2022 Mergers & Acquisitions in Photonics

The 2022 photonics M&A market and the M&A market as a whole do not stack up against prior years. Driving trends include inflation and rapid interest rate hikes, geopolitical instability in Europe and China, losses in both stock and bond markets, supply chain risk and labor shortages.

Regardless, strategic buyers of companies with core photonics technology continue to address the challenges of growth, an abundance of investment capital, advances in digital technologies and government intervention with M&A. They acquire companies to open new markets, enhance capabilities, implement new business models and secure supply chains.

In 2021, there is a trend to shift back from the high concentration of capability deals of 2018 and 2019 to scale deals as companies seek to strengthen their core business. In 2022, the trend reverses. Strategic buyers execute smaller capabilities deals and execute more vertical integration plays, bringing critical capabilities in-house. 2022 sees no mega-mergers, very few deals substantially scaling existing core businesses and a higher concentration of lower middle market transactions and corporate divestitures.

While financial indicators improve slightly year end, how will these trends influence 2023? Proactive buyers may take some risk in the near term and engage with sellers’ new mindsets around valuation. Less aggressive buyers may wait until mid-year for clarity on where inflation, interest rates and unemployment will land.

The Transactions

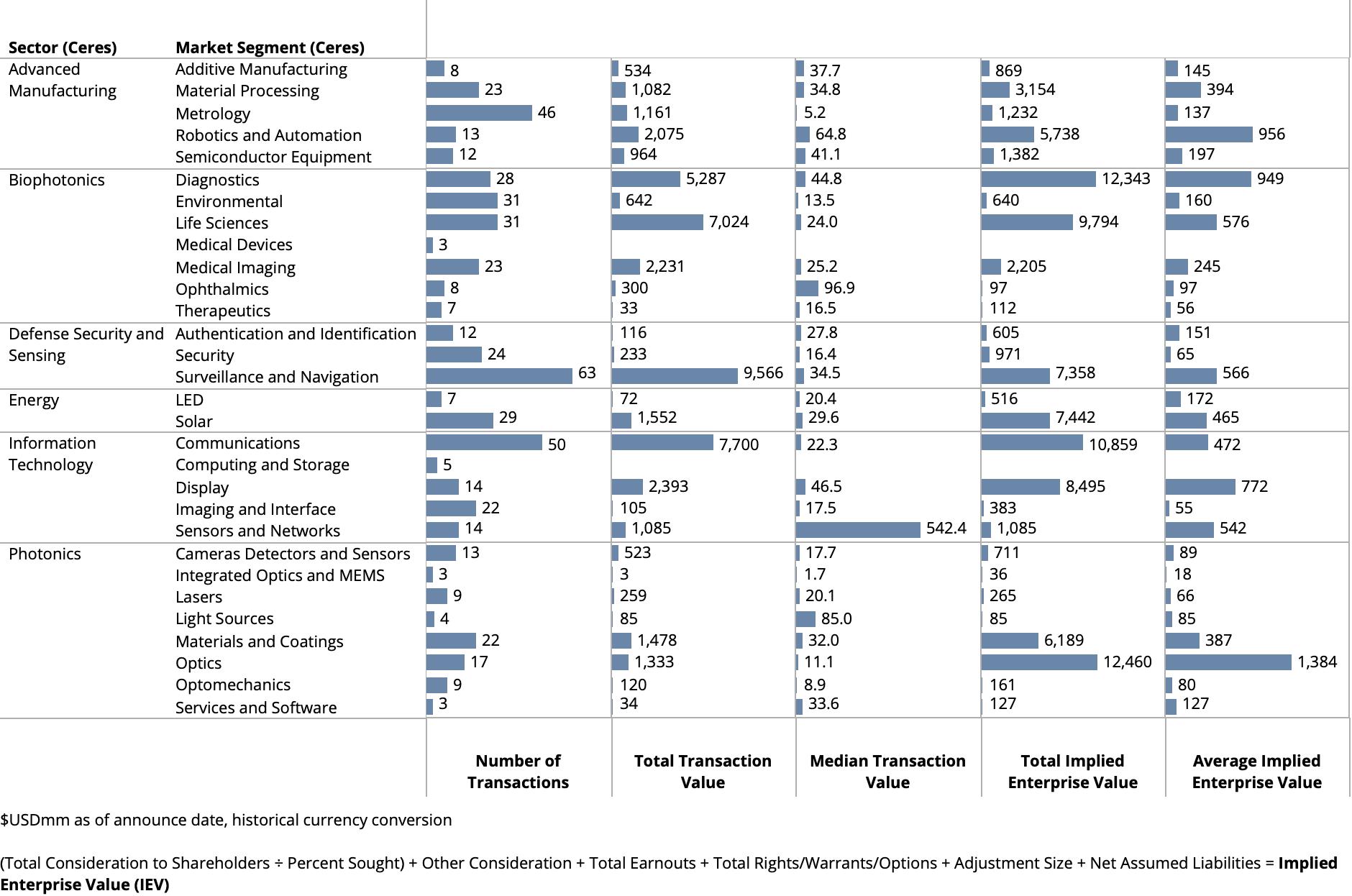

M&A transactions are researched with announce dates from January 1 to December 31, 2022. Activity and valuations are analyzed by market segments. Values are in $US at historical rates of exchange. Implied Enterprise Value (IEV) is defined as the total consideration to shareholders (adjusted for % acquired) plus earn-outs plus rights/warrants/options plus size adjustment plus net assumed liabilities.

49,633 transactions worth $3.1trillion are announced globally in 2022. Of that, CERES identifies and researches 553 transactions with reported value of $48B in the photonics industry and vertical markets employing photonics technologies as core differentiators. The 2022 M&A market as a whole is down 33% and 14% in total transaction size and count respectively from last year, as compared to down 55% and 41% respectively for the photonics M&A market.

The total and average Implied Enterprise Value of targets reporting financial data are $95B and $435M respectively. The median Transaction Value is $26M.

The Surveillance and Navigation (Defense Security and Sensing), Metrology (Advanced Manufacturing) and Communications (Information Technology) markets see the most activity. The high level of activity and relatively low total value in Metrology are evidence of a continued high concentration of capabilities deals – as well as vertical integration plays to secure supply chains. The high level of activity and high total value in Sensing and Communications are evidence of a continued high concentration of both consolidation and capabilities deals.

Due to two industry consolidating transactions, 2021 marks the highest total announced transaction value in history of M&A for the pure-play Photonics sector. Teledyne Technologies Incorporated (NYSE:TDY) closes on acquisition of FLIR Systems, Inc. (NasdaqGS:FLIR), provider of thermal and visible light imaging systems (US) for $7.5B. July 1 2023, Coherent, Inc. (NasdaqGS:COHR), laser supplier (US) and II-VI Incorporated (NasdaqGS:IIVI), supplier of engineered materials and optoelectronic components (US) complete transaction sized at $7.7B. In 2022, the largest pure-play photonics target transaction is Hangzhou MDK No. 1/2 Equity Investment Partnership acquisition of 9.4% share of MDK (Zhejiang) Smart Optoelectronics Technology Co., Ltd., developer of optoelectronics, optics, sensors and camera assemblies (China) sized at $1.1B.

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value of all photonics enabled sectors. Due to the relatively high research and development costs and risks, companies serving these markets are highly dependent on inorganic growth and competencies in M&A.

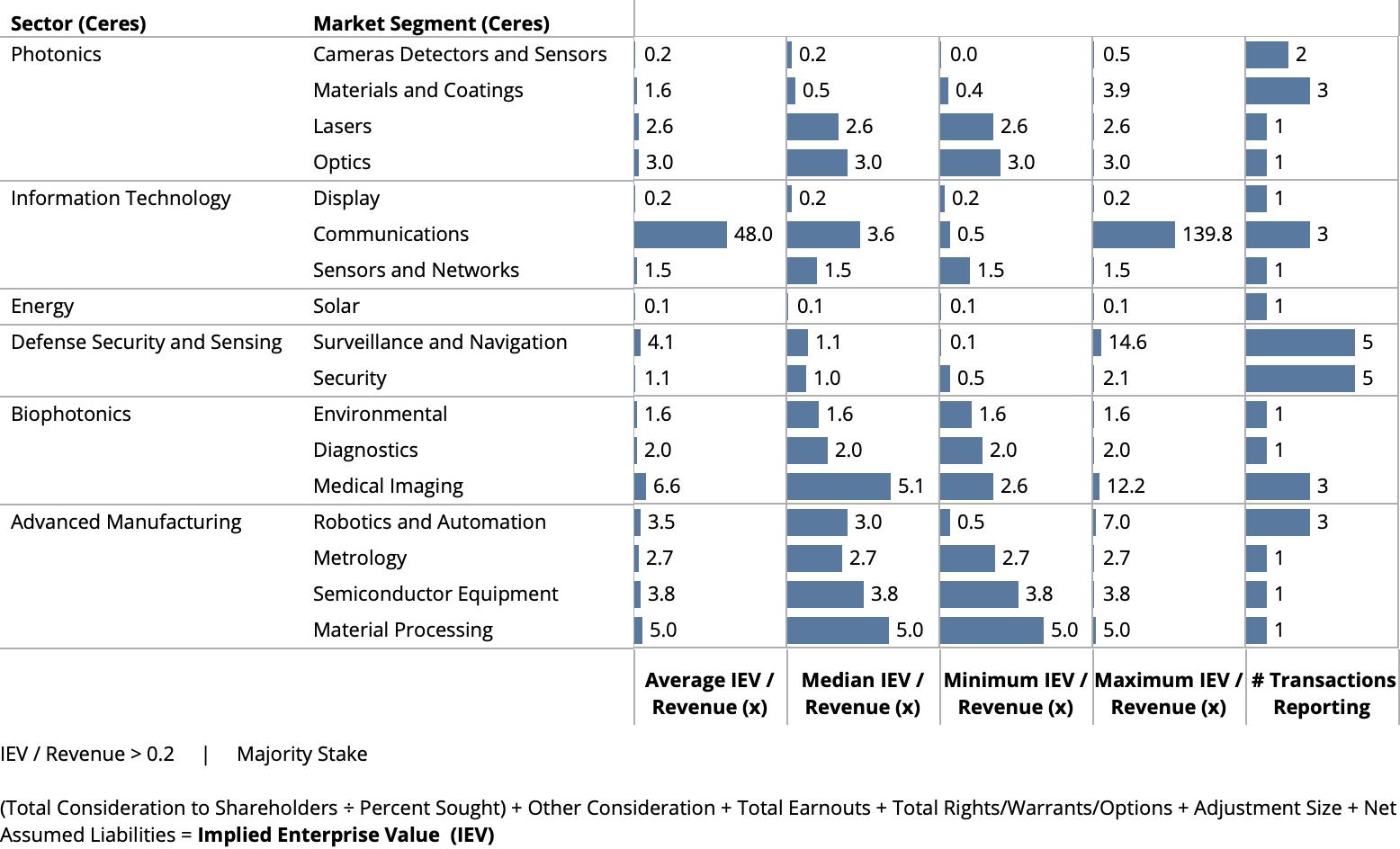

The Valuations

Few transactions report financials, because regulations do not require if a transaction does not have material near term impact on financial statements. Regardless, M&A transaction data is highly relevant to understand market dynamics and buyer behavior. Of the identified and researched transactions, 93 report valuation metrics. Of the 93 transactions, only 36 represent majority share.

In 2021, strategic deals trade at the highest multiples in history across the board. With the exception of the Biophotonics sector that historically always sees very high multiples, this is uniquely true of strategic deals involving companies with core photonics technology targets in other sectors.

Leading the pack on IEV / EBITDA for acquisitions of 100% share are: Oxford Instruments plc (LSE:OXIG) (27.1x), provider of atomic force microscopy, optical imaging, spectrometer, nuclear magnetic resonance, scientific camera and x-ray source products (UK); CyberOptics Corporation (17.9x), supplier of high precision sensing technology metrology solutions (US); Yunex GmbH (17.6x), provider of hardware, software, Internet of Things devices and advanced modular traffic management solutions (Germany); Maxar Technologies Inc. (NYSE:MAXR) (14.2x), provider of earth intelligence and space infrastructure solutions (US); and Tower Semiconductor Ltd. (NasdaqGS:TSEM) (12.2x), an independent semiconductor foundry providing customizable process technologies, including CMOS image sensors (Israel).

Leading the pack on Implied Enterprise Value / Revenue for acquisitions of 100% share are: ParaZero Technologies Ltd. (14.6x), provider of autonomous parachute safety systems for commercial drones (Israel); Parata Systems, LLC (7.0x), provider of pharmacy automation solutions (US); IZI Medical Products, Inc. (5.1x), provider of multimodality markers and needle guidance for computerized tomography (CT) medical devices (US); and Muon B.V. (5.0x), provider of laser processed micro-precision industrial components (Netherlands).

The Pure-Play Photonics Targets

Pure-play photonics market leaders are not acquisitive in 2022. Coherent, Inc. (NasdaqGS:COHR), Teledyne Technologies Incorporated (NYSE:TDY), Lumentum Holdings Inc. (NasdaqGS:LITE), and Jenoptik AG (XTRA:JEN) may be consumed digesting last year’s very large acquisitions made to scale their core businesses.

While total and average value, as well as number, of transactions are down substantially from previous years’ highs, there are more strategic vertical integration plays and more private equity buyers.

Lasers

In Lasers, other than Hamamatsu Photonics’ acquisition of NKT Photonics A/S (Denmark), vertical integration plays dominate. BluGlass, Penta Laser, TRUMPF, Luminar Technologies, MARKTEC and Amplitude Systemes all strengthen supply chains and competitive advantage with the acquisition of a laser supplier.

Cameras, Detectors and Sensors

Prior to 2021, the majority of acquisitions in Cameras, Detectors and Sensors market are horizontal integration plays to expand scope of product offerings. The majority of acquisitions now are vertical integration plays to secure supply chain.

One of the largest pure-play photonics transactions is Compagnie de SaintGobain S.A. (ENXTPA:SGO) divestiture of its crystals and detectors business to Edgewater Capital Management, LLC and SK Capital Partners.

Unlike recent years, there are very few mergers of photonics technology companies with special purpose acquisition companies (SPAC). Infrared Cameras Holdings, Inc. (US), provider of thermal cameras and infrared systems, however, announces a business combination with a publicly-traded SPAC.

Optics

The largest transaction in Optics is Ametek’s acquisition of Navitar, Inc. (US), supplier of optical subassemblies. Sill Optics GmbH & Co. KG, another widely recognized brand name optics company is acquired by DPE Deutsche Private Equity from its former private equity owner.

The Targets with Core Photonics Technology

Advanced Manufacturing

Within the Advanced Manufacturing sector, the Metrology market segment continues to see lots of activity with a high concentration of smaller strategic capabilities deals and vertical integration plays.

The largest transactions in the segment are AEA Investors LP acquisition of The Burke Porter Group (US), provider of machinery that integrates sensor based feedback for advanced manufacturing ($1.1B); and Becton, Dickinson and Company (NYSE:BDX) acquisition of Parata Systems, LLC (US), supplier of pharmacy automation solutions ($1.5B).

Information Technology

Intel Corporation (NasdaqGS:INTC) acquisition of Tower Semiconductor Ltd. (NasdaqGS:TSEM), an independent semiconductor foundry providing customizable process technologies, including CMOS image sensors (Israel), accounts for a large portion of total M&A value in the Information Technology sector.

While the activity and volume of transactions are down from previous years in the Display market, the consolidation of LED and OLED flat panel manufacturers continues.

With the exception of Meta Platforms, Inc. (NasdaqGS:META) acquisition of LUXeXceL Group B.V., provider of 3D printing technology to print ophthalmic lenses, there are no strategic acquisitions of 3D Augmented and Virtuality Reality display technologies, like Snap Inc. (NYSE:SNAP)‘s acquisition of WaveOptics, Ltd.‘s lightweight, binocular and large field of view augmented reality display technology for $520M in 2021.

Although the quantum computing market (Computing and Storage) is in its infancy, there are two strategic acquisitions by market leaders, Atlas Copco AB (OM:ATCO A) and SK Telecom Co.,Ltd (KOSE:A017670). Additional transactions represent VC funded start-ups merging. Given the venture bull market of the last 10 years, there are an unprecedented number of VC-funded companies with no exit in sight given the current financial markets. They are turning to M&A as sustaining alternative.

Biophotonics

Consistent with previous years, the Biophotonics sector sees the most activity and highest total value. Unlike other sectors, deal volume and value are down only slightly from recent years’ highs.

The largest transactions are Bain Capital Private Equity, LP acquisition of Evident Corporation, provider of biological and industrial microscopes, endoscopes and non-destructive testing equipment, from Olympus Corporation (TSE:7733) ($3.1B); Thermo Fisher Scientific Inc. (NYSE:TMO) acquisition of The Binding Site Group Ltd., provider of immuno-diagnostic assays and instrumentation ($2.6B); New Mountain Capital, L.L.C. acquisition of Applied, Food and Enterprise Services Businesses of PerkinElmer, Inc., supplier of diagnostics and life sciences solutions ($2.5B); Spectris plc (LSE:SXS) acquisition of Oxford Instruments plc (LSE:OXIG), provider of atomic force microscopy, optical imaging, spectrometer, nuclear magnetic resonance instrument, scientific camera and integrated x-ray source products ($2.3B); and MBK Partners acquisition of MEDIT corp., manufacturer of 3D intra-oral scanners and CAD/CAM solutions ($1.9B).

Defense, Security and Sensing

The high volume of M&A activity in the Surveillance and Navigation segment is largely attributed to targets supplying imaging and sensing engines, software and solutions for unmanned ground and aerial vehicles and smart robots. The high value of M&A activity in the Surveillance and Navigation segment is attributed to Advent International Corporation and British Columbia Investment Management Corporation acquisition of Maxar Technologies Inc. (NYSE:MAXR) (US), provider of provides earth intelligence and space infrastructure solutions ($6.6B).

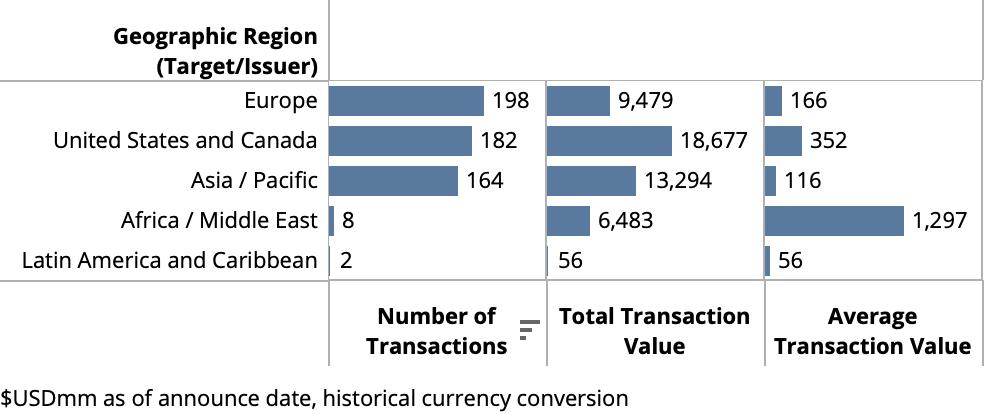

The Geographies

Geographically, since its peak in 2016, cross-regional acquisitions decline. In 2019, the trend accelerates with increased government intervention on cross-border deals and trade tensions between US and China and in 2021, this trend accelerates even further with supply chain concerns exposed by the Covid crisis and government scrutiny expanding beyond sensitive defense and technology industries.

In 2022, with a strong dollar and geopolitical stability in US, there is an increase in European targets acquired by US buyers.

Most Active Buyers

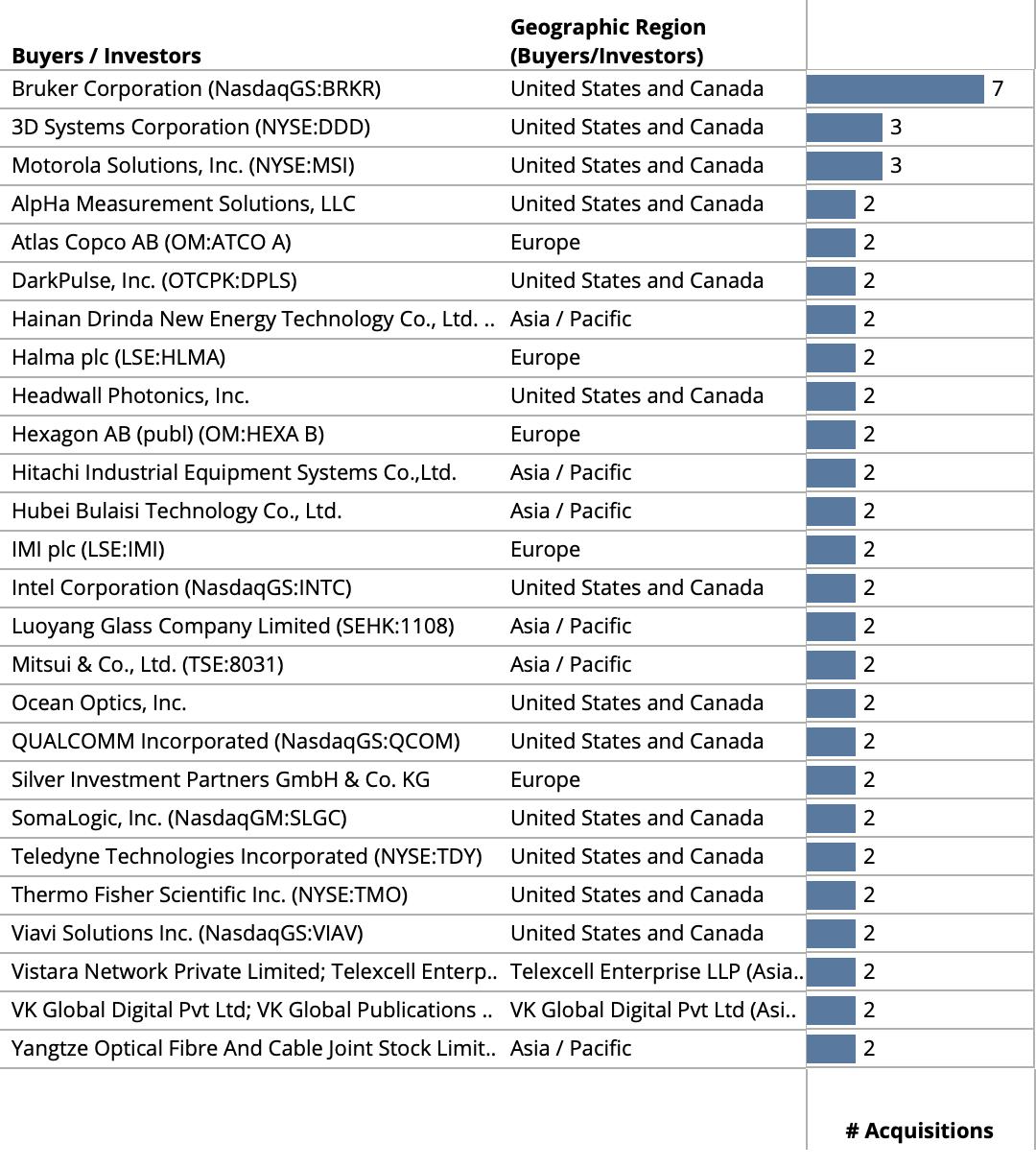

The most active buyer, by far, is Bruker Corporation (NasdaqGS:BRKR), who acquires two mass spectrometry companies, two life sciences process automation providers, a nanoflow liquid chromatography supplier, and two companies with diagnostic and discovery products targeting brain diseases and neurotherapeutics. Following, who each acquire three companies with core photonics technology are: 3D Systems Corporation (NYSE:DDD) acquiring medical device and industrial 3D printing platforms and its distributor; and Motorola Solutions, Inc. (NYSE:MSI) acquiring three video surveillance companies for public safety networks.

Strategic buyers execute the largest deals across all markets with the exception of Bain Capital Private Equity’s announced acquisition of Evident Corporation. The decline of the S&P 500 through early October allows mega fund firms to buy up public companies at discounts on recent record highs.

Strategic and Financial Buyers

In line with history, the overwhelming majority of deals are executed by strategic buyers. Strategic buyers have the advantage over financial sponsors, such as private equity firms, in that they can create proprietary deal flow. By Q3 2022, private equity deal making succumbs to higher interest rates and lower valuation multiples. As a result, private equity transactions are much smaller and easier to finance in the photonics M&A market and M&A market as a whole.

There are also more minority growth private equity transactions allowing firms to apply active management and to acquire interests in larger companies. In Biophotonics, Blackbird Ventures, NeoTribe Ventures, Ferd Capital and J&W Partners acquire minority shares of medical imaging and in vitro diagnostics companies.

2023

The 2022 photonics M&A market and the M&A market as a whole does not stack up against prior years. Trends driving it include inflation and rapid interest rate hikes, geopolitical instability in Europe and China, losses in both stock and bond markets, supply chain risks and labor shortages.

While financial indicators improve slightly year end, how will these trends influence 2023? Proactive buyers may take some risk in the near term and engage with sellers’ new mindsets around valuation. Less aggressive buyers may wait until mid-year for clarity on where inflation, interest rates and unemployment will land.

Uncertainty, is generally not good for M&A. However, this could be the best time for well capitalized strategic buyers to do deals. For financial buyers, who are more reliant on financial markets to raise capital from Limited Partners and secure debt, it will be more challenging.

Strategic buyers of companies with core photonics technology need to address the challenges of growth. The benefits of inorganic growth are amplified in this environment where technical and management talent are scarce, R&D budgets are low and disruptions in the supply chain continue to impede meeting customer demand. So, it follows that strategic buyers may not execute highly leveraged consolidation plays, but they will continue to execute smaller capabilities and vertical integration deals.

CERES sources transaction data from public sources. CERES analysis and data are subject to errors and omissions. Accuracy of information is responsibility of user.