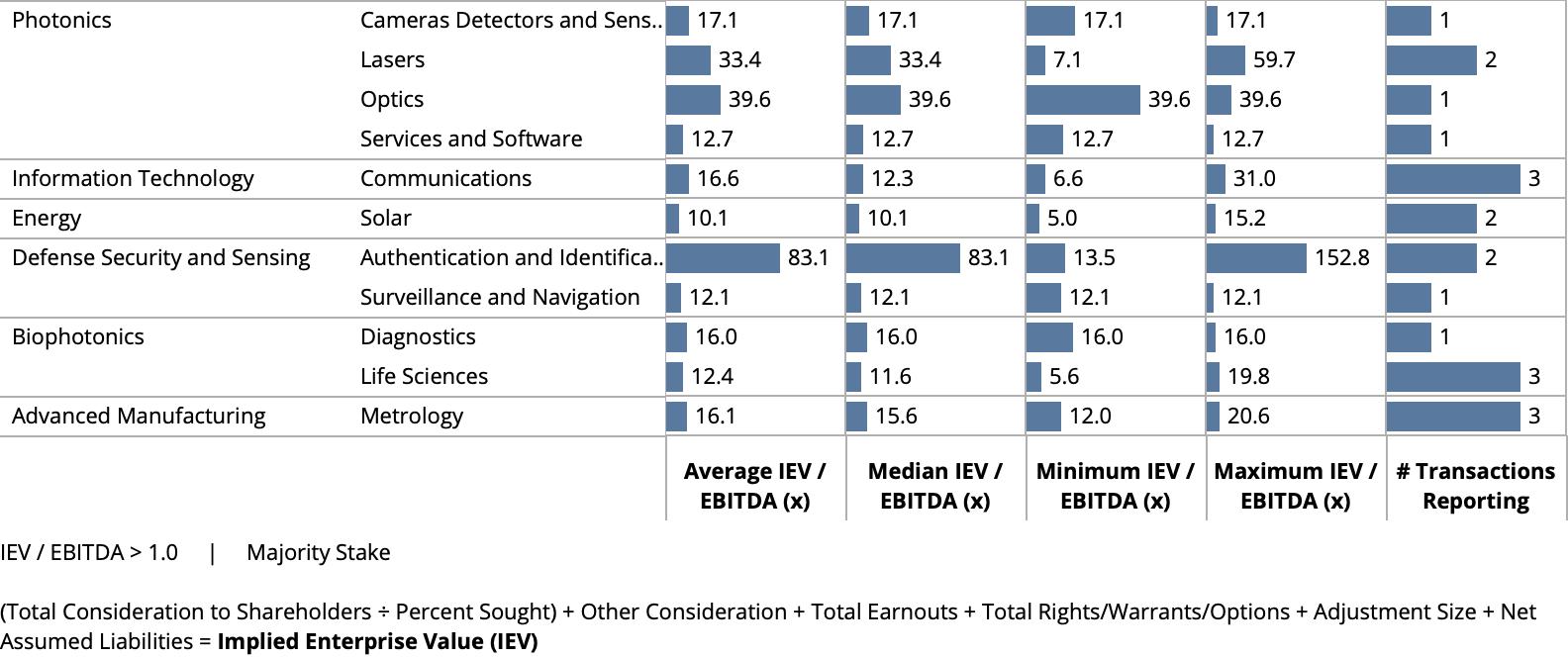

Few transactions report financials, because regulations do not require if a transaction does not have material near term impact on financial statements. Regardless, M&A transaction data is highly relevant to understand market dynamics and buyer behavior. Of the identified and researched transactions, 170 report valuation metrics. Of the 170 transactions, 80 represent majority share.

Companies employing core photonics technology and innovative business models across a wide breadth of vertical markets realize relatively high valuations from seed to growth stage investors. Reference “Photonics in Today’s Transformative Age Amidst a Global Pandemic” article.

In 2021, strategic deals trade at the highest multiples in history across the board. With the exception of the Biophotonics sector that historically always sees very high multiples, this is uniquely true of strategic deals involving companies with core photonics technology targets in other sectors.

Year over Year M&A Valuation Metrics

Implied Enterprise Value / EBITDA Multiples

Leading the pack on IEV / EBITDA for acquisitions of majority share are: Nanotech Security Corp. (152.8x), high-volume, roll-to-roll lithography producer of nano-optic structures for authentication applications (Canada); Coherent, Inc. (NasdaqGS:COHR) (59.6x); EXFO Inc. (31.0x); Zetec, Inc. (20.6x), manufacturer of nondestructive NDE inspection solutions (US); Luminex Corporation (19.8x); Teledyne FLIR, LLC (17.1x); Ortho Clinical Diagnostics Holdings plc (NasdaqGS:OCDX) (16.0x), provider of in vitro diagnostics instruments and assays (US); and Photon Control Inc. (TSX:PHO) (15.6x), supplier of optical position and temperature sensors (Canada).

Leading the pack on Implied Enterprise Value / Revenue for acquisitions of majority share are: TASCOM CO.,LTD (153.8x), provider of in vitro diagnostic portable point-of-care analyzers and consumables (S. Korea); Fetch Robotics, Inc. (30.5x), provider of autonomous mobile robot solutions for warehousing and intralogistics (US); and BioDiscovery, Inc. (27.8x), software solution provider of high throughput microarray and next generation sequencing data analysis (US).

2021 M&A Valuation Metrics

Implied Enterprise Value / EBITDA Multiples

2021 M&A Valuation Metrics

Implied Enterprise Value / Revenue Multiples

2021 M&A Valuation Metrics

Implied Enterprise Value Multiples

Pure-Play Photonics

While the overwhelming majority of pure-play photonics market leaders execute only a single transaction this year, the deals are large and scale existing core businesses. Teledyne Technologies Incorporated (NYSE:TDY) acquires FLIR Systems, Inc. (NasdaqGS:FLIR) for $7.5B on $1.9B revenue. Coherent, Inc. (NasdaqGS:COHR) receives proposal from II-VI Incorporated (NasdaqGS:IIVI), supplier of engineered materials and optoelectronic components, for total consideration of $7.0B on $1.2B revenue. Viavi Solutions Inc. (NasdaqGS:VIAV), provider of optical networking test equipment, acquires EXFO Inc., provider of optical networking test equipment, for $478M on $284M revenue. Lumentum Holdings Inc. (NasdaqGS:LITE), provider of photonics communications products, acquires NeoPhotonics Corporation (NYSE:NPTN), provider of optical transceivers/receivers for hyperscale data centers, for $979M on $278M revenue. Jenoptik AG (XTRA:JEN) acquires BG Medical Applications GmbH/SwissOptic AG/SwissOptic (Wuhan) Co., Ltd., OEM supplier of medical device optics for $349M.

2021 M&A – Photonics

Majority Stake Transactions

In 2021, valuations of pure-play photonics companies no longer lag valuations of companies in the vertical markets they serve.

Lasers

Since 2018, market leaders in Lasers are not acquiring for new capabilities or to enter new markets. Market leaders continue to consolidate with scale deals and smaller vertical integration plays to address in a challenging global macroeconomic environment and supply chain.

Cameras, Detectors and Sensors

Prior to 2021, the majority of acquisitions in Cameras, Detectors and Sensors market are horizontal integration plays to expand scope of product offerings. In 2021, the majority of acquisitions are vertical integration plays to secure supply chain.

Optics

Activity in Optics continues to be concentrated in micro market transactions by lower middle market strategic buyers. The exception is the acquisition of the medical optics businesses of the former Berliner Glas and SwissOptic by Jenoptik AG (XTRA:JEN).

2021 M&A – Companies with Core Photonics Technology

Advanced Manufacturing

Within the Advanced Manufacturing sector, the Metrology market segment continues to see lots of activity with a high concentration of smaller strategic capabilities deals. Although instrumental contributors to resolving supply chain woes, activity within other photonics technology enabled markets in the sector, such as Material Processing and Additive Manufacturing, is flat. This may be due to paused capital equipment installations caused by the Covid crisis.

Information Technology

Addressing the Communications market, the largest acquisition is ADTRAN, Inc (NasdaqGS:ADTN) $1.2billion acquisition of ADVA Optical Networking SE, provider of optical and Ethernet based networking solutions, at 12.3x IEV/EBTIDA. With four transactions valued over $475M, the dominant strategic buyers are executing scale deals in 2021.

While the activity and volume of transactions are consistent with previous years in the Display market, there is a marked addition in 2021 to the strategic consolidation of LED and OLED flat panel manufacturers. We see strategic acquisitions of 3D Augmented and Virtuality Reality display technologies, including Snap Inc. (NYSE:SNAP)‘s acquisition of WaveOptics, Ltd.‘s lightweight, binocular and large field of view augmented reality display technology for $520M.

Biophotonics

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value.

The largest transactions are Quoin Pharmaceuticals, Ltd. (NasdaqCM:QNRX) acquisition of Cellect Biotechnology Ltd., developer of a 3D time sequenced microscopy platform that functionally selects stem cells to enhance the safety of regenerative medicine ($9.4B); Quidel Corporation (NasdaqGS:QDEL) acquisition of Ortho Clinical Diagnostics Holdings plc (NasdaqGS:OCDX), in vitro diagnostics market leader ($8.4B); DiaSorin S.p.A. (BIT:DIA) acquisition of Luminex Corporation, supplier of biological testing technologies that integrate microfluidics, optics, and digital signal processing ($2.1B); GE Healthcare Inc. acquisition of BK Medical Holding Company, Inc., intraoperative ultrasound imaging equipment provider ($1.5B); and Boston Scientific Corporation (NYSE:BSX) acquisition of Lumenis Ltd.’s urology and otolaryngology laser and fiber optic systems manufacturing business ($1.1B).

Rockley Photonics Holdings Limited (NYSE:RKLY), provider of a mobile health monitoring platform based on silicon photonics; and Quantum-Si Incorporated (NasdaqGM:QSI), developer of next generation protein and genomics sequencing platform, ride the wave of Special Acquisition Companies (SPAC’s). SPAC’s are companies that are formed strictly to raise capital through an IPO for the purpose of acquiring an existing company. It is an attractive go-to-market strategy given the ability to quickly go to market at high valuations with lower levels of scrutiny relative to traditional IPOs.

Rockley and Quantum-Si start publicly trading following the completion of business combinations with SC Health Corporation and HighCape Capital Acquisition Corp. As of December 31 2021, their market capitalizations of $0.55B and $1.08B are far below their summer peaks of $2.0B and $1.9B respectively. Quantum-Si puts its publicly raised capital to work to secure its supply chain and support scaling commercialization efforts by acquiring Majelac Technologies Inc., a supplier of semiconductor and optoelectronic assembly services.

Defense, Security and Sensing

The high volume of M&A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for unmanned ground and aerial vehicles and smart robots. The high value of M&A activity in the Surveillance and Navigation segment is attributed to QUALCOMM Incorporated (NasdaqGS:QCOM) and SSW Partners make offer to acquire Veoneer, Inc. (NYSE:VNE) (Sweden), provider of automotive radar and camera systems for highly automated/autonomous driving and driver monitoring LiDAR sensor systems ($4.2B).

Geographies

Geographically, the most significant trend prior to 2018 is an acceleration of cross-regional acquisitions. That trend looses its momentum and falls off a cliff in 2019 with increased government intervention on cross-border deals and trade tensions between US and China. In 2021, this trend is accelerated by supply chain concerns exposed by the Covid crisis and government scrutiny expanding beyond sensitive defense and technology industries.

North American M & A activity involving Chinese buyers falls by more than 90% from its 2016 peak. Referencing article, “Foreign Investment in US Photonics Technologies“, US-based companies and Chinese acquirers cease doing business due somewhat to the trade war, but most likely due to The Committee on Foreign Investment in the US. CFIUS has effectively blocked transactions, mostly on national security grounds. Photonics, as well as Information Technology and Defense, Security and Sensing sectors, are affected.

2021 M&A Transactions by Target Geography

Most Active Buyers

Strategic buyers are the most active. However, across all markets served, no single buyer is very acquisitive in 2021. The most active buyers are Thermo Fisher Scientific Inc. (NYSE:TMO), who acquires four life sciences instrumentation companies and a PCR-based rapid point-of-care infectious disease testing platform; and Amphenol Corporation (NYSE:APH), who acquires four communications connectivity components suppliers. The following buyers each acquire three companies with core photonics technology. Halo Technology Group acquires communications connectivity components suppliers. BICO Group AB (OM:BICO) acquires life science instrumentation companies. Desktop Metal, Inc. (NYSE:DM) acquires materials, machines and processes for additive manufacturing. Salvo Technologies Inc. acquires thin film coating, optical component and spectroscopy instrumentation capabilities. Snap Inc. (NYSE:SNAP) acquires augmented reality (AR) technology. The Carlyle Group Inc. (NasdaqGS:CG) acquires providers and a contract manufacturer of life science tools and analytical instrumentation.

2021 Most Active Buyers by Count

2021 Most Active Buyers by Volume

In conclusion, photonics technology deal activity is keeping pace with M&A market activity as a whole. Strategic buyers have the advantage over financial sponsors, such as private equity, in that they can create proprietary deal flow. However, most M&A deals today are auction processes with stiff competition from financial sponsors, who have more deal making capability and capacity than strategic buyers – as well as $2.8trillion of dry powder. To compete, successful strategic buyers will have to expand their M&A capabilities and/or instead consider partnerships such as joint ventures or corporate venture capital to expand capabilities and address challenges in talent retention and supply chain.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.