Mergers & Acquisitions in Photonics | First Quarter 2024

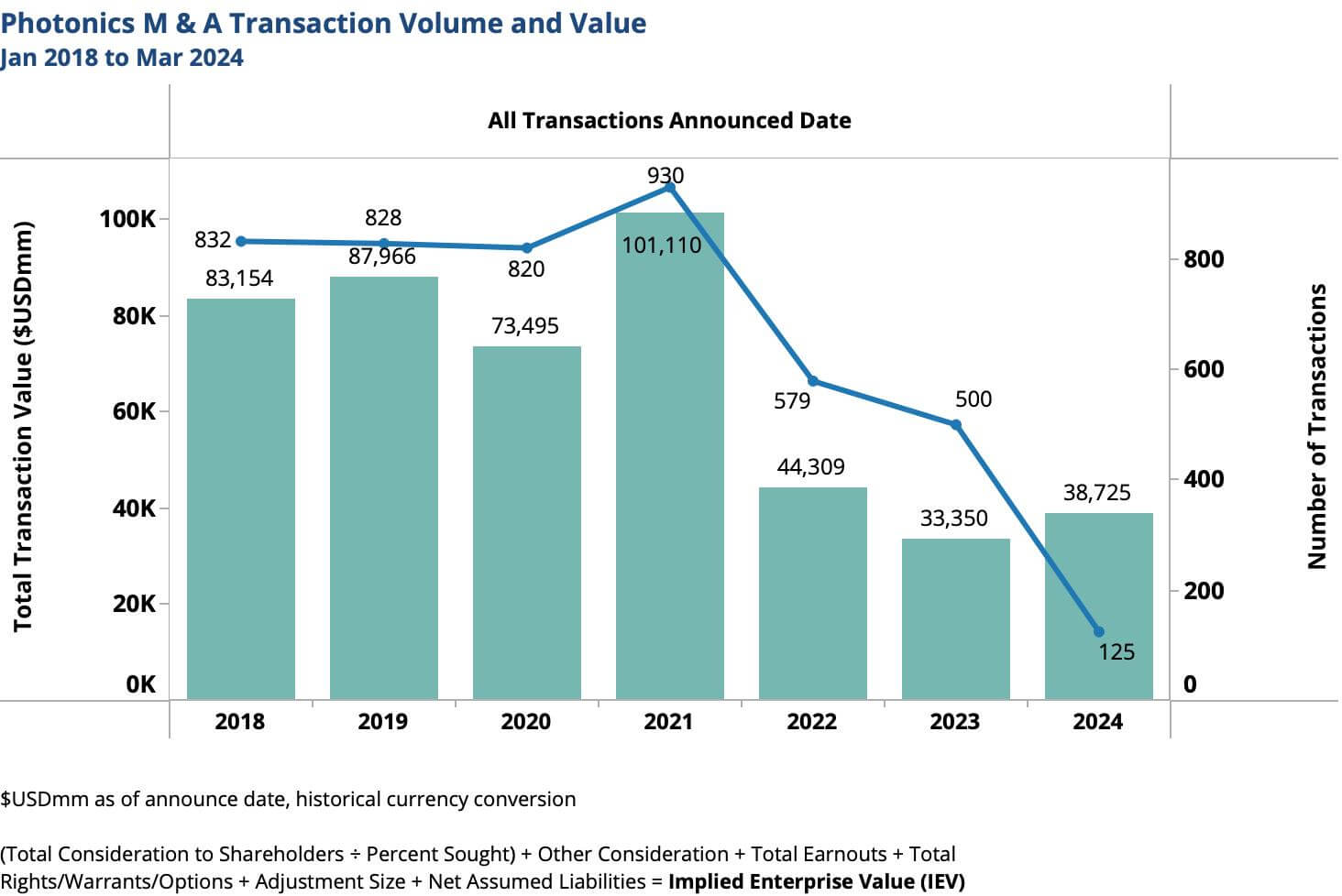

The first quarter of 2024 sees positive growth globally in the M&A market as a whole. However, M&A activity with targets employing photonics technology is off to a slow start.

The total value and volume of transactions with photonics targets is $39B and 125 respectively. Excluding Synopsys, Inc. $33B acquisition of ANSYS, Inc., a supplier of engineering simulation software and services, the total value is $5B, tracking less than 2023 record low of $33B. The volume in the first quarter 2024 is tracking in line with 2023 record low.

The Transactions

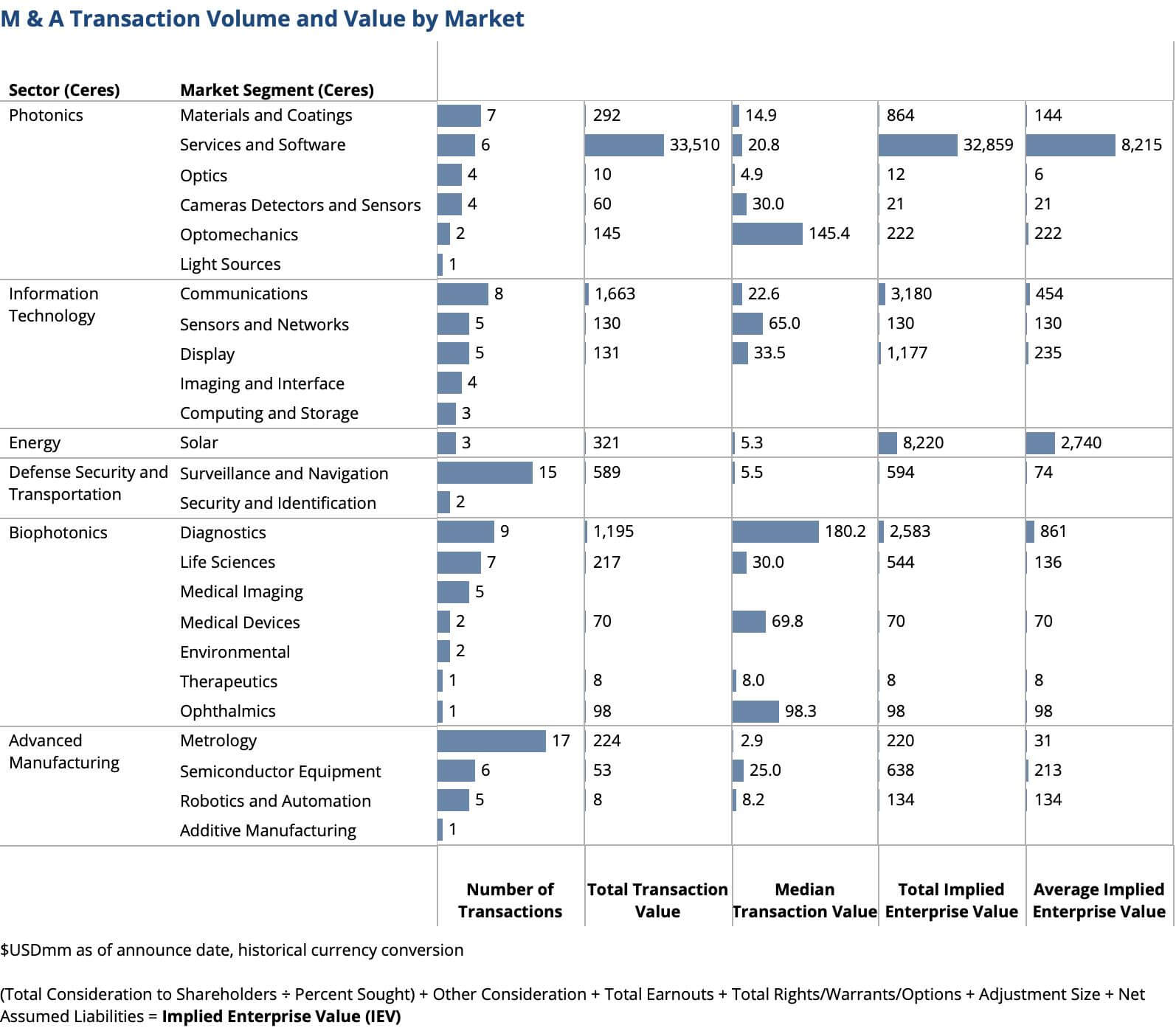

What types of transactions are getting done? Strategic buyers are acquiring lower middle market companies with core photonics technology that address their challenges of growth, scarce R&D resources and shortages of skilled workers and technical talent. M&A remains a key means for strategic buyers to enhance capabilities and to open new markets. Strategic buyers account for 90% of the transactions.

Consistent with 2023, Metrology (Advanced Manufacturing) and the Surveillance and Navigation (Defense Security and Transportation) see the most activity this quarter. The high level of activity and relatively low total value in these markets are evidence of a continued high concentration of capabilities deals.

Inconsistent with previous years, Biophotonics does not see the most activity and highest total value of all photonics enabled sectors this quarter. This is inherent to today’s market conditions in medical devices and diagnostics.

Leading the pack in Metrology are: private equity firm, Middleground Management LLC acquisition of The L.S. Starrett Company, provider of traditional optical metrology tools; Bruker Corporation acquisition of Nion Company, manufacturer of scanning transmission electron microscopes; and inTEST Italy, Inc. acquisition of Alfamation S.p.a., provider of test systems for micro-optics and optoelectronics manufacturing.

Leading the pack in Defense Security and Transportation are: Lockheed Martin Corporation acquisition of Terran Orbital Corporation, manufacturer of satellites for aerospace and US defense; and Honeywell International Inc. acquisition of Civitanavi Systems S.p.A., vertically integrated supplier of ITAR fee Fiber Optic Gyroscopes.

Geographically, in line with 2023, the first quarter sees target M&A activity in Asia and Pacific region out pacing both Unites States/Canada and Europe. 34% and 14% of buyer headquarters are in the United States and China respectively.

The Valuations

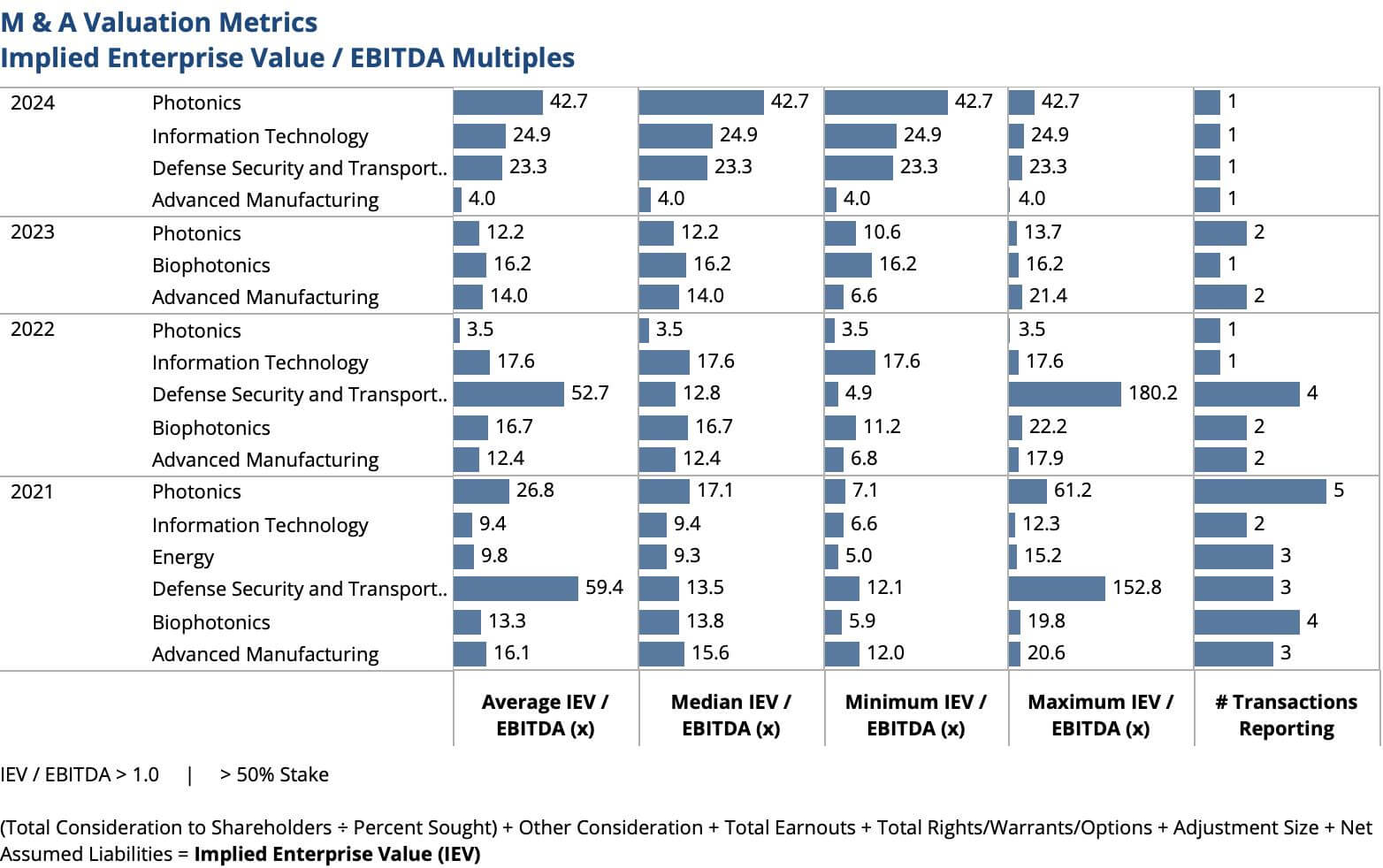

In the M&A market as a whole, strategic deals trade at the highest multiples in history across the board in 2021 with the decreasing valuations in 2023 continuing into the first quarter 2024. Many generalist analysts predict valuations to stabilize here with the new normal of higher interest rates, shortage of skilled labor and geopolitical instability. Based on researched transactions for targets with photonics technology, 2021 was also a banner year, but in contrast with the M&A market as a whole, strategic deals continue to trade high for photonics targets.

Very few transactions report target financials. Of the researched transactions for majority stake, 17 buyers report Implied Enterprise Value (IEV) multiples.

Spirent Communications plc, provider of automated test solutions for communications, satellite and autonomous vehicle networks, passes on $1.3B offer (IEV/EBITDA, 21.6x) from Viavi Solutions Inc. to pursue $1.5B offer (IEV/EBITDA, 24.9x) from Keysight Technologies, Inc.

The Buyers

In line with history, the most active buyer is Bruker Corporation who acquires four Biophotonics companies – Nanophoton Corporation, provider of laser microscopes (3.50x $5M revenue); Spectral Instruments Imaging, LLC, provider of preclinical optical systems for bioluminescent, fluorescent and x-ray imaging (3.75x $10M revenue); Tornado Medical Systems, Inc., provider of optical spectrometers for raman spectroscopy and spectral-domain optical coherence tomography; and ELITech Group SAS, manufacturer of in vitro diagnostic equipment and reagents for $943M. Bruker also acquires Nion Company (7.25x $8M revenue). Following, ABB Ltd acquires Real Tech Inc., provider of real-time water quality monitoring solutions and the remaining majority share of Sevensense Robotics AG, supplier of robot enabling software and multi-camera sensors for autonomously navigating dynamic spaces shared with humans.

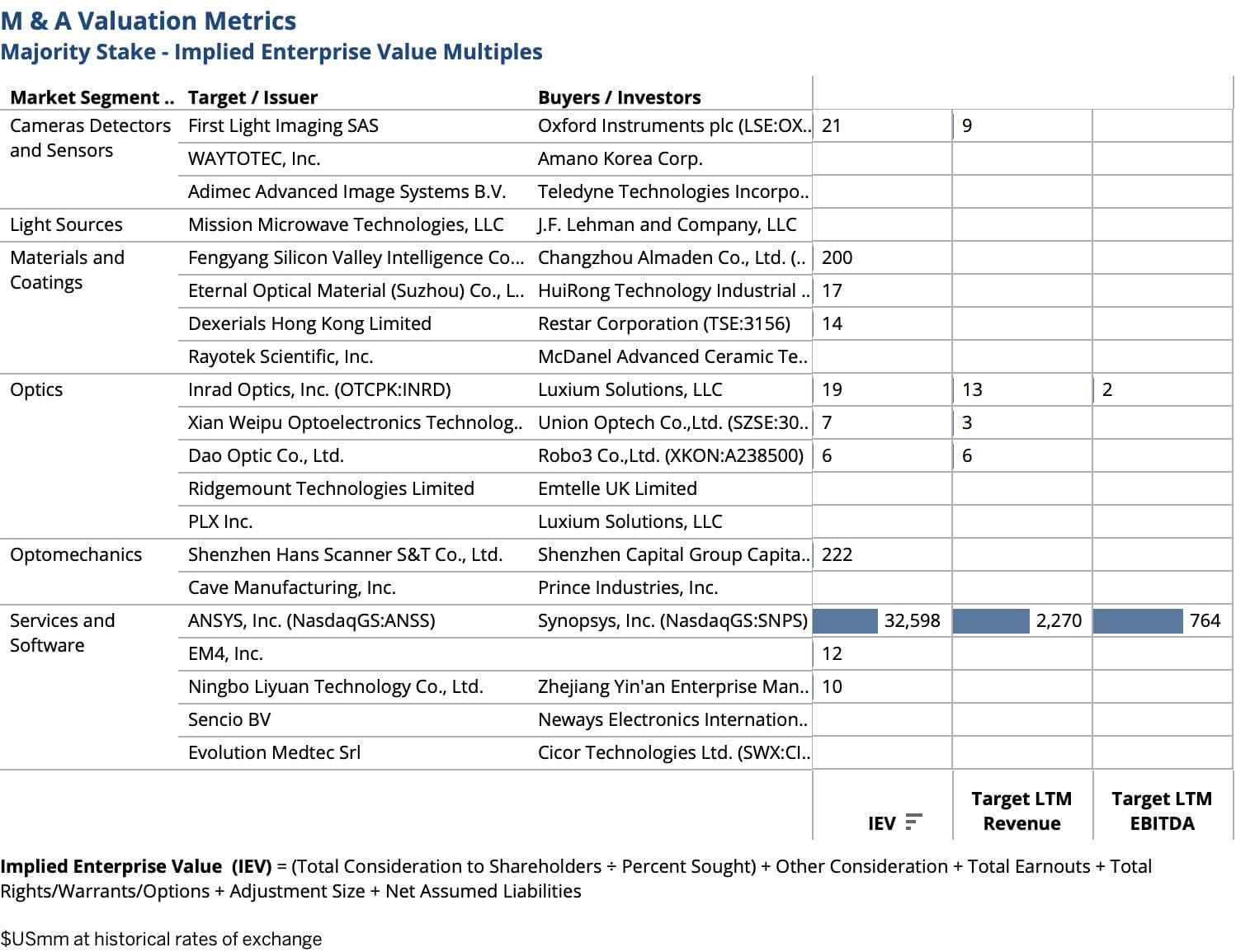

Pure-play Photonics market leaders are not acquisitive in 2023 and 2024. With the exception of Ansys transaction, total and average value, as well as number of transactions are down substantially from 2021 highs. There continues to be a high concentration of strategic acquisitions of capabilities, product lines and technical talent. The first quarter 2024 uniquely sees a high concentration of financial buyers and strategic buyers owned by private equity firms. Private equity owned Luxium Solutions, LLC acquires PLX Inc., manufacturer of retroflectors and Inrad Optics, Inc., optical components supplier (Q22024).

2024 Photonics M & A

Inflation and higher interest rates, geopolitical instability in the Middle East, Europe and China and shortages of skilled labor and technical talent will continue into 2024. While financial indicators improve, this could be the best time for well capitalized strategic and growth oriented financial buyers to do deals.

Lower concentration of mega-mergers and deals substantially scaling existing core businesses and continued higher concentration of lower middle market transactions and corporate carve-outs are expected to continue.

With private equity leveraged buy-outs scarce in the M&A market as a whole due to high interest rates and uncertainty around valuations with market volatility, financial buyers of companies with core photonics technology apply their playbooks from other industries. This includes cutting expenses to improve profitability, divesting non-core business units and product lines to beef up balance sheets and acquiring smaller add-ons for existing portfolio companies.

Proactive buyers may continue to take some risk in the near term and engage with sellers’ new mindsets around valuation. Less aggressive buyers may wait on the sidelines until clarity on where inflation, interest rates and unemployment will land.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.