Realizing Higher Average Valuations than All Other Sectors

The Mergers & Acquisitions market for photonics companies and those enabled by photonics remains strong in 2016. Although total transaction value is down almost 75%, compared to the M&A market as a whole, average valuation multiples for companies supplying core photonics technologies and components are higher than all manufacturing sectors.

*Source, Ceres; Source other sectors, McGraw Hill Financial

Middle market companies employing photonics to serve a wide breadth of markets, such as Semiconductor Equipment, Display, Surveillance & Navigation and Materials & Coatings, are realizing high valuations.

Leading the pack on Implied Enterprise Value/Revenue are early stage companies based in China and Korea. Interbulls Co., provider of back-end semiconductor equipment (56x); Shenzhen Xiaodou Technology Co., supplier of machine vision products (56x); Beijing 7D-VISION Technology Co., manufacturer of studio equipment to produce virtual reality content (55x); Guangzhou Geo Optical Technology Co., provider of global navigation satellite systems (48x); and E-SOL Co., manufacturer of smart solar glass films and windows (44x).

The Transactions

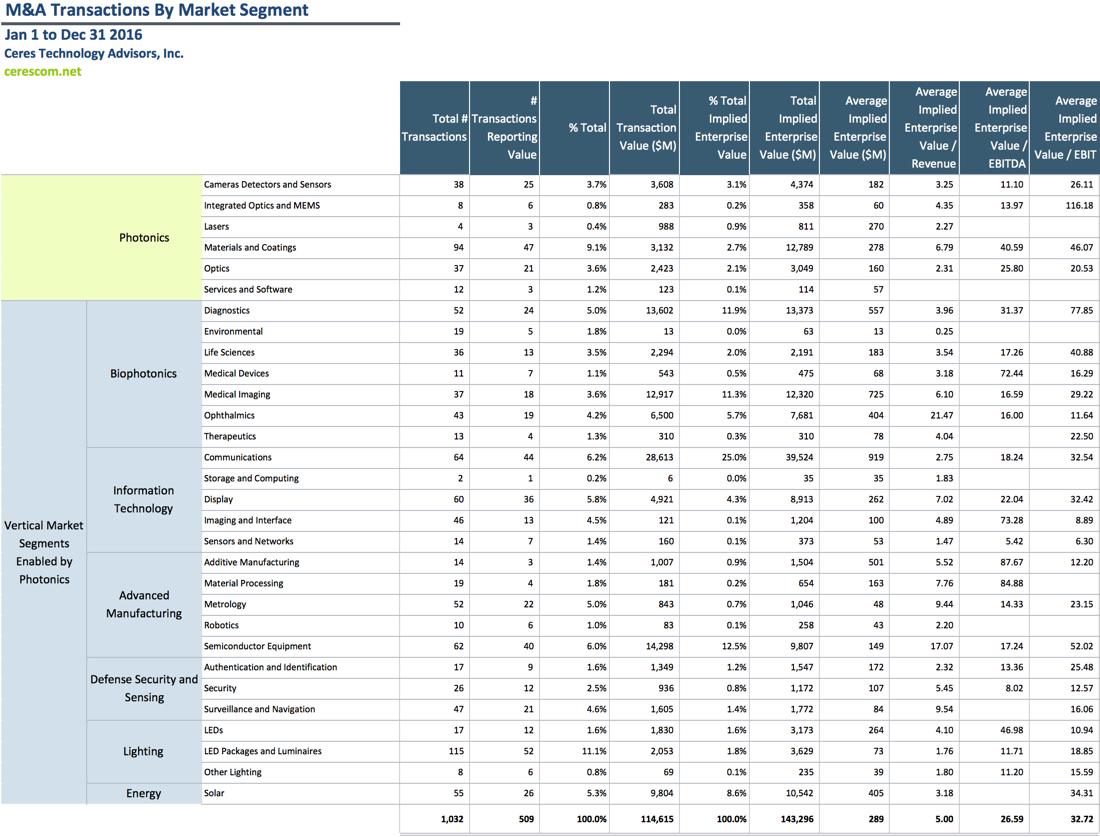

M&A transactions are researched with closing or announce dates from January 1 to December 31, 2016. Transactions volumes, values, geographies, and market segments are analyzed. Values are in $US at historical rates of exchange. Implied Enterprise Value is defined as the total consideration to shareholders (adjusted for % acquired) plus earnouts plus rights/warrants/options plus size adjustment plus net assumed liabilities.

Activity

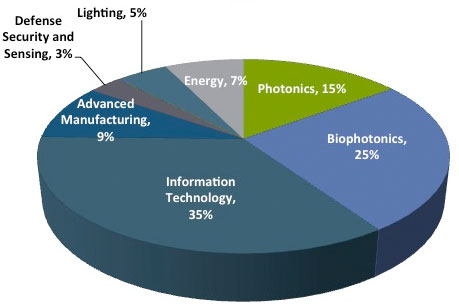

The LED Packages and Luminaires, Materials and Coatings, Communications, Semiconductor Equipment and Display segments see the most activity in volume of transactions.

M&A Transaction Volume

Photonics & Vertical Markets Served

2016

Click graphic for inputs

In 2016, the total and average Enterprise Value of the 509 transactions reporting financial data were $115billion and $289million – compared to $391billion and $718million in 2015 respectively. The Information Technology sector sees a higher concentration of larger transactions; where as the Advanced Manufacturing sectors sees a higher concentration of smaller transactions.

M&A Transaction Value

Photonics & Vertical Markets Served

2016

Click graphic for inputs

Photonics Core Technology Companies

Although most diversified market leaders in Photonics are not acquisitive in 2016, there are four atypically large transactions announced or closed in Photonics.

- OmniVision Technologies, Inc. by Shanghai Pudong Science and Technology Investment Co., Ltd.; CITIC Capital Partners; Gold Stone Investment Co., Ltd.; Hua Capital Management Ltd. for $1,886mm

- Newport Corp. by MKS Instruments, Inc. (NasdaqGS:MKSI) for $1,045mm

- Rofin-Sinar Technologies Inc. by Coherent, Inc. (NasdaqGS:COHR) for $956mm

- Heptagon Micro Optics Pte Ltd by ams AG (SWX:AMS) for $919mm

Optics, Lasers and Detectors

For a presentation of M&A activity in the Photonics industry, join us at Lasers & Photonics Marketplace Seminar on January 30 at Photonics West in San Francisco or visit this webpage after the seminar.

Materials and Coatings

Recent advances in commercially available materials and their related photonics technologies are driving innovation in lighting, life sciences, information technology and solar. 10% of the total M&A market volume is in Materials and Coatings – suppliers of fundamental materials such as rare earths, organic LED materials, dielectric optical coatings, semiconductors, nanoparticles, sapphire and display glasses.

Small and Middle Market

49% of researched transactions disclosed the transaction value. Consistent with previous five years, 81% are small market (<$5M), micro middle market ($5 to $25M), and small/middle market ($25 to $100M) transactions.

Since 2010, the lower and middle of the M&A middle markets is robust. These researched transactions are consistent with the market as a whole. However, uniquely, in the Photonics sector and the vertical market segments enabled by photonics, strategic buyers are acquiring orders of magnitude smaller businesses providing products that are highly differentiated with strong intellectual property positions.

M&A Transaction Size

Photonics & Vertical Markets Served

2016

Strategic vs. Financial on Buy and Sell Side

Like 2012 through 2015, the vast majority of transactions by volume and value are strategic. However, financial buyers and sellers are consistently more active since 2012. Financial buyers are up to 20% from 3% of transactions and financial sellers are up to 21% from 12% of transactions in 2012. Considering strategic buyers are more active in 2014, 2015 and 2016, this may be considered seller’s market with higher strategic premiums in valuations for both strategic and financial buyers.

Valuations

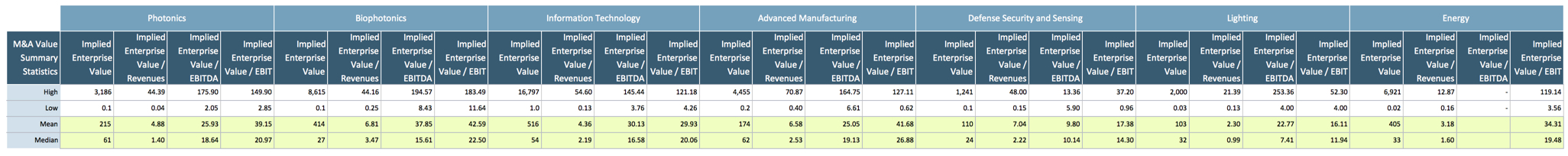

For researched market segments, the average and median of reported Enterprise Value to EBIT, EBITDA and Revenue multiples in 2014 to 2016 trend higher since 2012 and 2013. Implied Enterprise Value includes implied equity value, earn-out and contingent payments, rights, warrants, options, and net assumed liabilities adjusted for size.

Photonics and Markets Served

Photonics

The Ophthalmics (Biophotonics), Semiconductor Equipment (Advanced Manufacturing), Surveillance and Navigation (Defense, Security and Sensing), and Metrology (Advanced Manufacturing) segments realize high average multiples of Enterprise Value to Revenue due to strategic acquisitions of middle market companies with strong IP portfolios and high return on investment for the capital equipment they provide.

High average multiples of Enterprise Value to EBITDA are realized by Xiamen Changelight Co., producer of ultra-bright LED epitaxial wafers and chips, gallium arsenide solar cells, and LED lighting products in China (250x EBITDA); VirtualScopics, provider of medical imaging services to pharma and biotech clinical trials (195x); and MNTech Co., manufacturer of optical films for displays in South Korea (176x EBITDA).

Few transactions report financials, because buyers are not required to report publicly if a transaction does not have material near term impact on their financial statements. Regardless, M&A transaction data is highly relevant to understand market dynamics and buyer behavior.

Geography

Historically, the United States and Canada, as a geographical region, experience the most buy and sell side activity. This trend is changing. In 2015 and 2016, we see a much higher concentration of targets in Asia and Europe and of buyers in Asia.

Up from more than 25% in 2014 and 18% in 2015, more transactions represent buyers acquiring targets outside their geographical region.

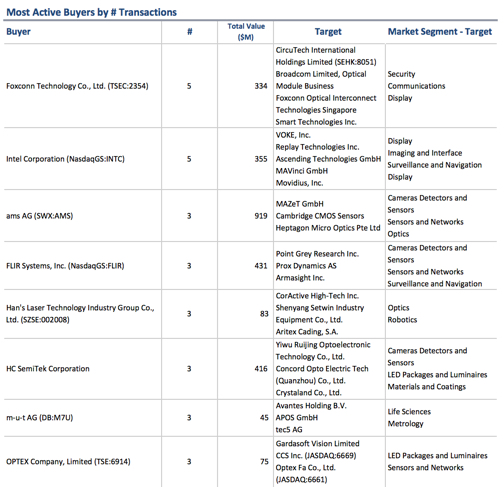

Most Active Buyers

Strategic buyers are by far the most active – acquiring small and middle market companies across a wide breadth of photonic technology enabled market segments. Unlike in 2014 and years prior, there are not a relatively large number of acquisitions per strategic buyer. Inconsistent with previous years, a new set of buyers top the most active buyers lists in 2016.

Transaction Detail

Follow this link to detail for each of the 1,032 transactions analyzed in this article. Detail includes: target company descriptions and deal comments; valuation multiples and target financials for publicly announced transactions; industry and market segmentation for quickly finding relevant comps. Find and sort transactions in excel format.