Snapshot of Photonics Industry M & A Activity

The whirlwind of Merger & Acquisition activity in the photonics industry continues with the volume of transactions increasing significantly in the first half of 2011. Comparing to 2010 Snapshot, there was more activity in the first half of 2011 than in all of 2010.

The trend of small and middle market consolidation in the highly fragmented vertical market segments enabled by photonics technologies remains. And given the prolonged market volatility and uncertainly around the future role of government regulation, it is likely that organic growth will remain muted and opportunistic buyers will continue to absorb targets – amplifying a pattern of consolidation well into the second half of 2011.

Follow this link to a snapshot of these of transactions. <2011 Q1 & Q2 Photonics M&A Transactions>

Activity

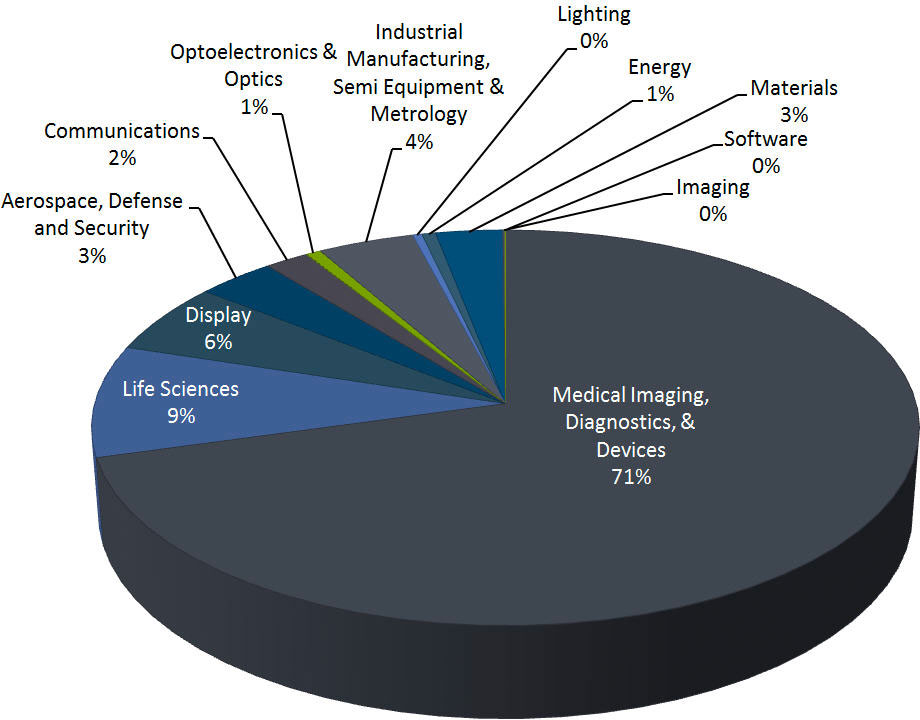

Lighting saw the most activity – dominated by small market acquisitions of LED based luminaire, automotive, safety and architectural lighting suppliers. Medical Imaging and Diagnostics followed with strategic buys of companies with proprietary technology supplying proteomics and cell based diagnostics instrumentation and consumables. Highly fragmented Optoelectronics and Optics markets, including optical components, materials, lasers, sensors, cameras and subassemblies, followed closely in terms of number of transactions.

Below is a snapshot of activity by market segment.

The majority of targets in Communications were fiber optic and integrated optic components companies, as opposed to networking gear providers. 3-D technologies were prevalent in Imaging and Medical Imaging.

Industrial Manufacturing and Metrology includes process control, factory automation, and industrial laser material processing equipment. Energy includes solar cell photovoltaics, materials and subassemblies. Security includes intelligent sensing, surveillance, personal identification, and trace detection.

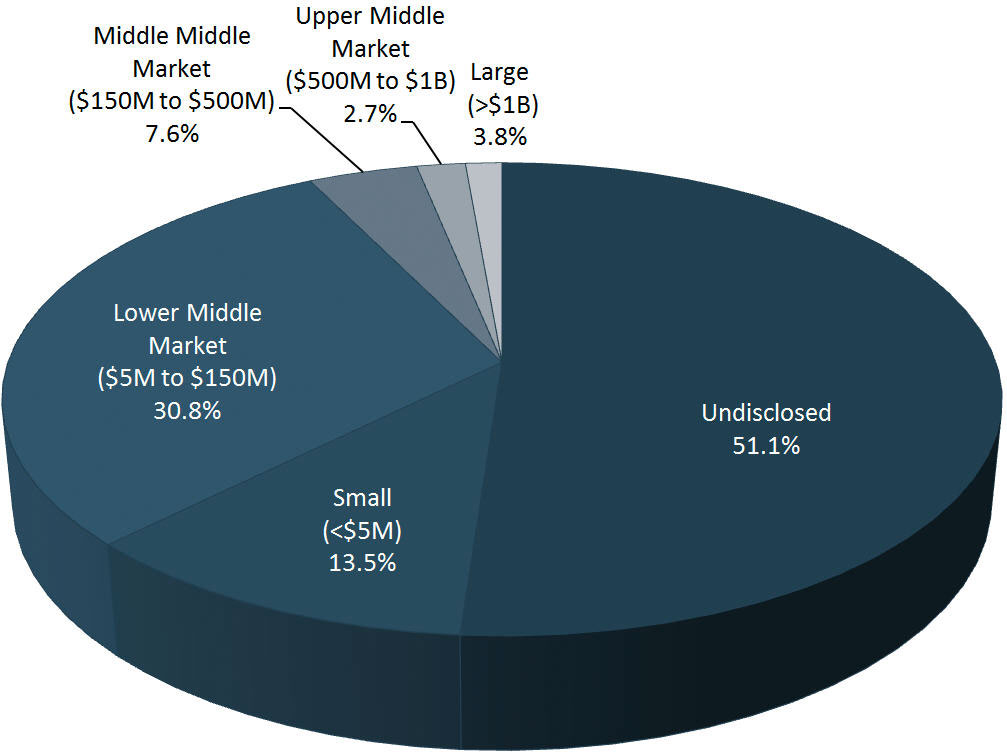

219 M&A transactions with target companies employing photonics technologies and closing dates in the first half of 2011 are researched. 49% of researched transactions disclose the transaction value. Of those disclosed, more than 85% are small and lower middle market companies. This may indicate a trend of consolidation in highly fragmented vertical market segments, such as Solid State Lighting, Medical and Life Sciences, and Semiconductor Equipment, where photonics plays a differentiating role – as well as continued consolidation of the the highly fragmented core photonics components market that includes manufacturers of lasers, sensors, optical components, and subassemblies for Original Equipment Manufacturers.

Although the vast majority of transactions by volume and value are strategic, private investment firms are active in the first half of 2011. 11% of transactions disclosed involve private investment buyers and 18% involve private investment sellers.

Valuations

The total and average value of researched transactions are $29 billion and $271 million. This is skewed high by the $12 billion merger of Novartis and Alcon and Danaher’s $7 billion acquisition of Beckman Coulter.

The simple average of reported Average Enterprise Value to Revenue and EBITDA multiples are 2.8 and 28.1 respectively. Average Enterprise Value to EBITDA is skewed high by two middle market transactions – Finisar’s acquisition of Ignis, a fiber optic components manufacturer (259x) and Toshiba Medical Systems acquisition of Vital Image,a medical imaging and diagnostic software supplier (94x).

Comparing a simple average with no adjustments for size, capital structure, or other dissimilarities by market segment – Medical Imaging & Diagnostics, Display, Materials, and Semiconductor Equipment realize the highest multiples of Enterprise Value to Revenue and Communications, Medical Imaging and Diagnostics and Semiconductor Equipment realize the highest multiples of Enterprise Value to EBITDA.

Later Half of 2011

The later half of 2011 is off to an active start. DuPont acquires Innovalight for its silicon ink that boosts photovoltaic efficiency. Newport announced that it will acquire Ophir for $230million and High Q Technologies, an ultrafast laser manufacturer with revenues of $20 million. Halma acquires photonic devices maker Avo Photonics for $9 million cash and an additional $11 million earnout. JDSU acquires critical assets from QuantaSol for concentrating photovoltaic solar-cell systems. nLIGHT, manufacturer of high power semiconductor lasers raises $17.5 million from Oak Investment Partners, Mohr Davidow Ventures, and Menlo Ventures.

The Transactions

Follow this link to a snapshot of these of transactions. <2011 Q1 & Q2 Photonics M&A Transactions>