2023 Mergers & Acquisitions in Photonics

The 2022 and 2023 photonics M&A market and M&A market as a whole do not stack up against prior years. Driving trends include inflation and rapid interest rate hikes, geopolitical instability in Middle East, Europe and China, supply chain risk and shortages of skilled workers and technical talent.

Regardless, strategic buyers of companies with core photonics technology continue to address the challenges of growth, advances in digital and machine learning technologies and government intervention with M&A. They acquire companies to open new markets, enhance capabilities, implement new business models and secure supply chains.

In 2021, there is a trend to shift back from the high concentration of capability deals of 2018 and 2019 to scale deals as companies seek to strengthen their core business. In 2022, the trend reverses. Strategic buyers execute smaller capabilities deals and execute more vertical integration plays, bringing critical capabilities in-house. 2022 and 2023 see very few mega-mergers and deals substantially scaling existing core businesses and a higher concentration of lower middle market transactions and corporate carve-outs.

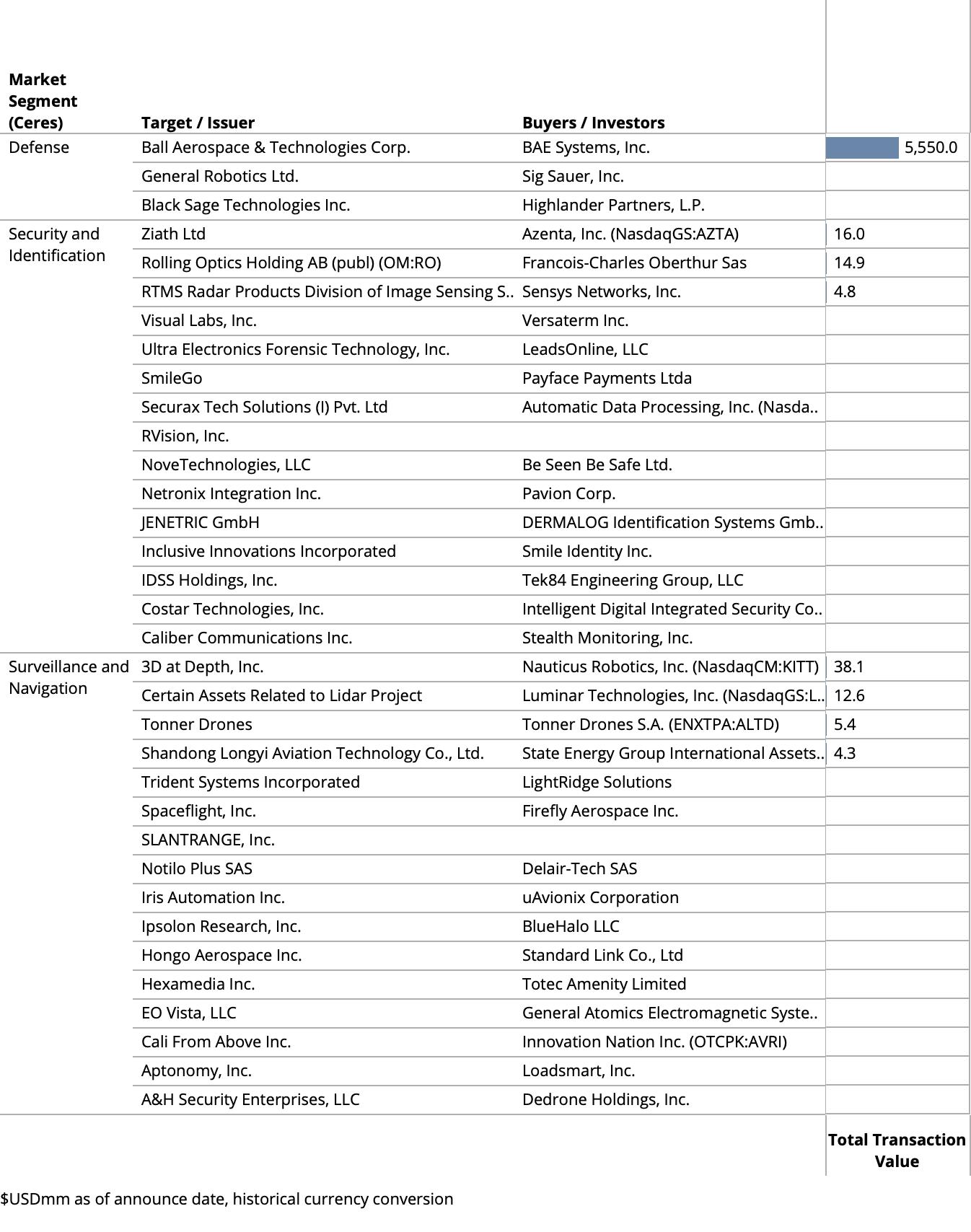

The Transactions

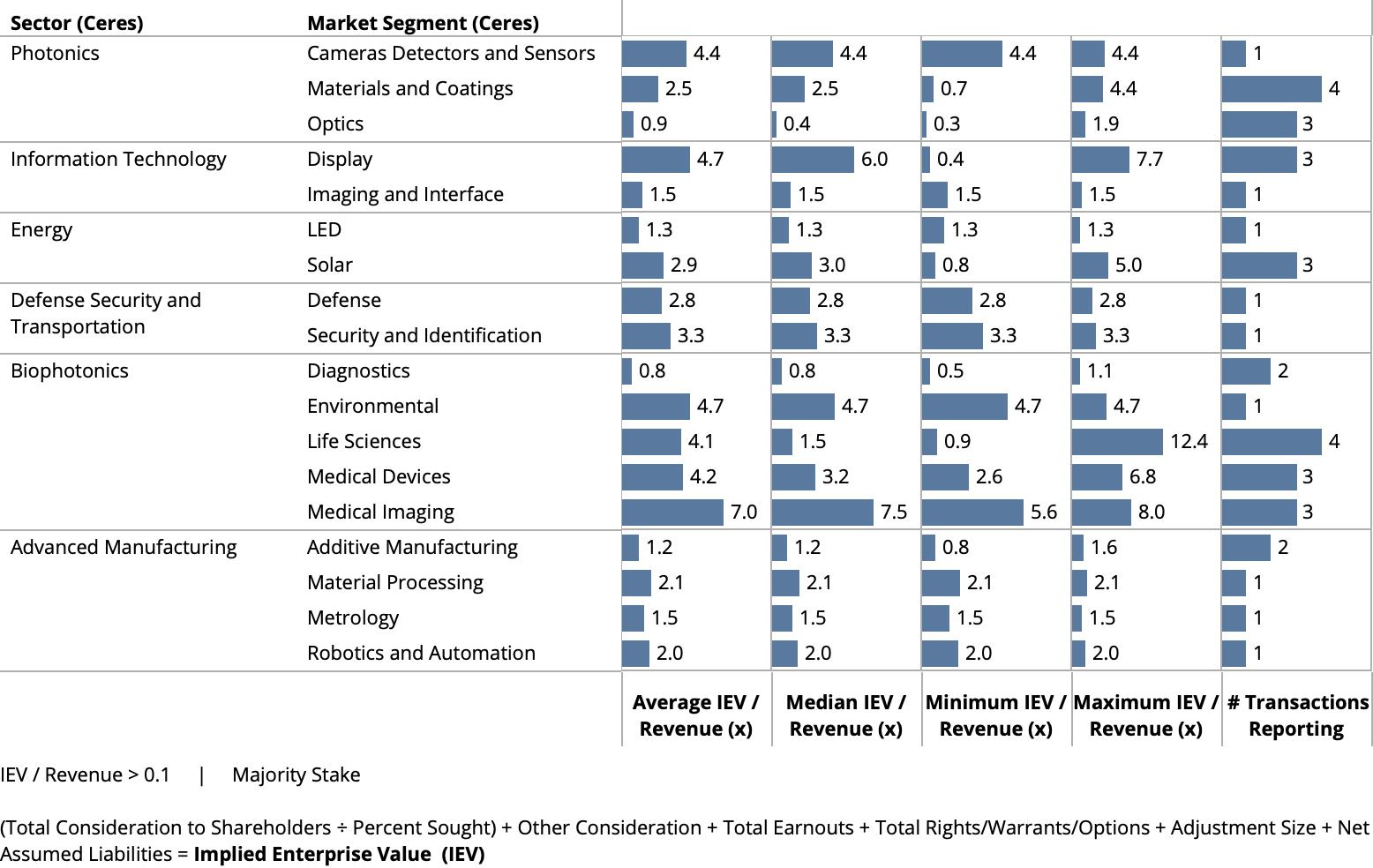

M&A transactions are researched with announce dates from January 1 to December 31, 2023. Activity and valuations are analyzed by market segments. Values are in $US at historical rates of exchange. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

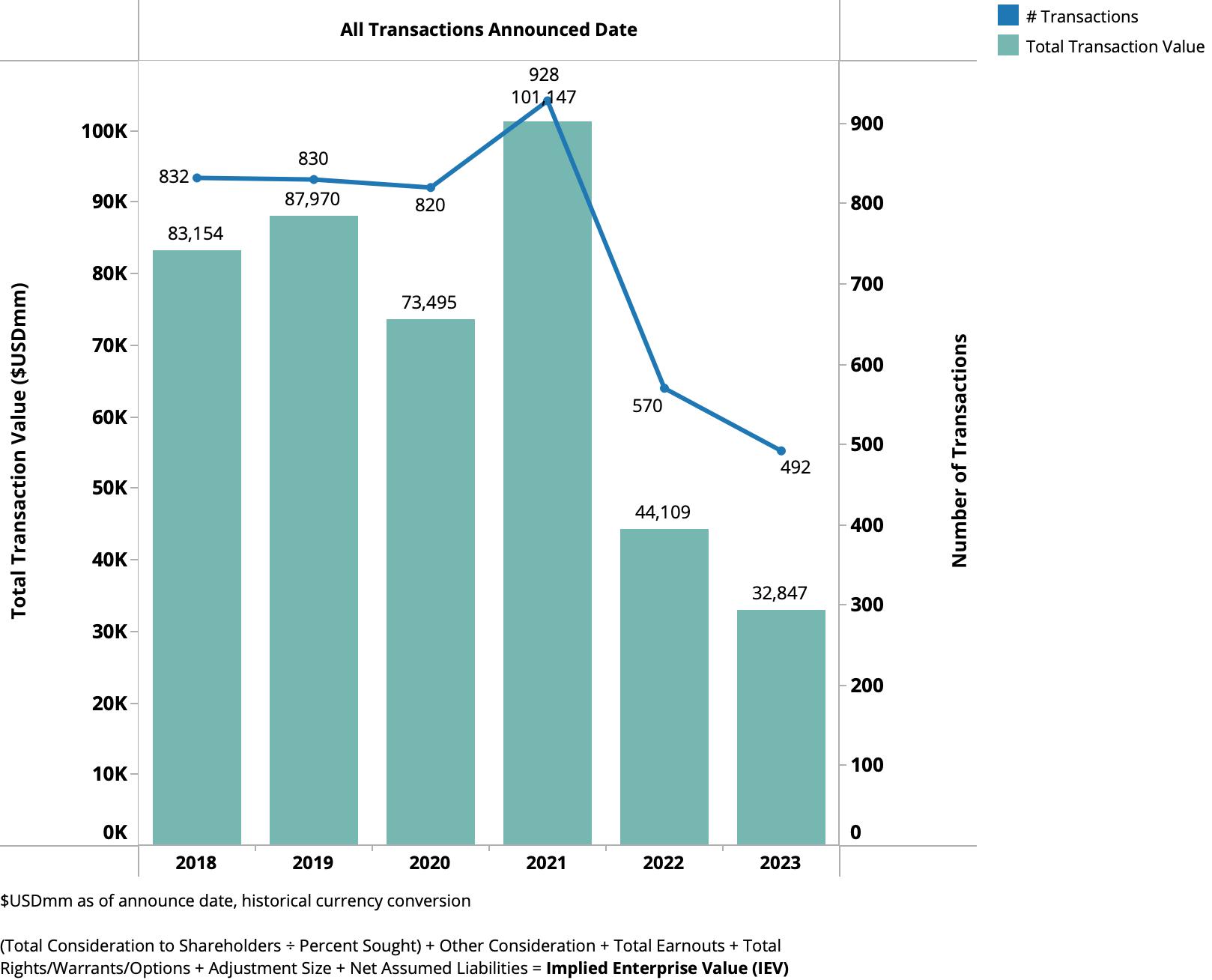

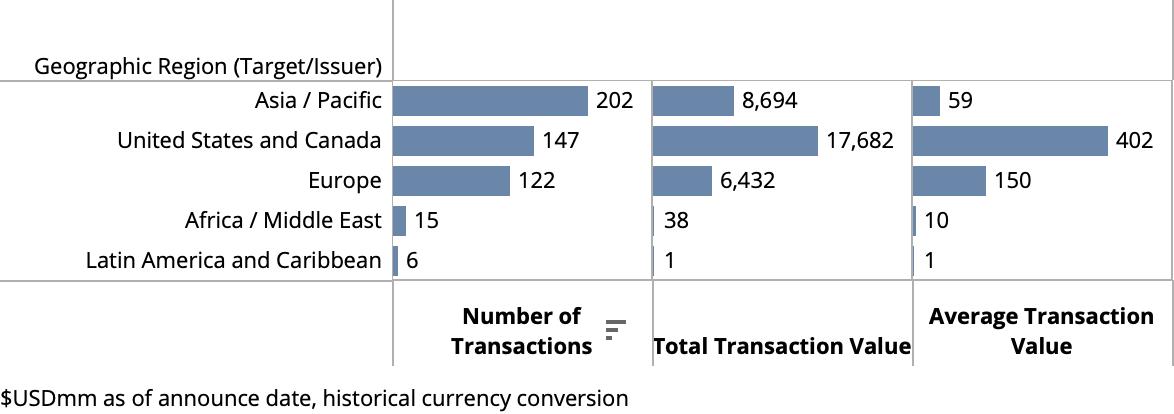

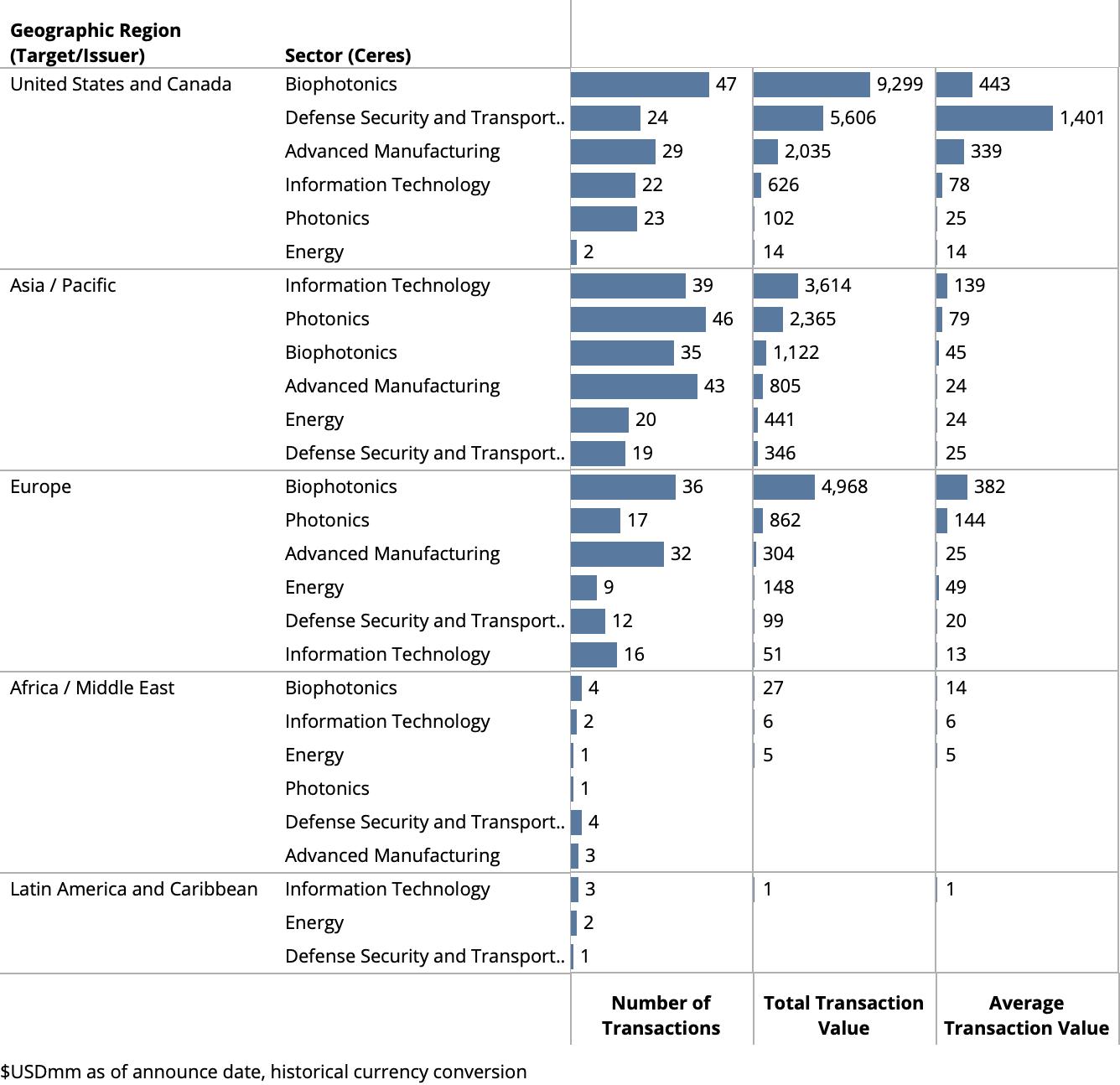

40,236 transactions worth $2.4trillion are announced globally in 2023. Of that, CERES identifies and researches 492 transactions with reported value of $33B in the photonics industry and vertical markets employing photonics technologies as core differentiators. The 2023 M&A market as a whole is down 49% and 30% in total transaction value and count respectively from its peak in 2021, as compared to down 69% and 47% respectively for the photonics M&A market.

The total and average Implied Enterprise Value of targets reporting financial data are $89B and $386M respectively. The median Transaction Value is $19M.

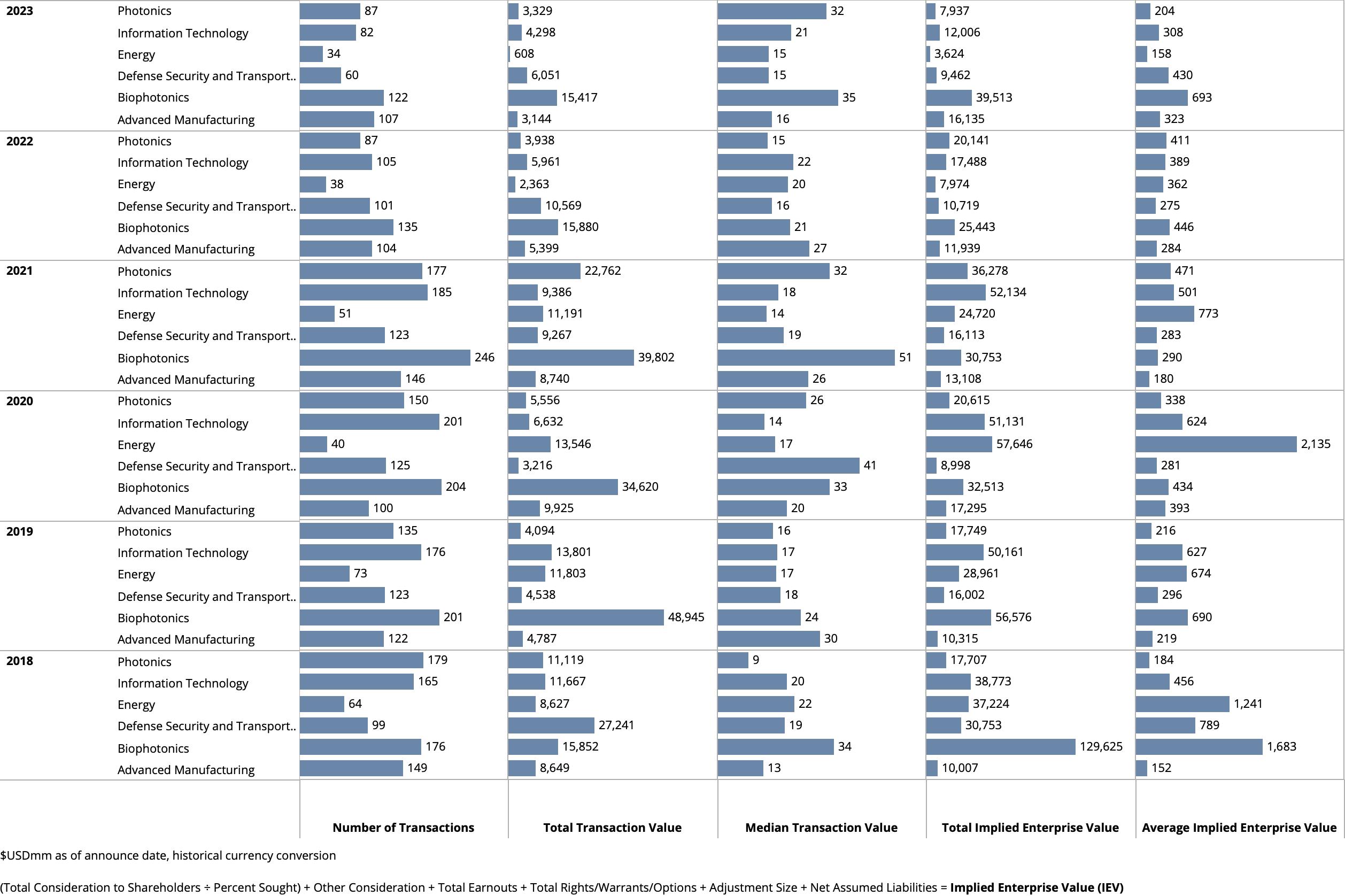

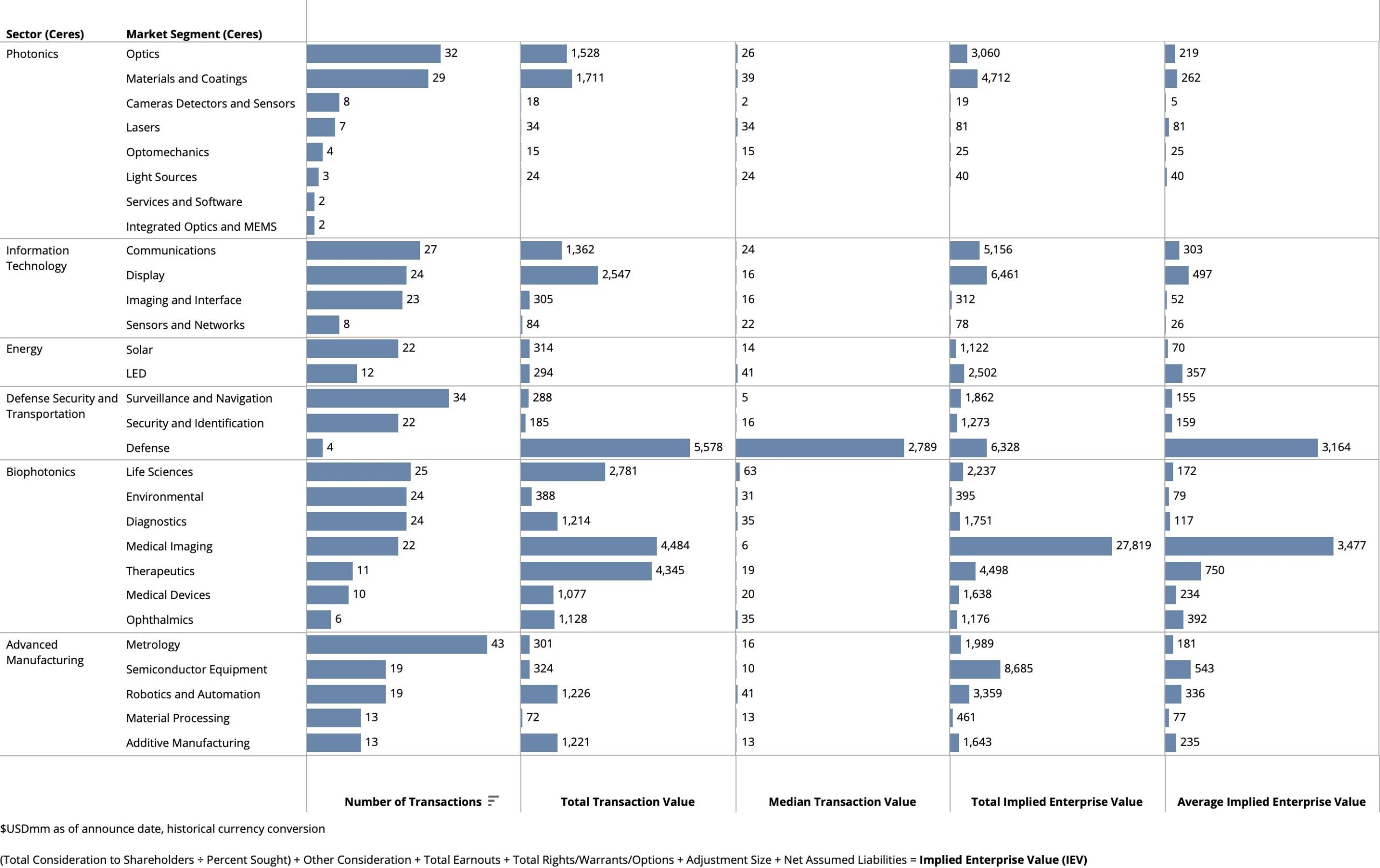

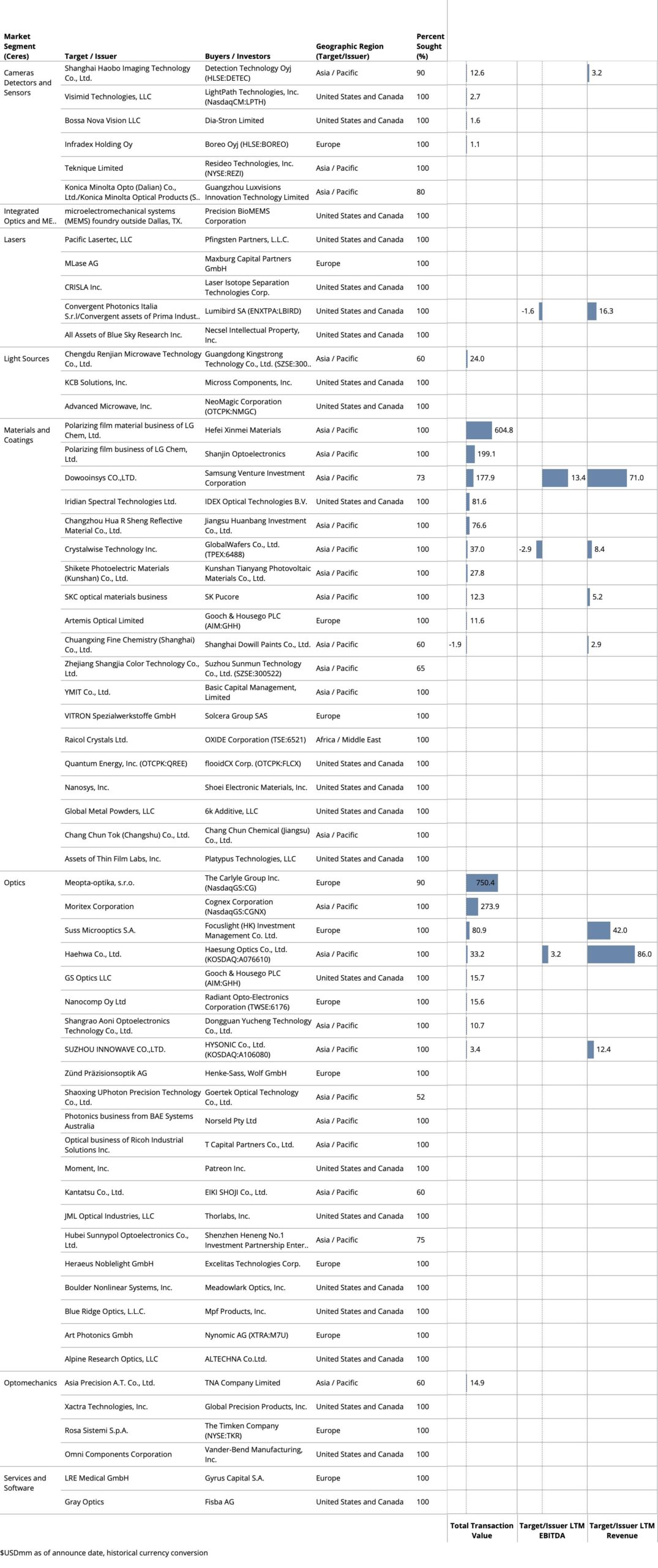

The Surveillance and Navigation (Defense Security and Transportation), Metrology (Advanced Manufacturing) and Optics (Photonics) markets see the most activity. The high level of activity and relatively low total value in these markets are evidence of a continued high concentration of capabilities deals. The high level of activity and high total value in Defense and Medical Imaging markets are evidence of both consolidation and capabilities deals.

Due to two industry consolidating transactions, 2021 marks the highest total announced transaction value in history of M&A for the pure-play Photonics sector. Teledyne Technologies Incorporated (NYSE:TDY) closes on acquisition of FLIR Systems, Inc. (NasdaqGS:FLIR), provider of thermal and visible light imaging systems (US) for $7.5B. July 1 2023, Coherent, Inc. (NasdaqGS:COHR), laser supplier (US) and II-VI Incorporated (NasdaqGS:IIVI), supplier of engineered materials and optoelectronic components (US) complete transaction sized at $7.7B. In 2023, the largest pure-play photonics target transaction is LG Chem (S. Korea) divestiture of its polarizer film business to Hefei Xinmei Materials (China) for $605M and its polarizer materials business to Shanjin Optoelectronics (China) for $199M.

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value of all photonics enabled sectors. Due to the relatively high research and development costs and risks, companies serving these markets are highly dependent on inorganic growth and competencies in M&A. The largest transaction is Bristol-Myers Squibb Company (NYSE:BMY) acquisition of RayzeBio, Inc. (US), developer of radiopharmaceutical therapeutics (RPT) for the treatment of cancer at $4.2B.

The Valuations

Few transactions report financials, because regulations do not require if a transaction does not have material near term impact on financial statements. Regardless, M&A transaction data is highly relevant to understand market dynamics and buyer behavior. Of the identified and researched transactions, 89 report valuation metrics. Of the 89 transactions, 38 represent majority share.

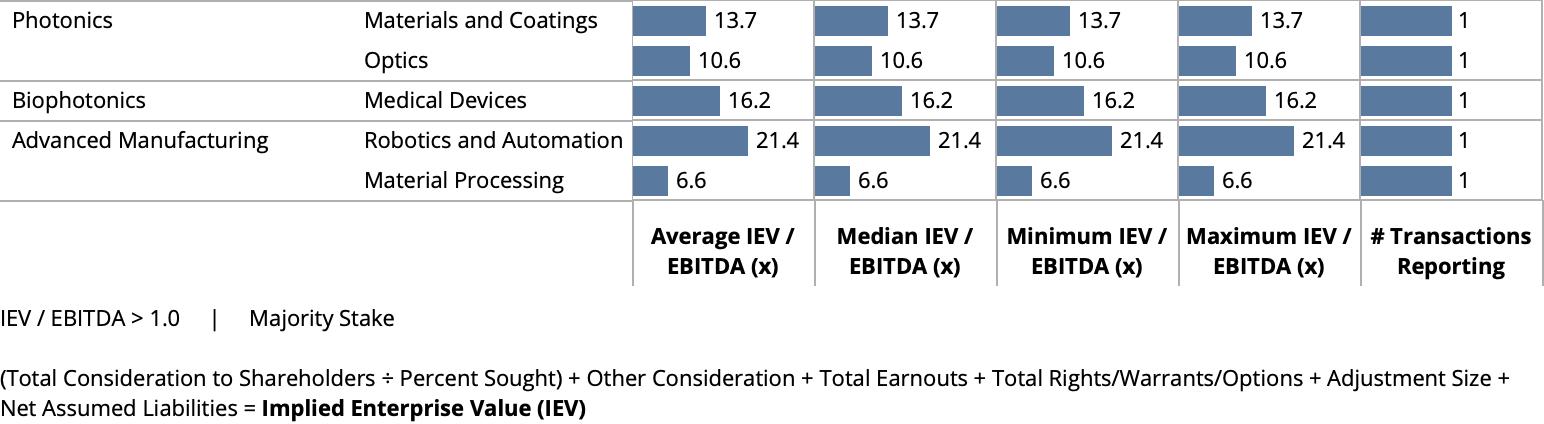

In 2021, strategic deals trade at the highest multiples in history across the board. For pure-play photonics companies and companies with core photonics technology in other markets, valuations are down in 2023, but remain higher relative to less differentiated companies without the competitive market advantages photonics technologies often yield.

Leading the pack on IEV / EBITDA for acquisitions of majority share are: MHM Automation Limited (NZSE:MHM) (21.4x), provider of factory automation including autonomous robotics and in line metrology (New Zealand) and Lutronic Corporation (16.2x), supplier of laser devices for the medical aesthetic industry in (S. Korea).

Leading the pack on Implied Enterprise Value / Revenue for acquisitions of 100% share are: Wyatt Technology Corporation (12.4x), provider of light scattering instrumentation for determining the absolute molar mass, size, charge and interactions of macromolecules and nanoparticles in pharmaceutical research (US); Volpara Health Technologies Limited (ASX:VHT) (8.0x), provider of artificial intelligence (AI) powered breast imaging analytics software (New Zealand); eMagin Corporation (7.7x), supplier of organic light emitting diode (OLED) miniature displays on-silicon micro displays (US); Solutions For Tomorrow AB (7.5x), provider of mobile x-ray solutions (Sweden); and Opsens Inc. (6.8x), provider of fiber optic sensors for cardiovascular interventions (Canada).

The Pure-Play Photonics Targets

Pure-play photonics market leaders are not acquisitive in 2023. While total and average value, as well as number of transactions are down substantially from 2021 highs, there continues to be a high concentration of small strategic acquisitions of capabilities, product lines and technical talent.

Lasers

In Lasers, formerly blocked by Danish Business Authority, Hamamatsu Photonics’ refiles its application to acquire NKT Photonics A/S (Denmark) for $216M. Unlike 2021 and even 2022, there are very deals and very few vertical integration plays.

Cameras, Detectors and Sensors

Prior to 2021, the majority of acquisitions in Cameras, Detectors and Sensors market are horizontal integration plays to expand scope of product offerings. The majority of acquisitions in 2022 are vertical integration plays to secure supply chain. 2023 sees a return to M&A to expand product lines and capabilities. One transaction reporting valuation metrics. Detection Technology Oyj (HLSE:DETEC) (Finland) agrees to acquire 90% stake in Shanghai Haobo Imaging Technology Co. (China) at 4.4x Implied Enterprise Value/Revenue.

Optics

Optics saw increase in transaction volume and value in 2023. The largest transaction in Optics is Ametek’s acquisition of Navitar, Inc. (US), supplier of optical subassemblies. Sill Optics GmbH & Co. KG, another widely recognized brand name optics company is acquired by DPE Deutsche Private Equity from its former private equity owner.

The largest pure-play photonics transactions are: The Carlyle Group Inc. (NasdaqGS:CG) acquisition of Meopta-optika, s.r.o.; Cognex Corporation (NasdaqGS:CGNX) acquisition of Moritex Corporation, supplier of optics and illumination modules for machine vision; and Focuslight (HK) Investment Management Co. Ltd. acquisition of Suss Microoptics S.A., divestiture of SÜSS MicroTec SE (XTRA:SMHN), who supplies microlens arrays.

The Targets with Core Photonics Technology

Advanced Manufacturing

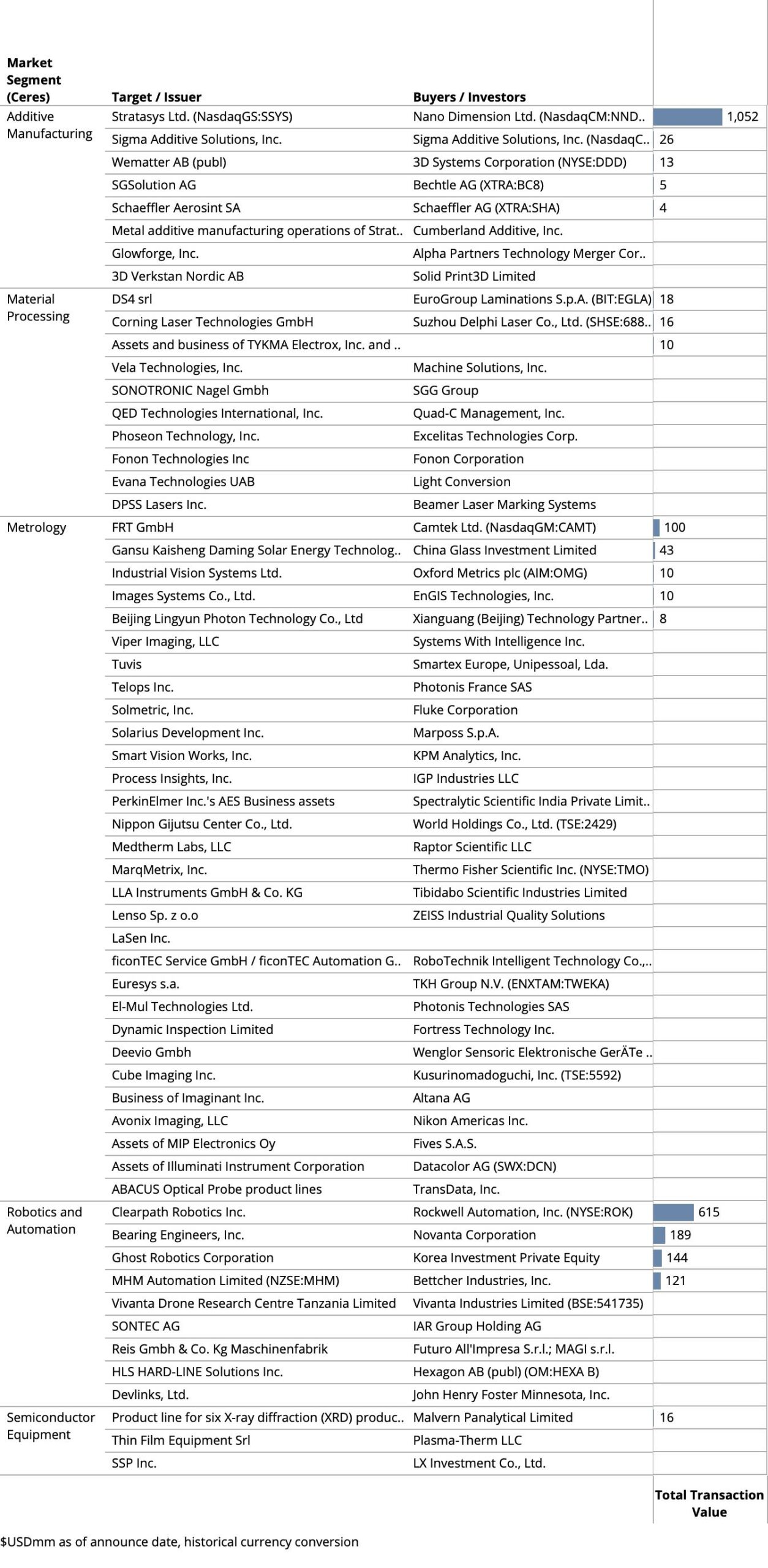

Within the Advanced Manufacturing sector, the Metrology market segment continues to see the most activity with a high concentration of smaller strategic capabilities deals while the Robotics and Automation market segment see the most activity in total volume.

The largest transactions in the sector are: Stratasys Ltd. (NasdaqGS:SSYS), supplier of polymer-based 3D printing solutions (1.6x Implied Enterprise Value/Revenues), acquired by Nano Dimension Ltd. (NasdaqCM:NNDM); Clearpath Robotics Inc., provider of industrial robotic vehicles, acquired by Rockwell Automation, Inc. (NYSE:ROK); Bearing Engineers, Inc., who previously acquired nPoint, provider of nanopositioning solutions, acquired by Novanta Corporation; Ghost Robotics Corporation, supplier of autonomous legged robots, acquired by Korea Investment Private Equity; and MHM Automation Limited (NZSE:MHM), provider of factory automation including autonomous robotics and in line metrology, acquired by Bettcher Industries, Inc. (2.0x and 21.4x Implied Enterprise Value/Revenues and EBITDA).

Information Technology

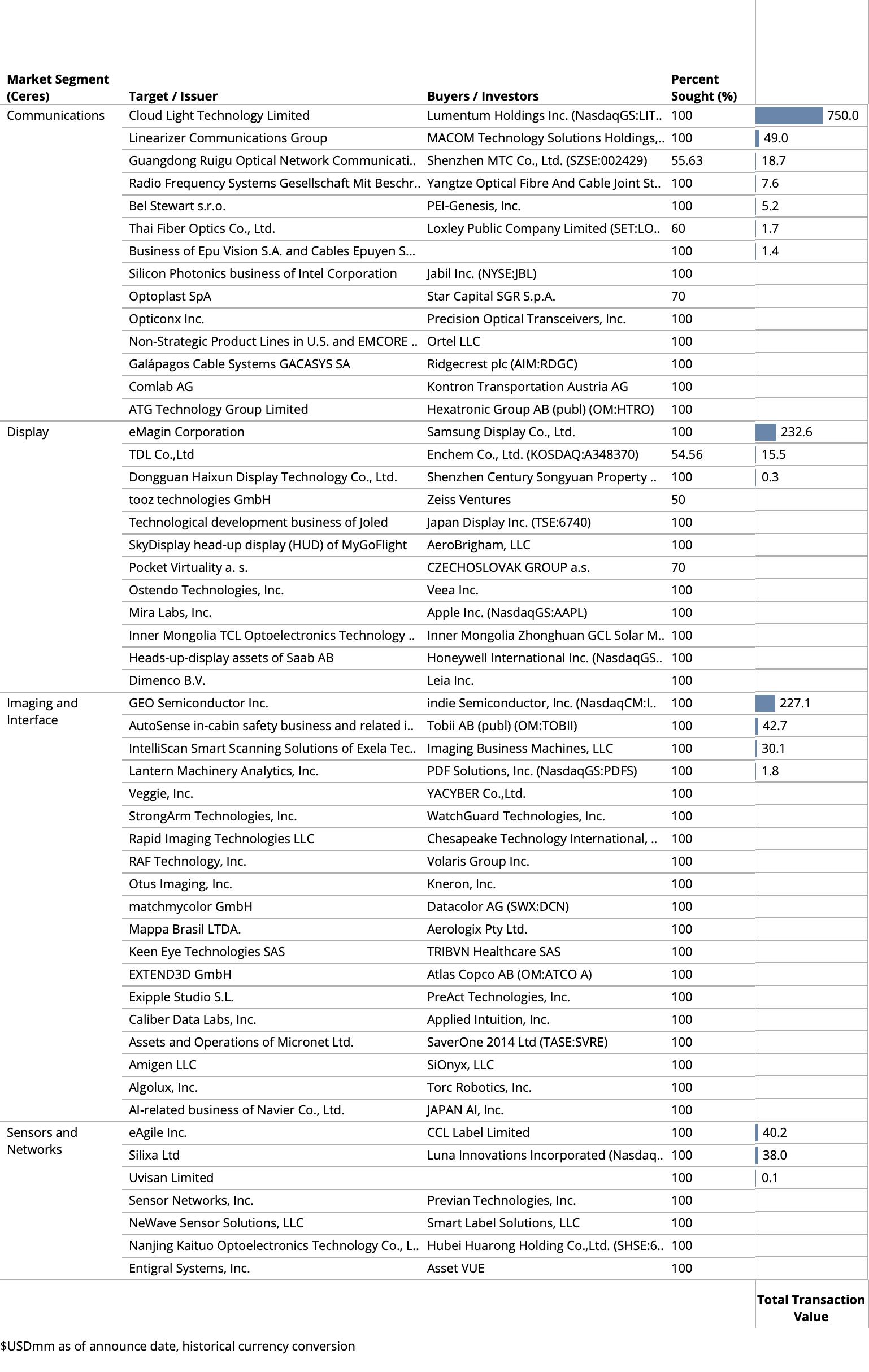

Within the Information Technology sector, the Display and Communications market segments see the most activity in total transactions and volume.

The largest transactions in the sector are: Cloud Light Technology, provider of optical modules for datacenter interconnect and optical sensors for automotive applications, acquired by Limited Lumentum Holdings Inc. (NasdaqGS:LITE); eMagin Corporation, supplier of organic light emitting diode (OLED) miniature displays, acquired by Samsung Display Co., Ltd. (7.7x Implied Enterprise Value/Revenues); GEO Semiconductor Inc., developer of video processors for automotive viewing cameras, acquired by indie Semiconductor, Inc. (NasdaqCM:INDI); and EverPro Technologies Company Ltd., supplier of Active Optical Cable (AOC), acquired by Broadex Technologies Co., Ltd. (SZSE:300548).

Unlike 2021, augmented reality and virtual imaging drove very little activity in 2023. In addition to eMagin Corporation, Apple Inc. (NasdaqGS:AAPL) acquires Mira Labs, Inc., developer of smartphone-powered augmented reality (AR) headsets and CZECHOSLOVAK GROUP a.s. acquires Pocket Virtuality a. s., provider of industrial augmented reality platform.

Unlike 2022, when the quantum computing market (Computing and Storage) saw a number of strategic acquisitions by market leaders placing bets on emerging companies and VC funded start-ups merging, there are no acquisitions in this market segment in 2023.

Biophotonics

Although typically immune to economic downturns, the Biophotonics sector also experiences a low. Regardless, consistent with previous years, Biophotonics sees the most activity and highest total value of sectors enabled by photonics technology.

In line with history, there is a high concentration of lower middle market companies with strong intellectual property positions acquired by market leading strategic buyers including: Acclarent, Inc., developer of ENT (ear, nose, throat) medical devices employing proprietary virtual camera guidance technology as alternative to endoscopy, acquired by Integra LifeSciences Holdings Corporation (NasdaqGS:IART); Opsens Inc., provider of fiber optic sensors for cardiovascular interventions, acquired by Haemonetics Corporation (NYSE:HAE); Apton Biosystems, Inc., developer of cancer detection based on proprietary super-resolution, high-speed imaging system acquired by Pacific Biosciences of California, Inc. (NasdaqGS:PACB); Resolution Bioscience, Inc., next generation cancer diagnostics specialist utilizing proprietary molecular analytics platform to analyze cell-free DNA obtained from blood tests, acquired by Exact Sciences Corporation (NasdaqCM:EXAS); and AcuFocus, Inc., an ophthalmic device company developing small aperture technologies for the improvement of near vision, acquired by Bausch + Lomb Corporation (NYSE:BLCO).

Defense, Security and Transportation

The volume of M&A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for autonomous ground and aerial vehicles and smart robots. The volume of M&A activity in the Security and Identification segment is largely attributed to targets supplying facial recognition and other optical biometrics security solutions.

The high value of M&A activity in the Defense segment is attributed to BAE Systems, Inc. acquisition of Ball Corporation (NYSE:BALL), developer and manufacturer of spacecraft, instruments and sensors, satellites, components that employ advanced photonics technologies ($5.6B).

The Geographies

Geographically, since its peak in 2016, cross-regional acquisitions decline. In 2019, the trend accelerates with increased government intervention on cross-border deals and trade tensions between US and China and in 2021, this trend accelerates even further with supply chain concerns exposed by the Covid crisis and government scrutiny expanding beyond sensitive defense and technology industries.

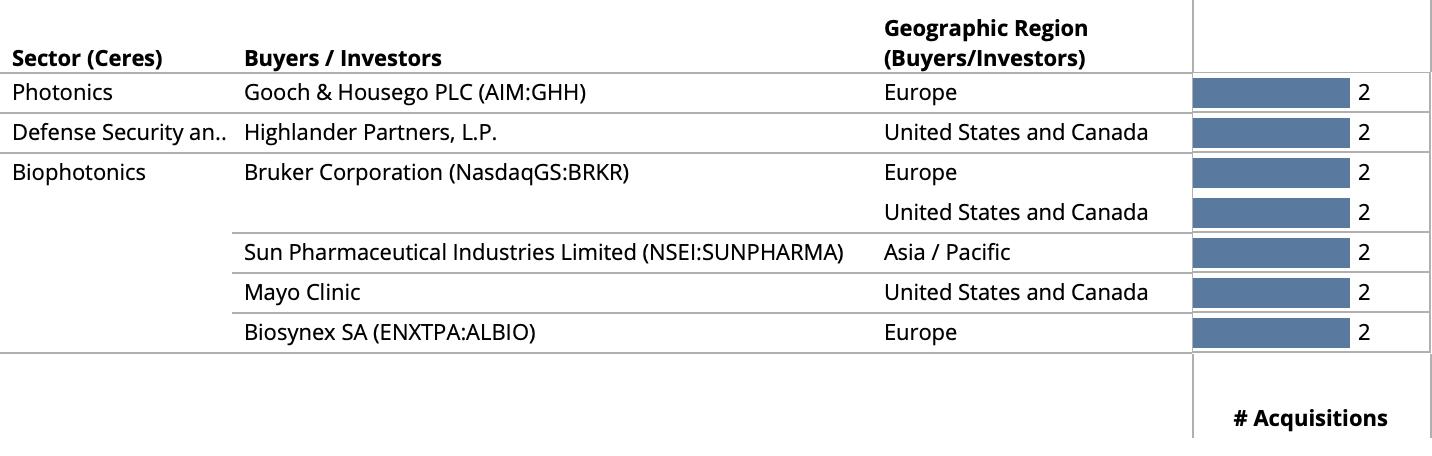

Most Active Buyers

Strategic buyers are the most active. However, across all markets, no single buyer is very acquisitive in 2023, except Bruker Corporation (NasdaqGS:BRKR), who acquires providers of high content screening microscopy, optical microscopy for research, live cell imaging and functional cell biological imagers (Life Sciences).

Following, who each acquire 100% stake of two companies with core photonics technology include: Gooch & Housego PLC (AIM:GHH) acquiring manufacturers of optical coatings and polymer injected molded optics; Mayo Clinic acquiring providers of pill-sized robots for gastrointestinal imaging and lab-on-skin sensing chips; Sun Pharmaceutical Industries Limited (NSEI:SUNPHARMA) acquiring developers of ophthalmic imaging and contactless medical diagnostics devices; Biosynex SA (ENXTPA:ALBIO) acquiring point-of-care medical diagnostics platforms; and Highlander Partners, L.P., private equity buyer, who acquires manufactures of Unmanned Aircraft Systems for Defense.

Strategic buyers execute the largest deals across all markets with the exception of The Carlyle Group Inc. (NasdaqGS:CG) who acquires Meopta-optika, s.r.o. (Czech Republic), manufacturer of optical and electro-optical assemblies. The largest transactions in the vertical markets employing photonics technologies include: Lumentum Holdings Inc. (NasdaqGS:LITE) acquisition of Cloud Light Technology Limited (Communications), manufacturer of optical modules for datacenter interconnect and optical sensors for automotive applications; BAE Systems, Inc. acquisition of Ball Corporation (NYSE:BALL) (Defense); Bristol-Myers Squibb Company (NYSE:BMY) acquisition of RayzeBio, Inc. (Therapeutics); and Nano Dimension Ltd. (NasdaqCM:NNDM) acquisition of its remaining 88% stake in Stratasys Ltd. (NasdaqGS:SSYS) (Additive Manufacturing).

Strategic and Financial Buyers

In line with history, more than 90% of transactions are executed by strategic buyers. Strategic buyers have the advantage over financial buyers, such as private equity firms, in that they can create proprietary deal flow and understand the risk in the inherently technology and intellectual property heavy assets more effectively and efficiently.

Approximately 40 transactions report a financial buyer in each of 2022 and 2023 compared to almost twice that in 2021. By Q3 2022 and throughout 2023, private equity deal making succumbs to higher interest rates on the buy-side and lower valuation multiples on the sell-side. As a result, transactions with financial buyers, such as private equity, are fewer and much smaller in the photonics M&A market and M&A market as a whole. Further, more than half of the financial buyer deals in 2023 represent minority growth transactions that allow private equity firms to acquire interests in less risky, larger companies while debt financing of larger stakes is unattractive.

2024 Photonics M & A

Trends driving slowdown in 2022 and 2023, including inflation and higher interest rates, geopolitical instability in Middle East, Europe and China, supply chain risks and shortages of skilled labor and technical talent are expected to continue into 2024.

While financial indicators improve, how will these trends influence 2024?

Uncertainty is generally not good for M&A. However, this could be the best time for well capitalized strategic and growth oriented financial buyers to do deals. For financial buyers, who are more reliant on financial markets to raise capital from Limited Partners and secure debt, it will be more challenging.

In general, expectations are continued lower concentration of mega-mergers and deals substantially scaling existing core businesses and continued higher concentration of lower middle market transactions and corporate carve-outs.

Strategic buyers of companies with core photonics technology need to address the challenges of growth. The benefits of inorganic growth are amplified in this environment where technical and management talent are scarce, R&D budgets are low and disruptions in the supply chain continue to impede meeting customer demand. So, strategic buyers may not execute highly leveraged consolidation plays, but they will continue to execute smaller capabilities and vertical integration deals.

With private equity leveraged buy-outs largely absent in the M&A market as a whole due to high interest rates and uncertainty around valuations with market volatility, financial buyers of companies with core photonics technology are likely to apply their playbooks from other industries. This includes cutting expenses to improve profitability, divesting non-core business units and product lines to beef up balance sheets and acquiring smaller add-ons for existing portfolio companies.

Proactive buyers may continue to take some risk in the near term and engage with sellers’ new mindsets around valuation. Less aggressive buyers may wait on the sidelines until clarity on where inflation, interest rates and unemployment will land.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.