Strategies

CERES designs and executes a buy-side program in line with client’s unique inorganic growth strategy.

Advance stategic planning greatly reduces the cost of analyzing randomly submitted opportunities. It enables a quantitative measure of how well or how poorly potential opportunities fit. Given multiple competing opportunities, defined criteria allows ranking degree of fit and risk – thus, preventing poor decisions by requiring that each opportunity stand on its own relative to pre-agreed criteria.

- Identify and quantify strengths and weaknesses to target only markets and companies where entry or expansion will both exploit strengths and mitigate weaknesses

- Pursue only opportunities that fit chosen strategy

- Reallocate cash flows from lower-yielding to higher-yielding investments

- Strategic planning on multiple levels - Enterprise, Corporate, Business Unit, Product Line, Functional

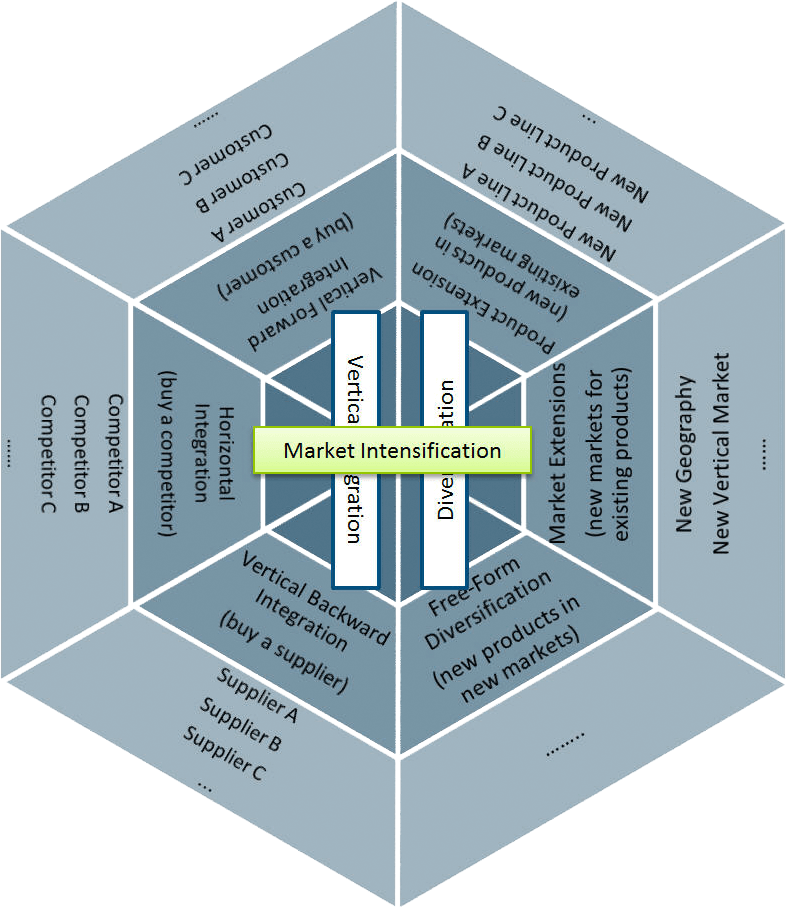

Alternatives include vertical integration, horizontal integration, or diversification.

Opportunity and Fit

Identify beneficial actions that will off-set weaknesses and exploit strengths and weight. In addition to outright acquisition, actions may include acquiring a partial ownership, creating a joint venture, or licensing. Rank opportunities by ability to maximize complimentary and supplementary effects. A good fit both offsets weaknesses and exploits strengths.