2019 Mergers & Acquisitions in Photonics

In the worldwide photonics industry, 2019 was another record year for mergers & acquisitions (M&A) in terms of both deal value and deal volume. However, M&A activity for pure-play photonics companies was down from recent years. Strategic buyers continued to dominate M&A, but financial buyers took an increasing role.

In 2018, strategic buyers address the challenges of slower growth, an abundance of investment capital, advances in digital and mobile technologies and government intervention with M & A. These buyers are still acquiring companies to open new markets, enhance capabilities and implement new business models. In 2019, however, we see more strategic buyers executing vertical integration plays. In the photonics industry and vertical markets employing photonics technologies, those acquired to enhance capabilities or to secure the supply chain are predominantly lower middle market companies with new technologies and/or innovative business models.

In 2019, although the majority of buyers are still strategic, there is a much higher concentration of financial buyers. Due to the trade war, strategic buyers of manufactured goods appear to be waiting out the uncertainty. Financial buyers appear to be forging ahead, investing their abundance of dry-powder with the flexibility of investing for the long-term that publicly traded strategic buyers do not enjoy.

To average-down the recent relatively high buy-in multiples for a platform middle market company, financial buyers are bullish on integration risk and subsequently scooping-up smaller “add-on” targets. This maps to a substantially larger M & A market for micro and lower middle market companies.

The Transactions

M & A transactions are researched with announce dates from January 1 to December 31, 2019. Transactions volumes, values, geographies, and market segments are analyzed. Values are in $US at historical rates of exchange. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

Follow this link to access detail for transactions analyzed in this article.

Photonics M & A Transaction Detail

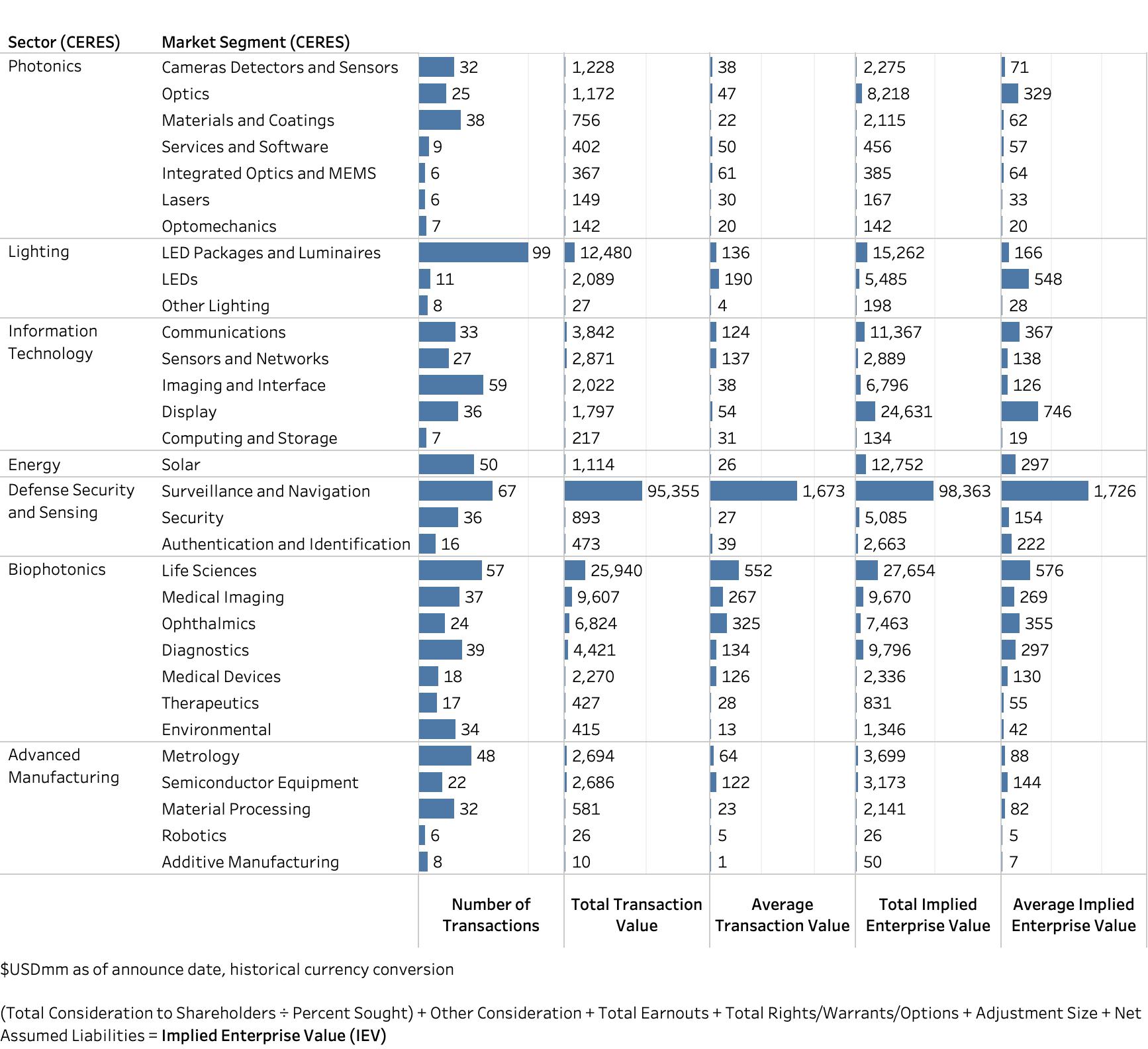

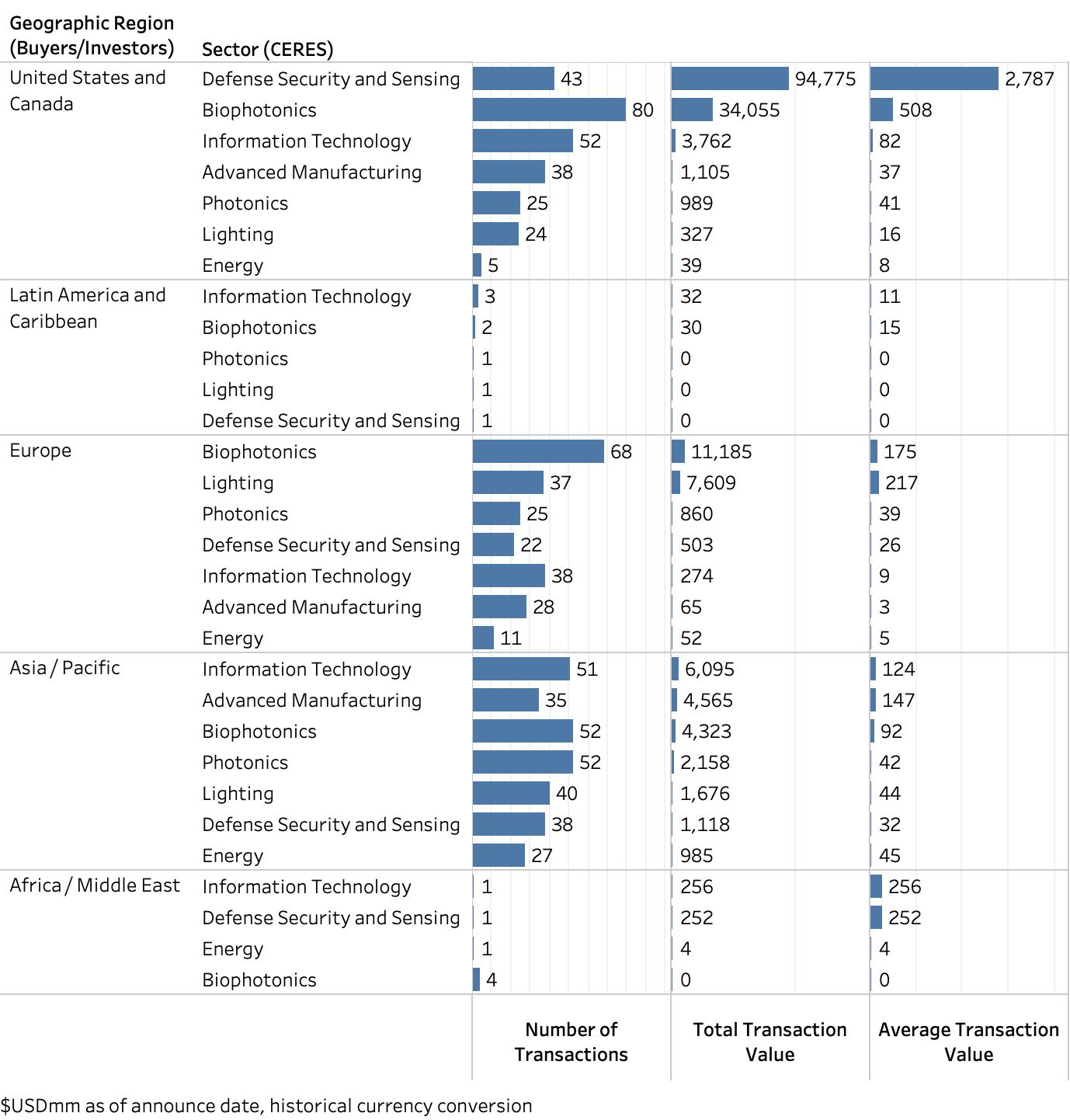

There are 51,940 transactions worth $3.5trillion announced globally in 2019. Of that, CERES identifies and researches 914 transactions with reported value of $183billion in the photonics industry and vertical markets employing photonics technologies as core differentiators. The total and average Enterprise Value reporting financial data are $268billion and $326million.

2019 M & A Transaction Volume and Value by Sector

Activity

Market segments relying on photonics technologies see more activity than the pure-play photonics market segments in both total number and total value of transactions. The LED Packages and Luminaires, Surveillance and Navigation, IT Imaging and Interface and Life Science segments see the most activity.

Because of mature industry consolidation, the Defense Security and Sensing and Life Sciences sectors each see a transaction between Largest Market Cap (>$10,000mm) companies highly dependent on photonics technology. United Technologies Corporation (US) announces $93billion acquisition of Raytheon Company (US). Danaher Corporation (US) announces $21billion acquisition of General Electric Company’s BioPharma Business (US).

For the first time, Biophotonics sees a very high concentration of Large Market transactions. Google (US), Grifols (Spain), Agilent Technologies (US), PHC Holdings (Japan), Siemens Medical (Germany), FUJIFILM (Japan), Dedalus Holding (Italy), Ethicon (US) and Novartis (Switzerland) made $multi-billion strategic acquisitions to expand product offerings and strengthen digital strategies.

2019 M & A Transaction Volume and Value by Market

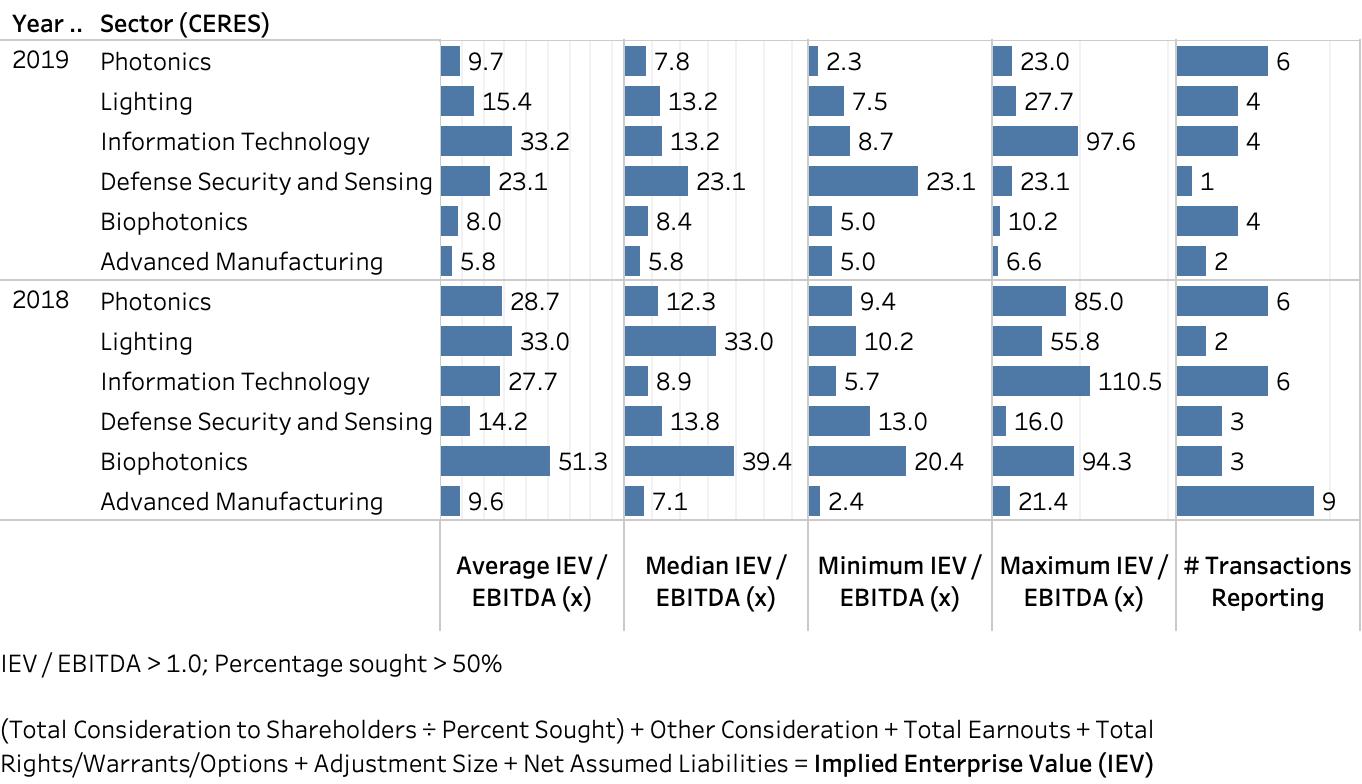

Valuations

Few transactions report financials, because regulations do not require if a transaction does not have material near term impact on financial statements. Regardless, M & A transaction data is highly relevant to understand market dynamics and buyer behavior. Of the identified and researched transactions, 225 report valuation metrics. Values are in $US at historical rates of exchange.

Companies employing core photonics technology and innovative business models across a wide breadth of vertical markets, continue to realize very high valuations. Reference “Photonics in Today’s Transformative Age” article.

Year over Year M & A Valuation Metrics

Implied Enterprise Value / EBITDA Multiples

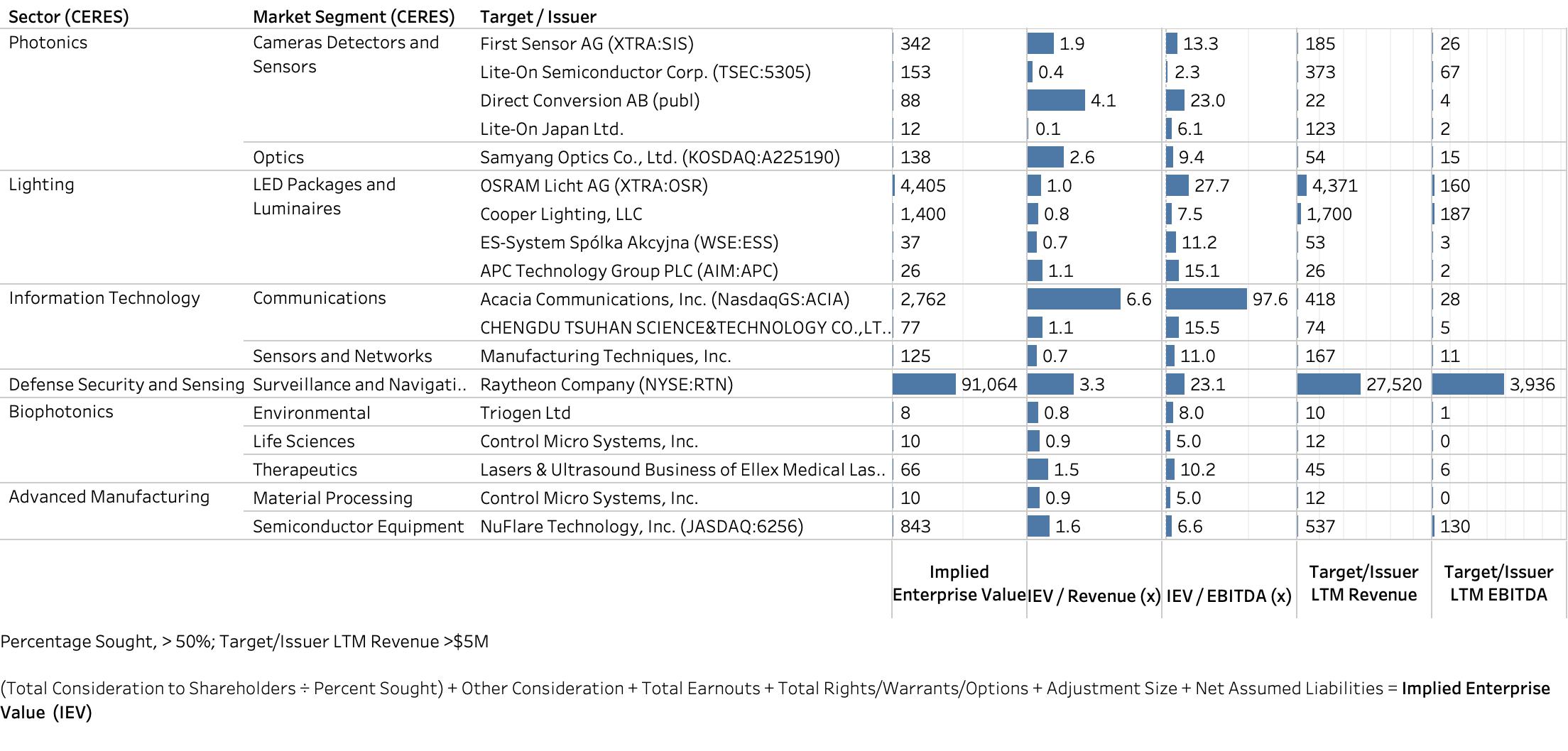

Leading the pack on Implied Enterprise Value / EBITDA for acquisitions of 100% equity are Acacia Communications, Inc. (97.6x), supplier of high-speed coherent optical interconnect products (US); OSRAM Licht AG (27.7x), solid state lighting provider (Germany); Raytheon Company (23.1x), developer of integrated defense solutions (US); and First Sensor (13.3x), supplier of optical and opto-electronic sensor solutions (Germany).

Leading the pack on Implied Enterprise Value / Revenue for acquisitions of 100% equity are Corindus Vascular Robotics, Inc. (71.2x), provider of robotic-assisted systems for interventional vascular procedures (US); AutoGuide Mobile Robots (41.3x), manufacturer of high-payload industrial autonomous mobile robots (US) and HexaTech, Inc. (28.6x), developer of next-generation semiconductor material for long-life UV LED’s (US).

2019 M & A Valuation Metrics

Implied Enterprise Value / EBITDA Multiples

2019 M & A Valuation Metrics

Implied Enterprise Value / Revenue Multiples

2019 M & A Valuation Metrics

Implied Enterprise Value Multiples

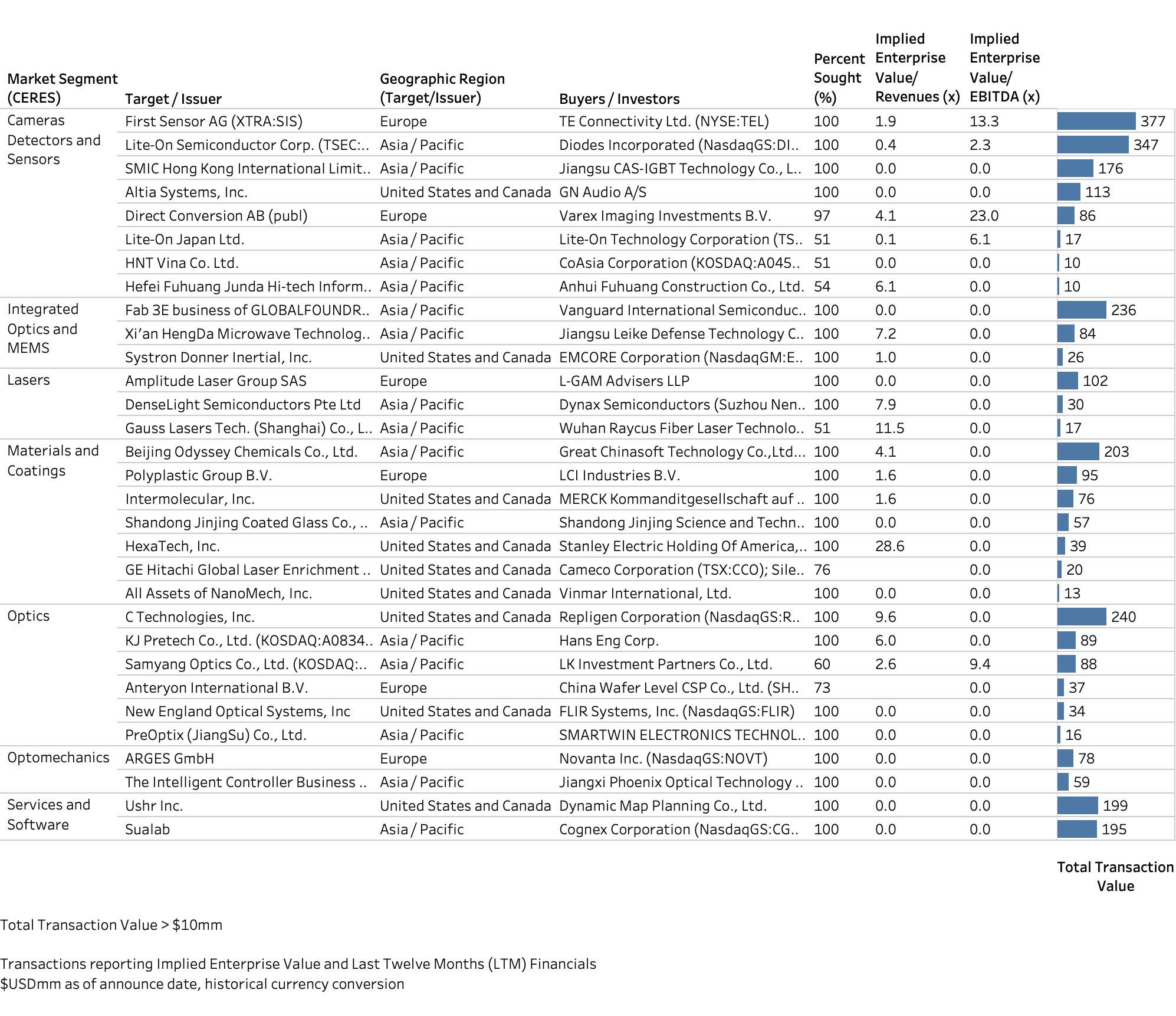

2019 M & A – Pure-Play Photonics Companies

In 2019, the largest announced strategic acquisition of 100% stake ($377million) and one of the highest IEV/EBITDA valuation (13.3x) in Photonics is the acquisition of First Sensor AG by TE Connectivity Ltd. The second largest strategic acquisition of 100% stake ($347million) in Photonics is the acquisition of Lite-On Semiconductor Corp. by Diodes Incorporated with one of the lowest IEV/EBITDA valuations (2.3x). Following is Repligen Corporation‘s acquisition of 100% stake in C Technologies, Inc. with one the highest IEV/Revenue valuations (9.6x).

Strategic buyers continued to lead; however, like the M & A market as a whole, there is a higher concentration of financial buyers. Of the majority stake transactions reporting value, there are two targets, Samyang Optics Co., Ltd ($88million) and Amplitude Laser Group SAS ($102million) acquired by financial buyers.

2019 M & A – Photonics

Majority Stake Transactions

Lasers

Unlike 2018, market leaders in Lasers are not acquisitive in 2019. Market leaders appear to be digesting recent years’ consolidation and vertical integration plays while operating in a challenging macroeconomic environment and competitive landscape in China. The two reporting transaction values are Amplitude Laser Group SAS ($102million) and DenseLight Semiconductors Pte Ltd. ($30million).

Cameras, Detectors and Sensors

In 2019, the vast majority of acquisitions in Cameras, Detectors and Sensors are horizontal integration plays to expand scope of product offerings.

The highest IEV/EBITDA valuation of 23.0x on $4.0million LTM EBITDA, is realized in Varex Imaging Corporation‘s (US) 97% acquisition of Direct Conversion AB, supplier of photon counting and hybridized semiconductor based X-ray imaging sensors (Sweden). The transaction is financed with $64million debt. The valuation appears to reflect large strategic synergies in global distribution, product line expansion and future growth.

First Sensor AG, supplier of opto-electronic sensor solutions, realizes IEV/EBITDA valuation of 13.3x on $25.8million LTM EBITDA.

Optics

Activity in Optics is limited to micro and lower middle market transactions and dominated by strategic buyers. The exception is the 73% acquisition of Samyang Optics Co., Ltd. (Korea), provider of camera lenses, by financial buyer, LK Investment Partners Co., Ltd., for $88million on $14.8million EBITDA (IEV/EBITDA 9.4x).

Horizontal Integration in Optics

- Hans Eng Corp. acquires KJ Pretech Co., Ltd. (Korea), manufacturer of polymer injection molded optics, for $89M (6.0x IEV/Revenue)

- Precision Optics Corporation, Inc. acquires substantially all assets of Ross Optical Industries, Inc (US), optical components supplier, for $4.2M (0.6 IEV/Revenue)

Forward Vertical Integration in Optics

- China Wafer Level CSP Co., Ltd. acquires 73% stake in Anteryon International B.V. (Netherlands), supplier of precision micro-optics and assemblies for $37M

Backward Vertical Integration in Optics

- Repligen Corporation acquires C Technologies Inc. (US), manufacturer of fiber optic assemblies for spectroscopy applications, for $240M

- FLIR Systems, Inc. acquires New England Optical Systems, Inc. (US), manufacturer of infra-red optical assembles, for $34M

- SMARTWIN ELECTRONICS TECHNOLOGY (HK) LIMITED acquires PreOptix (JiangSu) Co., Ltd. (China), provider of projector lenses and optical engines, for $16M

- Nireco Corporation acquires Kogakugiken Corp., optical component supplier, for $5M

2019 M & A – Companies with Core Photonics Technology

Advanced Manufacturing

Within Advanced Manufacturing sector, the Metrology market segment continues to see the most activity. The largest acquisition is Hitachi, Ltd.‘s $1.4billion vertical acquisition of JP Automation Technologies, LLC, provider of integrated advanced automation solutions that incorporate a wide range of optical inspection, sensing and material processing capabilities. Likely due to waiting out uncertainty, activity within Additive Manufacturing and Laser Material Processing is the lowest of the decade for strategic buyers in the US.

Information Technology

Within Information Technology sector, the largest and highest priced acquisition is Cisco Systems, Inc. $3.1billion acquisition of its Acacia Communications, Inc., provider of coherent optical interconnects, at 98x IEV/EBTIDA to enter the $multi-billion outside-the-data-center networking market. Cisco Systems, Inc. acquires Luxtera, Inc. Dec 2018 to own the inside-the-data-center optical networking market, for $660million.

The Imaging and Interface sees a large increase in activity in 2019. Strategic buyers acquire facial recognition technology, 3D imaging hardware and software to develop Augmented Reality content, image analytics and gesture recognition technology. Most acquisitions are vertical integration plays, including Huawei Technologies Co., Ltd.‘s acquisition of Vocord Telecom‘s facial recognition intellectual property; Facebook, Inc.‘s acquisition of GrokStyle Inc., developer of AI-based machine vision retail applications; and Apple Inc.‘s acquisition of Spectral Edge Ltd for its image enhancement and multi-spectral vision technologies.

Biophotonics

The M & A market in Biophotonics is up from 2018 in terms of volume, but valuations are lower. Environmental sees the biggest jump in activity with targets supplying water, soil, gas and air monitoring and treatment solutions. Technologies span spectroscopy to x-ray diffraction to gas imaging. The most active buyer is Pentair plc who acquired UV water treatment solution suppliers, Aquion, Inc. and Enviro Water Solutions, Inc. for $160million and $120million respectively.

Defense, Security and Sensing

The high volume of M & A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for unmanned ground and aerial vehicles. Funded from its $530million financing, Aurora Innovation, Inc. acquires Blackmore Sensors and Analytics Inc., frequency-modulated continuous-wave (FMCW) Lidar and supporting analytic tools that measure radial velocity. Porsche Automobil Holding SE acquires AEVA, INC., Lidar developer. Leica Geosystems Technology A/S acquires Melown Technologies SE computer vision developer supplying 3D visualisation of digital urban and natural landscape models. FARO Technologies, Inc. acquires Opto Tech Srl, manufacturer of 3D structured light scanning solutions for $22million.

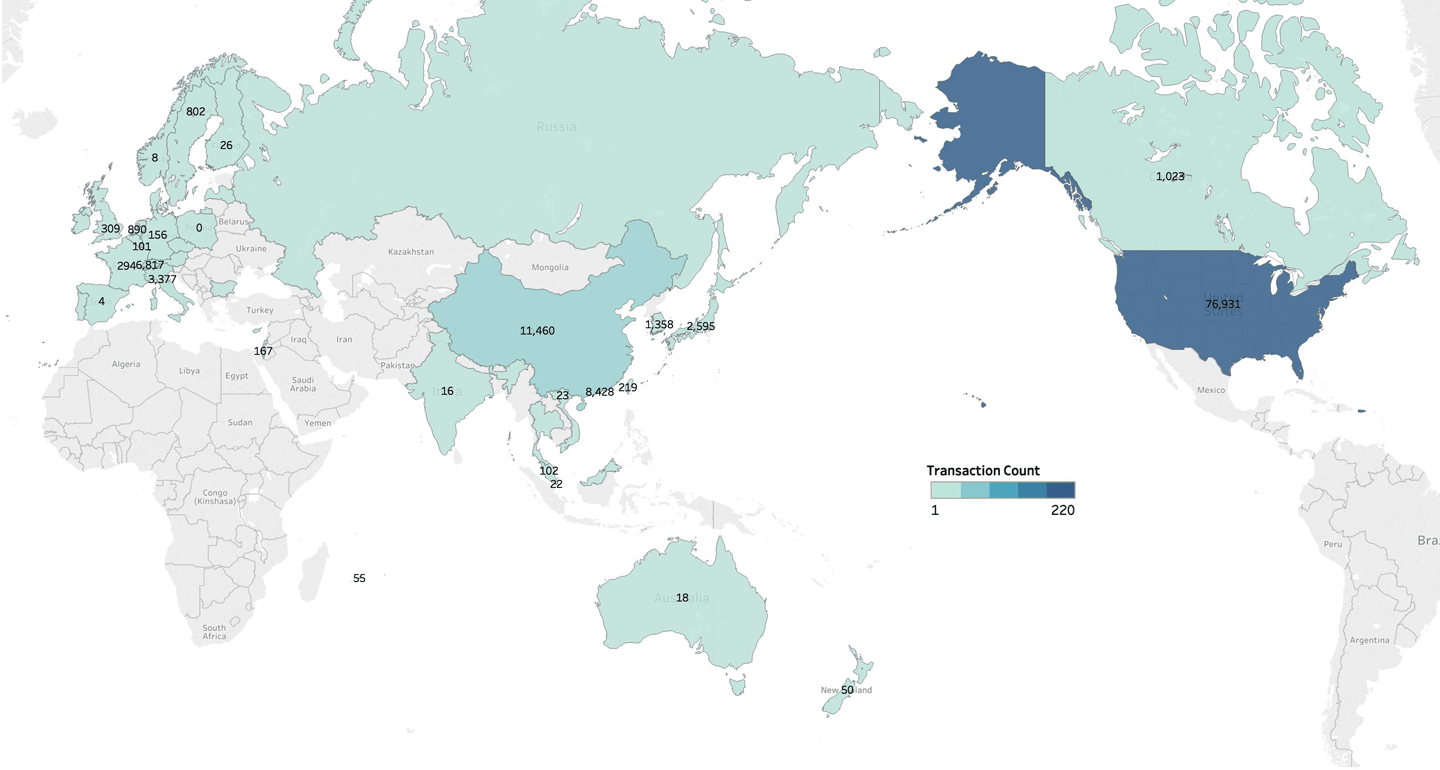

Geographies

Geographically, the most significant trend over the previous 5 years is an acceleration of cross-regional acquisitions. Prior to 2018, buyers are acquiring more targets in geographical areas outside their own. That trend lost its momentum in 2018 and fell off a cliff in 2019.

North American M & A activity involving Chinese buyers is on pace to fall by more than 90% from its 2016 peak. Referencing article, “Foreign Investment in US Photonics Technologies“, US-based companies and Chinese acquirers cease doing business due somewhat to the trade war, but most likely due to The Committee on Foreign Investment in the US. CFIUS has effectively blocked transactions, mostly on national security grounds. Photonics, as well as Information Technology and Defense, Security and Sensing sectors, are affected.

Due to China trade war, strategic buyers of manufactured goods appear to be waiting out the uncertainty, forcing financial buyers to hold investments. Financial buyers appear to forge ahead, investing their abundance of dry-powder with the flexibility of being able to invest for the long-term, unlike publicly traded strategic buyers.

2019 M & A Transactions by Target Geography

2019 M & A Transactions by Buyer Geography

On a country basis, United States still sees, by far the most buy and sell side activity in photonics. Activity in China and South Korea are steadily increasing year over year until 2019 when activity decreases substantially.

2019 M & A Transaction Value & Volume by Target Country

Headquarters Country of Ultimate Parent (Target/Issuer)

2019 M & A Transaction Value & Volume by Buyer Country

Headquarters Country of Ultimate Parent (Buyer/Investor)

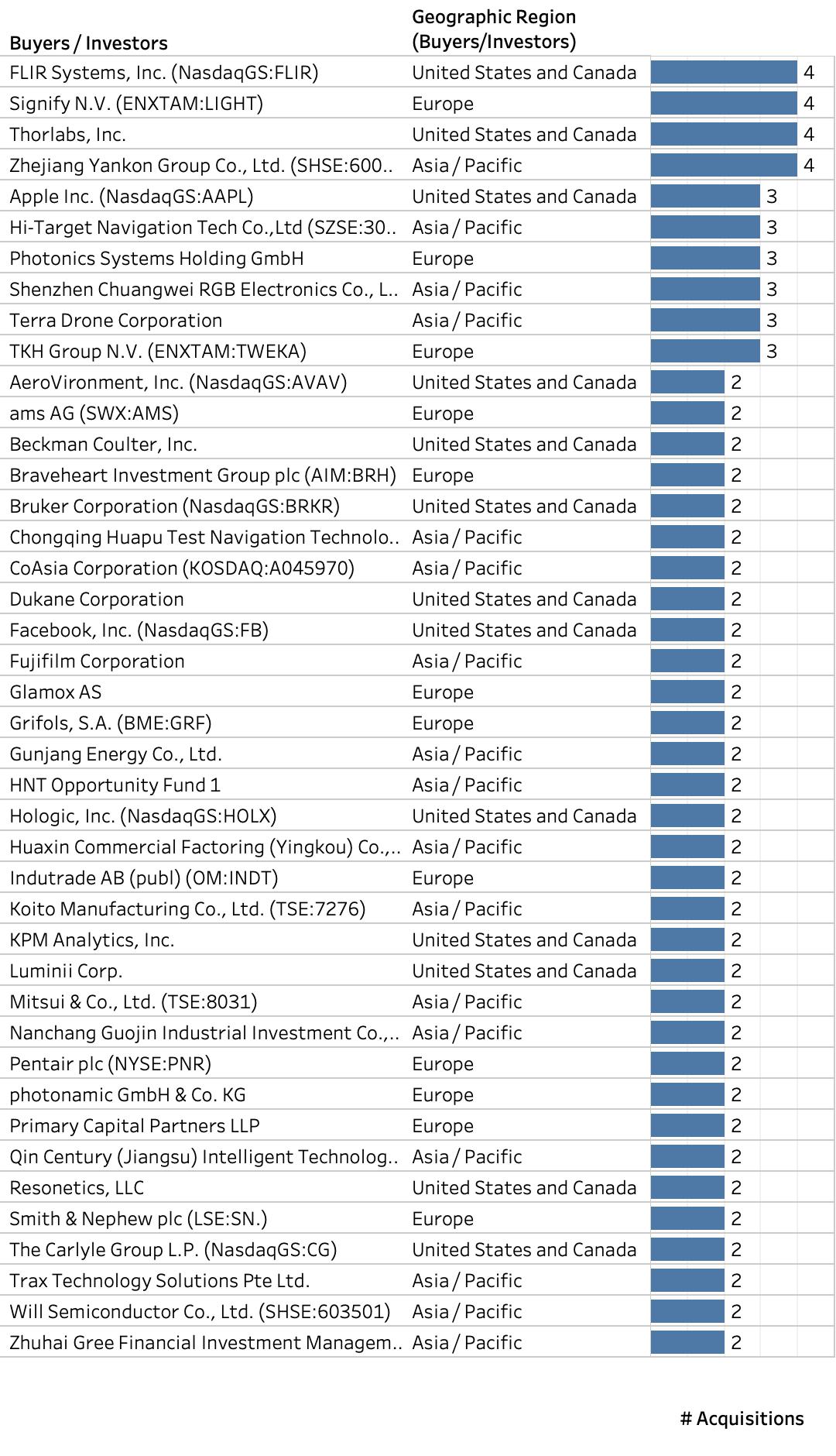

Most Active Buyers

Strategic buyers are the most active – acquiring small and middle market photonics technology enabled companies across a wide breadth of markets.

In 2019, the most active buyers by number of transactions are FLIR Systems, Inc., Signify N.V., Thorlabs, Inc., and Zhejiang Yankon Group Co., Ltd. FLIR Systems, Inc. acquired:

Aria Insights, Inc. and Aeryon Labs Inc., providers of unmanned aerial systems and vehicles; New England Optical Systems, Inc., manufacturer of infra-red optical assemblies; and Providence Photonics, LLC, developer of optical gas imaging software. ThorLabs, Inc. acquired four micro market companies with core photonics technology in x-ray metrology, Raman spectroscopy and thin film coating. Signify N.V. and Zhejiang Yankon Group Co., Ltd. each acquired four LED lighting companies.

2019 Most Active Buyers by Count

In 2019, following United Technologies Corporation and Danaher Corporation mentioned above, the most active buyers by volume are ams AG and Bain Capital, LP lead consortium who acquired OSRAM Licht AG and Ethicon UC, LLC who acquired Auris Health, Inc., developer of an endoscopic diagnostics robotics platform.

2019 Most Active Buyers by Volume

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.