Robust Market Enabled by Biophotonics

Biophotonics is the interdisciplinary science of applying light to biological life sciences – such as genomics, molecular biology, neuroscience, pharmacology, cell biology, biomechanics, and proteomics. It is a core technology enabling Medical Diagnostics, Medical Devices, Therapeutics, Life & Environmental Sciences and Medical Imaging markets. From early diagnosis of disease to minimally invasive surgery to detection of environmental contamination, biophotonics is addressing and solving today’s environmental and healthcare challenges. It enhances our quality of life and safeguards our health and environment.

Life Sciences and Healthcare markets are highly regulated, have high customer acquisition costs, and are characterized by strategic cooperation among competitors. Intellectual property landscapes are typically complex. Whether a business is a start-up or an established player launching a new product, access to capital is paramount to success.

The market for private and public placements in development stage and high growth life science and healthcare businesses is robust. In 2012, a reported $3billion of private placements went to work commercializing technology and scaling businesses with core enabling technology in biophotonics. So far, in 2013, 335 private placements topped $3.6billion and public offerings exceeded $8billion.

Private Placements

Private placement transactions for target companies including equity and debt are researched with closing, effective, or announce dates from January 1 to December 8, 2013. Transactions volumes, values, geographies and market segments are analyzed. Values are in $US at historical rates of exchange. Follow this link to transaction detail. <2013 Jan to Dec Biophotonics Private Placements>

Activity

Transaction Volume

In line with last year, the Diagnostics segment saw the most activity in 2013 – 40% of the total number of transactions. It predominantly included investments in companies employing fluorescence, optical label-free, and imaging methods to protein and cell based diagnostic assays, drug development, and point-of-care devices.

The Imaging and Life Sciences segments followed in volume of transactions with approximately 20% each of the total volume of transactions. Investments in Imaging fueled companies developing and supplying medical imaging instruments and consumable dyes – Computed Tomography (CT, OCT, SPECT, PET), Magnetic Resonance Imaging (MRI), Multispectral Imaging, X-ray Imaging, and Nuclear Imaging. Investments in Life Sciences fueled companies supplying and developing research tools and equipment used for environmental analysis.

Private Placement Transaction Volume

Biophotonics & Vertical Markets Served

January – December 2013

The Medical Devices segment included investments in Endoscopy, Image-Guided Surgery, Dental Imaging, and Surgical Laser Ablation, Cutting and Surfacing. The Therapeutics sector included investments in Photodynamic Therapy, Drug Delivery, Orthopedics, and Ophthalmology Therapies.

Transaction Value

The Diagnostics sector accounted for $1.2billion, one-third of the total transaction value. In this segment, most investments were early stage. There were 41 transactions valued at $1million or less. With the exception of $175 million in convertible debt raised by Opko Health, a pre-earnings company developing molecular diagnostics tests for Alzheimer’s disease, there was no single large transaction in the Diagnostics segment accounting for the overall high value in the segment. There were 25 growth stage investments ranging from $10 to $63million.

The total transaction value for Life Sciences and Medical Devices sectors is skewed high by two $500million private placements. Thermo Fisher Scientific (Life Sciences) will use the proceeds from Maxwell (Mauritius) Pte Ltd, an Africa based investment holding company, to fund a portion of the acquisition of Life Technologies Corporation. In Medical Devices, SONY closed a $535 million transaction resulting in an 11.5% stake in Olympus Corporation, a worldwide leader in medical and industrial optical instrumentation with its largest business unit supplying medical devices for endoscopy.

Private Placement Transaction Value

Biophotonics & Vertical Markets Served

January – December 2013

Very large transactions valued at more than $500million account for only 1% of the total number of transactions. Almost two-thirds of private placements ranged in value from $1 to $50million. More than half of $3.6billion was invested in deals ranging in value from $1 to $50million.

Private Placement Volume by Deal Size

Biophotonics & Vertical Markets Served

January – December 2013

Private Placement Value by Deal Size

Biophotonics & Vertical Markets Served

January – December 2013

The Targets

Development Stage

The lion’s share of private placements, more than 90%, is made by development or product launch stage companies realizing less than $10 million revenue and no earnings.

Growth Stage

Unsurprisingly, mature companies that are growing inorganically through acquisition, are raising the most private and public investment and are the largest employers. Thermo Fisher Scientific and Olympus each raised $500million in a private placement and collectively employ 73,000 worldwide.

Geography

The concentration of private placements for targets in the Unites States and Canada is growing. In the same analysis in 2012, targets in the United States and Canada saw 2x the volume of Asia and Europe. In 2013, they saw 5x to 15x the volume in Asia and Europe and realized almost 70% of the value.

Private Placement Transaction Volume

By Target Geography

Biophotonics & Vertical Markets Served

January – December 2013

Private Placement Transaction Value

By Target Geography

Biophotonics & Vertical Markets Served

January – December 2013

Private Placement Transactions

Follow this link to transaction detail. <2013 Jan to Dec Biophotonics Private Placements>

Public Offerings

Public offerings for target companies are researched with closing, effective, or announce dates from January 1 to November 15, 2013. Transactions volumes, values, geographies and market segments are analyzed. Values are in $US at historical rates of exchange. Follow this link to transaction detail. <2013 Jan to Nov Biohotonics Public Offerings>

Activity

Transaction Volume

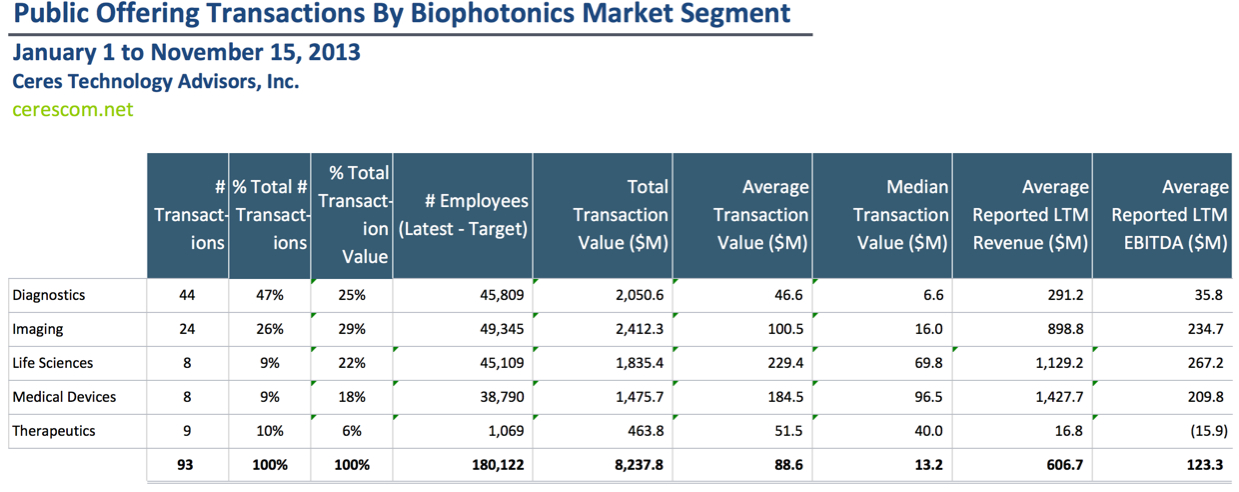

The Diagnostics segment saw the most activity – almost half of the total number of transactions.

Public Offering Transaction Volume

Biophotonics & Vertical Markets Served

January – November 2013

Transaction Value

The Diagnostics, Imaging, and Life Sciences segments of each accounted for approximately one-quarter of the total transaction value.

Public Offering Transaction Value

Biophotonics & Vertical Markets Served

January – November 2013

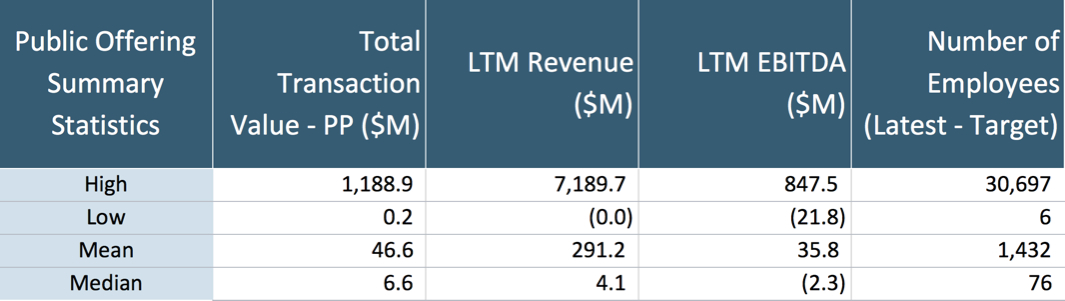

Very large transactions valued at more than $500million account for only 5% of the total number of transactions – whereas almost two-thirds of public offerings ranged in value from $1 to $50million.

Public Offering Transaction Size

Biophotonics & Vertical Markets Served

January – November 2013

The Targets

The lion’s share of public offerings is issued by growth stage companies with proceeds going toward scaling operations and funding inorganic growth through acquisition.

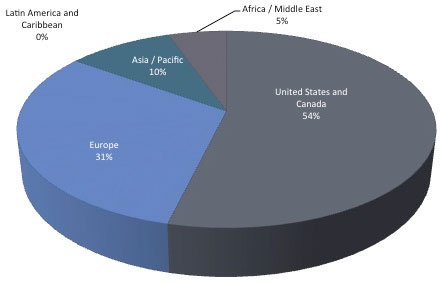

Geography

Targets in the United States & Canada saw more than half of the volume of transactions. This is not in line with the concentration of public offering transactions worldwide. In the same period, Europe saw 40% of public transaction volume whereas the United Sates & Canada and Asia each saw approximately 25% of the volume.

Public Offering Transactions by Geography Target

Biophotonics & Vertical Markets Served

January – November 2013

Public Offering Transactions

Follow this link to transaction detail. <2013 Jan to Nov Biophotonics Public Offerings>