Highlights from 2016

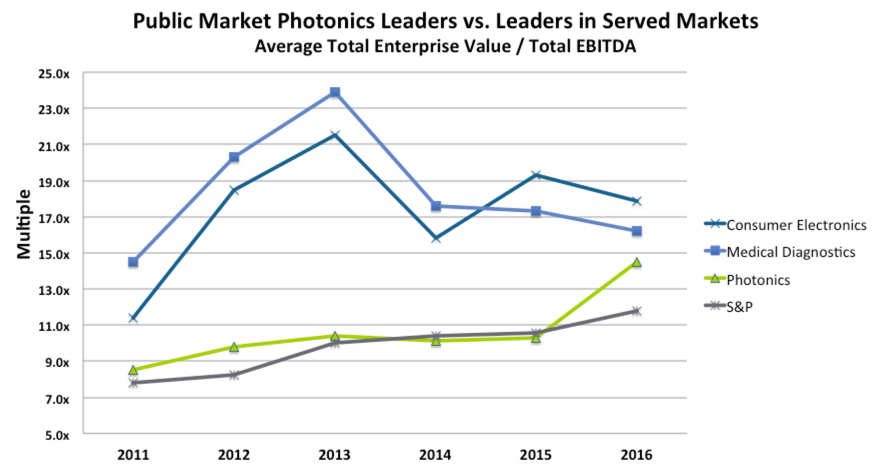

Photonics has been at the core of many modern day inventions and economic growth for decades now. However, the environment for photonics technology and component providers remains highly fragmented and fiercely competitive with their OEM customers and end-users further up the value chain realizing more of the value. Is that changing? It appears the public market leading photonics companies are catching up with their customers and capturing more value in 2016.

However, what about 3,000+ privately held photonics companies?

Private Placements

In 2016, more than $30billion of the $725billion in private placements worldwide goes to work commercializing photonics technology and scaling businesses with core enabling technology in photonics.

Private placement transactions for target companies are researched with closing, effective, or announce dates from January 1 to December 31, 2016. Private placements include private equity or growth capital, venture capital and private investments in public entities. Transactions volumes, values, geographies and market segments are analyzed. Values are in $US at historical rates of exchange.

<Download 2016 Photonics Private Placement Transaction Detail>

Markets Enabled by Photonics

Information Technology

The Gartner Hype Cycles provide a snapshot of emerging technologies along a predictable pattern of enthusiasm, disillusionment and eventual realism. “The Hype Cycle for Emerging Technologies distills insights from more than 2,000 technologies into a succinct set of must-know emerging technologies and trends that will have the single greatest impact on an organization’s strategic planning,” said Mike J. Walker, research director at Gartner. “This Hype Cycle specifically focuses on the set of technologies that is showing promise in delivering a high degree of competitive advantage over the next five to 10 years.” Referencing below, Photonics is the key enabling technology for these emerging information technologies.

Display – Virtual and Augmented Reality

Augmented Reality is jumping out of the “Trough of Disillusionment” onto the “Slope of Enlightenment” with Virtual Reality. Augmented Reality (AR) and Virtual Reality (VR) are forecast to be $120 and $30billion markets by 2020 (Digi-Capital). This maps to $45 and $6billion markets for display and content creation hardware that integrate optics and photonics by 2020.

2016 Private Placement Highlights

21st Century Fox leads $58mm round in Osterhout Design Group, developer of electro-optics and sensor-based technologies & smart glasses.

CITC Capital leads $35mm in Beijing Baofeng Mojing Technology Co., manufacturer of VR headsets.

Samsung Ventures leads $11mm in FOVE, manufacturer of eye tracking VR headsets.

DCM & McKesson Ventures participate in $23mm round for Augmedix who focuses on harnessing the power of Google Glass for medicine.

BMW i Ventures leads $5mm investment in STRIVIR Labs’ VR training software for athletes.

Blippar.com, developer of consumer marketing mobile app based on AR, computer vision & image recognition technologies, closes $54mm with Khazanah Nasional Berhad (Malaysia).

Diota, developer of AR solutions to interconnect data & human workers in complex industrial manufacturing processes, raises $3mm.

In addition to today’s core gaming and 3D film markets, virtual reality is used in high-end simulation and training applications, including military flight simulators. It is also used in scientific visualization and modeling, including geomodeling in the oil industry and genome mapping, as well as for product design, where VR systems are used to experience automobile or equipment design. Medical professionals will use VR for telepresence doctoring and remote surgery.

Currently, augmented reality applications or mixed-reality scenarios (where HMDs and context-aware software are used in a hybrid augmented/virtual environment) are popular technology approaches to the problem of marrying immersive VR to a consumer setting. Consumer AR implementations are external-facing solutions intended to be used directly by the consumer. To date, these have been for marketing, advertising, gaming, and education. Business AR implementations are typically internal-facing AR solutions. These solutions include training and maintenance, product and parts visualization, maintenance and repair, prototyping, and connecting human workers with information real time.

Private placement investments in 2016 crossed the value chain from displays and video hardware used to create content to services and software applications.

Biophotonics

Medical Diagnostics

2016 Private Placement Highlights

Intuity Medical, supplier of blood glucose systems, closes $40mm with U.S. Ventures and Venrock.

The Founders Fund & Andreessen Horowitz lead $6mm round in Freenome for a genomic thermometer.

Bio-Techne invest $20mm in Astute Medical to develop protein markers and proprietary tools and consumable cartridges for novel diagnostic tests.

Qualcomm Ventures & Sanofi-Genzyme BioVentures lead $2mm round for Common Sensing to develop pen to record insulin intake & transmit to mobile.

STMicroelectronics participates in $10mm round for Biovoton to develop mobile wearable device for measuring blood circulation.

NeuroVision Imaging, developer of retinal imaging technology for monitoring amyloid pathology related to Alzheimer’s disease, raises $10mm from Wildcat.

SenGenix raises $2mm to develop POC diagnostic tests based on fluorescently responsive sensors.

In the $55billion In Vitro Diagnostics market, there is a concentrated base of instrument manufacturers employing fluorescence, optical label-free and molecular imaging methods to gene, protein and cell based diagnostics. Thousands of companies worldwide are developing assays and pharmaceuticals with those instruments.

In 2016, Biophotonics is fueling economic growth and investment in improved platform technology, point-of-care devices, bioinformatics, reagents, sample collection and clinical laboratory services – as well as prolific commercialization of disease-specific and personalized assays and pharmaceuticals.

Advanced Manufacturing

3D Printing

2016 Private Placement Highlights

Sequoia Capital, GE Ventures, Nikon, and Google Ventures invest $181mm in Carbon 3D’s high speed UV layer-less processing that is amenable to the breadth of commercially available polymer materials.

Ben Franklin Technology Development invests $1.5mm in Biobots’ 3D bio printers that build functional 3D living tissues.

Stratasys invests in Massivit 3D Printing Technologies’ solutions for point-of-purchase advertisers and branding designers.

Catalyst, China Everbright, and Autodesk invest $25mm in XJet’s inkjet based 3D printers for metal parts.

Draper Fisher Jurvetson & Autodesk invest $41mm in Formlabs’ high resolution, low cost 3D desktop printers employing stereolithography.

Khosla Ventures invests $7mm in AREVO, supplier of thermoplastic filaments and additive manufacturing software for carbon fiber materials.

The $4billion Additive Manufacturing market is dominated by a handful of players supplying 3D printers. Hundreds of companies worldwide are providing scanners, materials, software, integrated systems, contract manufacturing services and content. Additive manufacturing allows goods to be infinitely more customized and manufactured closer to point of consumption – causing a switch from centralized factories to local production with higher unit costs but no shipping and inventory costs.

In 2016, Photonics is fueling economic growth and investment in improved printing technology, 3D scanners, materials, software, rapid prototyping and contact manufacturing services.

Surveillance and Navigation

Unmanned Ground and Aerial Vehicles

2016 Private Placement Highlights

Velodyne Lidar, supplier of Time-of-Flight 3D distance measuring sensors for autonomous vehicles, industrial equipment, and 3D surveillance, receives $150mm from Ford Motor and Baidu.

CRV leads $29mm investment in Airobotics, manufacturer of automated industrial drones for inspection, surveying, and emergency response.

Innoviz Technologies, developer of LiDAR for smart 3D sensing and sensor fusion for autonomous vehicles, raises $9mm from Vertex Ventures Israel.

Bessemer leads $7mm investment in Oryx Vision, developer of solid state depth vision solutions for autonomous vehicles.

Blue Vision Labs, developer of augmented reality and machine perception technology based self-driving cars, raises $3mm.

Samsung Venture and Delphi Automotive lead $90mm round in Quanergy, developer of sensing solutions for real-time 3D mapping and tracking.

Light Imaging, Detection, And Ranging (LIDAR) is a metrology method that measures distance to a target by illuminating it with a laser. It is a key enabling technology in Drones and Self Driving Cars. It is used to make high-resolution maps, with applications in geography, geology, geomorphology, forestry, laser guidance and altimetry. For the autonomous applications, LIDAR with a laser 3D scanner is used for obstacle detection and collision avoidance.

The Unmanned Aerial Vehicle (UAV) market is estimated at $13.2billion in 2016 and projected to reach $28.3Billion by 2022, at a CAGR of 13.5%.

The Unmanned Ground Vehicle (UGV) market is projected to grow from $6.4billion in 2015 to $18.7billion by 2020, at a CAGR of 23.7%.

Photonics

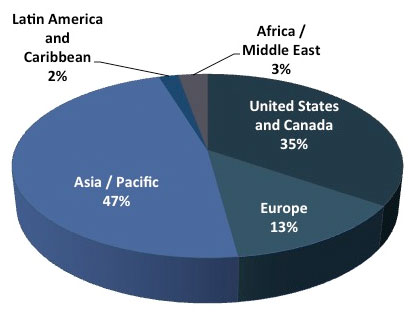

There is a significantly higher percentage of transaction value in global private placement market in Asia since 2012. The increase is even higher, since 2012, in Asia based photonics companies compared to private placement market as whole. North America & Europe, historically with larger private equity markets, are lagging Asia in growth capital investments to scale manufacturing operations.

Materials and Coatings

In the Photonics segment, Materials and Coatings sees the most investment in 2016. $50million and larger private placements are announced or closed by suppliers of silicon for photovoltaics, optical glass, display panel glass, fluoro molecules for LCD’s and functional optical films for display based in China, Taiwan and Russia. $5million and smaller private placements are announced and closed by early stage companies developing man-made diamond technology, asteroid mining, quantum dots and other nanoparticles based in US.

2016 Private Placement Highlights

Nanos Co. (S. Korea), supplier of filters & camera lens modules for consumer electronics, announces 40mm.

Nanchang O-Film Tech. Co. (China), supplier of optics and coatings, announces $47mm investment.

Sangbo Co. (S. Korea), developer and supplier of nanomaterial diffusers and optical films for displays, solar, and construction, raises $39mm.

ONDA Entertainment Co. (S. Korea), designer and manufacturer of lenses for mobiles, CCTV, and endoscopes, closes $13mm private placement.

Hi-Light Tek Co. (Taiwan), provider of diffusers, reflectors, microlens, and prism films, raises $9mm.

Digital Optics Co. (S. Korea), supplier of reflector, diffuser, and prism sheets for displays, raises $12mm.

Chemilens (Vietnam), manufacturer of injected molded polymer optics, raises $6mm.

Optics and Lasers

North America & Europe photonics companies continue to realize more smaller and early stage private placements (publicly disclosed) than Asia photonics companies. However, the total value is very low for optics and laser companies in US. In 2016, there is less than $10million and less than $5million in private placements in US laser and US optics companies respectively.

For a presentation of private equity and venture capital investments in Photonics, join us at Lasers & Photonics Marketplace Seminar on January 30 at Photonics West in San Francisco or visit this webpage after the seminar.

Private Placement Activity

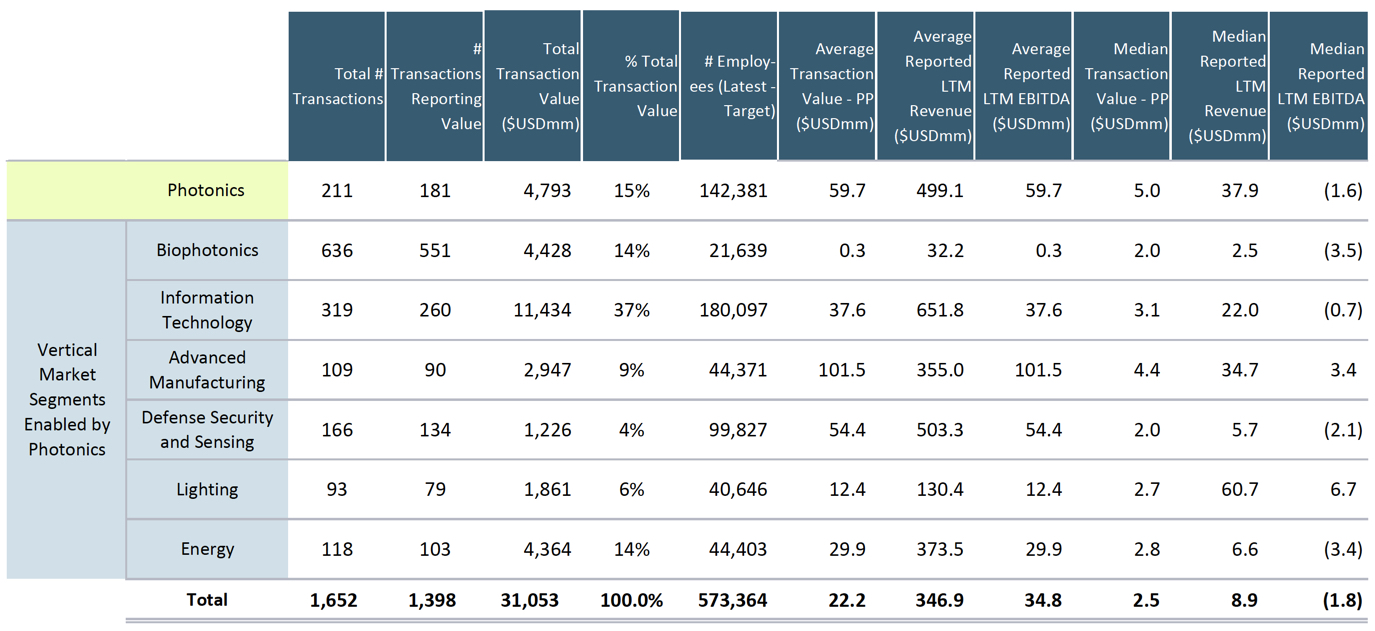

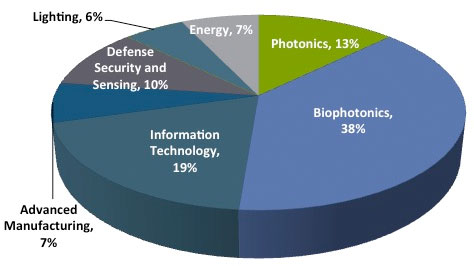

Transaction Volume

In line with previous years, the Biophotonics sector sees the most activity in 2016 – almost 40% of private placements. The Diagnostics predominantly includes investments in companies employing fluorescence, optical label-free, and molecular imaging methods to gene, protein, and cell based diagnostic assays and point-of-care devices. There is a relatively higher volume of investments promising to make cost effective genetic testing and personalized medicine a reality in the not so distance future. Also, in 2016, there are a significant number of investments in companies offering wearable sensor devices tracking everything from general fitness to environmental toxins.

Private Placement Volume

Photonics & Vertical Markets Served

2016

Information Technology follows in volume of investment activity. In addition to the large Display transactions cited above, there are a large number of investments in augmented and virtual reality hardware and content. In the Imaging and Interface segment, we see investments across a wide range of consumer electronics applications including low-cost application specific cameras and 3D scanners, 3D image processing technology and gesture control interfaces.

Transaction Value

By far, in 2016, the most investment is directed toward the Display, Solar, Materials and Coatings, and Communications. In the Materials & Coatings segment, the majority of investments support the Solar, Display and LED markets.

Private Placement Value

Photonics & Vertical Markets Served

2016

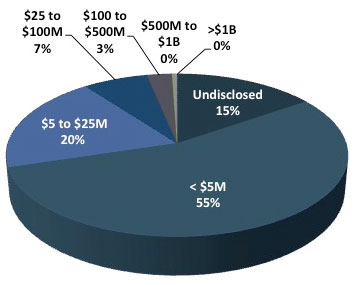

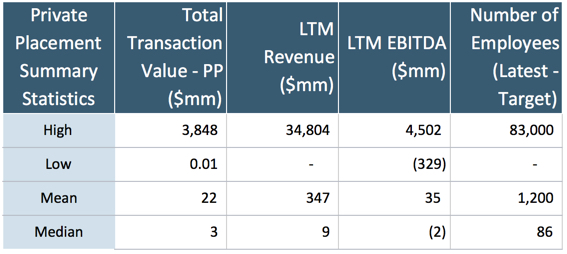

Size of Transaction

Up from 53% of total in 2012, transaction values for two-thirds of private placements are less than $5million. 30% of the $31billion, as compared to 12% of the $48billion in 2015, is invested in deals greater than $25million.

Trend Toward Higher Concentration of Later Growth Stage Investments

In 2012, the majority of private placements, more than 90%, are made by development or product launch stage companies realizing less than $10million revenue and no earnings. In 2016, that drops to 50% of investments reporting transaction value in companies with >$10million revenue. This implies that more investors are investing at a much later stage.

Geography – High Concentration in Asia for Photonics

In 2016, there are 33,785 private placement transactions across all sectors. There is a 5-year trend of more and higher concentration of investments in Asian targets in the Photonics industry than in the all sectors combined.

In 2016, there is $725billion of private placement value across all sectors – compared to $635billion transactions announced in 2012. There is a 5-year trend of higher and lower total transaction value in Asia/Pacific and Europe respectively. There is a substantially higher concentration of investment value in Asian targets in the Photonics industry than in the all sectors combined.

Given the relatively smaller transaction values, the relatively larger # of transactions and the negative EBITDA’s for target companies in Europe and North America, it appears that investment in European and North American Photonics companies is focused on technology commercialization whereas investment in Asian Photonics companies is focused on growth.

Transaction Detail

Follow this link to detail for each of the 1,652 transactions analyzed in this article. Detail includes: target company descriptions and deal comments; valuation multiples and target financials for publicly announced transactions; industry and market segmentation for quickly finding relevant comps. Find and sort transactions in excel format.

<Download 2016 Photonics Private Placement Transaction Detail>